This version of the form is not currently in use and is provided for reference only. Download this version of

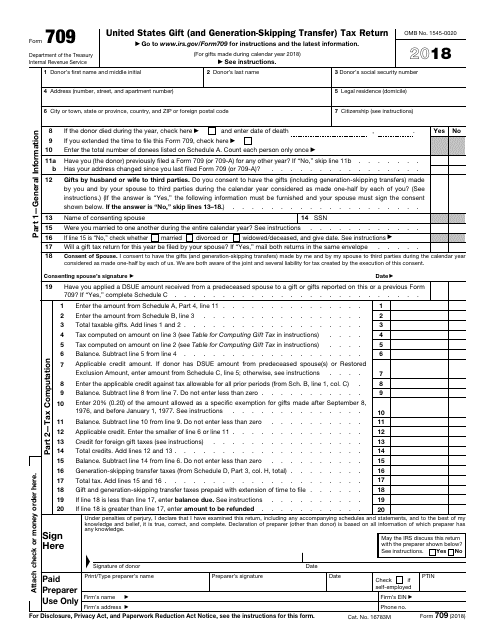

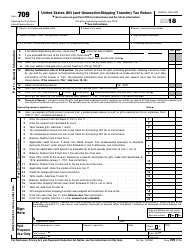

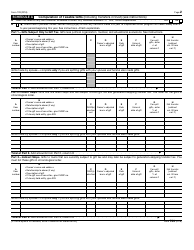

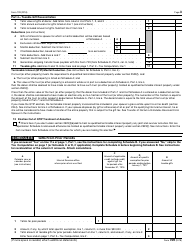

IRS Form 709

for the current year.

