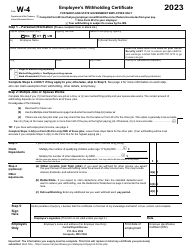

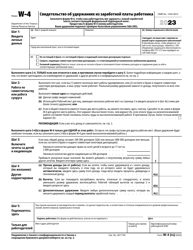

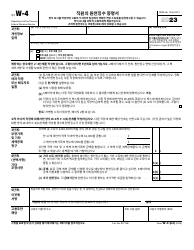

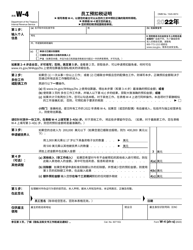

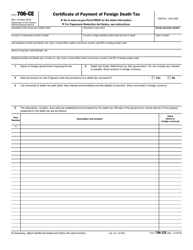

This version of the form is not currently in use and is provided for reference only. Download this version of

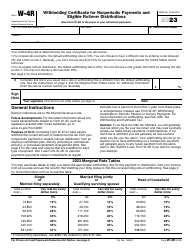

IRS Form W-4P

for the current year.

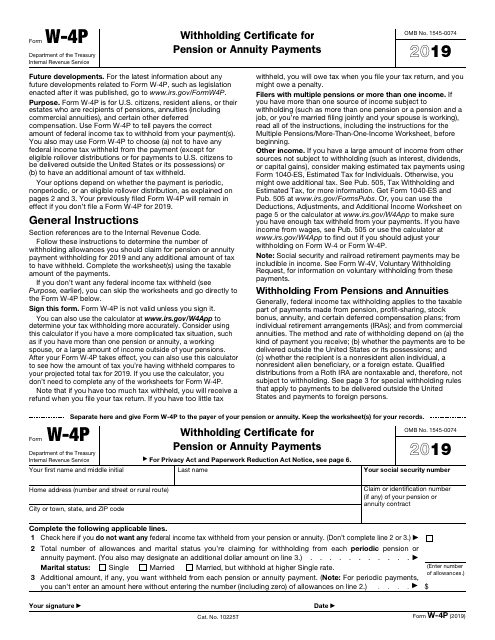

IRS Form W-4P Withholding Certificate for Pension or Annuity Payments

What Is W-4P Form?

IRS Form W-4P, Withholding Certificate for Pension or Annuity Payments , also known as the "pension withholding tax form", is a document used by U.S. citizens, resident aliens, and their estates who receive annuities, pensions, and other deferred compensation to inform payers of the accurate amount of the federal income tax to be withheld from the payments. Additionally, it is possible to choose not to have any income tax withheld from the payment or to have an additional amount of tax withheld. Usually, federal income tax withholding applies to the taxable payments made from profit-sharing, annuity, pension, stock bonus, commercial annuities, and deferred compensation plans.

The form is renewed every year. The latest version of the form was released by the Internal Revenue Service (IRS) in 2019 with all previous editions obsolete. A fillable W-4P Form is available for download below. If you claimed exemption from federal income tax withholding the previous calendar year, you must file a new form by February 15 to prolong your exemption for another year. The IRS recommends submitting a new IRS W-4 Form each year and every time your financial or personal situation undergoes a change.

How to Fill Out W-4P Form?

- If you have a complicated tax situation, for example, you have a working spouse, a large income outside your pensions, or there is more than one annuity or pension, you can use the calculator at the IRS official website to determine your tax withholding accurately;

