This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040 Schedule H

for the current year.

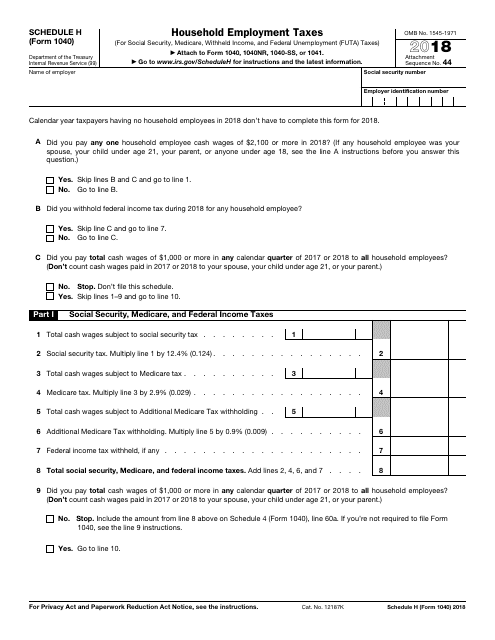

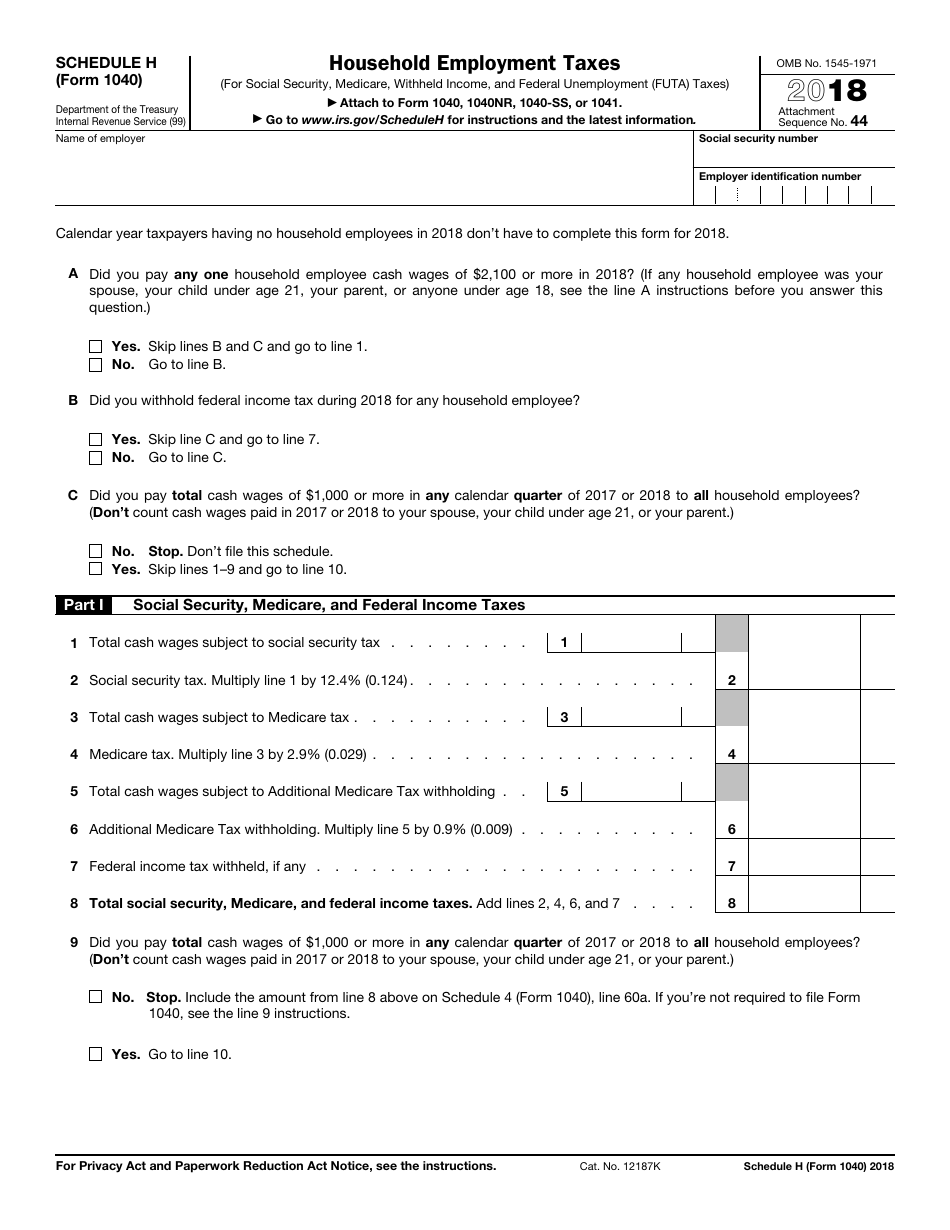

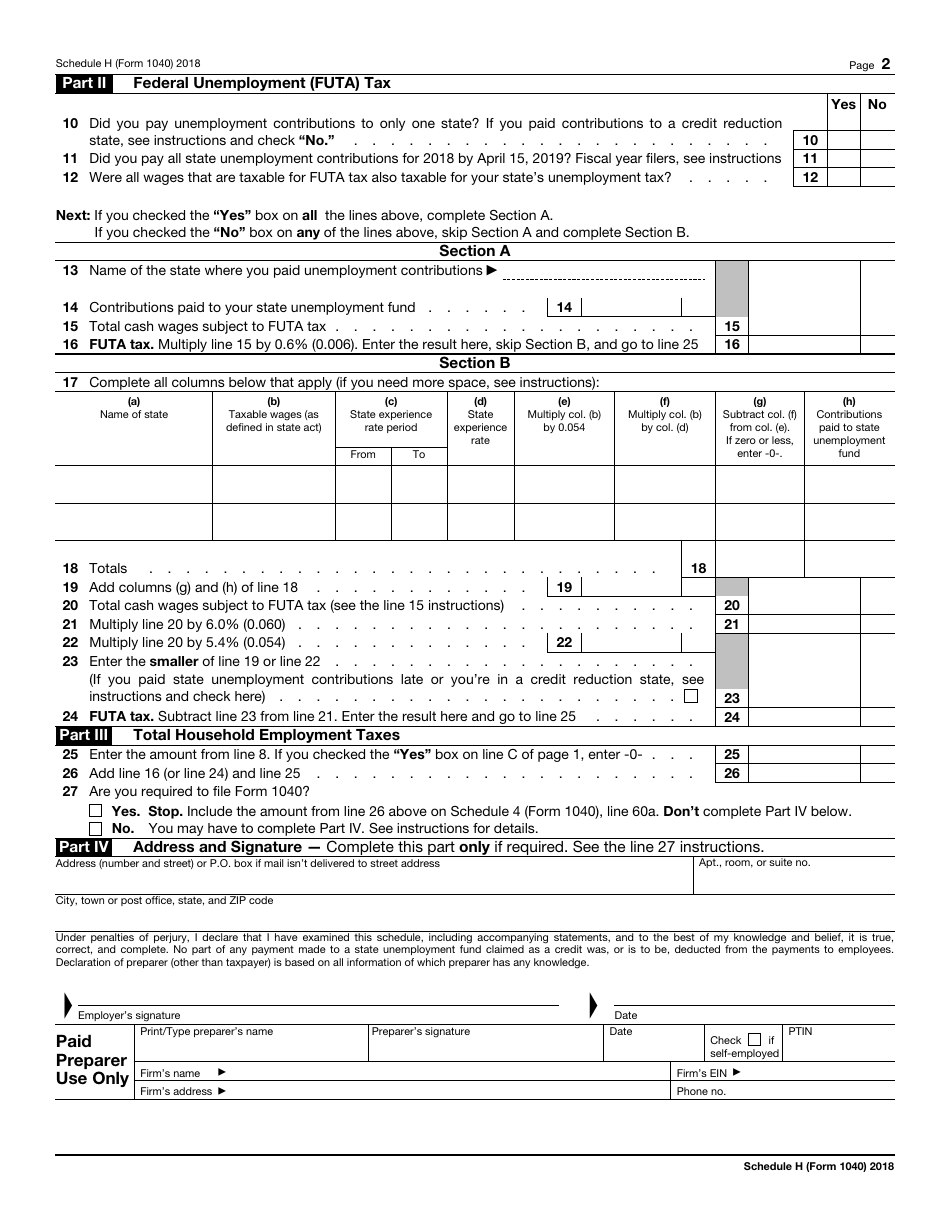

IRS Form 1040 Schedule H Household Employment Taxes

What Is IRS Form 1040 Schedule H?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 1040 Schedule H?

A: Form 1040 Schedule H is used to report household employment taxes.

Q: Who needs to file Form 1040 Schedule H?

A: You need to file Form 1040 Schedule H if you paid a household employee and have to pay employment taxes.

Q: What are household employment taxes?

A: Household employment taxes are taxes paid by individuals who employ household workers, such as nannies, babysitters, or housekeepers.

Q: What information is required to complete Form 1040 Schedule H?

A: To complete Form 1040 Schedule H, you will need information about your household employee, including their wages and taxes withheld.

Q: When is the deadline to file Form 1040 Schedule H?

A: The deadline to file Form 1040 Schedule H is usually the same as the deadline to file your individual income tax return, which is April 15th.

Q: Are there any penalties for not filing Form 1040 Schedule H?

A: Yes, there can be penalties for not filing Form 1040 Schedule H or for underreporting the employment taxes.

Q: Can I file Form 1040 Schedule H electronically?

A: Yes, you can file Form 1040 Schedule H electronically if you use tax software or hire a professional tax preparer.

Q: Can I claim any deductions or credits on Form 1040 Schedule H?

A: No, Form 1040 Schedule H is only used to report household employment taxes and does not provide any deductions or credits.

Q: Do I need to file Form 1040 Schedule H every year?

A: You only need to file Form 1040 Schedule H if you have a household employee and need to pay employment taxes. If you don't have a household employee, you don't need to file this form.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule H through the link below or browse more documents in our library of IRS Forms.