This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8396

for the current year.

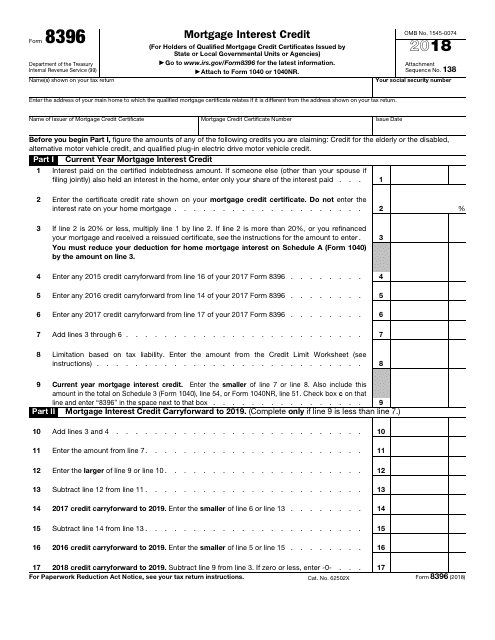

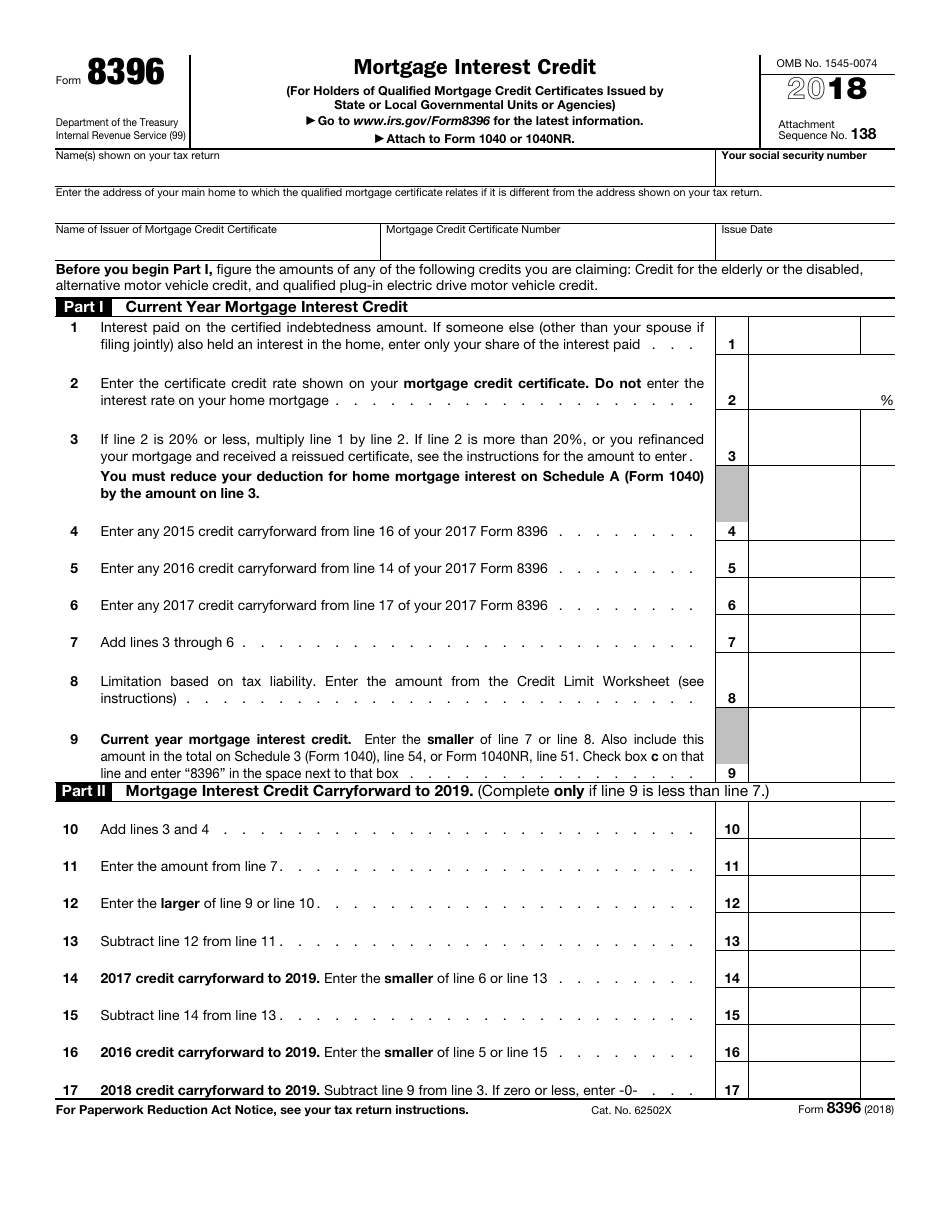

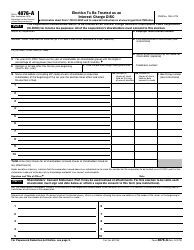

IRS Form 8396 Mortgage Interest Credit (For Holders of Qualified Mortgage Credit Certificates Issued by State or Local Governmental Units or Agencies)

What Is IRS Form 8396?

IRS Form 8396, Mortgage Interest Credit is the document you fill out in order to calculate and claim the tax credit on your mortgage interest for the current tax year, as well as to request the credit extension for the next year. The issuing agency of the form is the Internal Revenue Service (IRS) .

The main aim of the credit is to help low- and moderate-income individuals to afford property ownership. The maximum amount of credit you can get is $2,000 per year.

The IRS mortgage interest credit form is revised annually and attached to the IRS Form 1040 or the IRS Form 1040NR before submitting. Download the latest fillable IRS Form 8396 through the link below.

