This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form W-3

for the current year.

IRS Form W-3 Transmittal of Wage and Tax Statements

What Is Form W-3?

IRS Form W-3, Transmittal of Wage and Tax Statements is a form that employers complete and file when they need to file a paper Form W-2, Wage and Tax Statement, with the Social Security Administration (SSA). All employers who are engaged in a trade or business and pay the remuneration of $600 or more per year of services provided by an employee are required to file an IRS W‑2 Form for each employee from whom income tax, social security tax, or Medicare tax was withheld. In addition, a copy of Form W-2 must be furnished to each employee.

The form is issued by the Internal Revenue Service (IRS) and is renewed annually. Use the link below to download a fillable copy of the IRS Form W-3.

What Is Form W-3 Used For?

The form is used for transmitting a paper Copy A of Form W-2, to the SSA. Form W-3 must not be filed alone and must be completed only when W-2 Copy A is filed on paper. This form is not necessary if Form W-2 is filed electronically.

When Is Form W-3 Due?

The due date for filing 2019 Form W-3 is January 31, 2020.

Penalties for failure to file Form W-2 by the due date are imposed on employers who cannot show a reasonable cause of failure. Penalty amounts have been adjusted for inflation, and this increase applies to returns required to be filed after December 31, 2019. Based on the date of filing, the amounts are as follows:

- $50 per form if it is correctly filed within 30 days of the due date;

- $110 per form if it is correctly filed more than 30 days after the due date but by August 1;

- $270 per form if it is filed after August 1, or if it is not filed or corrected.

IRS Form W-3 Instructions

The IRS provides specific instructions on Form W‑3 and W‑2. You can find detailed instructions for this form on the IRS site or by following this link. Employers are required to use a Form W-3 even if they are filing only one paper Form W-2. Both forms must show the same correct tax year and Employer Identification Number (EIN).

Even employers with only one household employee must also file Form W-3 to transmit Copy A of Form W-2, and the "Hshld. emp." checkbox must be checked.

As paper forms must comply with standards set forth by the IRS and be machine-readable, the digital W-3 fillable form provided online is for informational purposes only. Employers may scan the official printed version of this IRS form, but not a printed copy of its online version. The SSA does not accept photocopies.

Employers should make a copy of IRS Form W-3 and keep it with Copy D (For Employer) of Form W-2 for their records. The IRS recommends that employers retain these copies for at least four years. Employers must make sure not to file paper forms for the same returns that were e-filed. The SSA strongly suggests that employers file Form W-3 and Form W-2 Copy A electronically instead of on paper.

The form may be signed on behalf of the employer or payer by a transmitter or sender if they are authorized to sign by a valid agency agreement and if they write "For (name of the payer)" next to their signature. Employers must send the W-3 together with Form W-2 Copy A to the following address: Social Security Administration Direct Operations Center Wilkes-Barre, PA 18769-0001. However, if "Certified Mail" is used to file, the ZIP code must be changed to "18769-0002." The IRS also approves some private delivery services, which, if used, require that "ATTN: W-2 Process, 1150 E. Mountain Dr." be added, and ZIP must be "18702-7997."

No cash, check, money order, or any other form of payment should be sent with the Forms W-2 and W-3 submitted to the SSA.

How to Fill Out Form W-3?

Follow these steps to fill out the report:

