This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule H

for the current year.

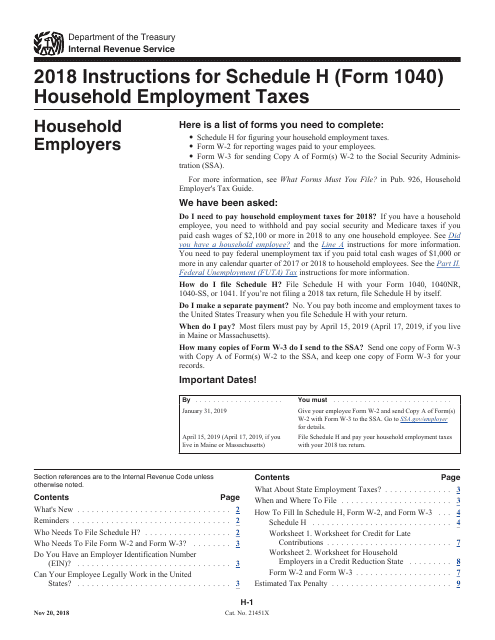

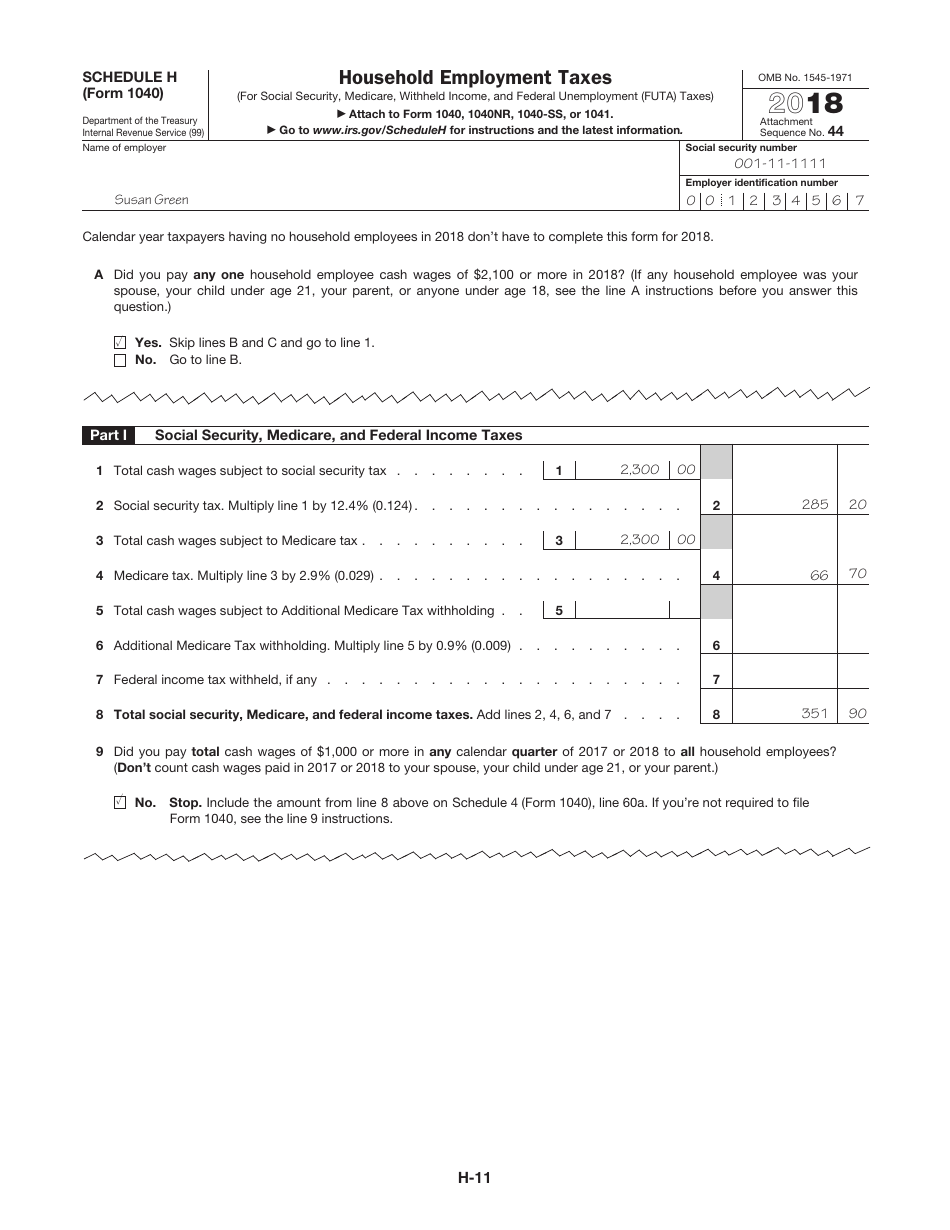

