This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 709

for the current year.

Instructions for IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return

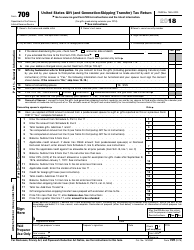

This document contains official instructions for IRS Form 709 , United States Gift (And Generation-Skipping Transfer) Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 709 is available for download through this link.

FAQ

Q: What is IRS Form 709?

A: IRS Form 709 is the United States Gift (And Generation-Skipping Transfer) Tax Return.

Q: Who needs to file IRS Form 709?

A: Individuals who have made gifts that exceed the annual gift tax exclusion need to file IRS Form 709.

Q: What is the purpose of IRS Form 709?

A: The purpose of IRS Form 709 is to report and pay gift and generation-skipping transfer (GST) taxes.

Q: What is the annual gift tax exclusion?

A: The annual gift tax exclusion is the amount of money or property that an individual can give to another person without having to pay gift tax. As of 2021, the annual exclusion is $15,000 per person.

Q: What is the generation-skipping transfer tax?

A: The generation-skipping transfer tax is a tax on transfers of property that skip a generation. It is in addition to any gift or estate tax that may be owed.

Q: How do I file IRS Form 709?

A: To file IRS Form 709, you can either use tax preparation software, hire a tax professional, or manually fill out the form and mail it to the IRS.

Q: When is the deadline for filing IRS Form 709?

A: The deadline for filing IRS Form 709 is April 15th of the year following the gift.

Q: What happens if I don't file IRS Form 709?

A: If you are required to file IRS Form 709 and fail to do so, you may face penalties and interest on the unpaid tax amount.

Q: Can I file IRS Form 709 electronically?

A: At the time of writing, IRS Form 709 cannot be filed electronically. It must be filed by mail.

Instruction Details:

- This 20-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.