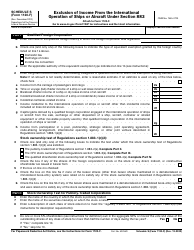

This version of the form is not currently in use and is provided for reference only. Download this version of

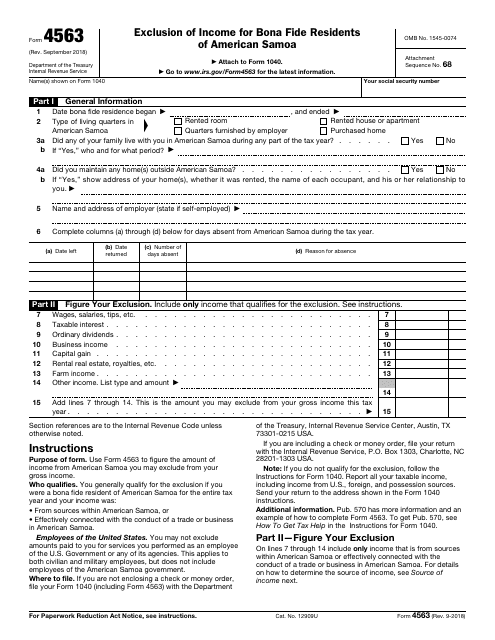

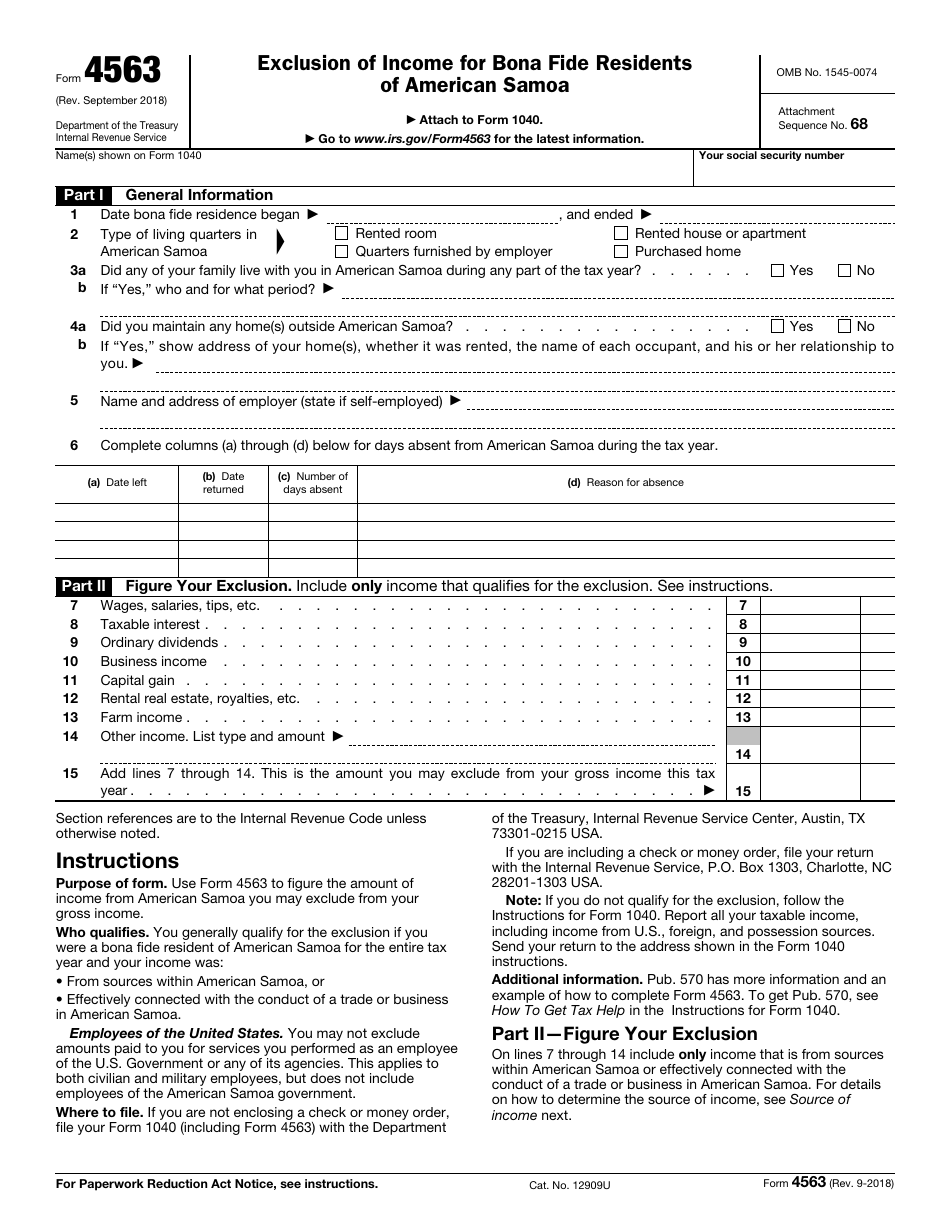

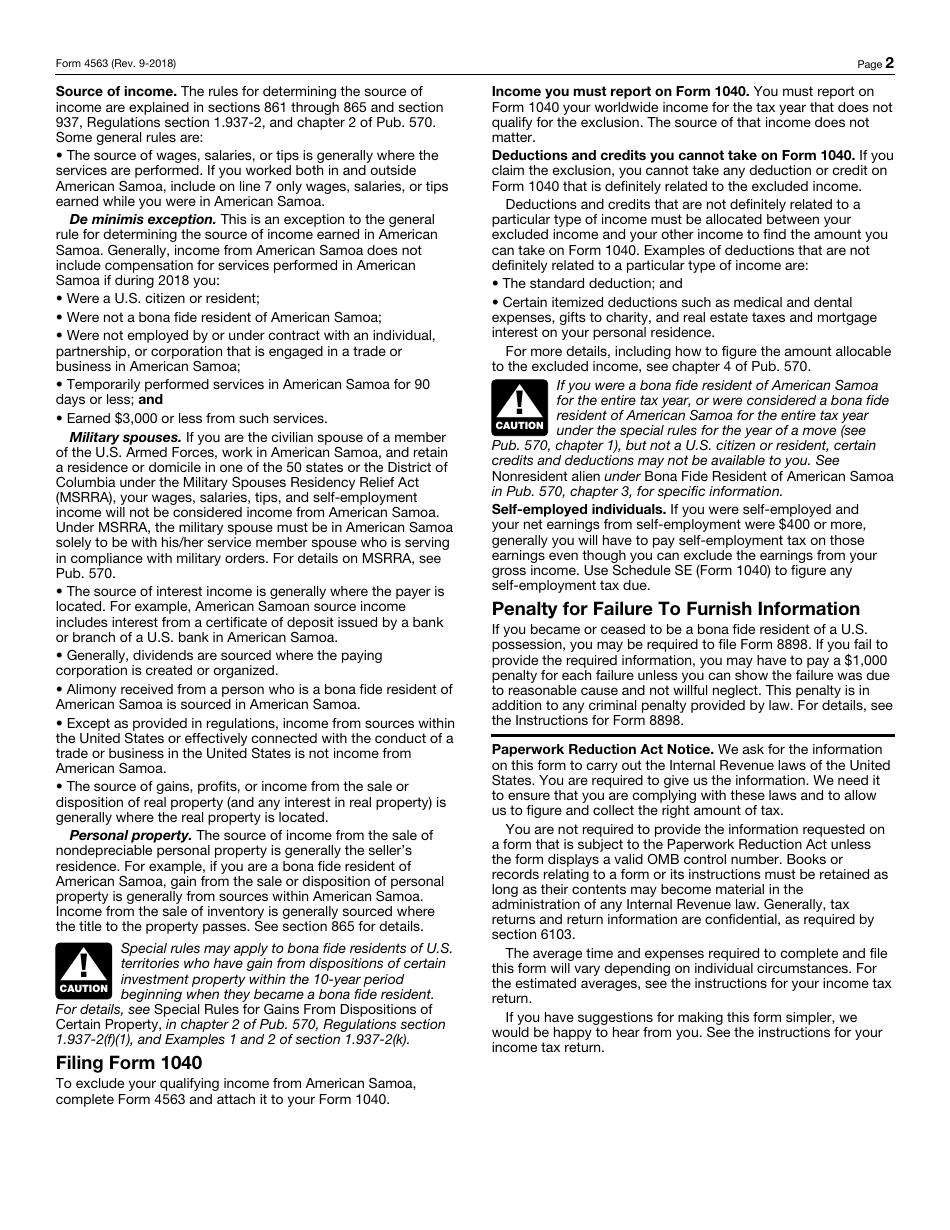

IRS Form 4563

for the current year.

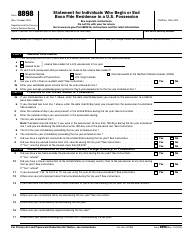

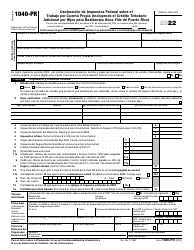

IRS Form 4563 Exclusion of Income for Bona Fide Residents of American Samoa

What Is IRS Form 4563?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 4563?

A: IRS Form 4563 is a form used to exclude income for bona fide residents of American Samoa.

Q: Who is eligible to use IRS Form 4563?

A: Only bona fide residents of American Samoa are eligible to use IRS Form 4563.

Q: What is the purpose of IRS Form 4563?

A: The purpose of IRS Form 4563 is to exclude income earned by bona fide residents of American Samoa from federal income tax.

Q: How does the exclusion of income work?

A: If you are a bona fide resident of American Samoa, you can exclude a certain amount of income earned in American Samoa from your federal income tax.

Q: What is the benefit of using IRS Form 4563?

A: The benefit of using IRS Form 4563 is that you can reduce your taxable income by excluding income earned in American Samoa.

Q: Are there any limitations or conditions for using IRS Form 4563?

A: Yes, there are limitations and conditions for using IRS Form 4563. You must meet the criteria of being a bona fide resident of American Samoa.

Q: Are there any deadlines for filing IRS Form 4563?

A: Yes, there are specific deadlines for filing IRS Form 4563. It is important to check with the IRS for the most up-to-date information on deadlines.

Q: Do I need to attach any additional documents with IRS Form 4563?

A: Yes, you may need to attach additional documents, such as proof of residency in American Samoa, when filing IRS Form 4563.

Q: Can I e-file IRS Form 4563?

A: No, you cannot e-file IRS Form 4563. It must be filed on paper and mailed to the appropriate IRS address.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4563 through the link below or browse more documents in our library of IRS Forms.