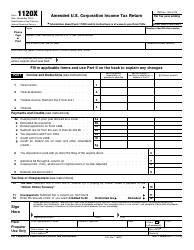

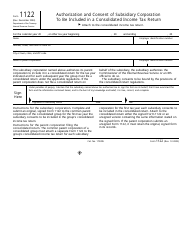

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1120-S

for the current year.

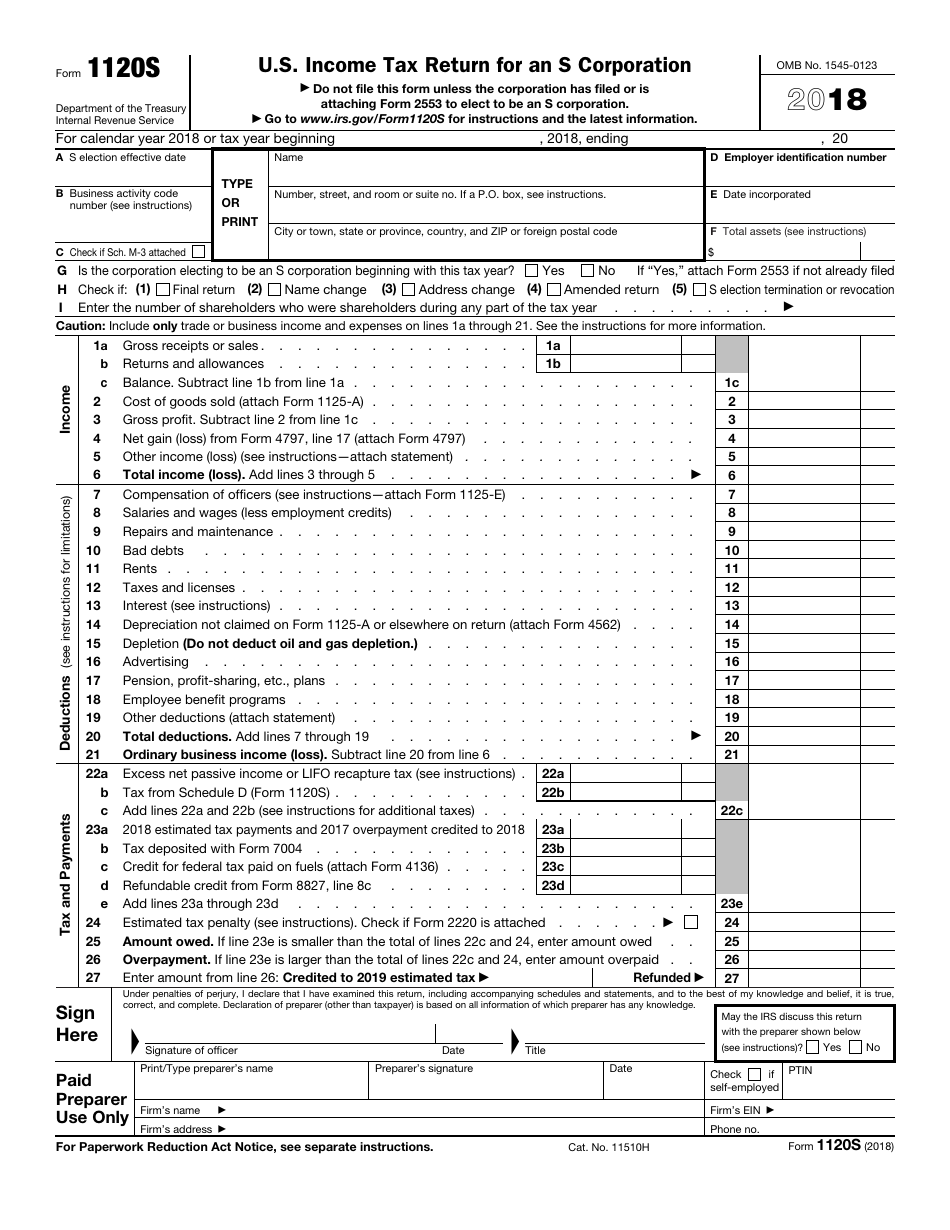

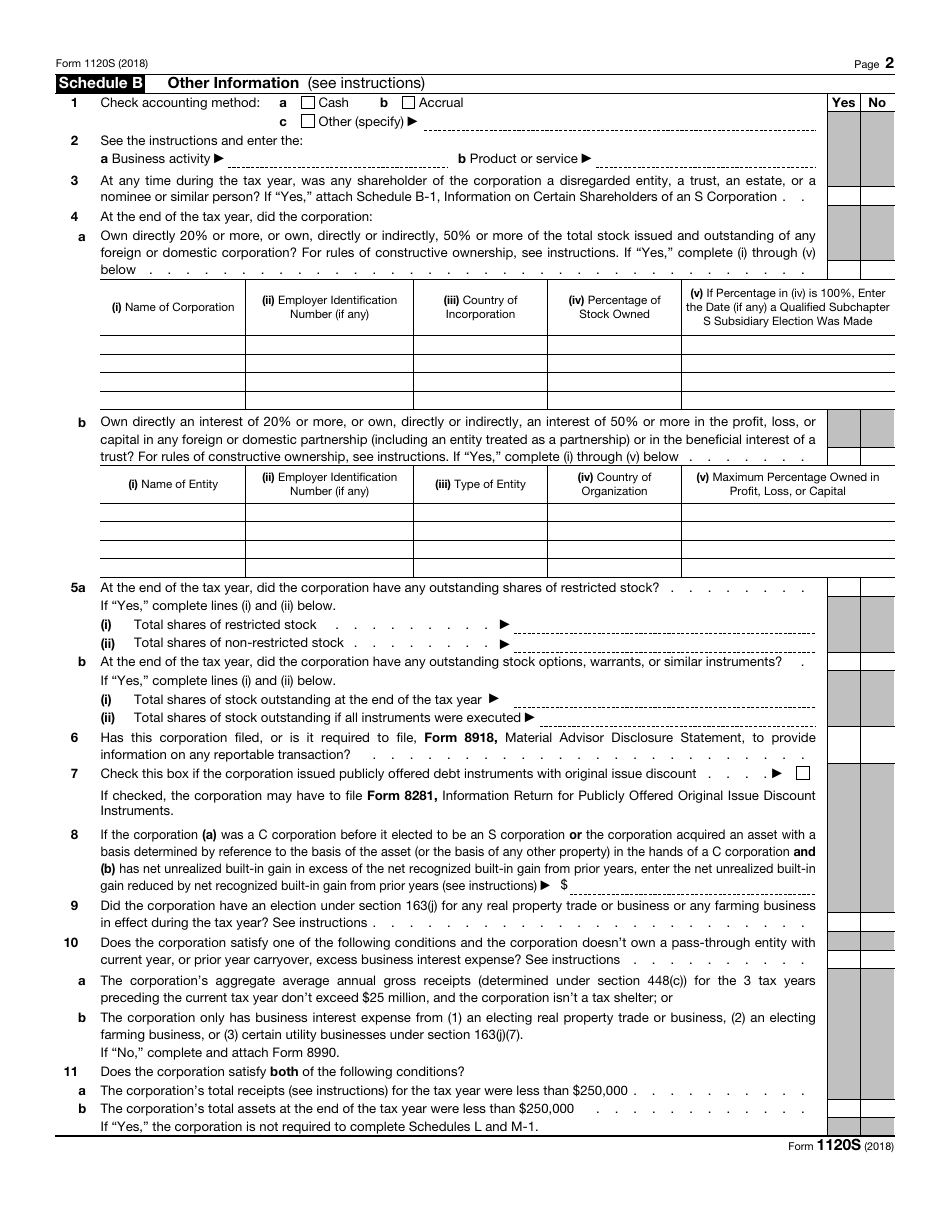

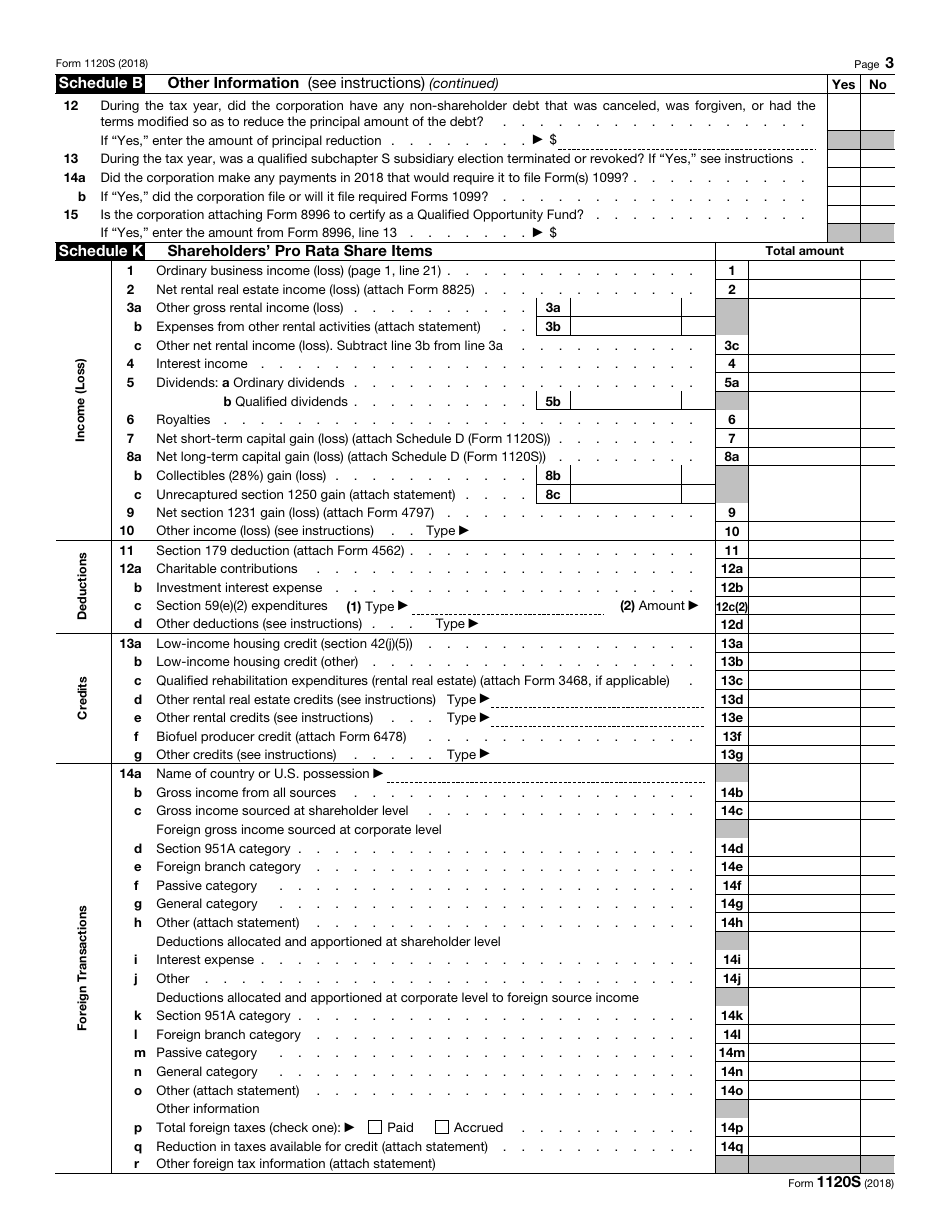

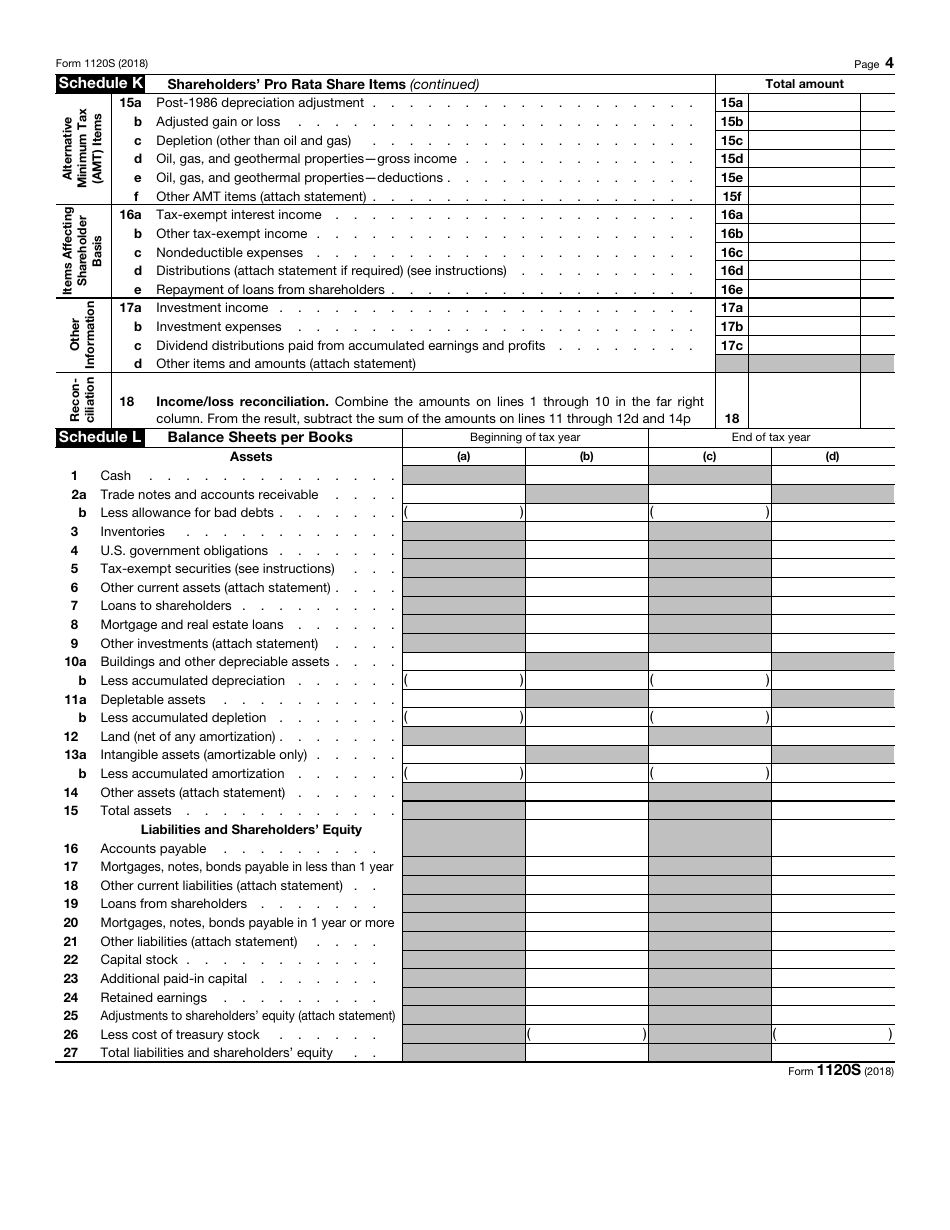

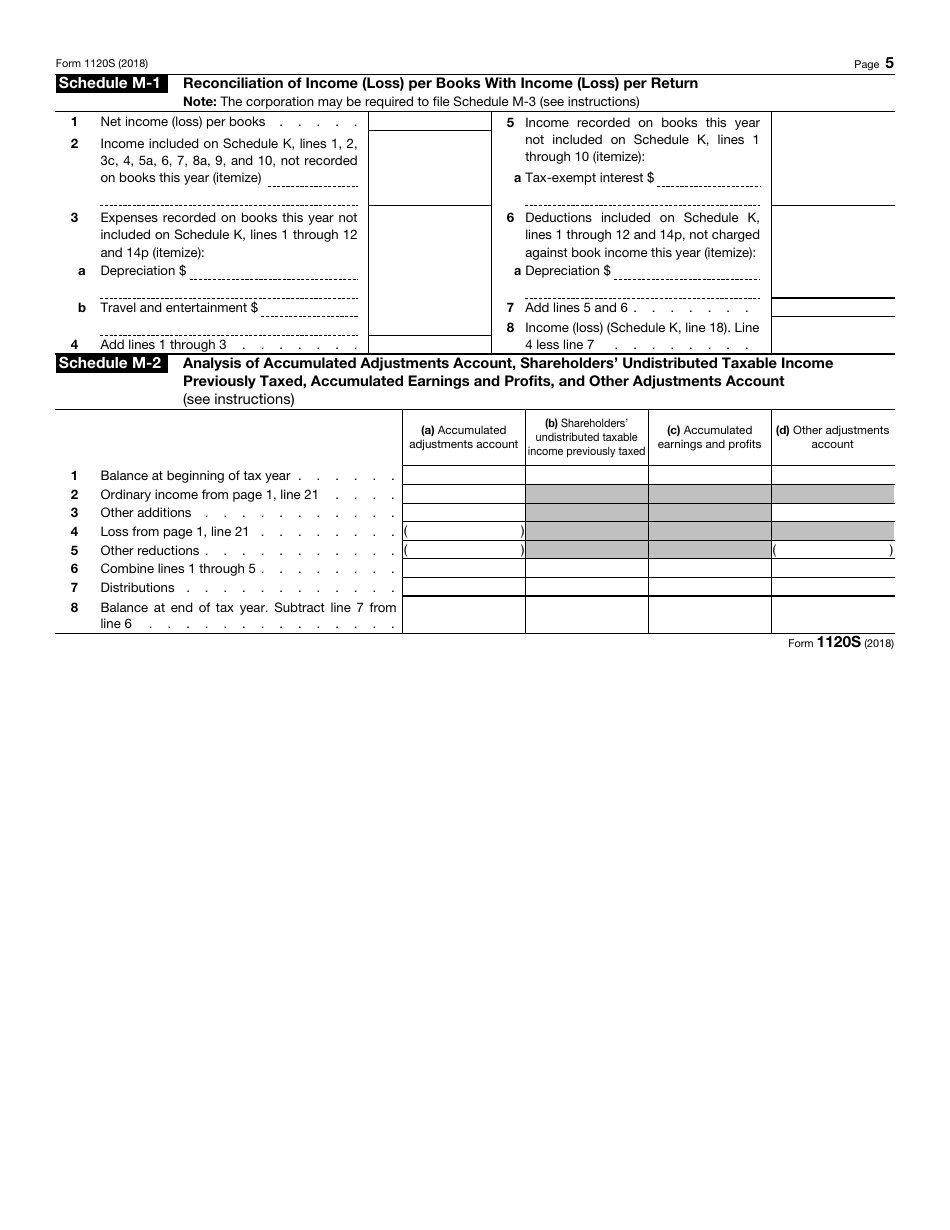

IRS Form 1120-S U.S. Income Tax Return for an S Corporation

