This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8843

for the current year.

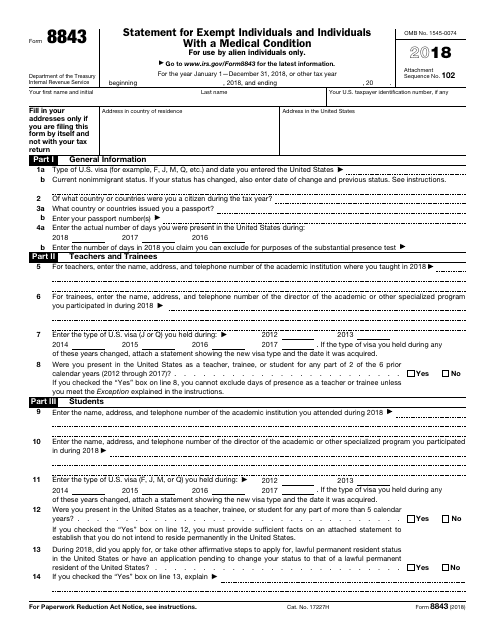

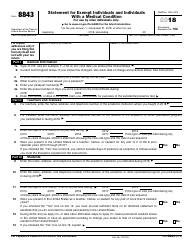

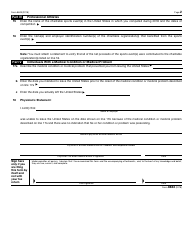