IRS Form 8396 Instructions

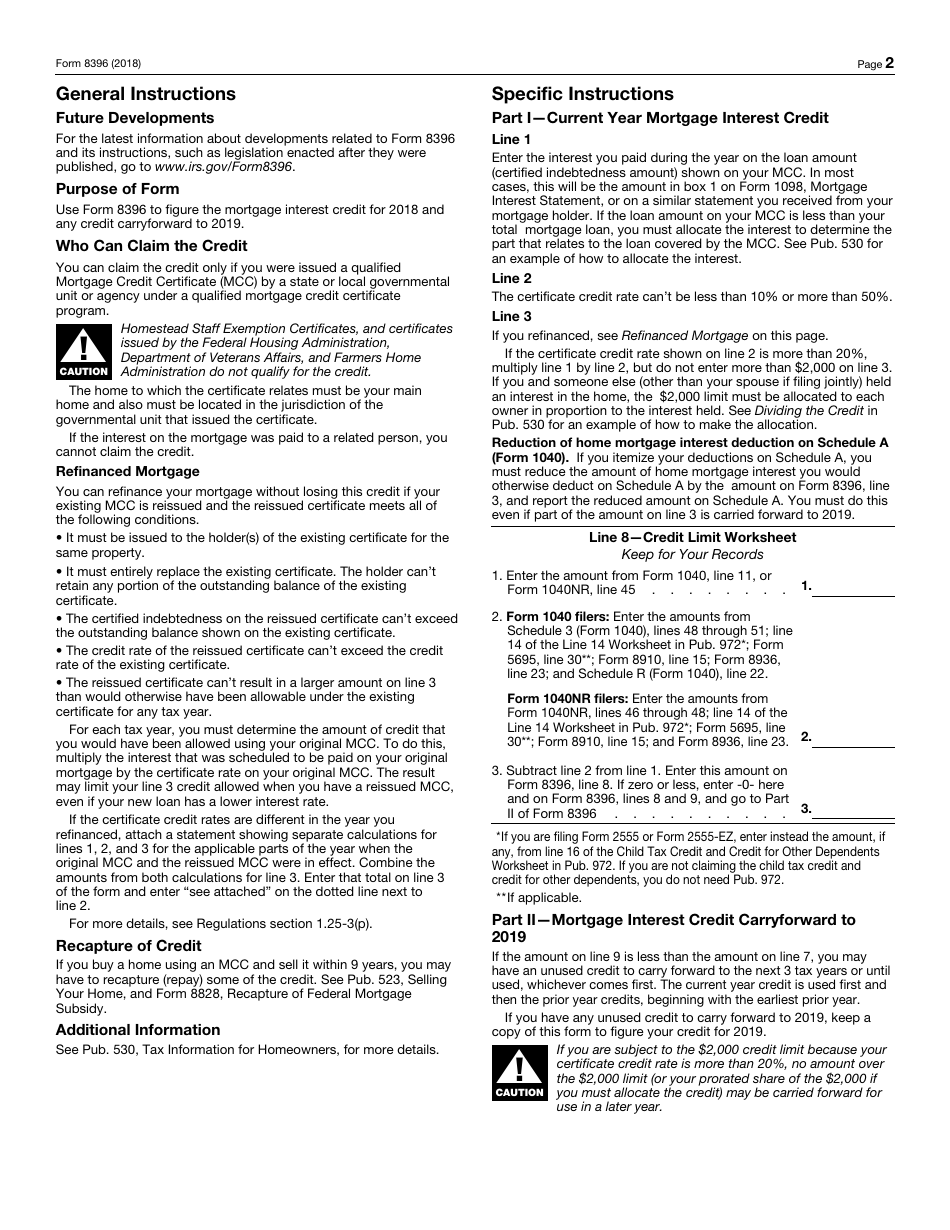

You can claim the tax credit on this form only if you have a qualified Mortgage Credit Certificate (MCC) issued by a state or local government agency or unit. The MCC is the document that converts a part of the mortgage interest you pay into a non-refundable tax credit. Note that if you possess the certificate issued by the Department of Veterans Affairs, Federal Housing Administration, or Farmers Home Administration, you are not entitled to this credit. The same applies if you have a Homestead Staff Exemption Certificate.

To be eligible for this credit, you have to meet two more requirements:

- The home the MCC was issued for must be your primary residence;

- The home must be within the same jurisdiction as the government agency that provided you with the MCC.

Homeowners itemizing their tax deductions on Schedule A (Form 1040) must reduce their deductions on the amount of credit claimed on this form.

How to Fill Out IRS Form 8396?

Use this guide to fill out your IRS 8396 Form properly:

- Enter your identification information: name as shown on your tax return form, Social Security number, and the address of the home the MCC was issued for;

- Specify the details about the MCC: issuer name, number, and issue date;

