This version of the form is not currently in use and is provided for reference only. Download this version of

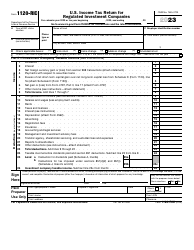

Instructions for IRS Form 1120-PC

for the current year.

Instructions for IRS Form 1120-PC U.S. Property and Casualty Insurance Company Income Tax Return

This document contains official instructions for IRS Form 1120-PC , U.S. Property and Casualty Insurance Company Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-PC Schedule M-3 is available for download through this link.

FAQ

Q: What is IRS Form 1120-PC?

A: IRS Form 1120-PC is the Income Tax Return for Property and Casualty Insurance Companies in the United States.

Q: Who needs to file IRS Form 1120-PC?

A: Property and Casualty Insurance Companies in the United States are required to file IRS Form 1120-PC.

Q: What is the purpose of IRS Form 1120-PC?

A: The purpose of IRS Form 1120-PC is to report the income, deductions, and credits of Property and Casualty Insurance Companies for tax purposes.

Q: Are there any filing deadlines for IRS Form 1120-PC?

A: Yes, Property and Casualty Insurance Companies must file IRS Form 1120-PC by the 15th day of the 3rd month following the end of their tax year.

Q: What are some common mistakes to avoid when filing IRS Form 1120-PC?

A: Some common mistakes to avoid when filing IRS Form 1120-PC include errors in reporting income, deductions, and credits, failing to attach required schedules or forms, and missing the filing deadline.

Q: Are there any penalties for late filing of IRS Form 1120-PC?

A: Yes, there are penalties for late filing of IRS Form 1120-PC. The penalty is generally based on the amount of tax owed and the number of days late.

Q: Is there any assistance available for completing IRS Form 1120-PC?

A: Yes, the IRS provides resources and assistance for completing IRS Form 1120-PC. Taxpayers can refer to the instructions for the form or seek professional assistance if needed.

Instruction Details:

- This 24-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.