This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form W-10

for the current year.

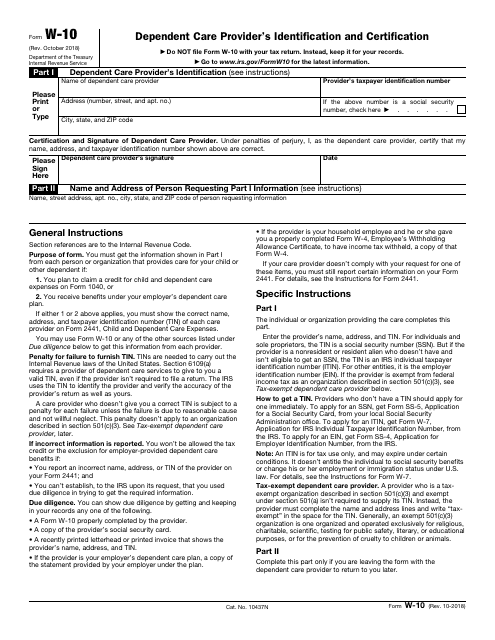

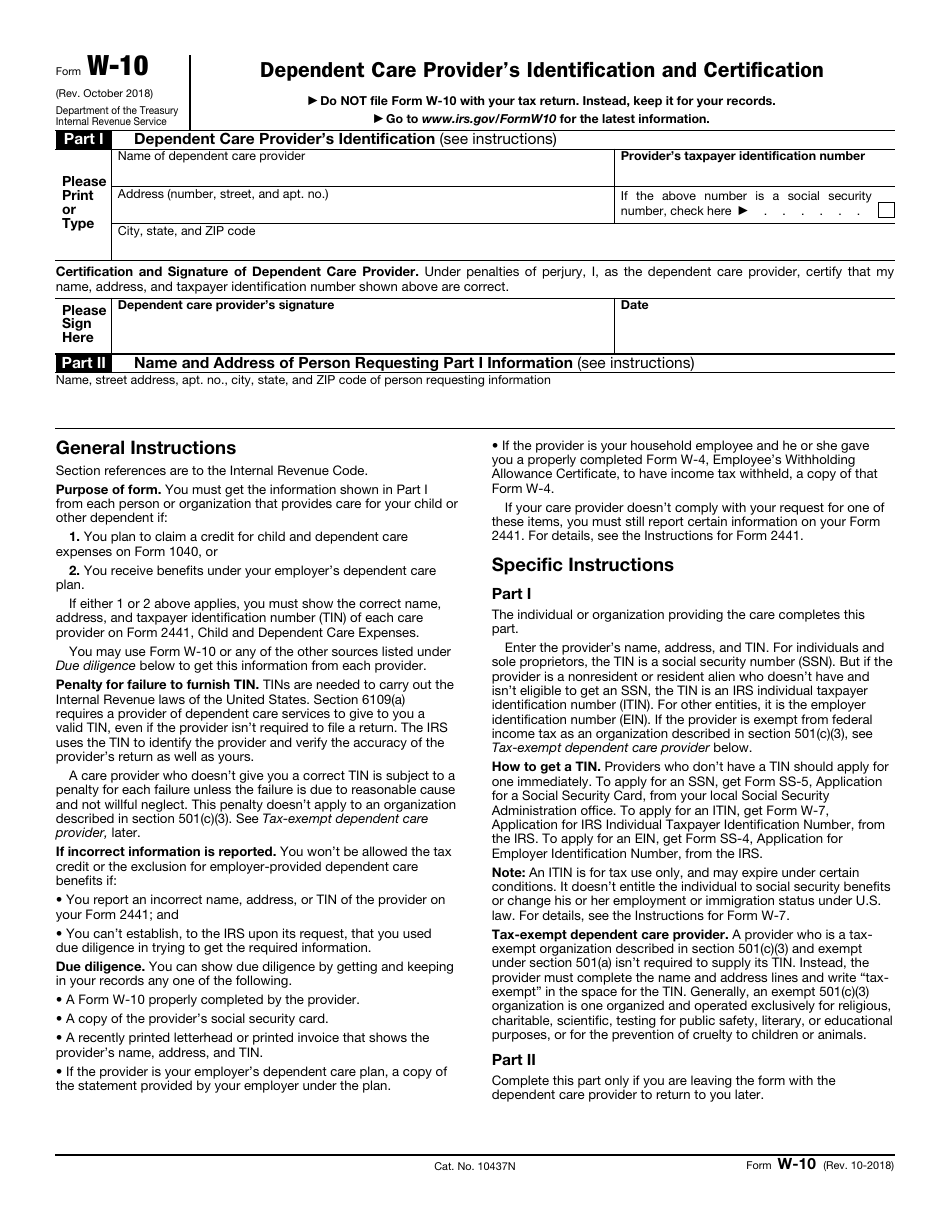

IRS Form W-10 Dependent Care Provider's Identification and Certification

What Is IRS Form W-10?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form W-10?

A: IRS Form W-10 is the Dependent Care Provider's Identification and Certification form.

Q: Who should fill out IRS Form W-10?

A: Dependent care providers who provide services for a person's child or dependent should fill out IRS Form W-10.

Q: What information is required on IRS Form W-10?

A: IRS Form W-10 requires the dependent care provider's name, address, and taxpayer identification number (TIN).

Q: Why is IRS Form W-10 important?

A: IRS Form W-10 is important for individuals who want to claim the Child and Dependent Care Tax Credit on their tax return.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form W-10 through the link below or browse more documents in our library of IRS Forms.