This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 944

for the current year.

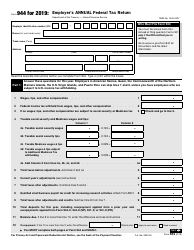

Instructions for IRS Form 944 Employer's Annual Federal Tax Return

This document contains official instructions for IRS Form 944 , Employer's Annual Federal Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 944?

A: IRS Form 944 is the Employer's Annual Federal Tax Return.

Q: Who needs to file IRS Form 944?

A: Certain small employers who meet certain criteria need to file IRS Form 944 instead of Form 941.

Q: What is the purpose of IRS Form 944?

A: IRS Form 944 is used by eligible small employers to report and pay their annual employment taxes.

Q: How often do I need to file IRS Form 944?

A: Employers who file Form 944 are required to file it annually.

Q: What are the eligibility requirements to file IRS Form 944?

A: To be eligible to file Form 944, an employer must have a total annual liability of $1,000 or less for social security, Medicare, and withheld federal income taxes.

Q: What are the penalties for not filing Form 944?

A: Failure to file IRS Form 944 or filing it late may result in penalties and interest.

Q: Can I e-file IRS Form 944?

A: Yes, you can e-file IRS Form 944 using IRS-approved software or through a tax professional.

Q: When is the deadline to file IRS Form 944?

A: The deadline to file IRS Form 944 is January 31 of the following year.

Q: What other forms do I need to submit with IRS Form 944?

A: In addition to Form 944, you may need to submit Schedule R if you paid wages subject to the Additional Medicare Tax or if you are a semiweekly schedule depositor.

Q: Can I request an extension to file IRS Form 944?

A: Yes, you can request an extension of time to file IRS Form 944 using Form 944-X.

Q: What is the minimum threshold for filing IRS Form 944?

A: If your total annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less, you can file IRS Form 944.

Q: Do I need to attach copies of W-2 forms with IRS Form 944?

A: No, you do not need to attach copies of W-2 forms with IRS Form 944. However, you must provide W-2 forms to your employees and submit Copy A of each employee's W-2 with Form W-3 to the Social Security Administration.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.