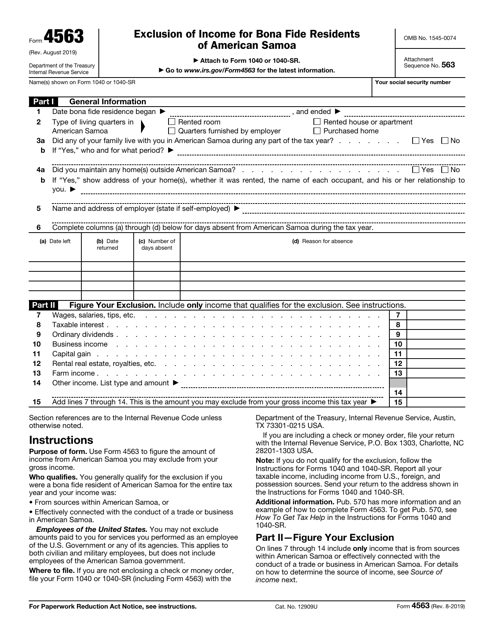

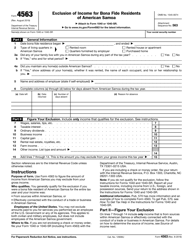

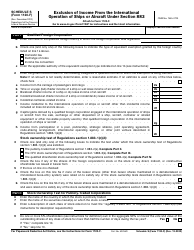

IRS Form 4563 Exclusion of Income for Bona Fide Residents of American Samoa

What Is IRS Form 4563?

IRS Form 4563, Exclusion of Income for Bona Fide Residents of American Samoa , is a tax instrument people permanently residing in American Samoa can use to exclude certain income from their gross income.

Alternate Name:

- Tax Form 4563.

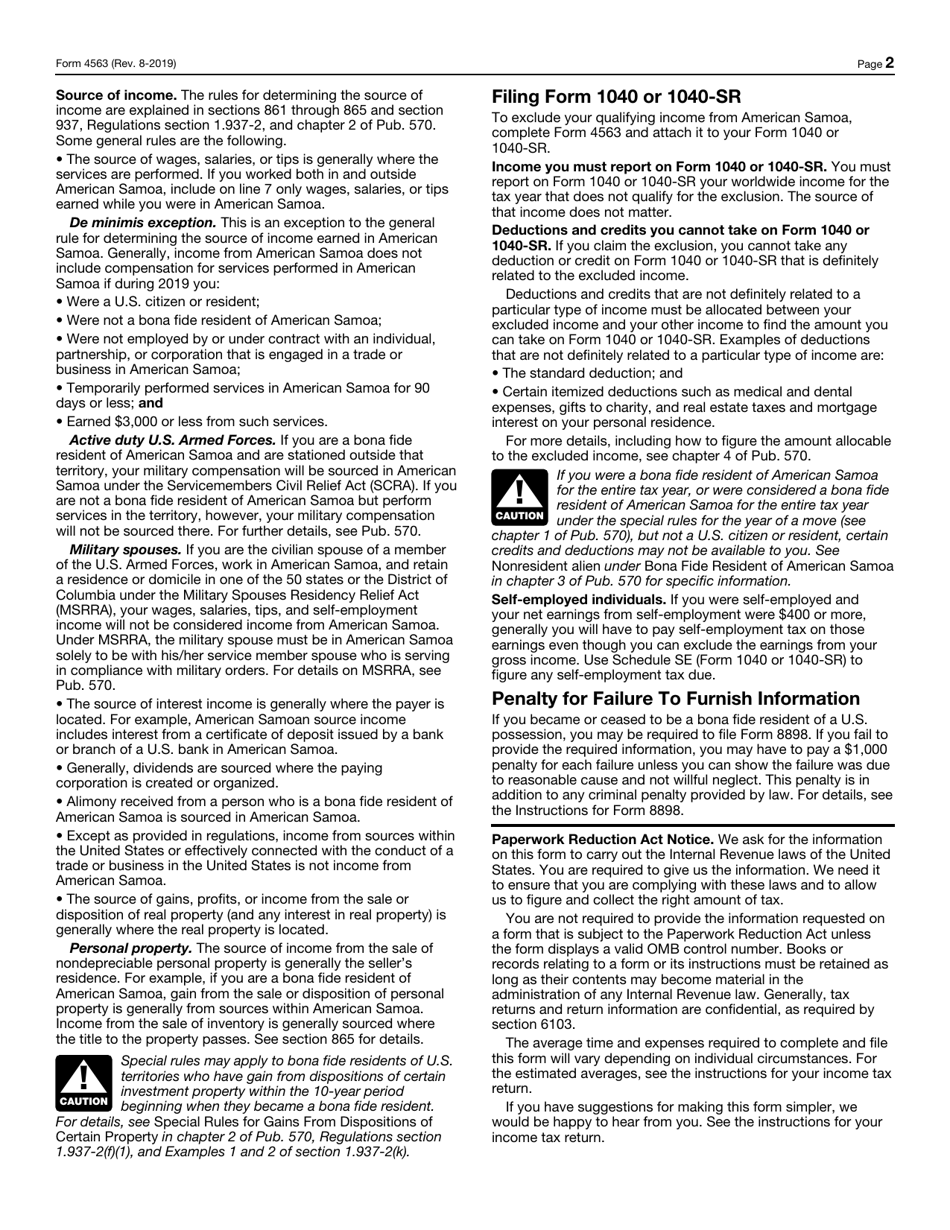

If your income was generated from American Samoa sources or you had real connections with businesses of the territory, it is possible to attach this form to your annual tax return and qualify for an exemption. This document was released by the Internal Revenue Service (IRS ) on August 1, 2019 , making all older editions obsolete. Download an IRS Form 4563 fillable version via the link below.

Identify yourself, provide information about your residence - state where you and your family have lived during the tax year and clarify whether you have residential property outside the territory of American Samoa, indicate the name and contact details of your employer, elaborate on the time you have been absent from American Samoa, and specify the types of income you believe comply with the qualification requirements for the exclusion.

The income varies from wages to profits you have incurred through operating a farm - calculate the total amount and write it down in an appropriate field. The form features instructions that point out who is eligible for the exclusion in question, describe how to compute the income, explain where to submit the paperwork, and inform the taxpayer about the penalty that may be imposed if the information is not filed correctly.