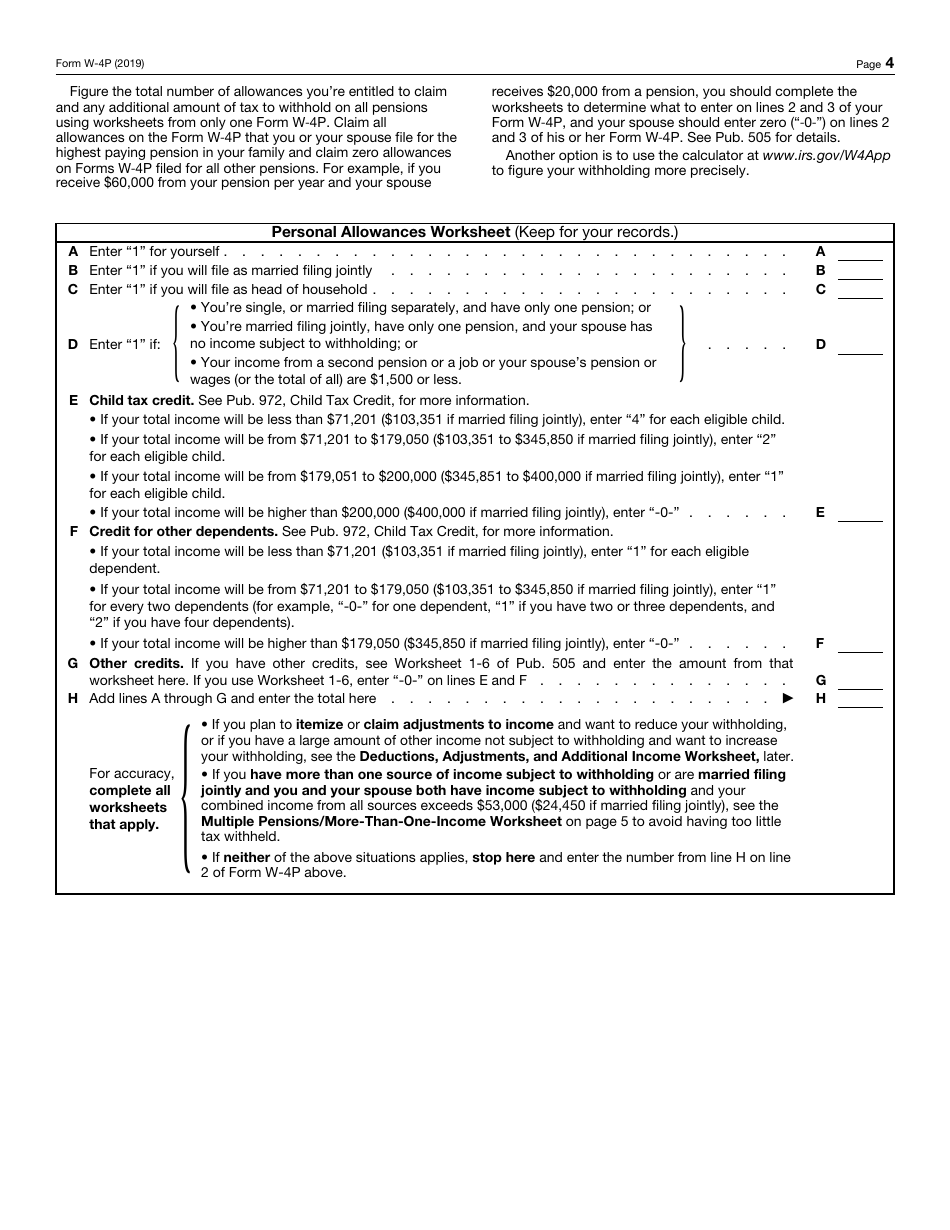

- The IRS W-4P Form includes three worksheets - Personal Allowances Worksheet, Deductions, Adjustments, and Additional Income Worksheet, and Multiple Pensions/More-Than-One-Income Worksheet. You can use them instead of a calculator to determine the number of withholding allowances you need to claim;

- Once you file the form, it will stay in effect until a new form is submitted. You have a right to submit a new document once your life situation changes and you refigure your withholding, for example, when you retire and your pension is now your only source of income, you can claim an additional allowance;

- There are periodic payments for which you cannot use this form. Retirement pay for service in the Armed Forces, tax-exempt organizations' deferred compensation plans, and payments from nonqualified deferred compensation plans are already defined as wages subject to income tax withholding. Ask your payer whether the pension withholding tax form applies.