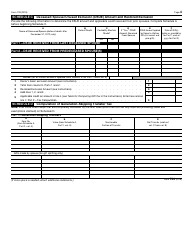

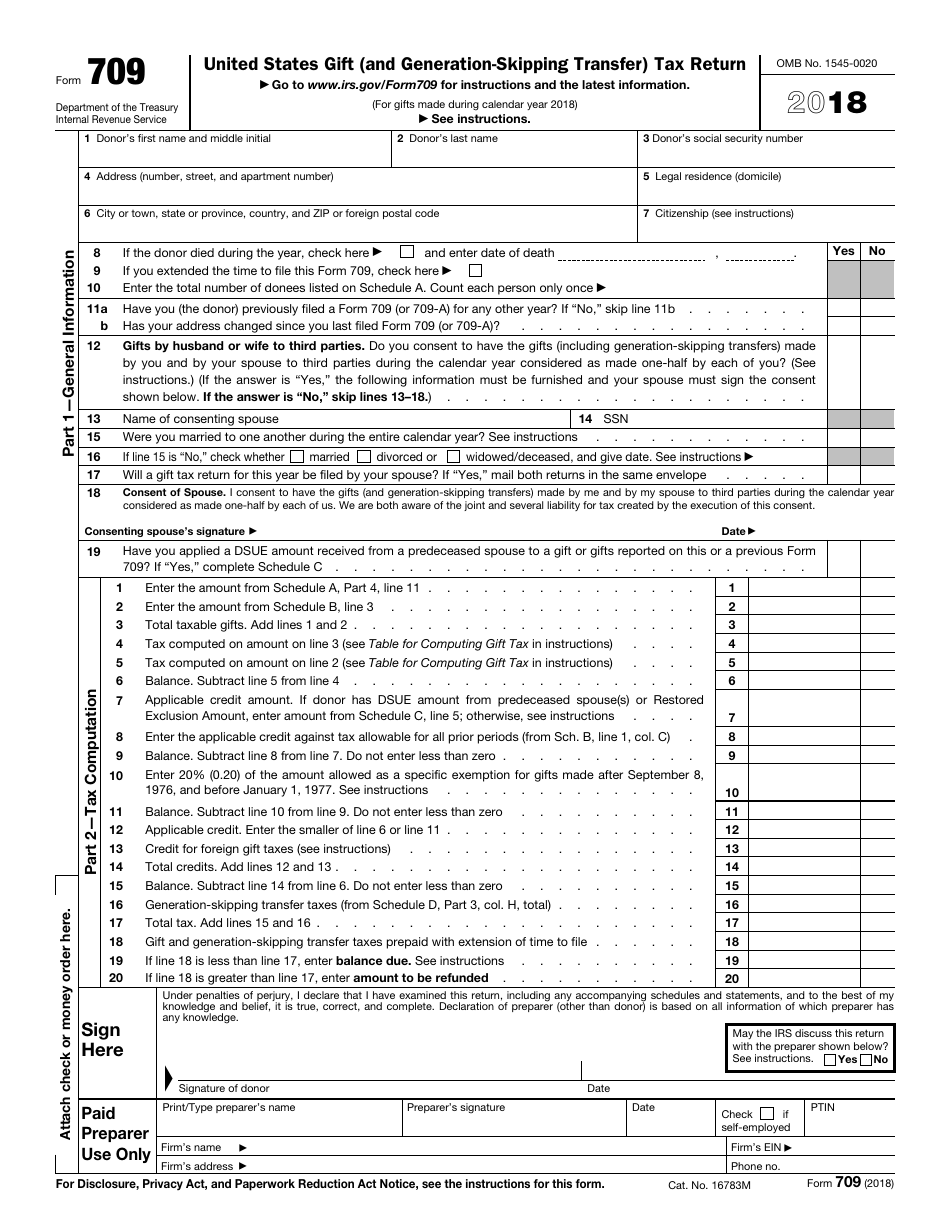

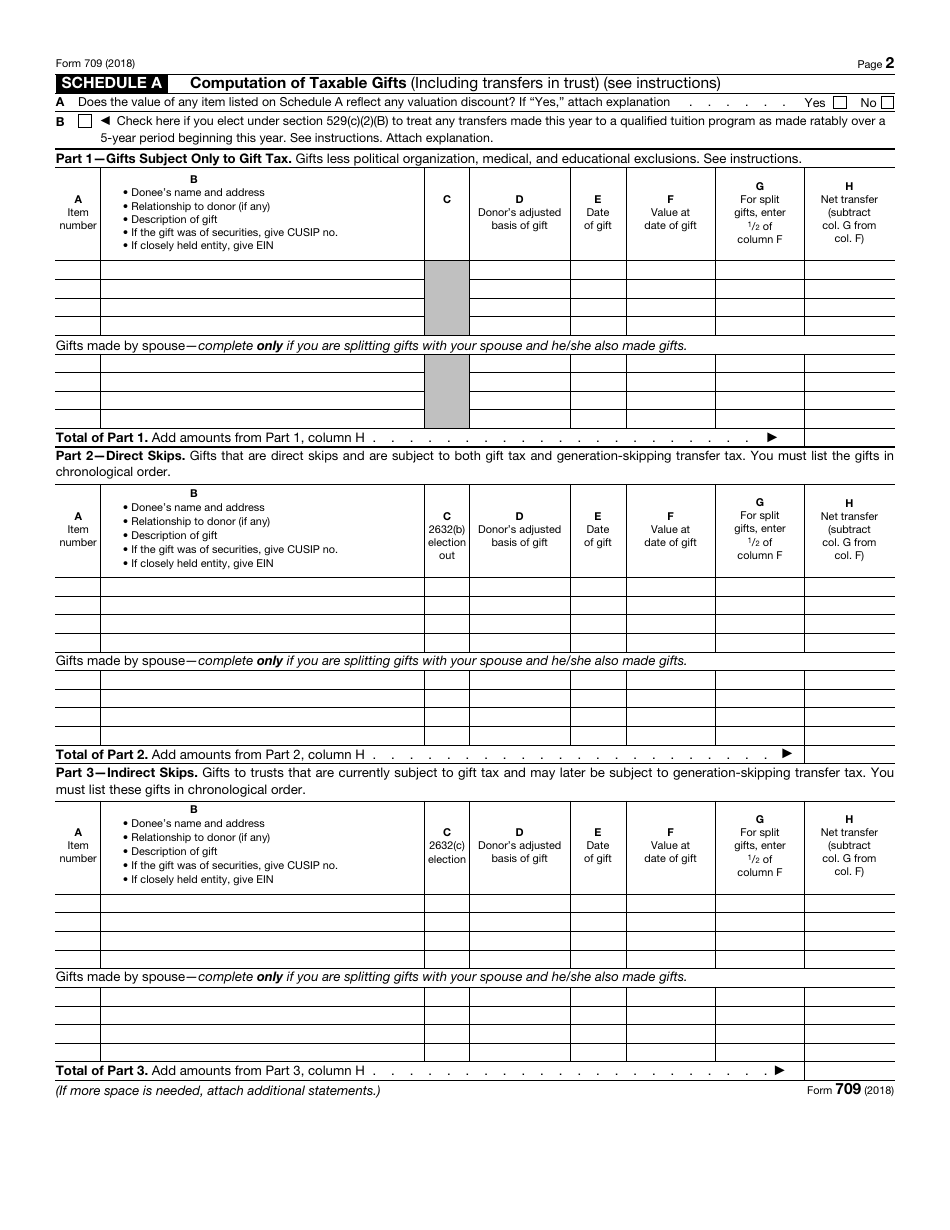

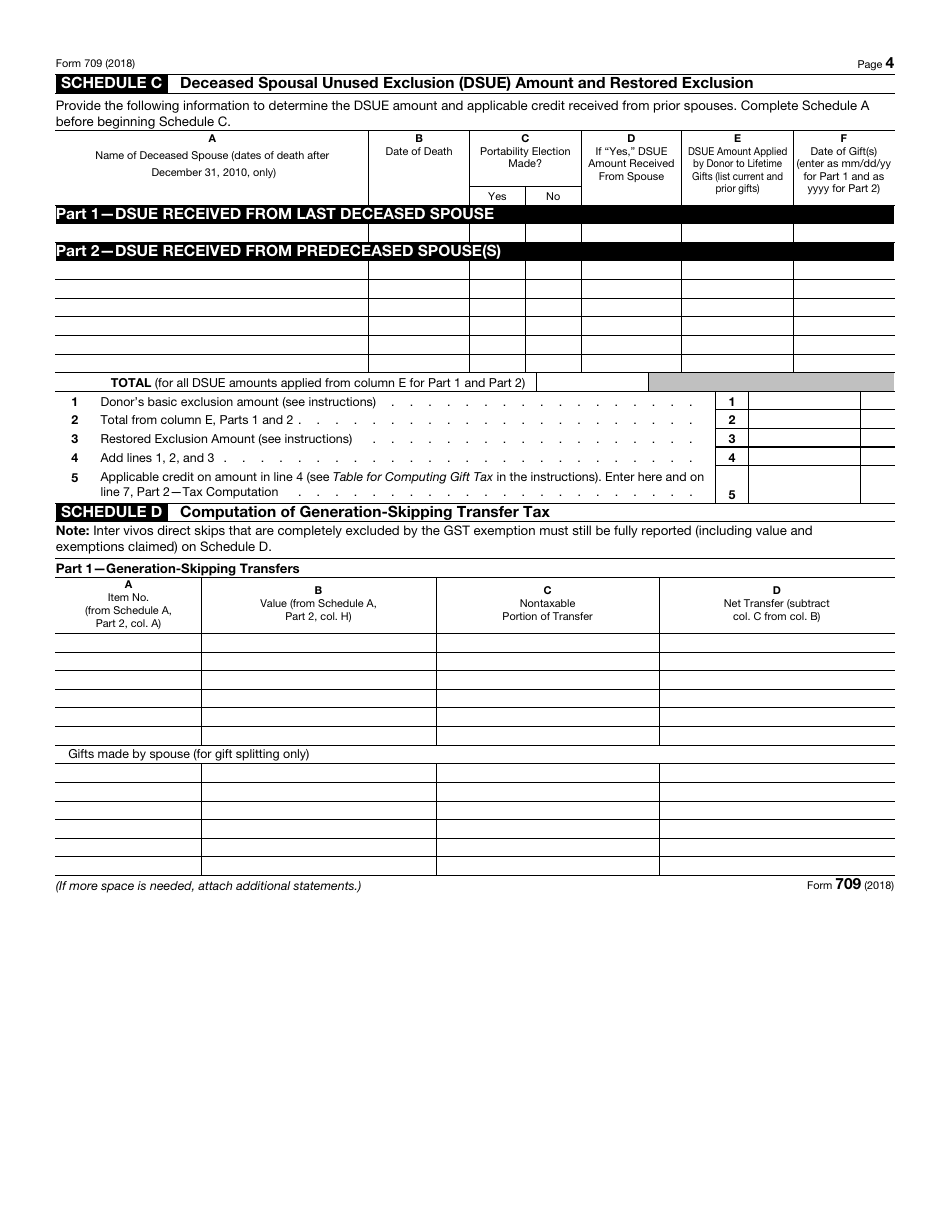

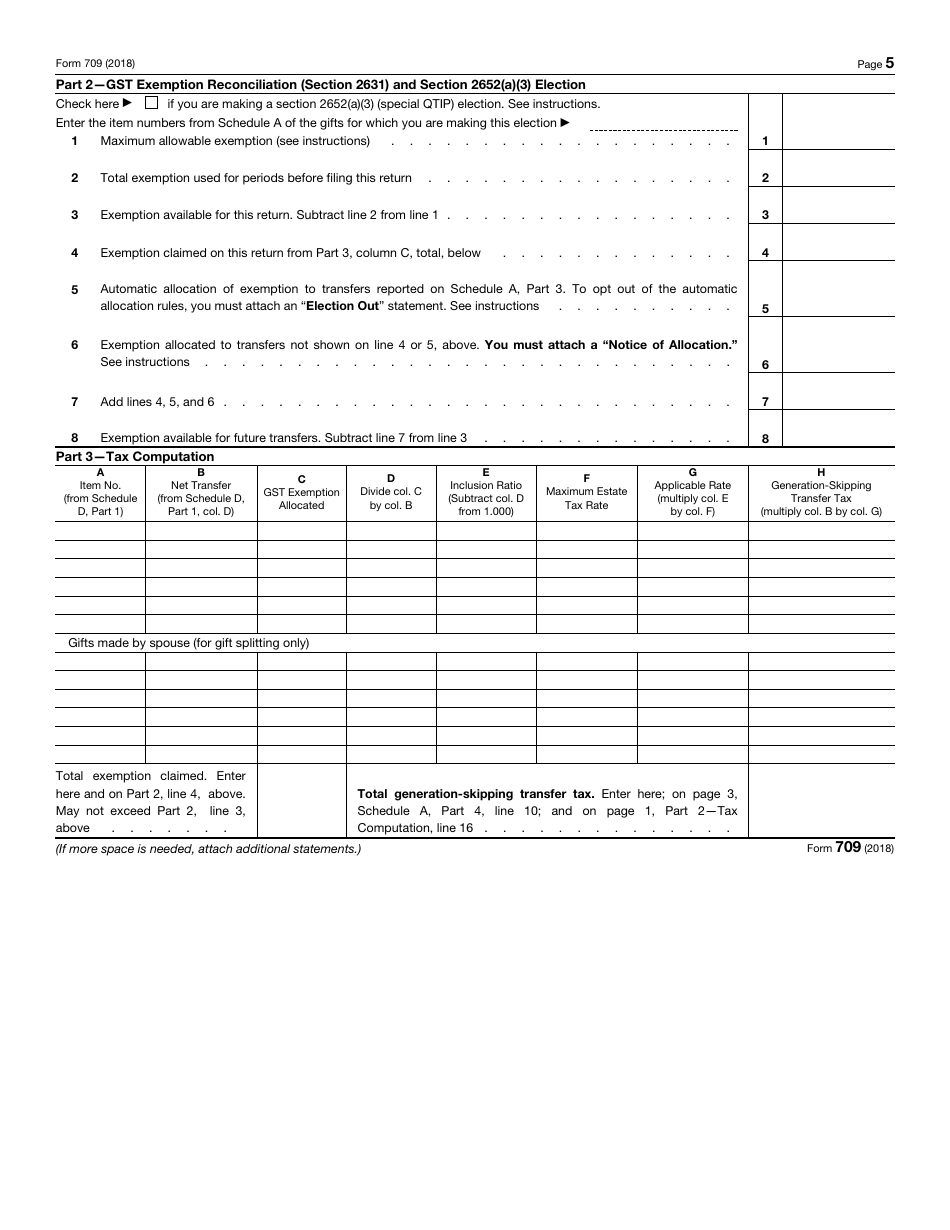

IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return

What Is IRS Form 709?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 709?

A: IRS Form 709 is the United States Gift (And Generation-Skipping Transfer) Tax Return.

Q: Who needs to file IRS Form 709?

A: Individuals who make taxable gifts or generation-skipping transfers need to file IRS Form 709.

Q: What is considered a taxable gift?

A: A taxable gift is any transfer of property where the fair market value of the property exceeds the annual exclusion amount.

Q: What is the purpose of filing IRS Form 709?

A: The purpose of filing IRS Form 709 is to report taxable gifts and determine any gift or generation-skipping transfer tax owed.

Q: What is the annual exclusion amount for gifts?

A: The annual exclusion amount for gifts is the maximum amount that can be given to an individual each year without incurring gift tax. As of 2021, the annual exclusion amount is $15,000 per recipient.

Q: What is a generation-skipping transfer?

A: A generation-skipping transfer is a transfer of property to a beneficiary who is two or more generations younger than the donor.

Q: What is the gift tax rate?

A: The gift tax rate is determined by the value of the taxable gifts made in a lifetime. As of 2021, the gift tax rate ranges from 18% to 40%.

Q: When is the deadline for filing IRS Form 709?

A: The deadline for filing IRS Form 709 is April 15th of the year following the year in which the taxable gift or generation-skipping transfer was made.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 709 through the link below or browse more documents in our library of IRS Forms.