This version of the form is not currently in use and is provided for reference only. Download this version of

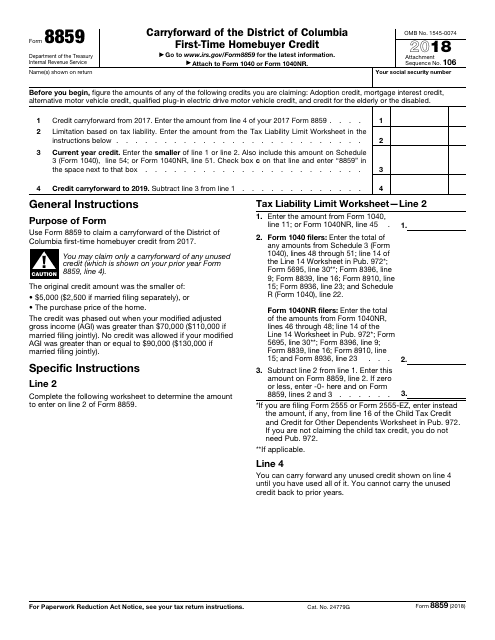

IRS Form 8859

for the current year.

IRS Form 8859 Carryforward of the District of Columbia First-Time Homebuyer Credit

What Is IRS Form 8859?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8859?

A: IRS Form 8859 is a form used to claim the carryforward of the District of Columbia First-Time Homebuyer Credit.

Q: Who can use IRS Form 8859?

A: IRS Form 8859 is used by individuals who are claiming the carryforward of the District of Columbia First-Time Homebuyer Credit.

Q: What is the District of Columbia First-Time Homebuyer Credit?

A: The District of Columbia First-Time Homebuyer Credit is a credit that allows eligible individuals to reduce their federal income tax liability.

Q: What does the carryforward mean?

A: The carryforward allows individuals to continue claiming any unused portion of the District of Columbia First-Time Homebuyer Credit from a previous tax year.

Q: Are there any restrictions or limitations on using IRS Form 8859?

A: Yes, there are certain eligibility requirements and restrictions that must be met in order to claim the carryforward of the District of Columbia First-Time Homebuyer Credit using IRS Form 8859.

Q: Is there a deadline for filing IRS Form 8859?

A: Yes, you must file IRS Form 8859 by the due date of your federal income tax return, which is usually April 15th.

Q: Can I e-file IRS Form 8859?

A: No, you cannot e-file IRS Form 8859. It must be filed by mail along with your federal income tax return.

Q: Can I claim the District of Columbia First-Time Homebuyer Credit on my state tax return?

A: The availability of the credit on your state tax return may vary. You should consult your state's tax agency for more information.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8859 through the link below or browse more documents in our library of IRS Forms.