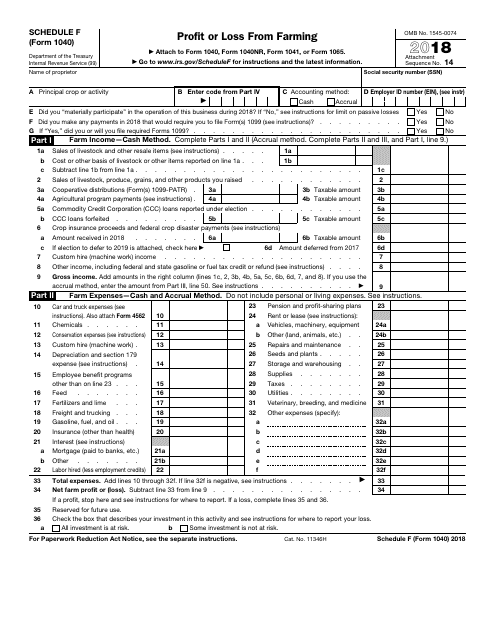

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040 Schedule F

for the current year.

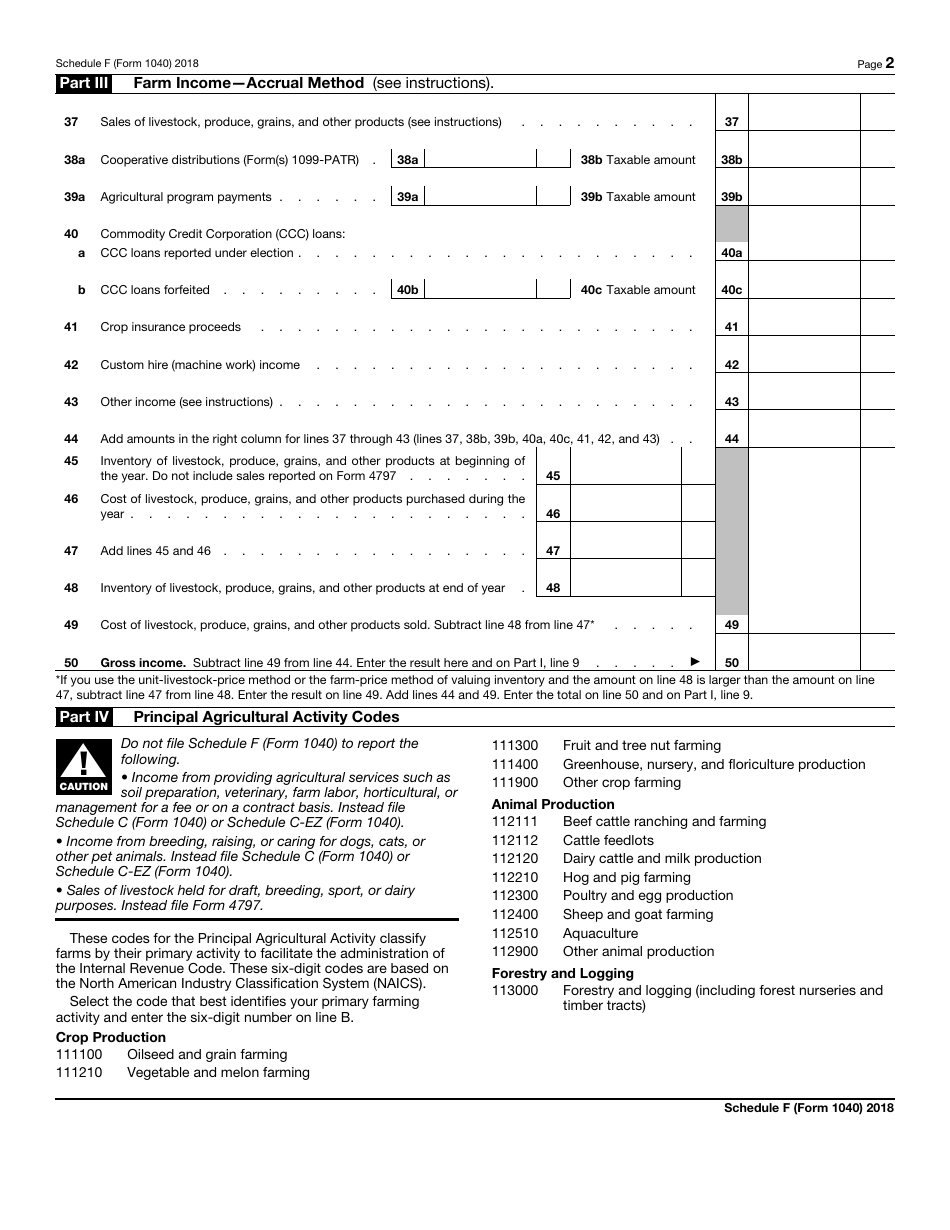

IRS Form 1040 Schedule F Profit or Loss From Farming

What Is IRS Form 1040 Schedule F?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040 Schedule F?

