This version of the form is not currently in use and is provided for reference only. Download this version of

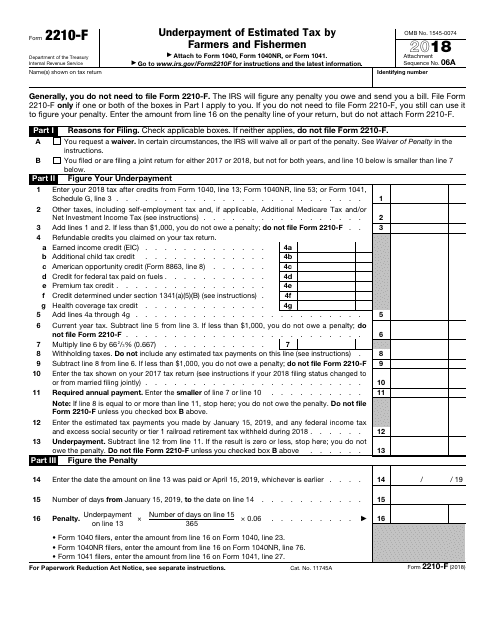

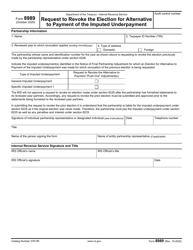

IRS Form 2210-F

for the current year.

IRS Form 2210-F Underpayment of Estimated Tax by Farmers and Fishermen

What Is IRS Form 2210-F?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 2210-F?

A: IRS Form 2210-F is a form used to calculate and report underpayment of estimated tax by farmers and fishermen.

Q: Who is required to file IRS Form 2210-F?

A: Farmers and fishermen who did not pay enough estimated tax throughout the year must file IRS Form 2210-F.

Q: What is the purpose of IRS Form 2210-F?

A: The purpose of IRS Form 2210-F is to calculate the penalty for underpayment of estimated tax by farmers and fishermen.

Q: How do I calculate the penalty for underpayment of estimated tax using IRS Form 2210-F?

A: You can use the instructions provided with IRS Form 2210-F to calculate the penalty for underpayment of estimated tax.

Q: When is IRS Form 2210-F due?

A: IRS Form 2210-F is generally due on April 15th, along with your tax return for the year.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 2210-F through the link below or browse more documents in our library of IRS Forms.