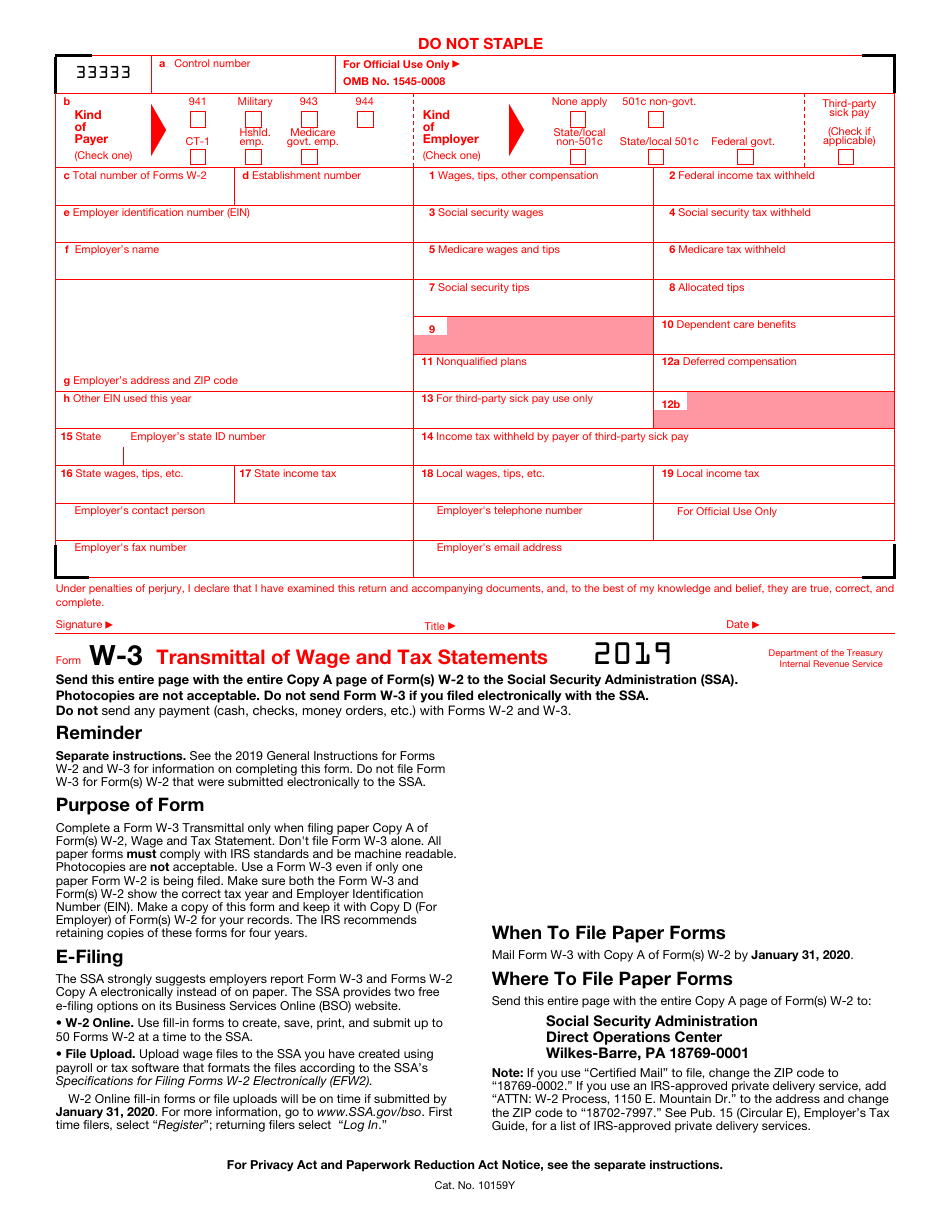

- Box A. Control number. This box may be used for numbering the whole transmittal.

- Box B. Kind of Payer and Kind of Employer. Check the boxes that apply.

- Box C. Total number of Forms W-2. Enter the number of individual Forms W-2 that you are being transmitted with this W-3 Form.

- Box D. Establishment number. You may identify separate establishments in your business. However, employers may use a single Form W-3 for all Forms W-2 of the same type.

- Boxes E through Box G are self-explanatory.

- Boxes 1 through 8. Enter the total amounts reported in boxes 1 through 8 on the Forms W-2.

- Box 10. Dependent care benefits. Enter the total amount reported in box 10 on Forms W-2.

- Box 11. Nonqualified plans. Enter the total amount reported in box 11 on Forms W-2.

- Box 12a. Deferred compensation. Enter the total sum of all amounts that were reported with codes D through H, S, Y, AA, BB, and EE in box 12 on Forms W-2.

- Box 13. For third-party sick pay use only. Leave this blank.

- Box 14. Income tax withheld by the payer of third-party sick pay. Complete this only if you are the employer and have employees who had income tax withheld on third-party payments of sick pay.

- Box 15. State/Employer's state ID number. Enter the abbreviation for the state or territory being reported on Forms W-2. Also, enter your territory-assigned ID number, unless the Forms W-2 contain information from more than one territory, in which case you must only enter an "X" under "State".

- Boxes 16 through 19. Enter the total amounts shown in their corresponding boxes on the Forms W-2.

IRS W-3 Related Forms:

- Form W-3SS, Transmittal of Wage and Tax Statements, which is a form that must be filed with the SSA by anyone who is required to transmit a paper Copy A of forms W-2AS, W-2CM, W-2GU, and W-2VI to the SSA;

- Form W-3C, Transmittal of Corrected Wage and Tax Statements, a form used for transmitting Copy A of Form W-2C, Corrected Wage and Tax Statements. The latter is filed to correct errors on forms W-2, W-2AS, W-2CM, W-2GU, W-2VI, and W‑2C that were filed with the SSA.