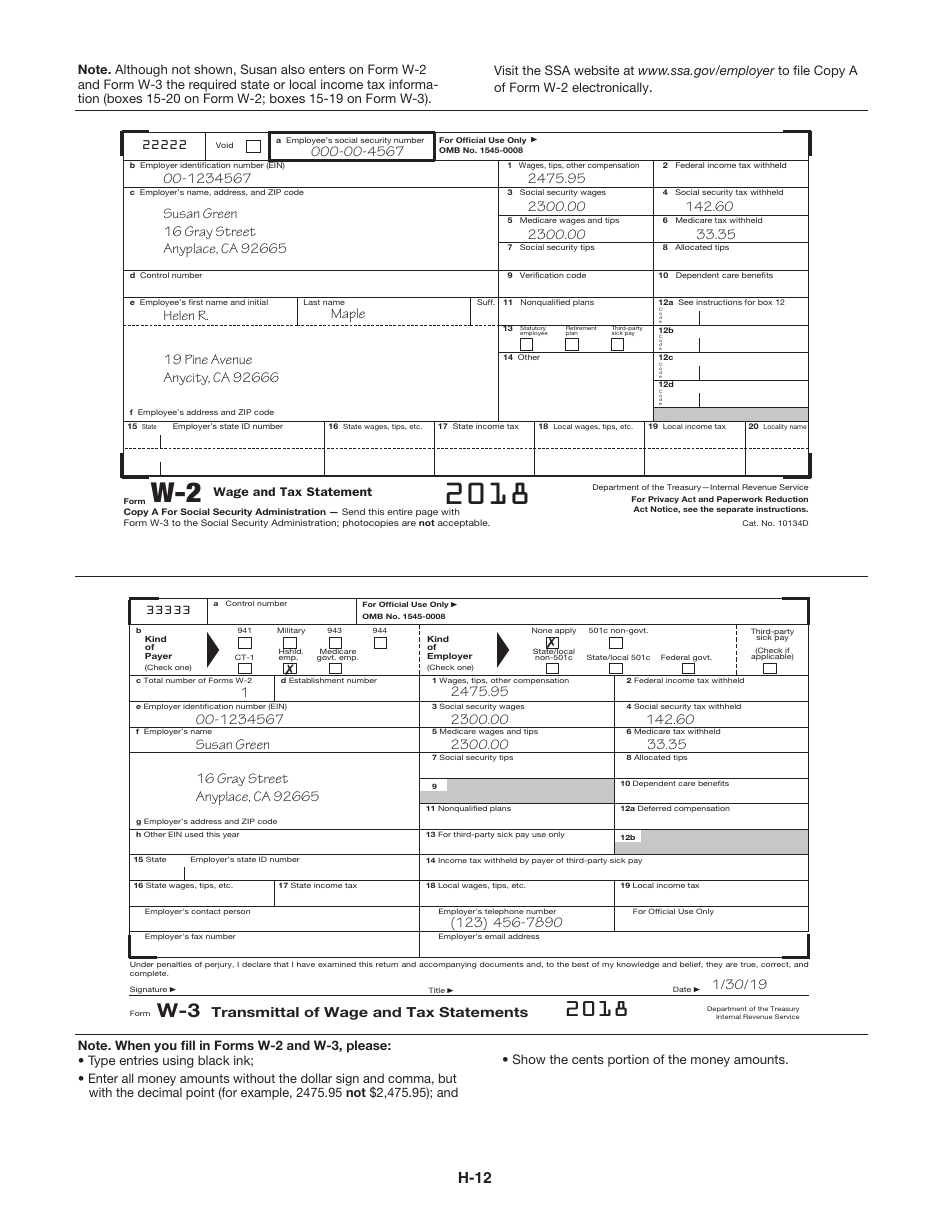

Instructions for IRS Form 1040 Schedule H Household Employment Taxes

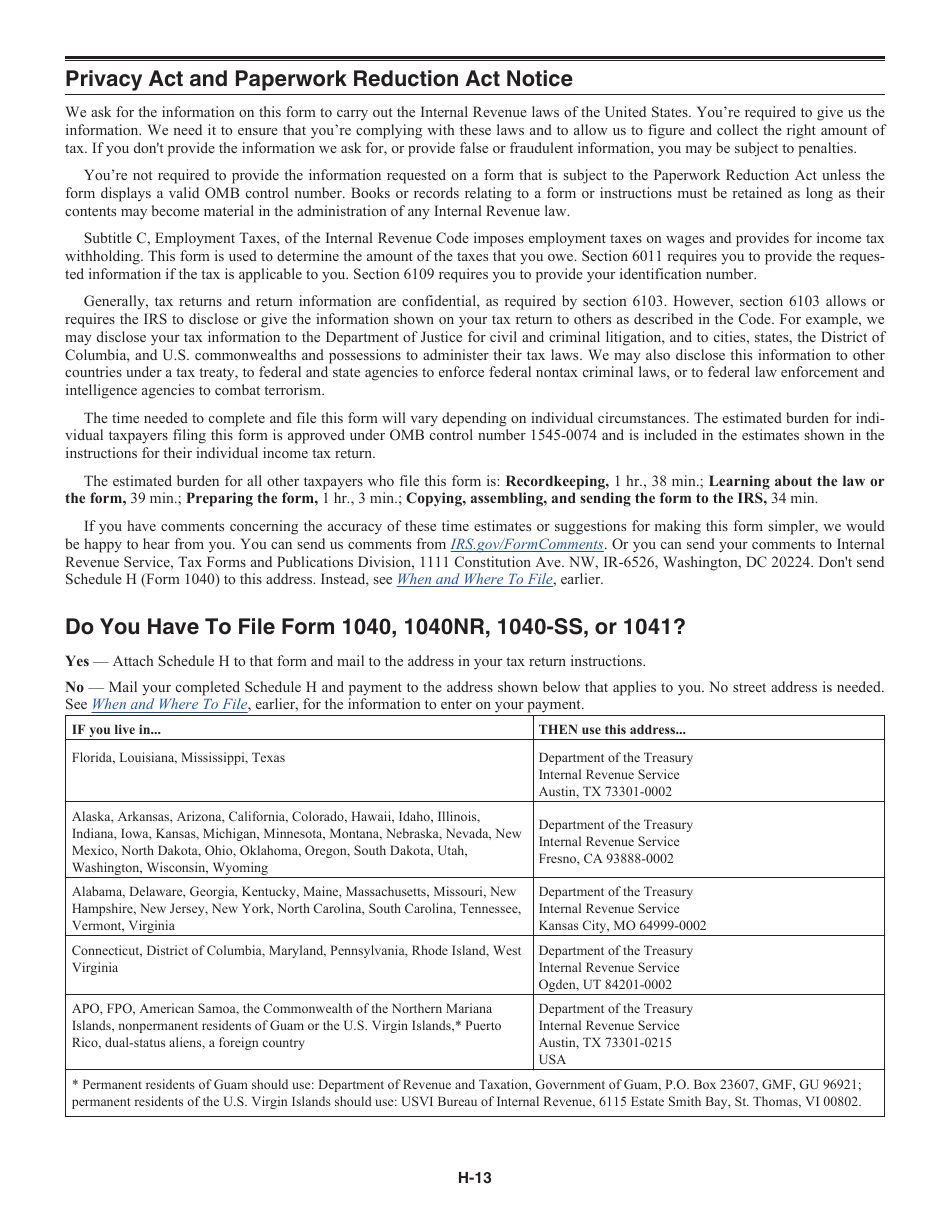

This document contains official instructions for IRS Form 1040 Schedule H, Household Employment Taxes - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule H is available for download through this link.

