This version of the form is not currently in use and is provided for reference only. Download this version of

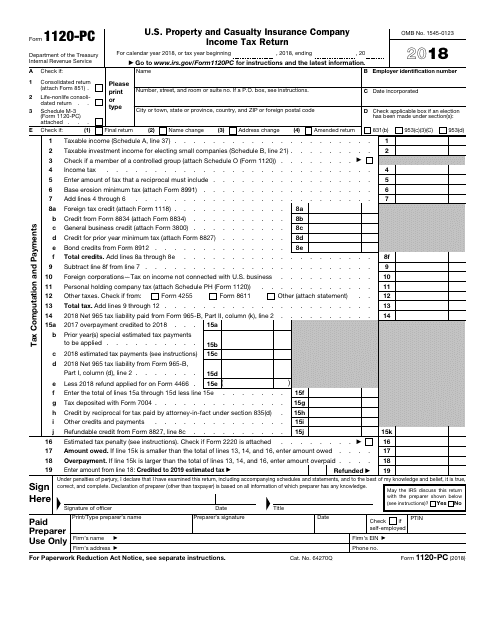

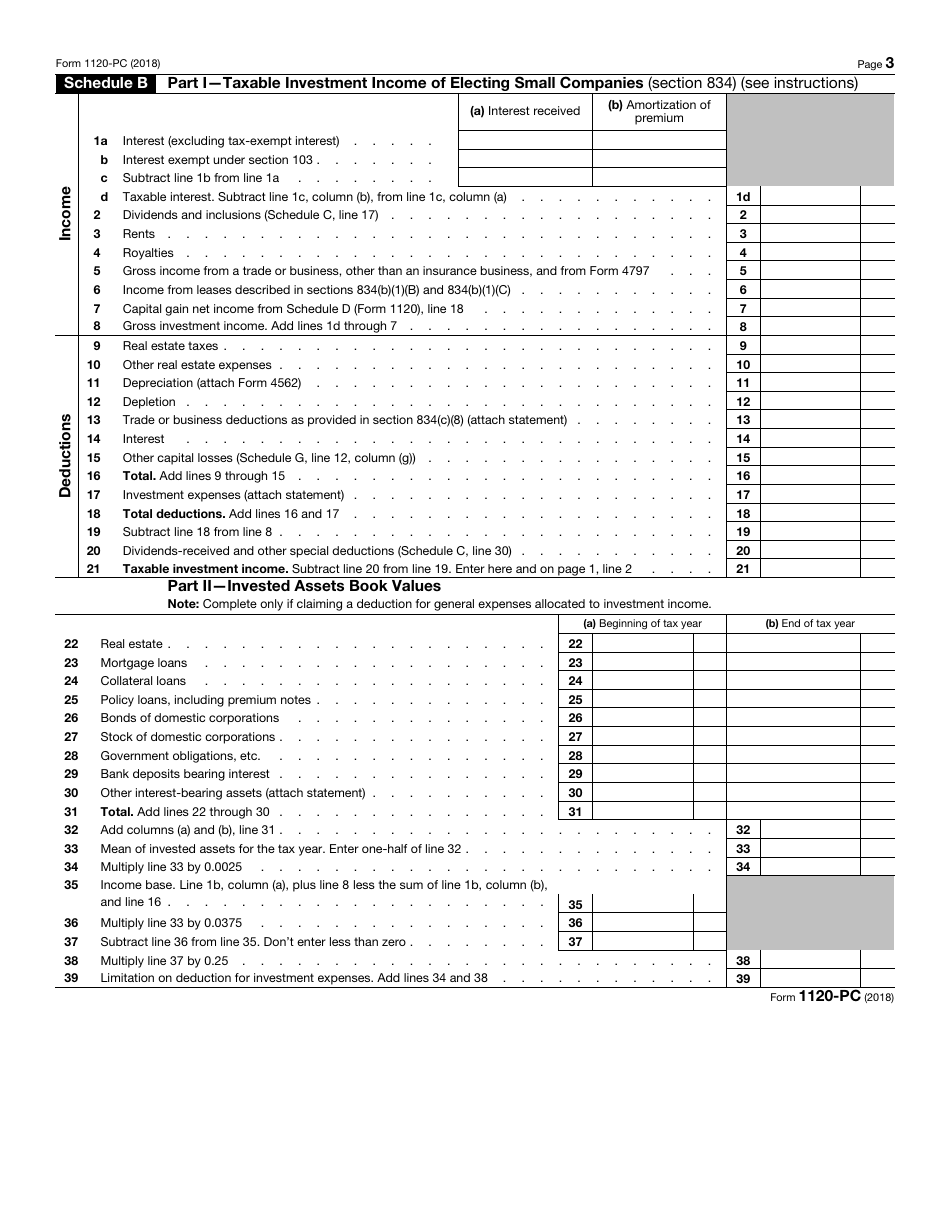

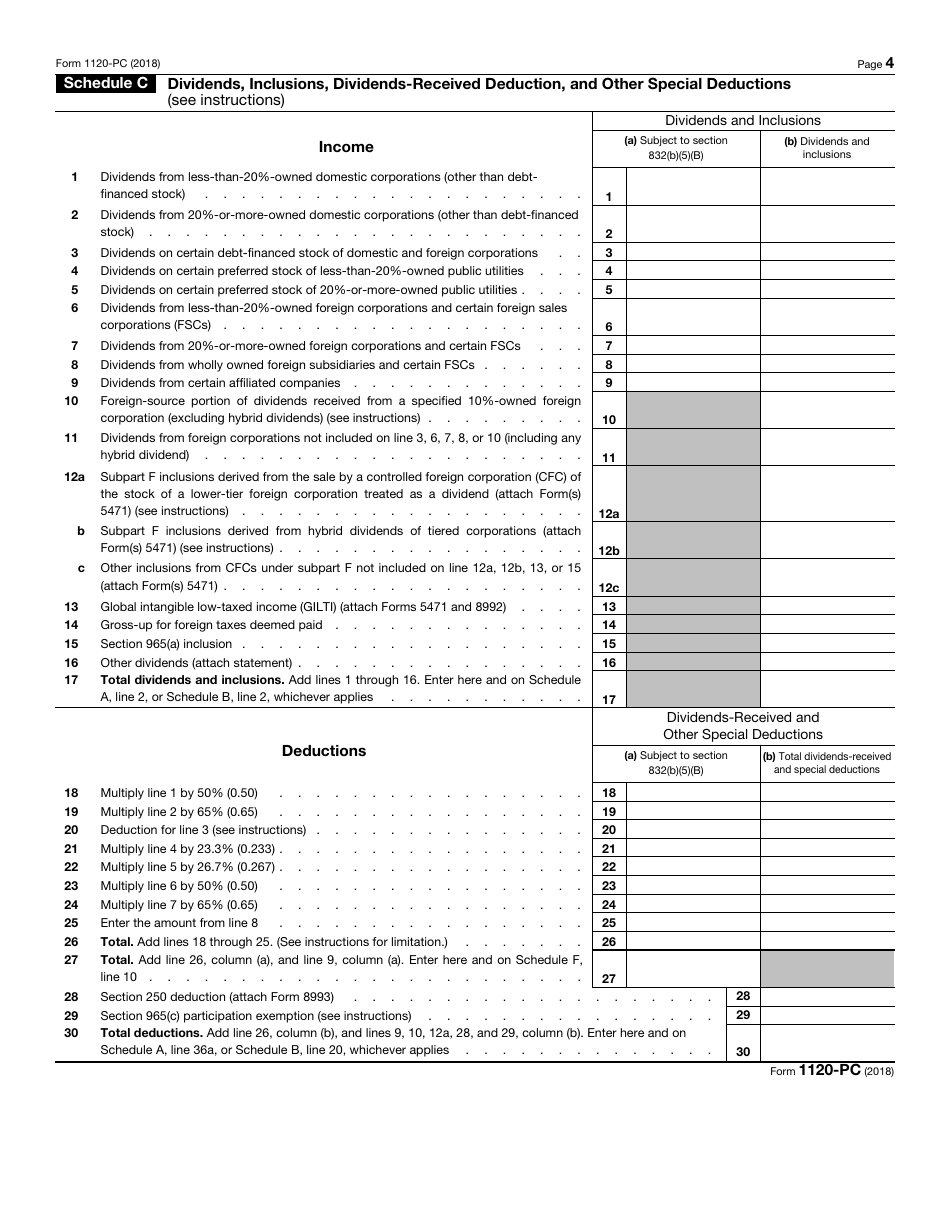

