This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990, 990-EZ Schedule C

for the current year.

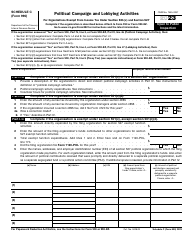

Instructions for IRS Form 990, 990-EZ Schedule C Political Campaign and Lobbying Activities

This document contains official instructions for IRS Form 990 Schedule C and IRS Form 990-EZ Schedule C . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 (990-EZ) Schedule C is available for download through this link.

FAQ

Q: What is Form 990?

A: Form 990 is an information return that tax-exempt organizations are required to file with the IRS.

Q: What is the purpose of Form 990-EZ?

A: Form 990-EZ is a simplified version of Form 990 for smaller tax-exempt organizations to report their financial information.

Q: What is Schedule C?

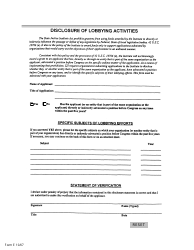

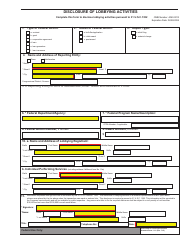

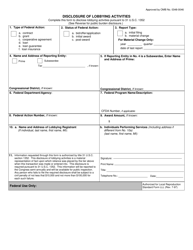

A: Schedule C is a section of Form 990-EZ used to report political campaign and lobbying activities.

Q: Who needs to file Schedule C?

A: Tax-exempt organizations that engage in political campaign and lobbying activities need to file Schedule C along with Form 990-EZ.

Q: What information is required on Schedule C?

A: Schedule C requires organizations to provide details about their political campaign and lobbying activities, including expenses and grants given to other organizations for lobbying purposes.

Q: Are there any penalties for not filing Form 990-EZ?

A: Yes, failure to file Form 990-EZ or its schedules may result in penalties for the tax-exempt organization.

Instruction Details:

- This 9-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.