FAQ

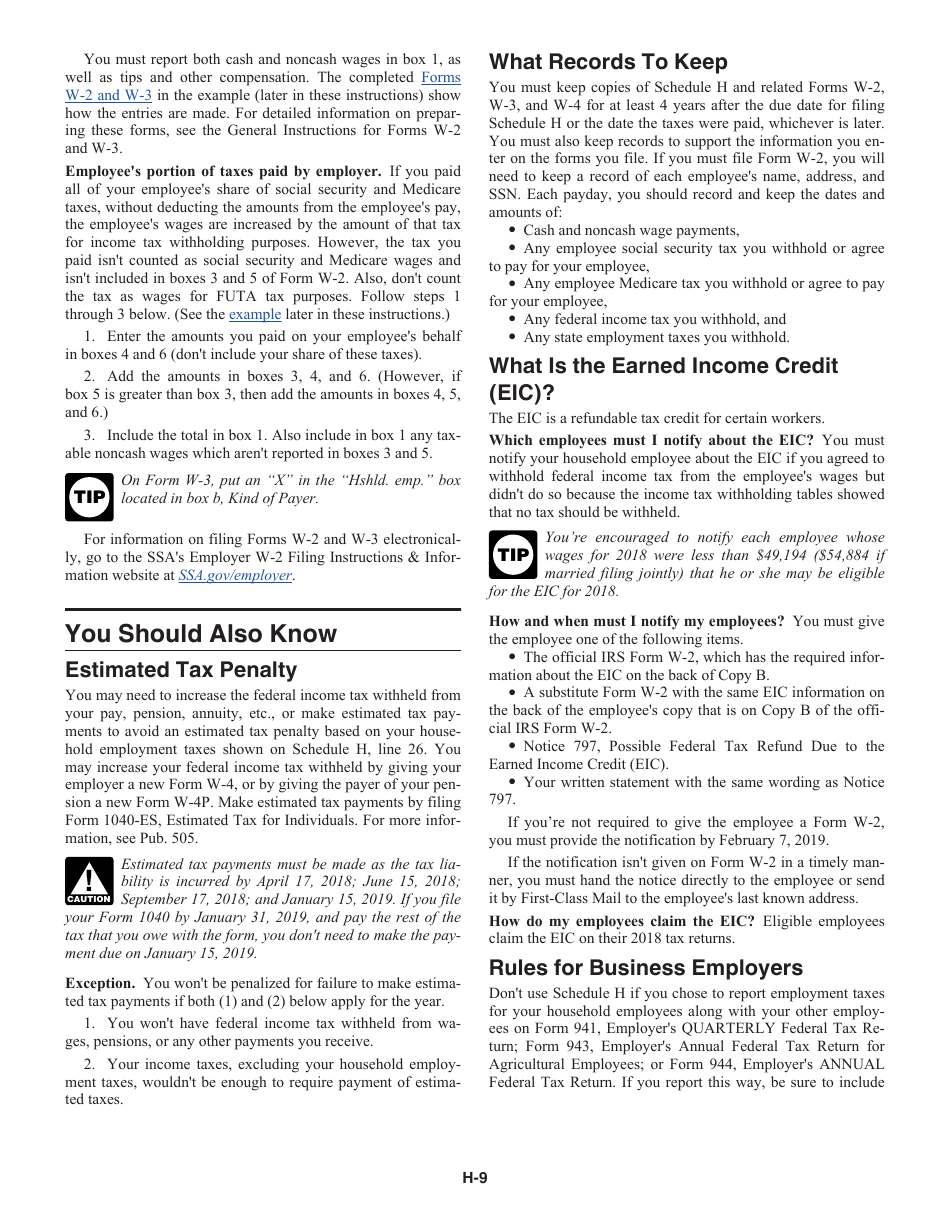

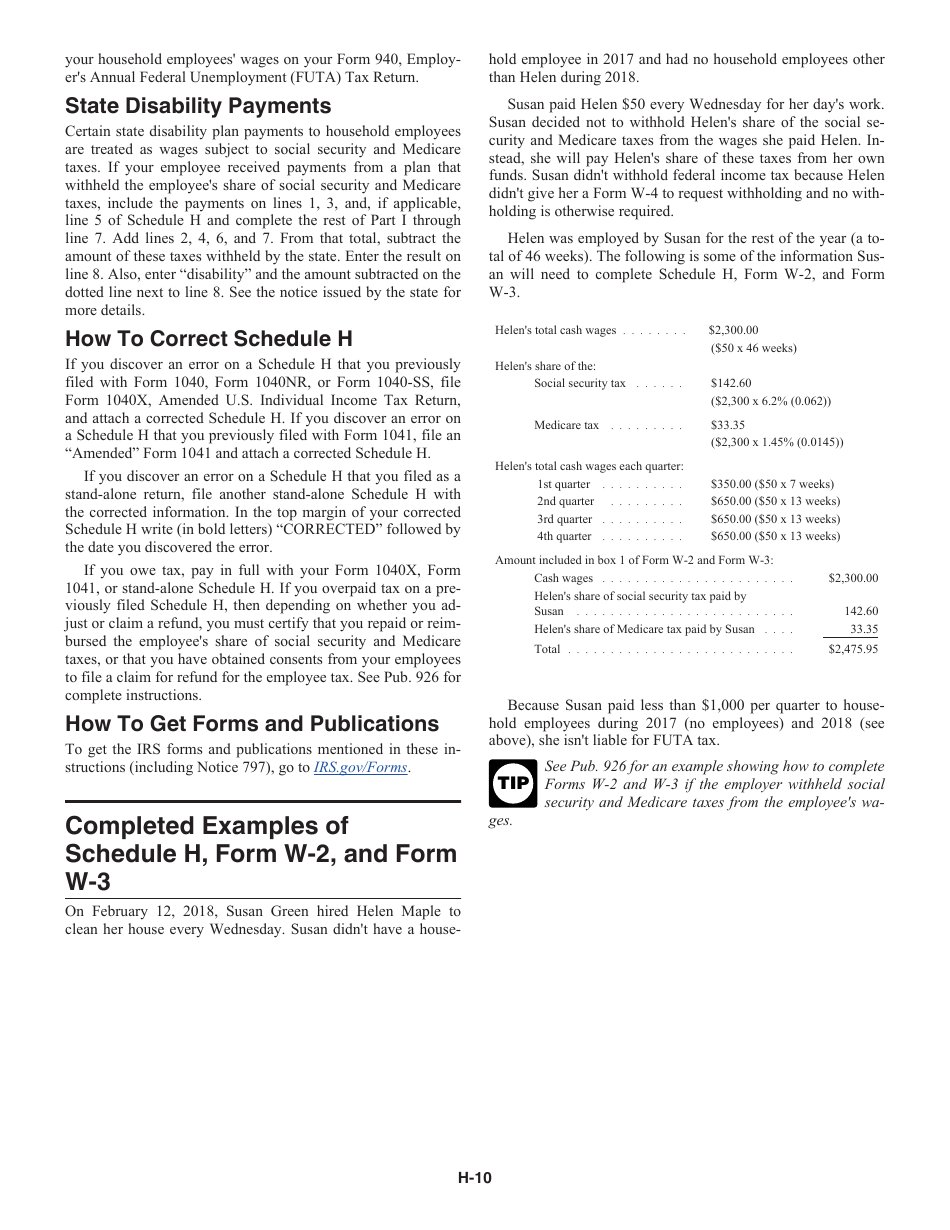

Q: What is Form 1040 Schedule H?

A: Form 1040 Schedule H is used to report household employment taxes.

Q: Who needs to file Form 1040 Schedule H?

A: You need to file Form 1040 Schedule H if you paid household employees like nannies, babysitters, or housekeepers.

Q: What do I need to include on Form 1040 Schedule H?

A: You need to include information about the household employees you paid, such as their names, Social Security numbers, and wages.

