This version of the form is not currently in use and is provided for reference only. Download this version of

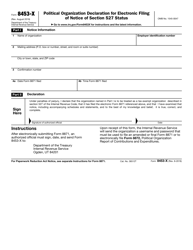

IRS Form 990 (990-EZ) Schedule C

for the current year.

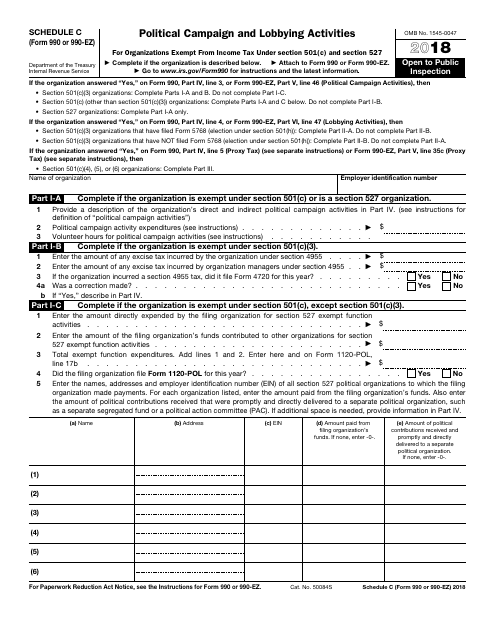

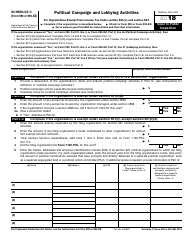

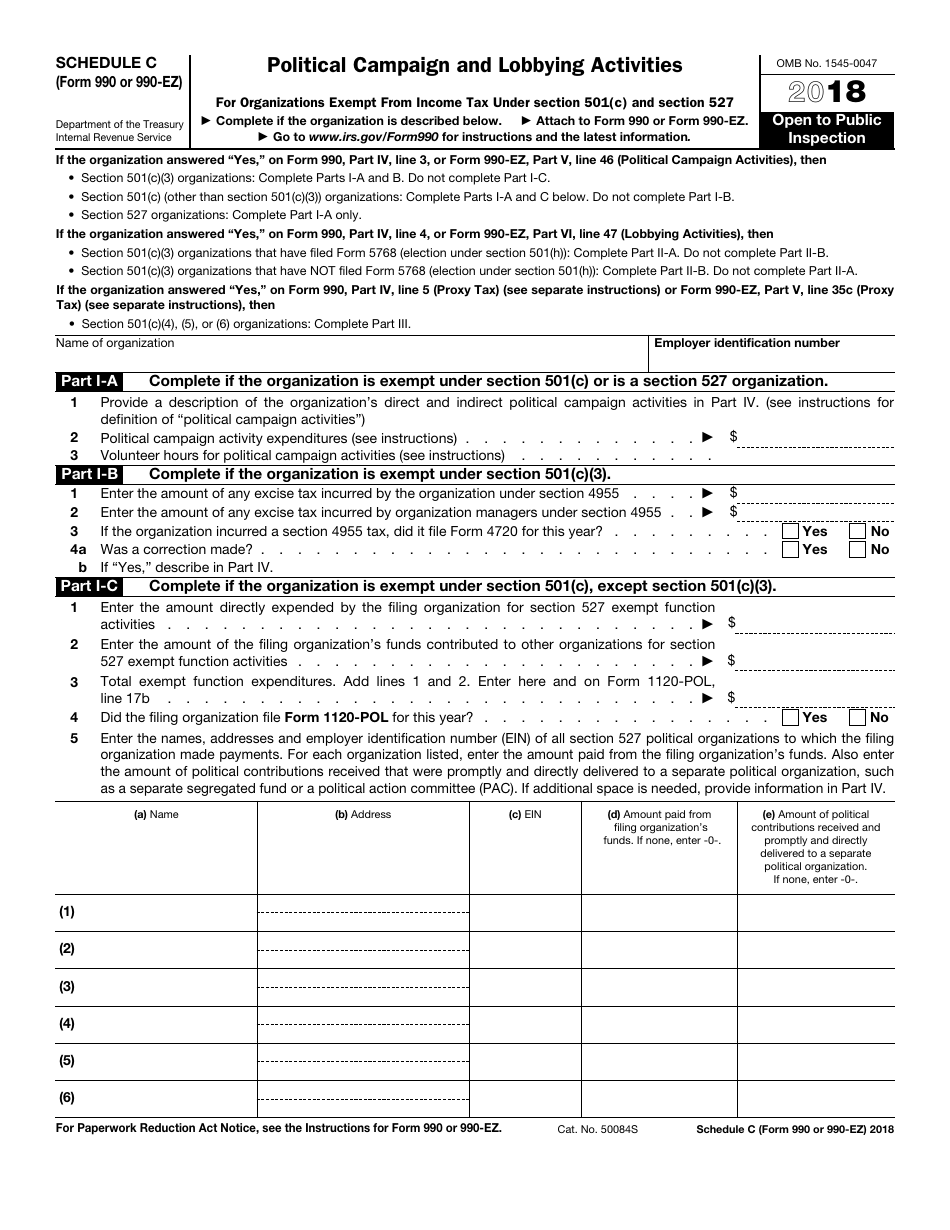

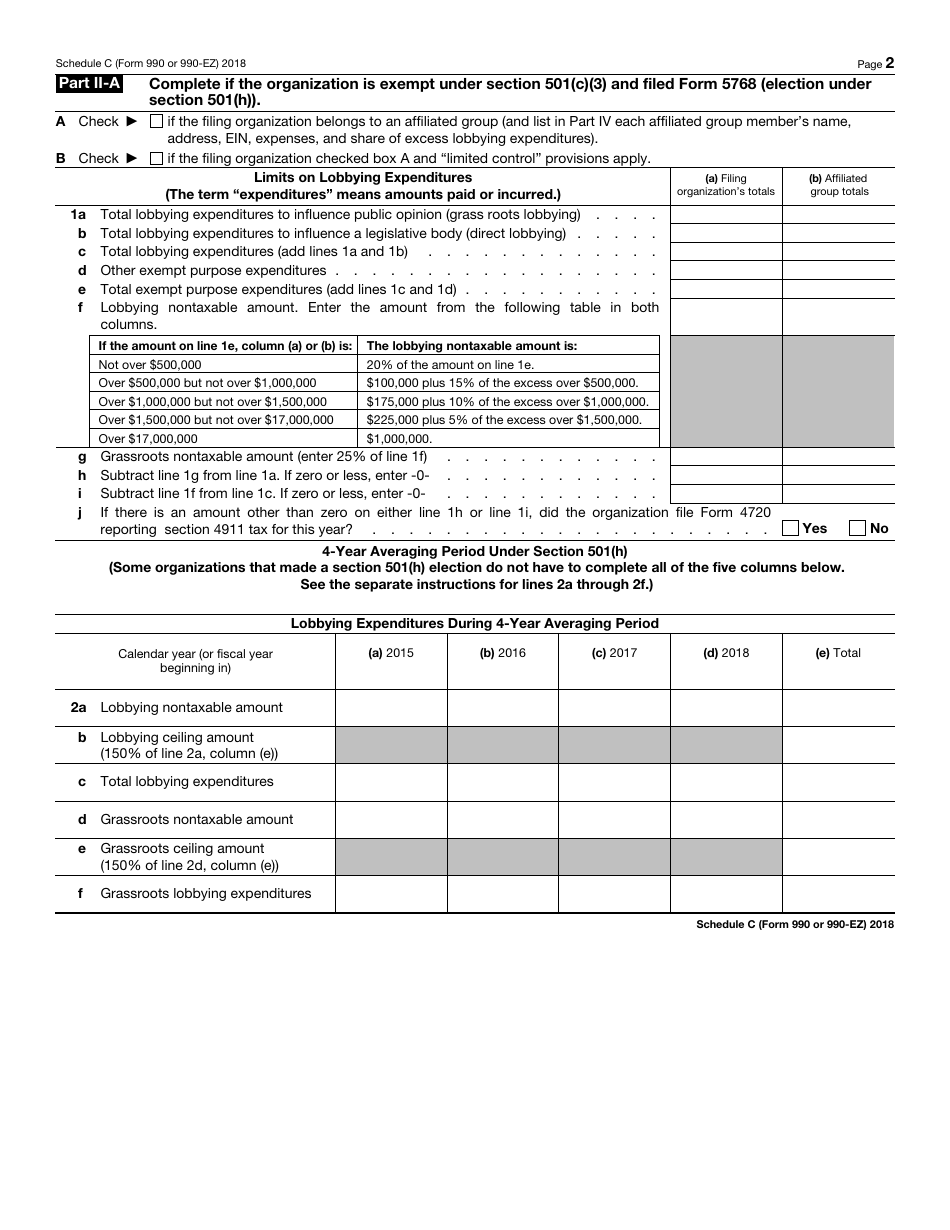

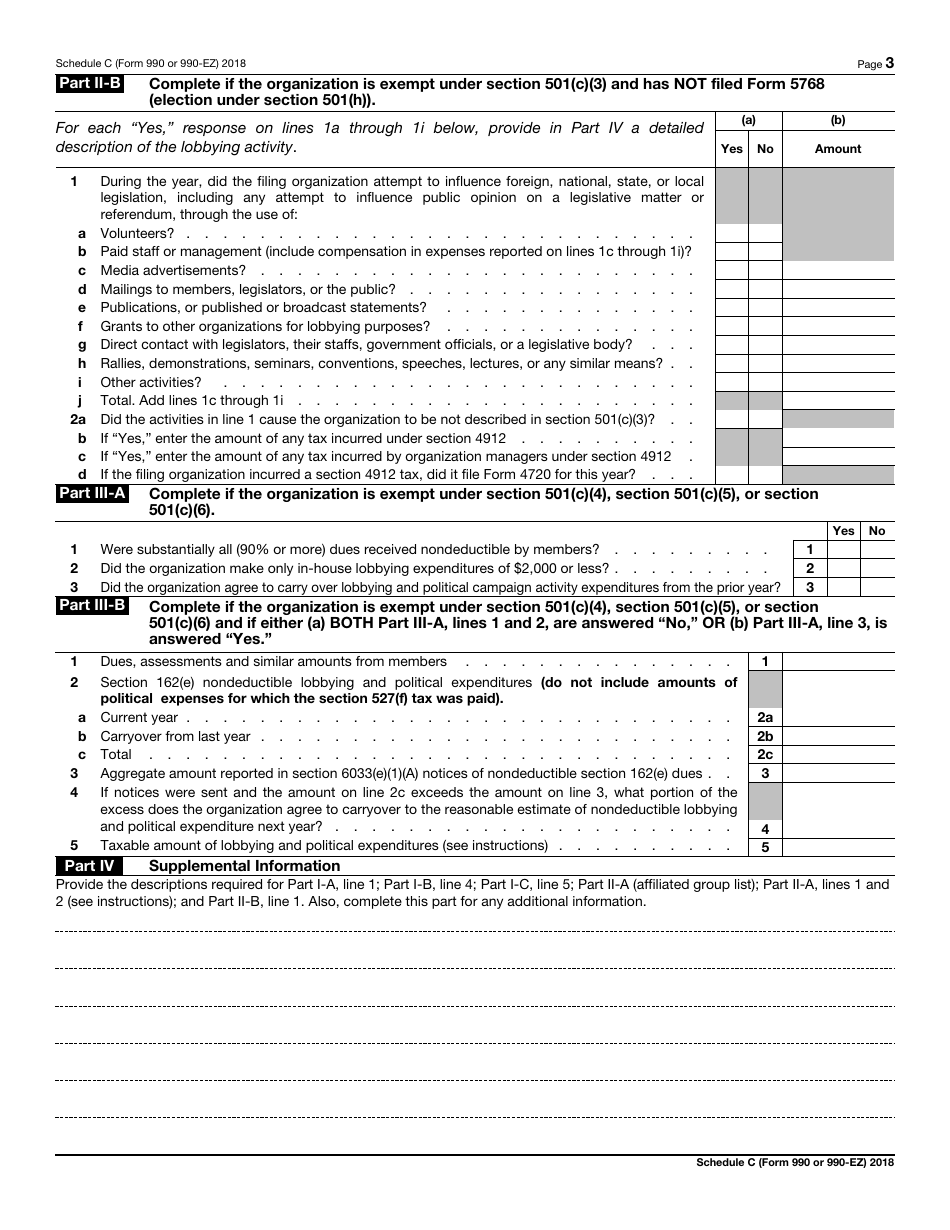

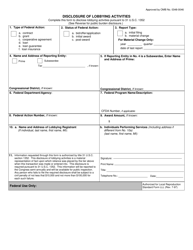

IRS Form 990 (990-EZ) Schedule C Political Campaign and Lobbying Activities

