This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8606

for the current year.

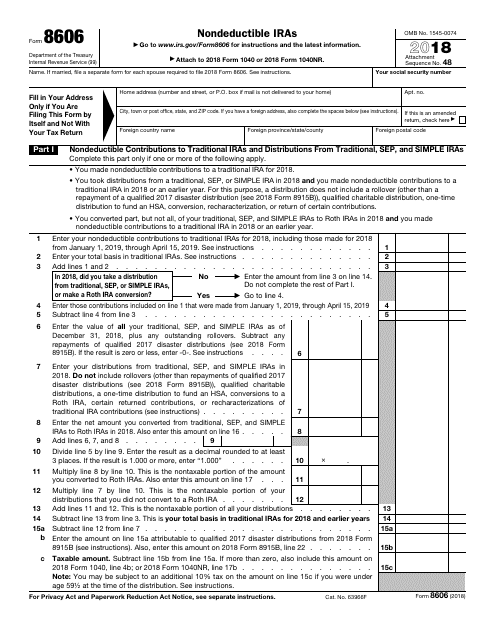

IRS Form 8606 Nondeductible Iras

What Is IRS Form 8606?

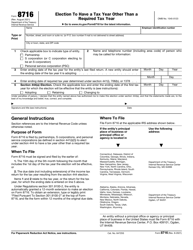

IRS Form 8606, Nondeductible IRAs , is a document issued by the Internal Revenue Service (IRS) and used for providing the IRS with information on taxpayers who make nondeductible contributions to their Individual Retirement Account (IRA). The form was last revised in 2018 . It is supposed to be submitted for each tax year when nondeductible contributions are made. A fillable 8606 Form is available for download through the link below.

Alternate Name:

- Tax Form 8606.

IRS Form 8606 must be filed by certain types of taxpayers. Individuals must submit the application if they:

- Made nondeductible contributions to a traditional IRA for 2018, including a repayment of a qualified reservist distribution.

- Received distributions from a traditional, SEP, or Savings Incentive Match Plan for Employees Individual Retirement Account (SIMPLE IRA) in 2018 and their basis in traditional IRAs is more than zero.

- They converted an amount from a traditional, SEP, or SIMPLE IRA to a Roth IRA in 2018.

- They received certain distributions from a Roth IRA in 2018.

- They received a distribution from an inherited traditional IRA that has a basis, or they received a distribution from an inherited Roth IRA that wasn't a qualified distribution.

Even though there is a long list of cases where a taxpayer must file an application, there are situations when individuals don't have to submit one. For example, Form 8606 is not required when a taxpayer makes deductible IRA contributions or takes a qualified Roth IRA distribution.

What Is IRS Form 8606 Used For?

IRS Form 8606 is supposed to be used by taxpayers when they want to designate the following:

- Nondeductible contributions made to traditional IRAs.

- Distributions from traditional, Simplified Employee Pension (SEP), or SIMPLE IRAs, if they have ever made nondeductible contributions to traditional IRAs.

- Conversions from traditional, SEP, or SIMPLE IRAs to Roth IRAs.

- Distributions from Roth IRAs.

How to File IRS Form 8606?