What Is IRS Form 1120S?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120S?

A: IRS Form 1120S is the U.S. Income Tax Return specifically for S Corporations.

Q: Who needs to file IRS Form 1120S?

A: S Corporations need to file IRS Form 1120S to report their income, deductions, gains, losses, and other tax-related information.

Q: What is an S Corporation?

A: An S Corporation is a type of business entity that passes corporate income, losses, deductions, and credits through to its shareholders for federal tax purposes.

Q: What information is required to complete IRS Form 1120S?

A: To complete IRS Form 1120S, you will need to provide information about the corporation's income, deductions, credits, shareholders, and other relevant details.

Q: When is IRS Form 1120S due?

A: IRS Form 1120S is due on the 15th day of the 3rd month after the end of the corporation's tax year.

Q: Is there a penalty for not filing IRS Form 1120S?

A: Yes, there can be penalties for not filing IRS Form 1120S or for filing it late. It is important to meet the filing deadline to avoid potential penalties.

Q: Can I e-file IRS Form 1120S?

A: Yes, you can e-file IRS Form 1120S. The IRS encourages electronic filing for faster processing and more accurate tax returns.

Q: Are there any specific requirements for S Corporations?

A: Yes, S Corporations have specific requirements and limitations, such as having no more than 100 shareholders and having only certain eligible shareholders. Consulting with a tax professional is recommended to fully understand these requirements.

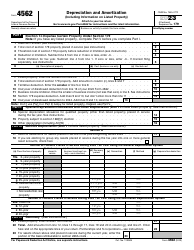

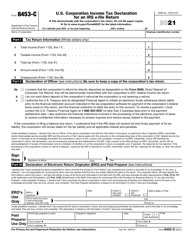

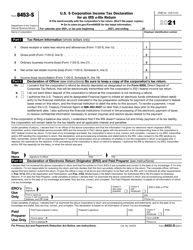

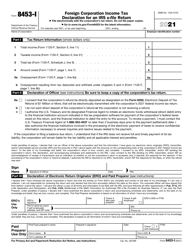

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120S through the link below or browse more documents in our library of IRS Forms.