- Line 1. Provide the amount of the interest you paid on your loan. Your calculations should be based only on the loan amount indicated in your MCC. To specify the amount, look through Box 1 of IRS Form 1098, Mortgage Interest Statement or any other statement sent you by your mortgage holder;

- Line 2. Provide the certificate credit rate. Note that it should fit in 10% - 50% limits;

- Line 3. If you refinance your mortgage, multiply the interest scheduled on your original mortgage by the rate indicated on your original MCC. If the certificate credit rate you have indicated on Line 2 exceeds 20%, multiply the digits entered on the previous two lines. Keep in mind that you should stick to the $2,000 limit. If you held the interest with any other person, the $2,000 amount will be divided between you in direct proportion to the interest you held;

- Lines 4 - 7. Self-explanatory;

- Line 8. Use the Credit Limit Worksheet to determine the amount you indicate in this part. Find the Credit Limit Worksheet in the instructions attached to this form. Do not file the worksheet with this credit form, keep it for your records;

- Line 9. Enter the amount indicated on Line 7 or on Line 8, whichever smaller;

- Part II. Lines 10 - 17. Fill out this part only if the amount indicated on Line 7 exceeds the amount indicated on Line 9. In this case, you may carry forward your unused credit to the following three years or until used. If you carry forward your unused credit, make a copy of this form and keep it for your records. It will help you to calculate your credit for the next year.