This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1099-S

for the current year.

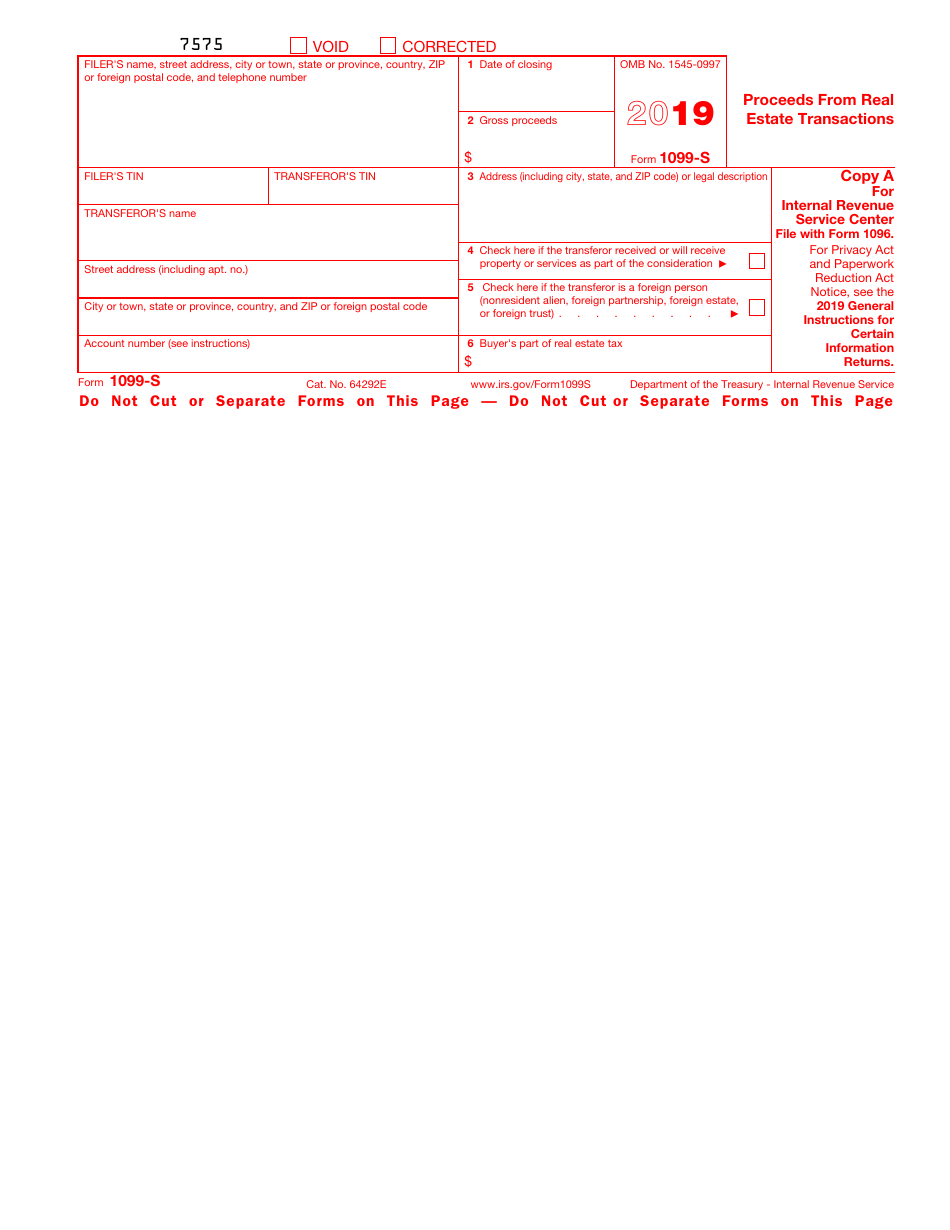

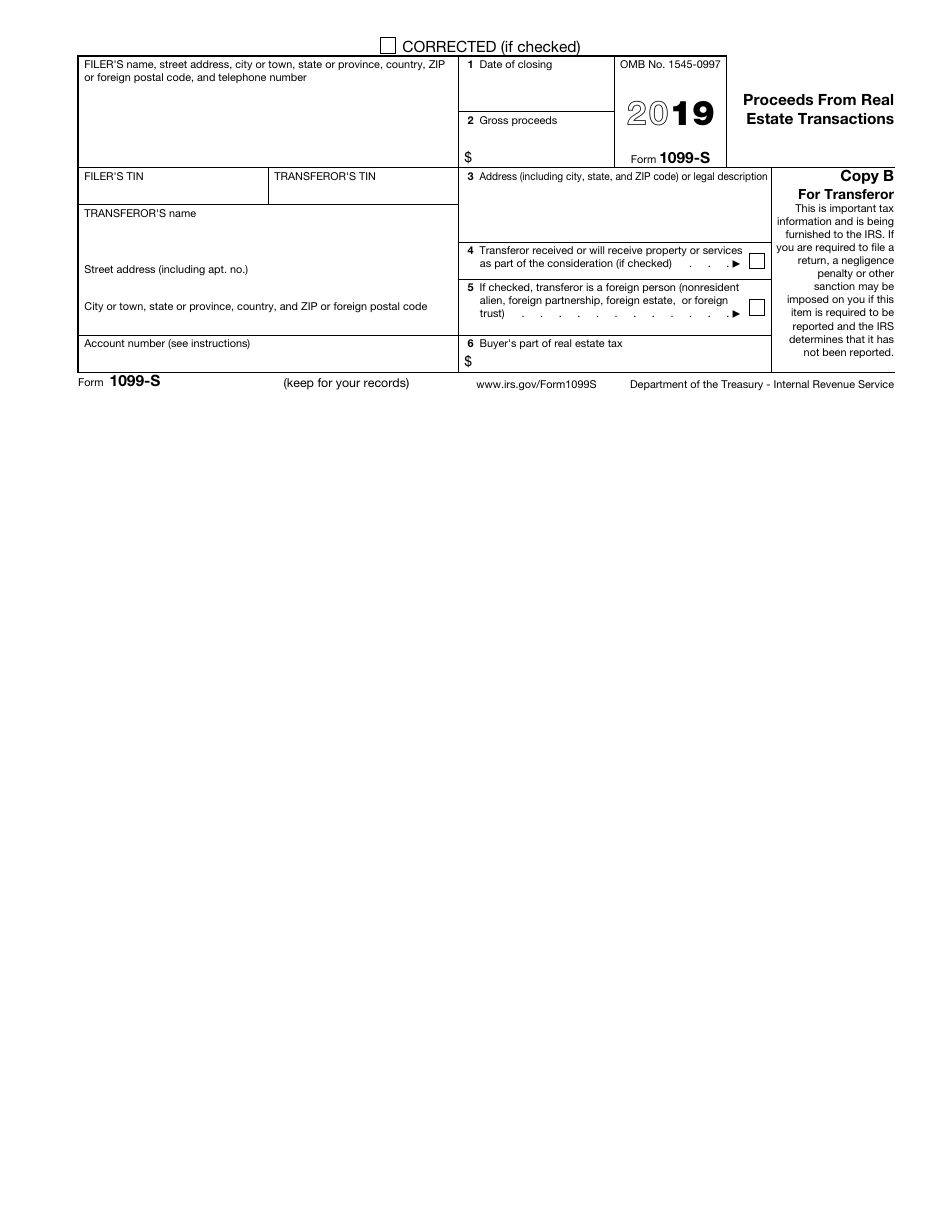

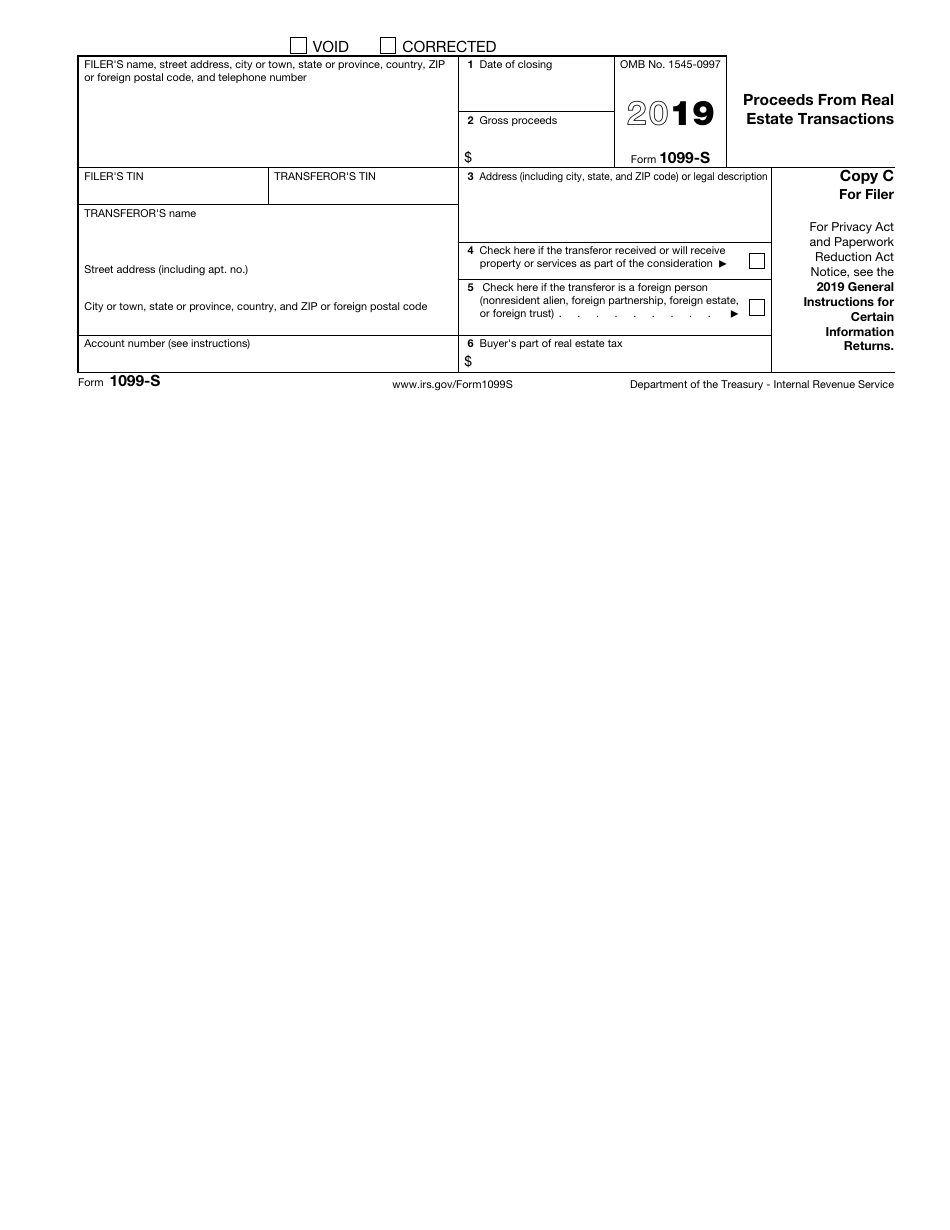

IRS Form 1099-S Proceeds From Real Estate Transactions

What Is IRS Form 1099-S?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1099-S?

A: IRS Form 1099-S is a tax form used to report proceeds from real estate transactions.

Q: Who needs to file IRS Form 1099-S?

A: Any person or entity that receives proceeds from a real estate transaction needs to file IRS Form 1099-S.

Q: What information is reported on IRS Form 1099-S?

A: IRS Form 1099-S reports information such as the seller's name, taxpayer identification number, and the gross proceeds from the real estate transaction.

Q: When is IRS Form 1099-S due?

A: IRS Form 1099-S is generally due by January 31st of the year following the calendar year in which the transaction occurred.

Q: What are the consequences of not filing IRS Form 1099-S?

A: Failing to file IRS Form 1099-S or filing it late can result in penalties and can also impact the accuracy of the seller's tax return.

Form Details:

- A 6-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-S through the link below or browse more documents in our library of IRS Forms.