What Is IRS Form 990 (990-EZ) Schedule C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, and IRS Form 990-EZ. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 (990-EZ) Schedule C?

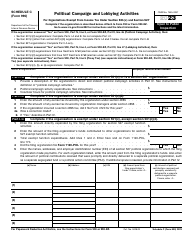

A: IRS Form 990 (990-EZ) Schedule C is a section of the Form 990 or 990-EZ that is used to report political campaign and lobbying activities of a tax-exempt organization.

Q: Who is required to fill out IRS Form 990 Schedule C?

A: Tax-exempt organizations that are engaged in political campaign or lobbying activities are required to fill out IRS Form 990 Schedule C.

Q: What information is reported on IRS Form 990 Schedule C?

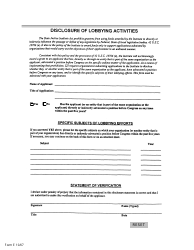

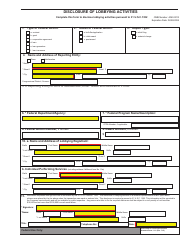

A: IRS Form 990 Schedule C requires organizations to provide details about the expenditures, contributions, and activities related to political campaign and lobbying.

Q: Why is it important to report political campaign and lobbying activities on IRS Form 990 Schedule C?

A: Reporting political campaign and lobbying activities on IRS Form 990 Schedule C is important to ensure transparency and compliance with the IRS regulations for tax-exempt organizations.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 (990-EZ) Schedule C through the link below or browse more documents in our library of IRS Forms.