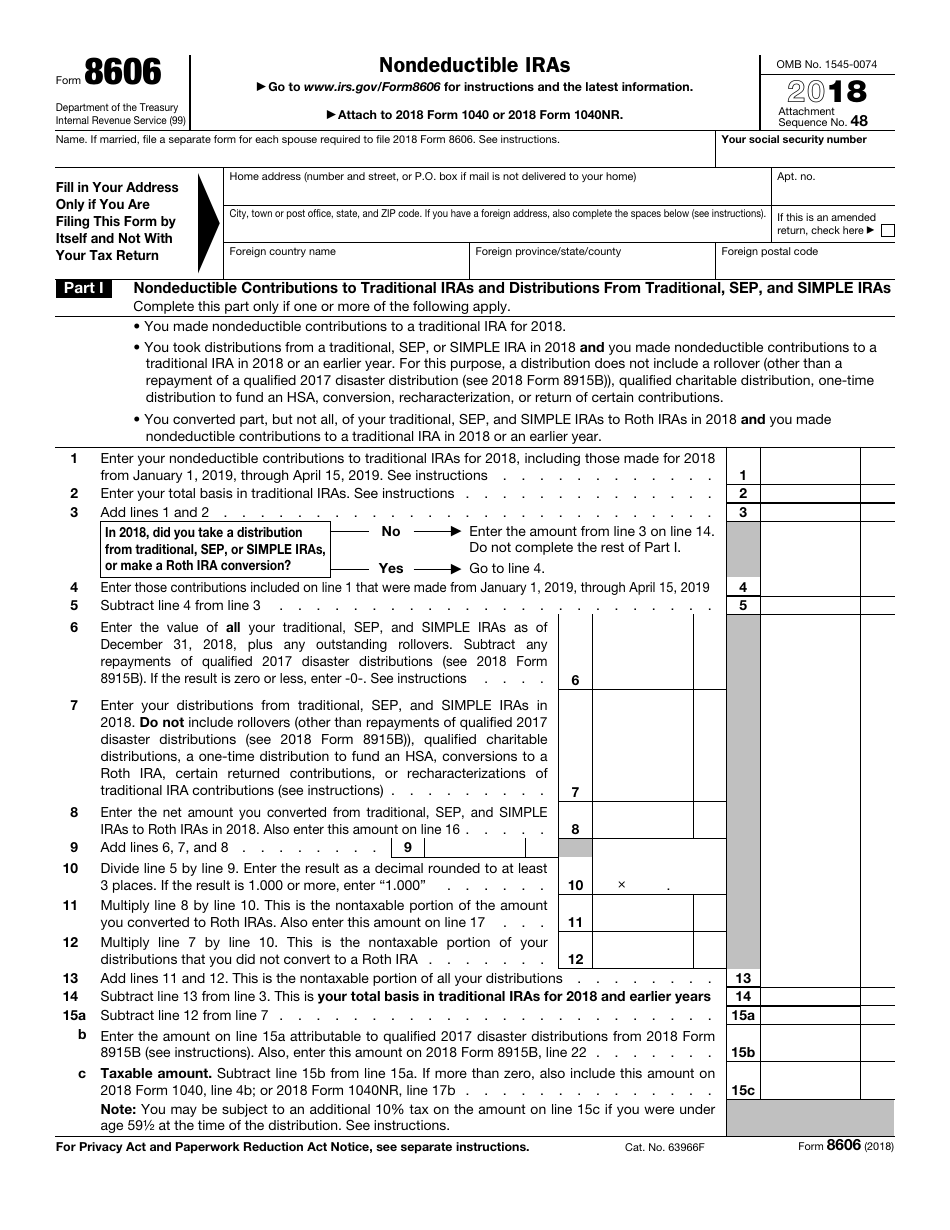

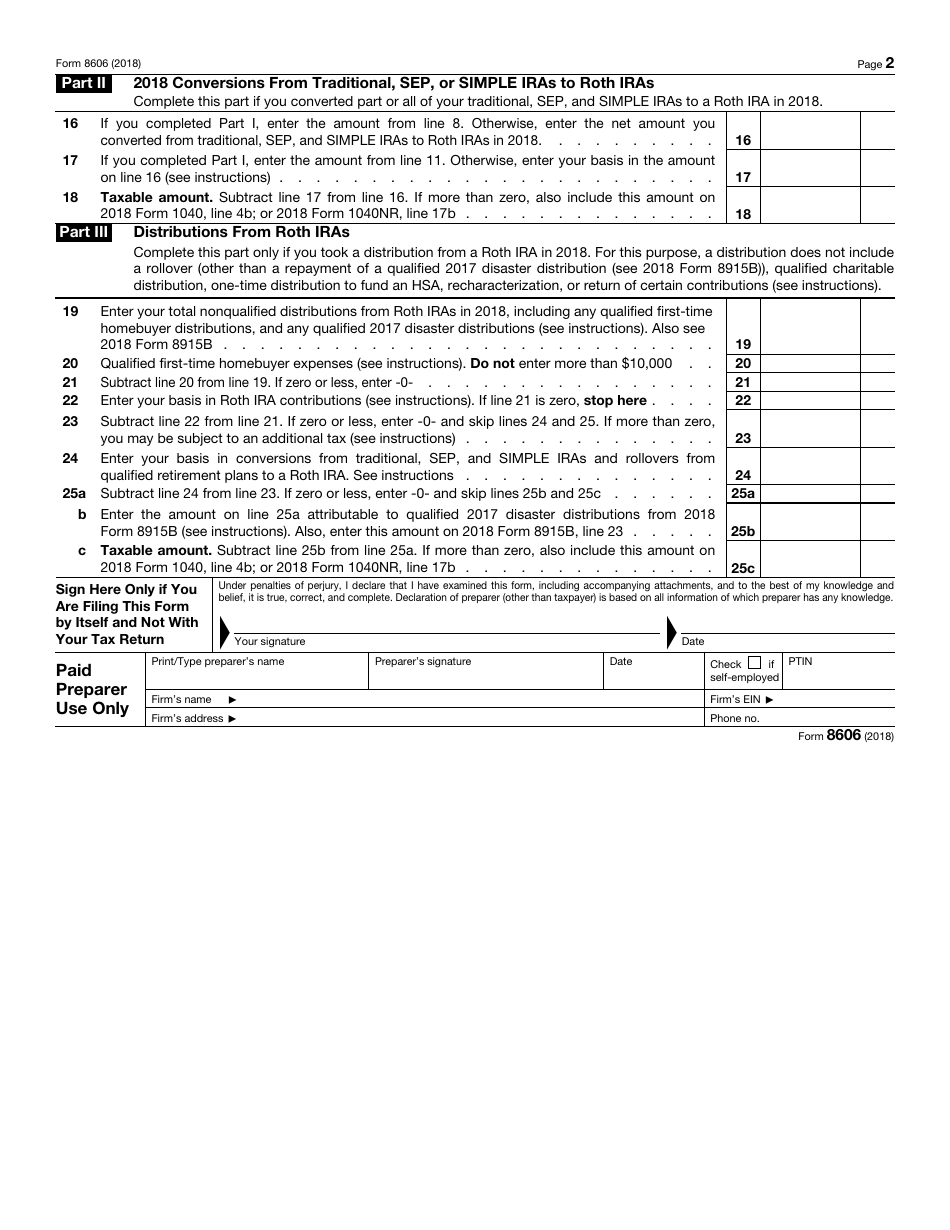

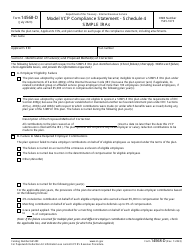

IRS instructions for Form 8606 provide general information on the purpose of the form, how to fill it out, necessary definitions, and various explanations on different questions that a taxpayer can come up with while filling in the document. While instructions provide the necessary information, the application itself is presented as two pages divided into three major parts:

- "Nondeductible Contributions to Traditional IRAs and Distributions From Traditional, SEP, and SIMPLE IRAs;"

- "2018 Conversions From Traditional, SEP, or SIMPLE IRAs to Roth IRAs;"

- "Distributions From Roth IRAs."

Where to Mail Form 8606?

Tax Form 8606 can be filed in conjunction with other forms, related to an income tax return, or by itself. An individual must file Form 8606 with IRS Form 1040, U.S. Individual Income Tax Return, or IRS Form 1040-NR, U.S. Nonresident Alien Income Tax Return, by the appropriate due date.

If an individual is required to submit only Form 8606, they need to complete it fully and send it off to the IRS. It is supposed to be done at the same time and place they would otherwise submit their income tax return applications.