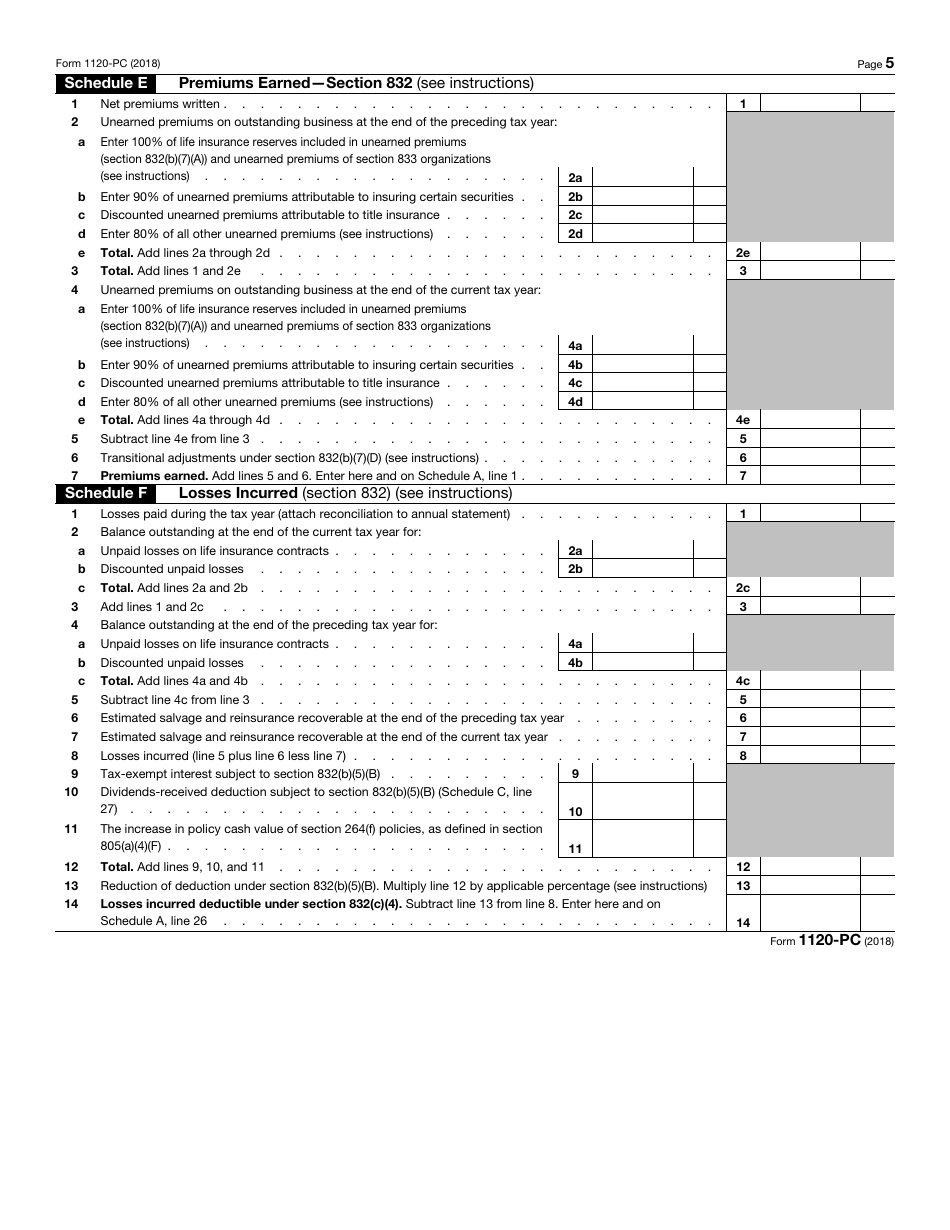

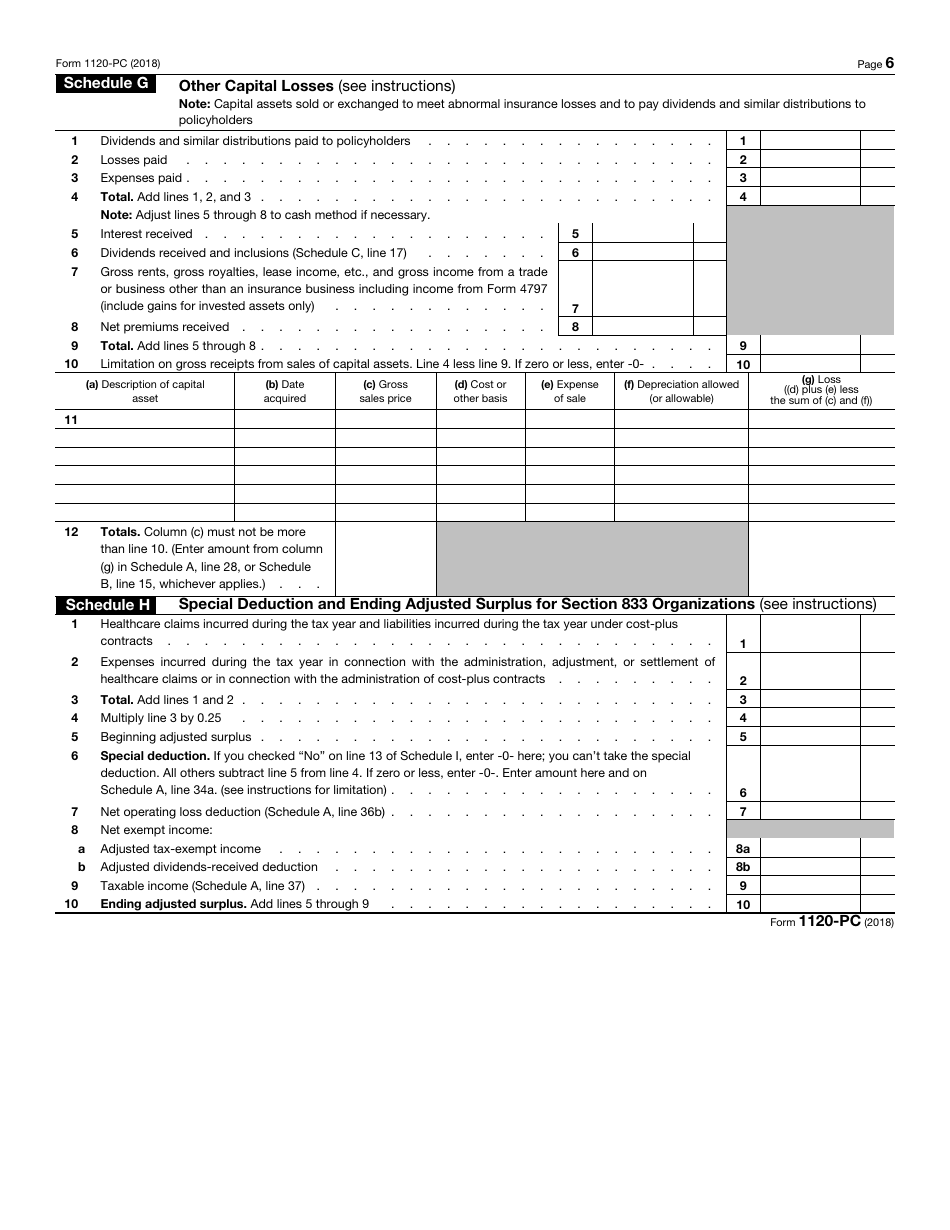