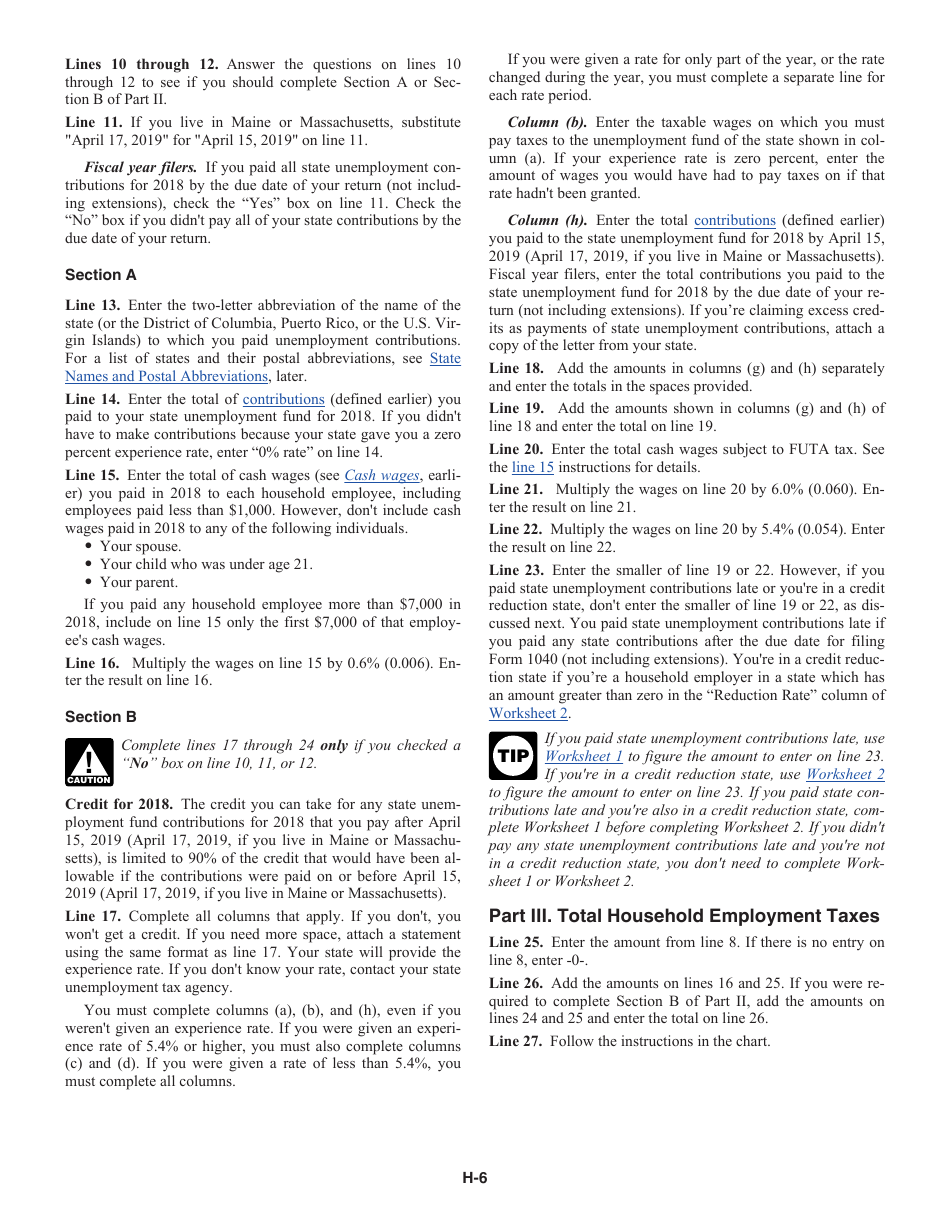

Q: How do I calculate the household employment taxes?

A: To calculate the taxes, you need to determine the total wages paid to household employees and apply the appropriate tax rates.

Q: When is the deadline to file Form 1040 Schedule H?

A: The deadline to file Form 1040 Schedule H is the same as the deadline for your federal income tax return, usually April 15th.

Q: Can I e-file Form 1040 Schedule H?

A: No, you cannot e-file Form 1040 Schedule H. It must be filed on paper and submitted by mail.

Q: What happens if I don't file Form 1040 Schedule H?

A: If you are required to file Form 1040 Schedule H and fail to do so, you may be subject to penalties and interest on the unpaid taxes.

Q: Is there a separate Form 1040 Schedule H for each household employee?

A: No, you only need to file one Form 1040 Schedule H for all household employees that you paid during the tax year.

Instruction Details:

- This 13-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.