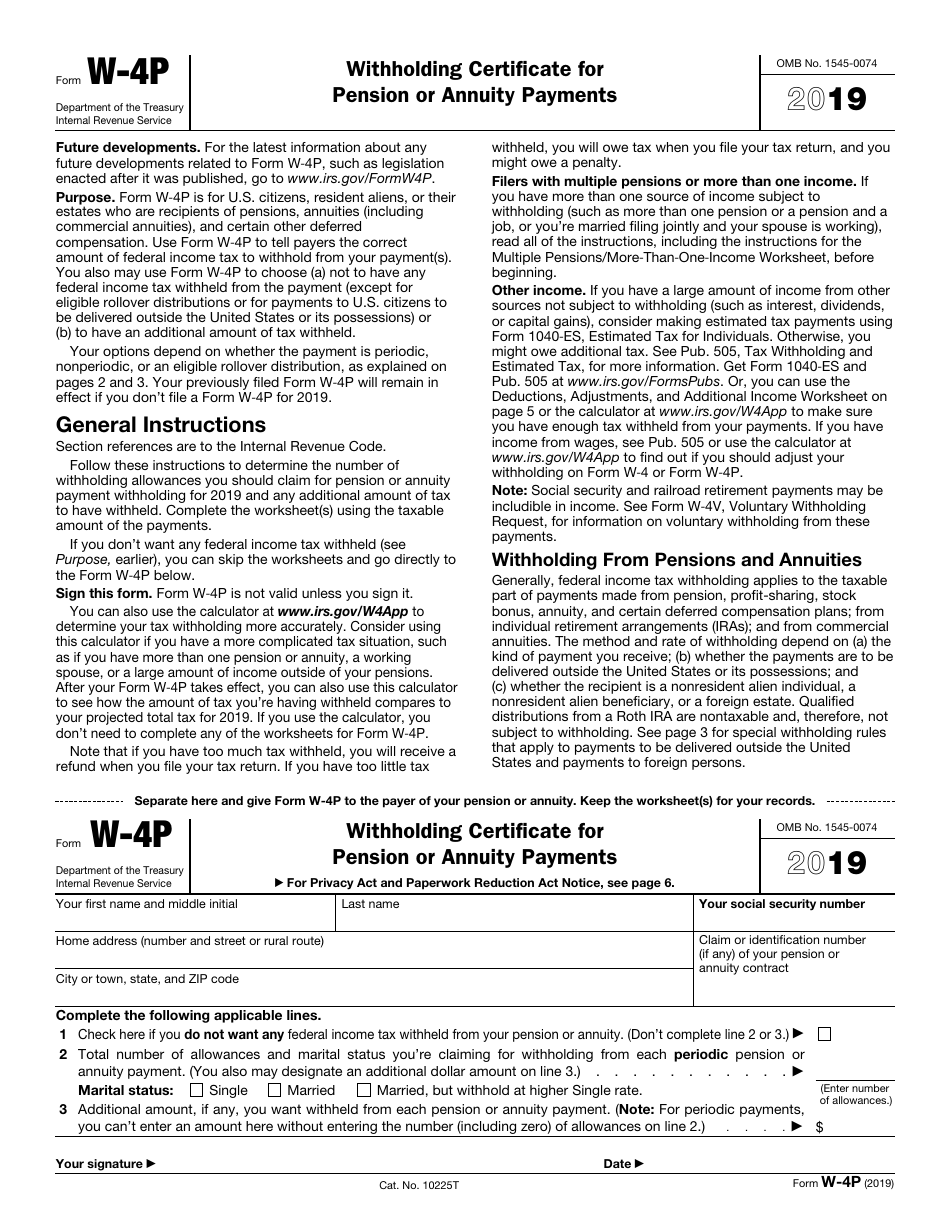

W-4P Form Instructions

Instructions for Form W-4P are as follows:

- Enter your full name and your social security number;

- State your home address;

- Write down the claim or the identification number that belongs to your annuity or pension contract;

- Indicate if you do not want federal income tax withheld from your annuity or pension;

- State total number of allowances and marital status you claim for withholding from each annuity payment or periodic payment. There are three options - single, married, married, but withhold at a higher single rate;

- Write down the additional amount you want to be withheld from each annuity payment or pension;

- Sign and date the form.

IRS W-4P Related Forms:

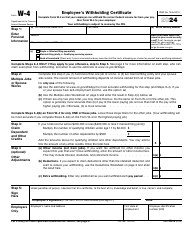

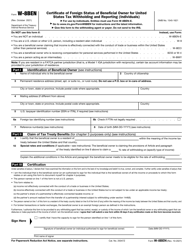

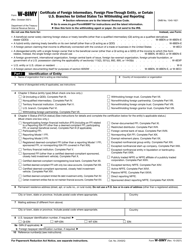

- IRS Form W-4, Employee's Withholding Allowance Certificate, also known as the IRS employee withholding form, is a document completed by employees to let the employer know how much money to withhold from their paychecks for federal taxes.

- IRS Form W-4V Voluntary Withholding Request is a document used to ask the payer to withhold federal income tax by individuals who receive social security payments, unemployment compensation, or other dividends and distributions that can be defined as a government payment.

- IRS Form W-4S, Request for Federal Income Tax Withholding from Sick Pay is a document the employee needs to give to the third-party payer of the sick pay, for example, an insurance company if the employee wishes federal income tax withheld from the payments.