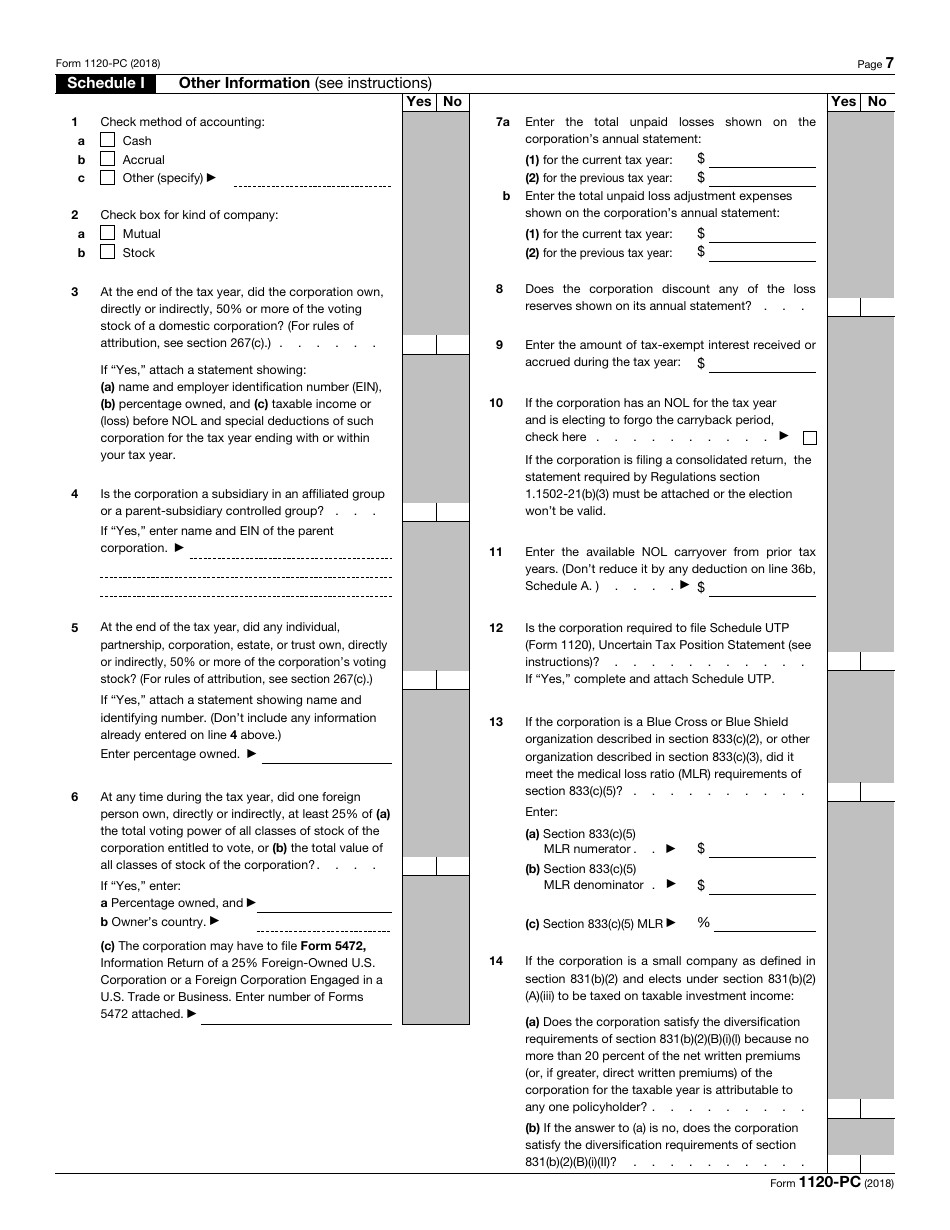

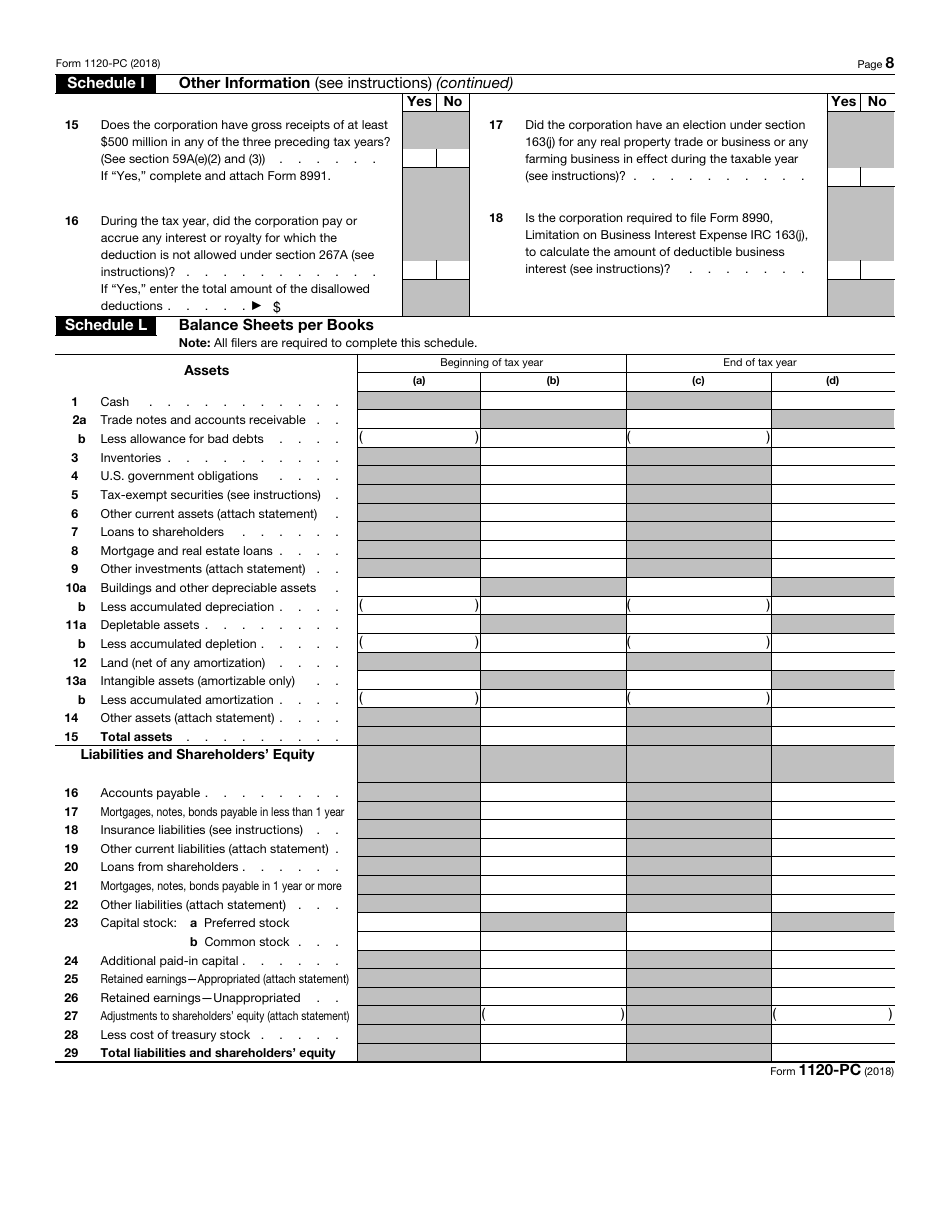

