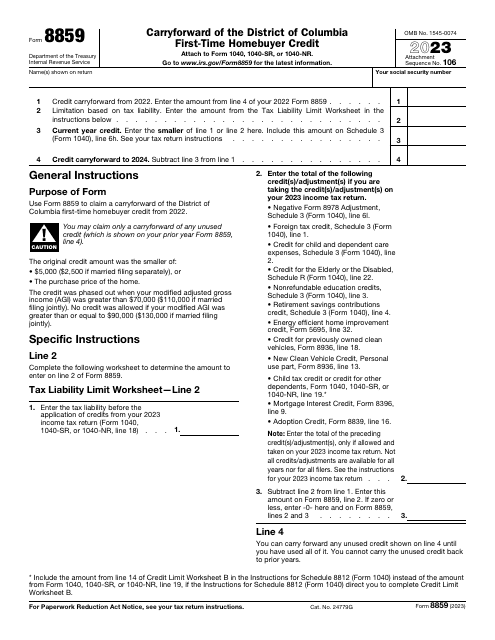

IRS Form 8859 Carryforward of the District of Columbia First-Time Homebuyer Credit

What Is IRS Form 8859?

IRS Form 8859, Carryforward of the District of Columbia First-Time Homebuyer Credit , is a fiscal document residents of the District of Columbia are permitted to complete in order to claim a carryforward credit they will be able to use in the future. If you purchased residential property for the first time in your life, you can qualify for a tax credit unless you earned more than $90.000 during the year ($130.000 for people that file joint tax returns with their spouses).

This statement was issued by the Internal Revenue Service (IRS) in 2023 , making older editions of the form outdated. You may find an IRS Form 8859 fillable version via the link below.

Identify yourself by your name and social security number, state the amount of credit carryforward from the claim you prepared for the previous year, record the tax liability limitation you calculate with the help of the worksheet at the bottom of the form, indicate the credit of the current year, and specify how big the credit carryforward is for the upcoming year. Once Form 8859 is filled out, attach it to the tax return you are obliged to file annually. Unlike tax deductions that will decrease the amount of your income subject to tax, this tax credit will lower the taxes you owe to the IRS which makes this type of non-refundable credit an appealing option for taxpayers that plan to reduce their tax liability later on.