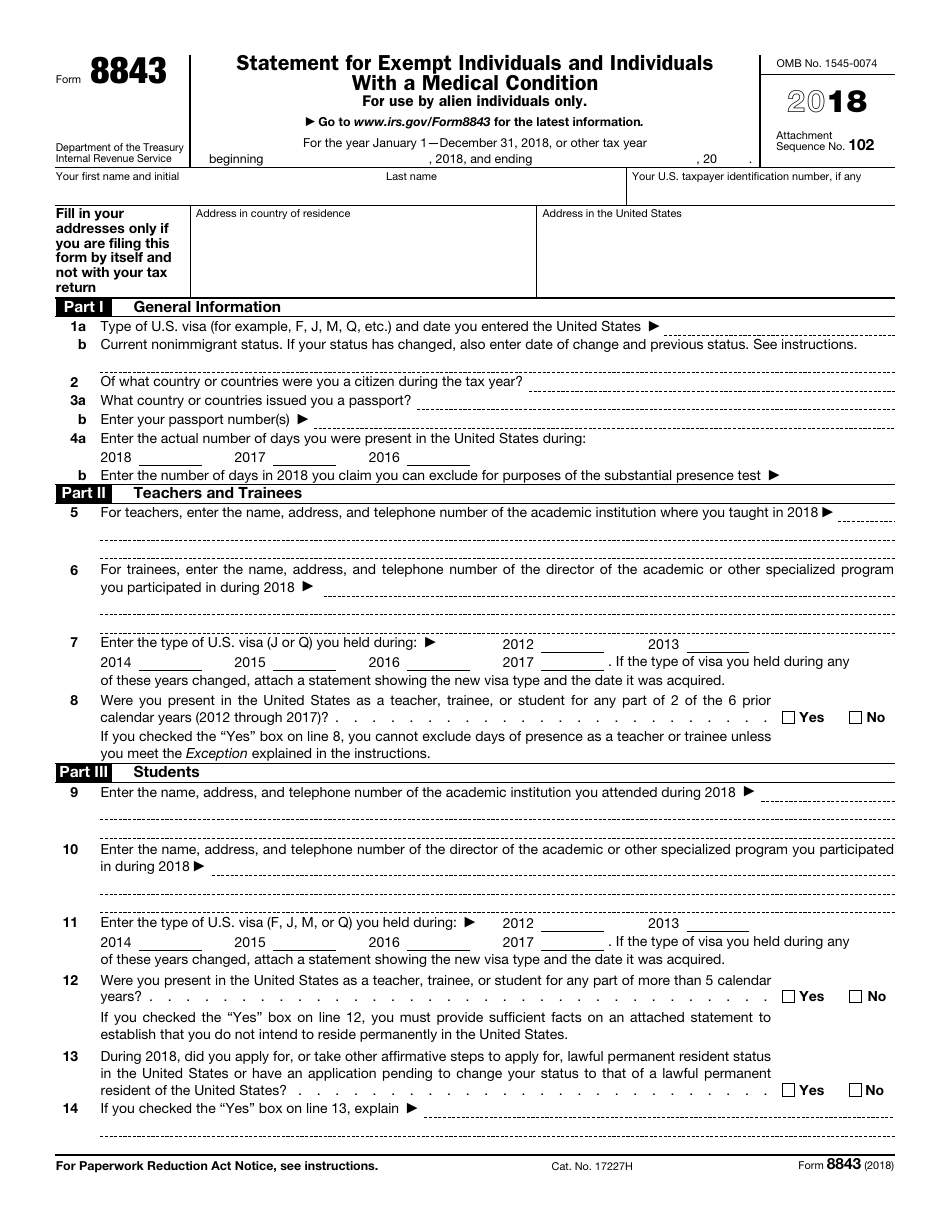

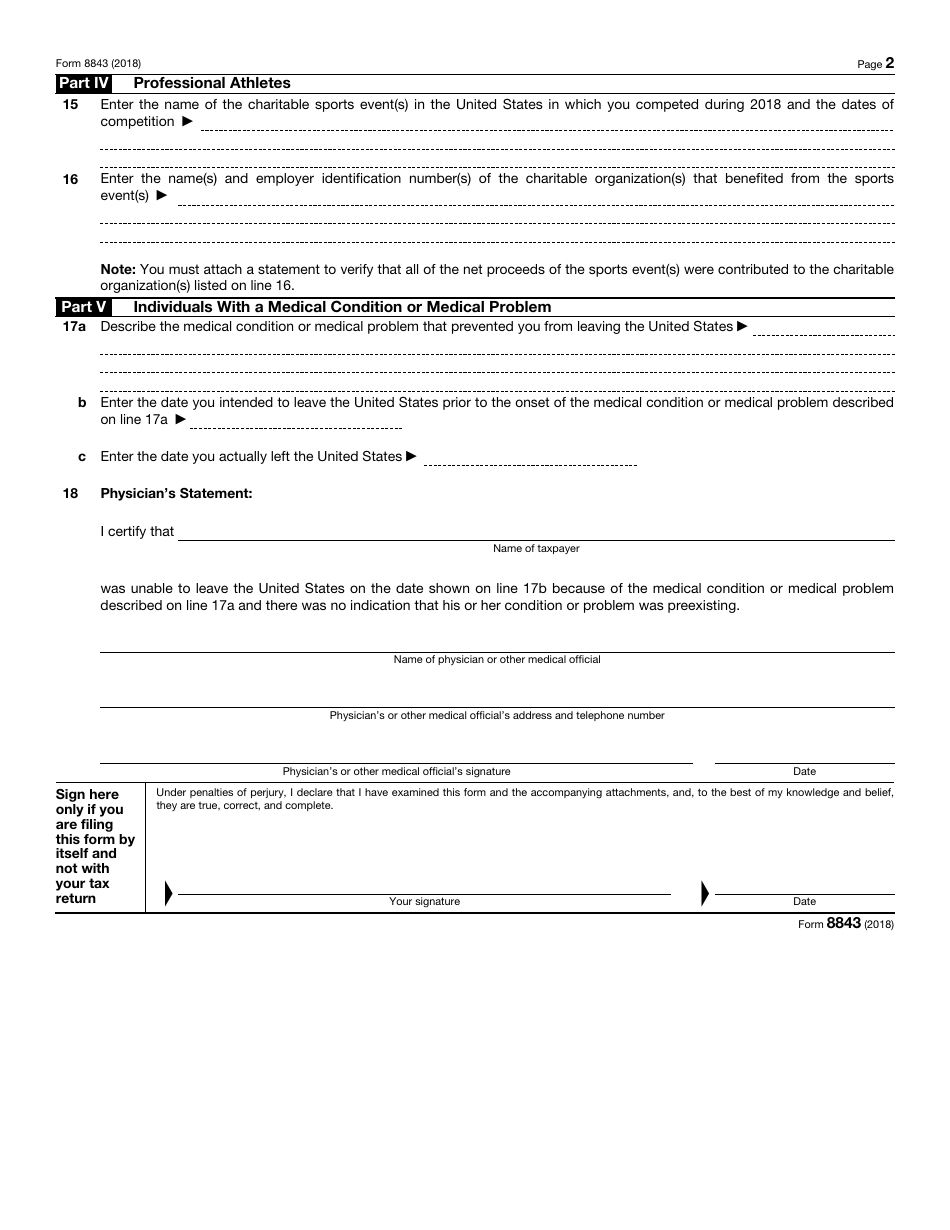

IRS Form 8843 Statement for Exempt Individuals and Individuals With a Medical Condition

What Is IRS Form 8843?