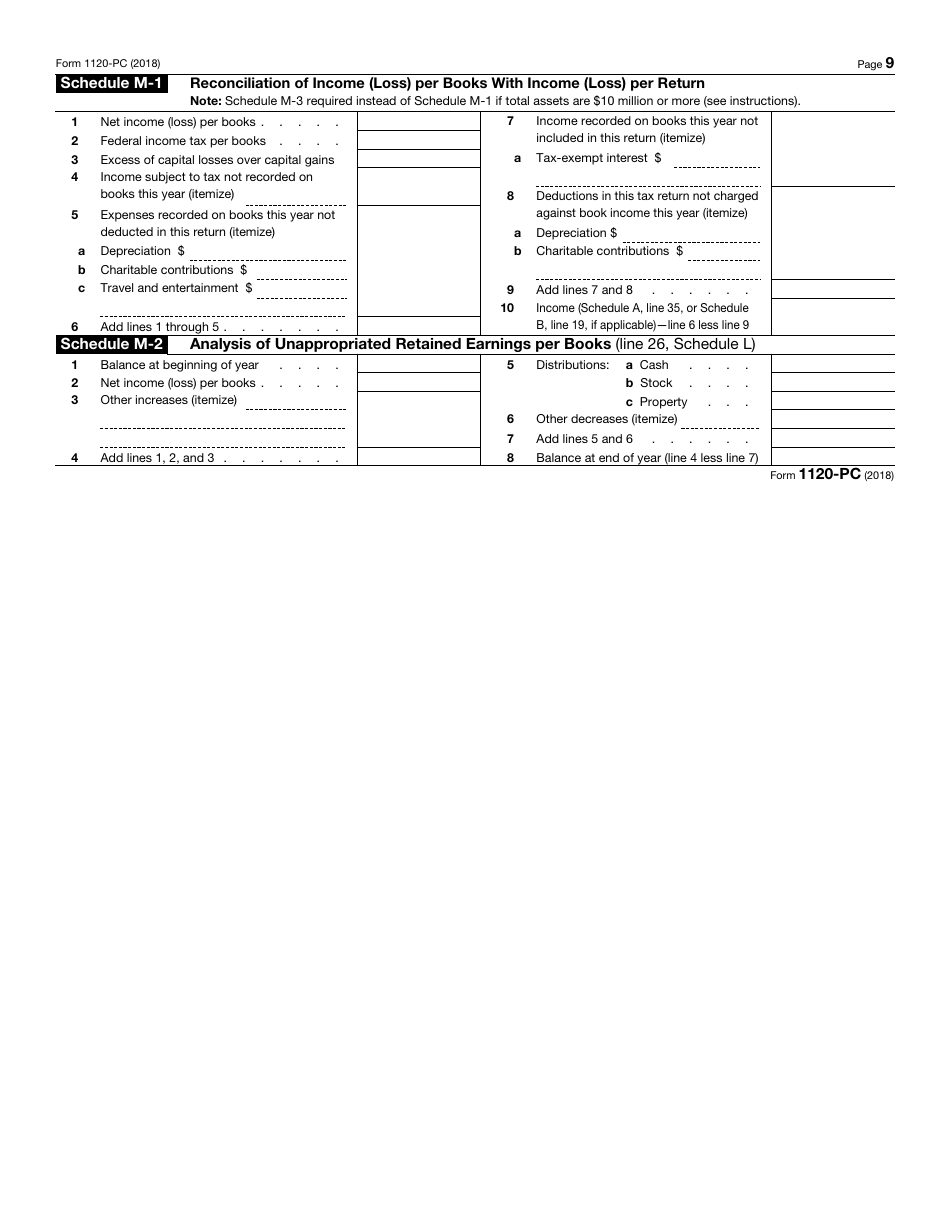

IRS Form 1120-PC

for the current year.