A: IRS Form 1040 Schedule F is a tax form used to report profit or loss from farming activities.

Q: Who should use IRS Form 1040 Schedule F?

A: Farmers and ranchers who have income and expenses from their farming operations should use IRS Form 1040 Schedule F.

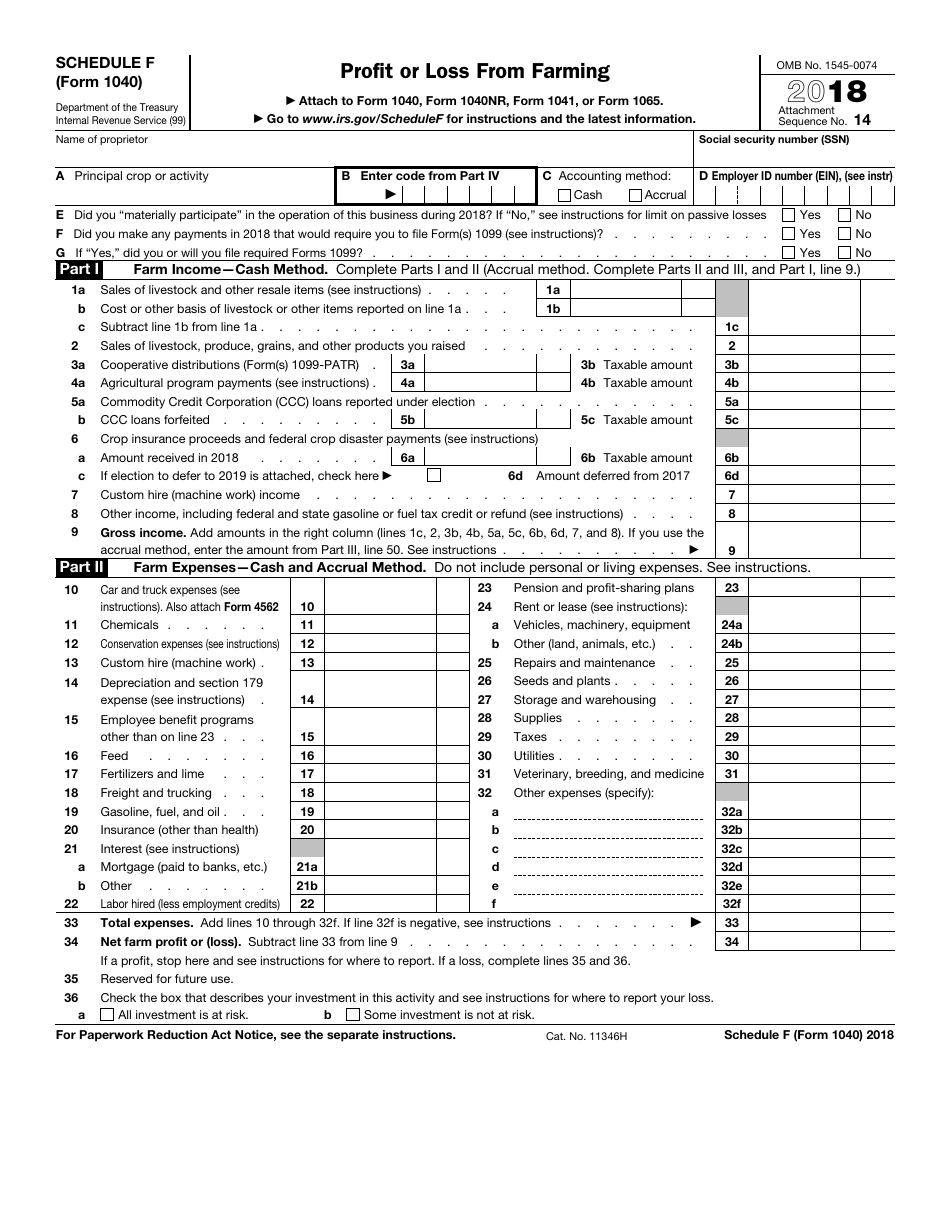

Q: What income should be reported on IRS Form 1040 Schedule F?

A: Income such as sales of livestock, produce, and grains, as well as government payments and rental income from farmland, should be reported on IRS Form 1040 Schedule F.

Q: What expenses can be deducted on IRS Form 1040 Schedule F?

A: Expenses such as feed, seed, fuel, repairs and maintenance, rent, and wages can be deducted on IRS Form 1040 Schedule F.

Q: When is the deadline for filing IRS Form 1040 Schedule F?

A: The deadline for filing IRS Form 1040 Schedule F is the same as the deadline for filing your individual income tax return, which is usually April 15.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule F through the link below or browse more documents in our library of IRS Forms.