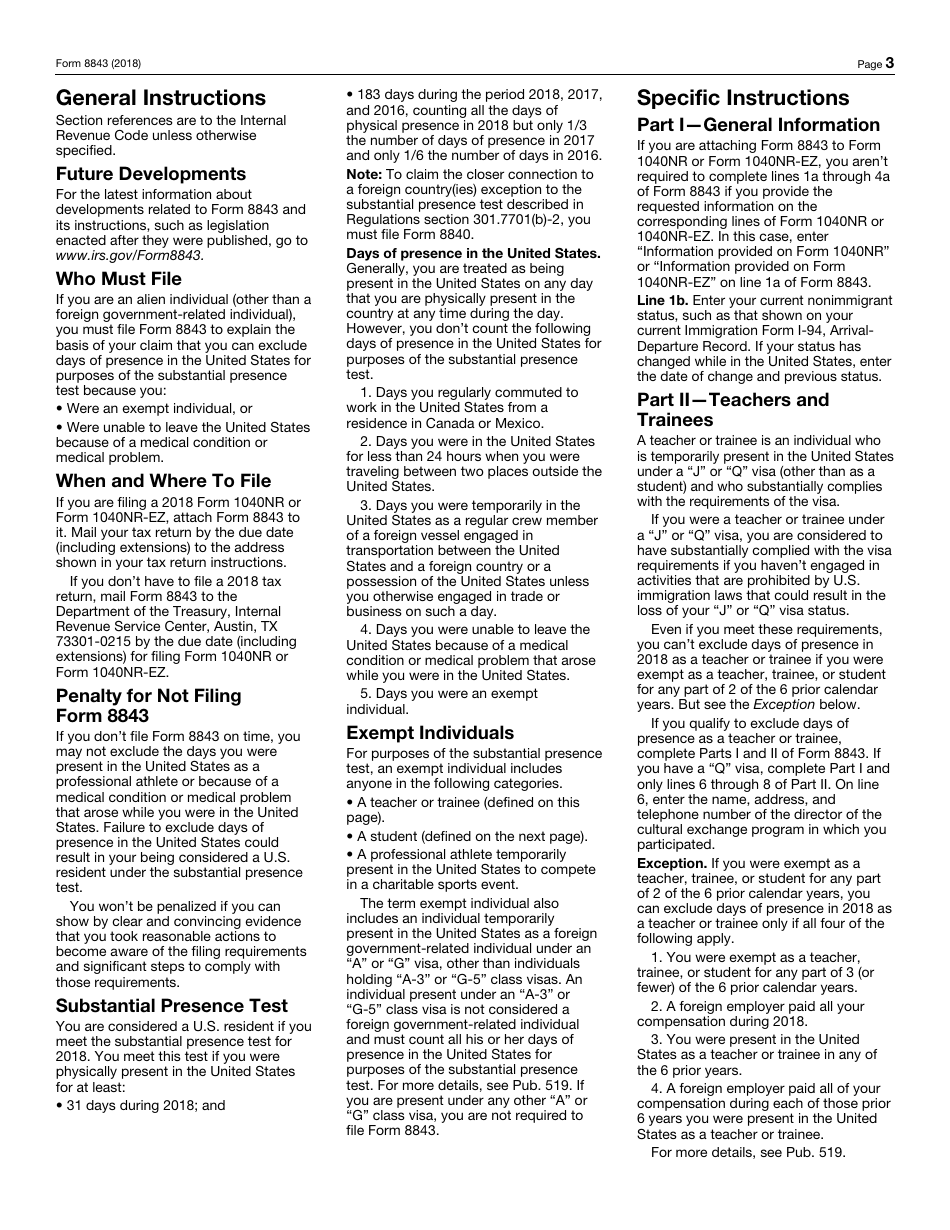

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8843?

A: IRS Form 8843 is a statement for exempt individuals and individuals with a medical condition.

Q: Who needs to fill out IRS Form 8843?

A: Nonresident aliens who meet certain criteria, such as being exempt individuals or having a medical condition, need to fill out IRS Form 8843.

Q: What is the purpose of IRS Form 8843?

A: The purpose of IRS Form 8843 is to declare your status as an exempt individual or an individual with a medical condition to the IRS.

Q: What information is required on IRS Form 8843?

A: IRS Form 8843 requires information such as your personal details, your immigration status, and a statement explaining your eligibility for exemption or medical condition.

Q: When is the deadline to submit IRS Form 8843?

A: The deadline to submit IRS Form 8843 is typically April 15th, the same as the deadline for filing federal income tax returns.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8843 through the link below or browse more documents in our library of IRS Forms.