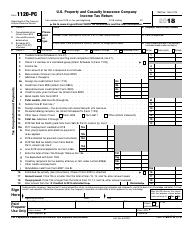

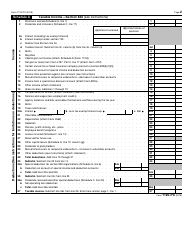

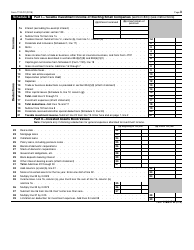

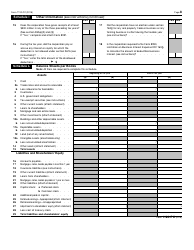

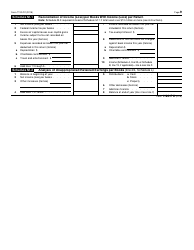

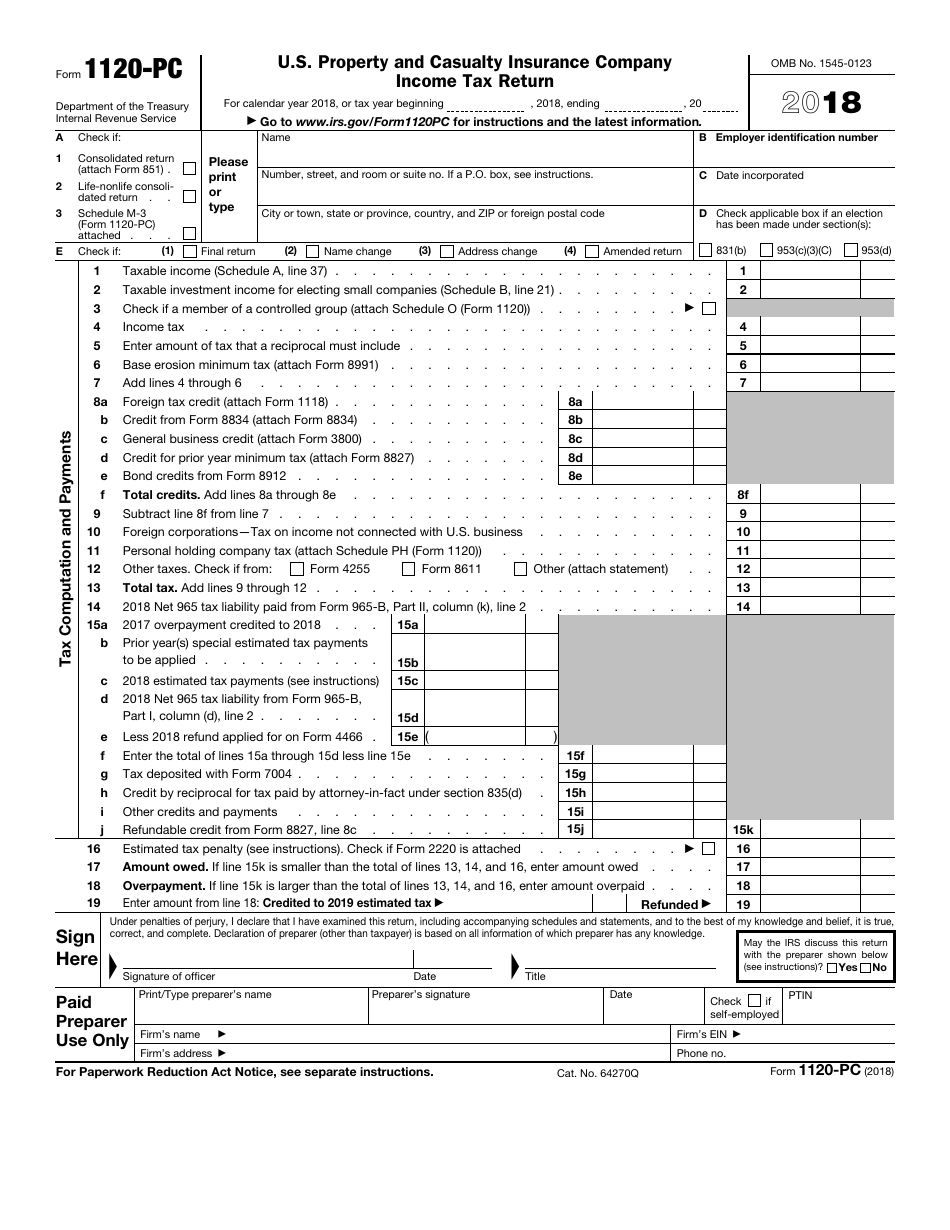

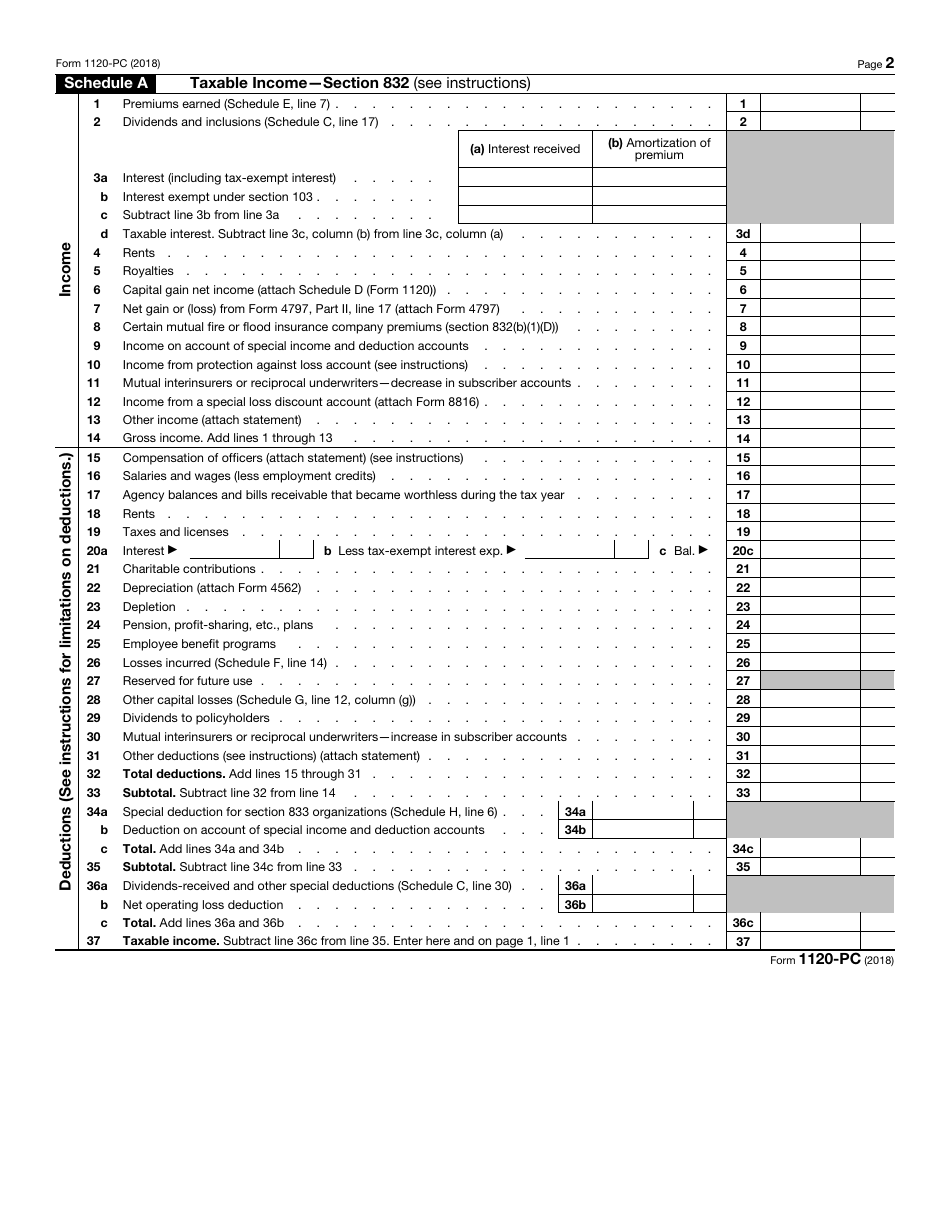

IRS Form 1120-PC U.S. Property and Casualty Insurance Company Income Tax Return

What Is IRS Form 1120-PC?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: Who needs to file Form 1120-PC?

A: U.S. property and casualtyinsurance companies need to file Form 1120-PC.

Q: What is Form 1120-PC used for?

A: Form 1120-PC is used by U.S. property and casualty insurance companies to report their income and deductions.

Q: When is Form 1120-PC due?

A: Form 1120-PC is generally due by the 15th day of the 3rd month after the end of the company's tax year.

Q: Can Form 1120-PC be filed electronically?

A: Yes, Form 1120-PC can be filed electronically.

Q: Are there any penalties for late filing of Form 1120-PC?

A: Yes, there can be penalties for late filing of Form 1120-PC. It is important to file on time to avoid penalties.

Form Details:

- A 9-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-PC through the link below or browse more documents in our library of IRS Forms.