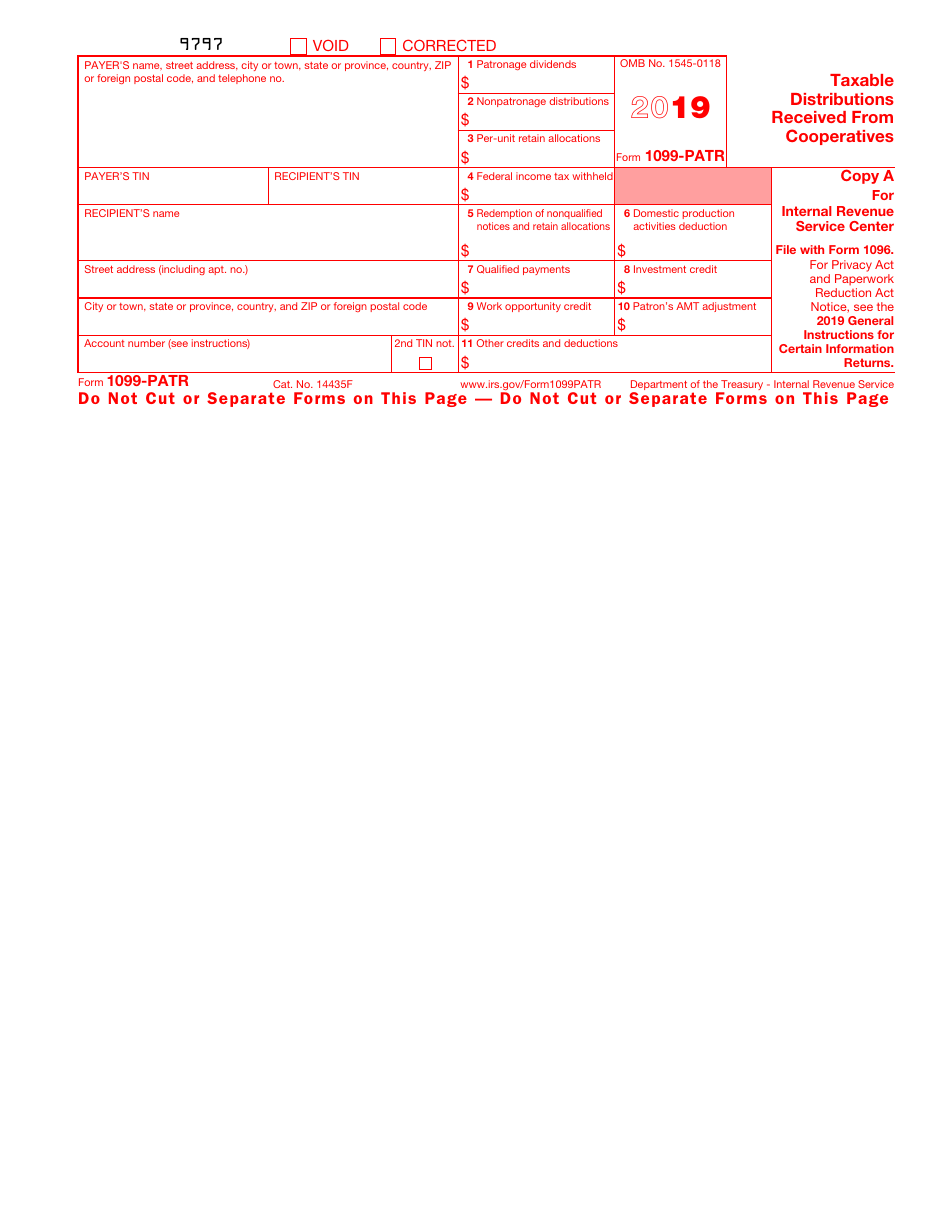

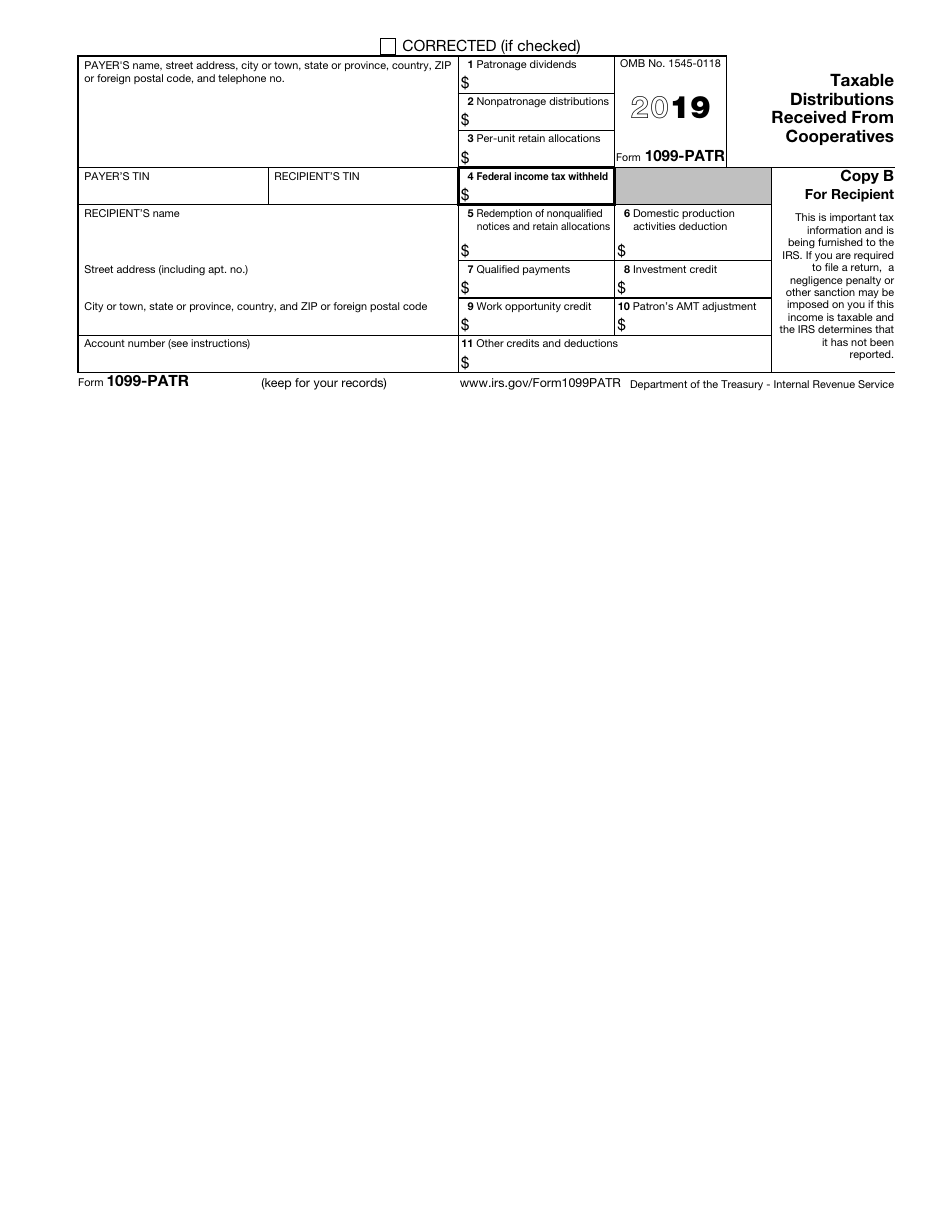

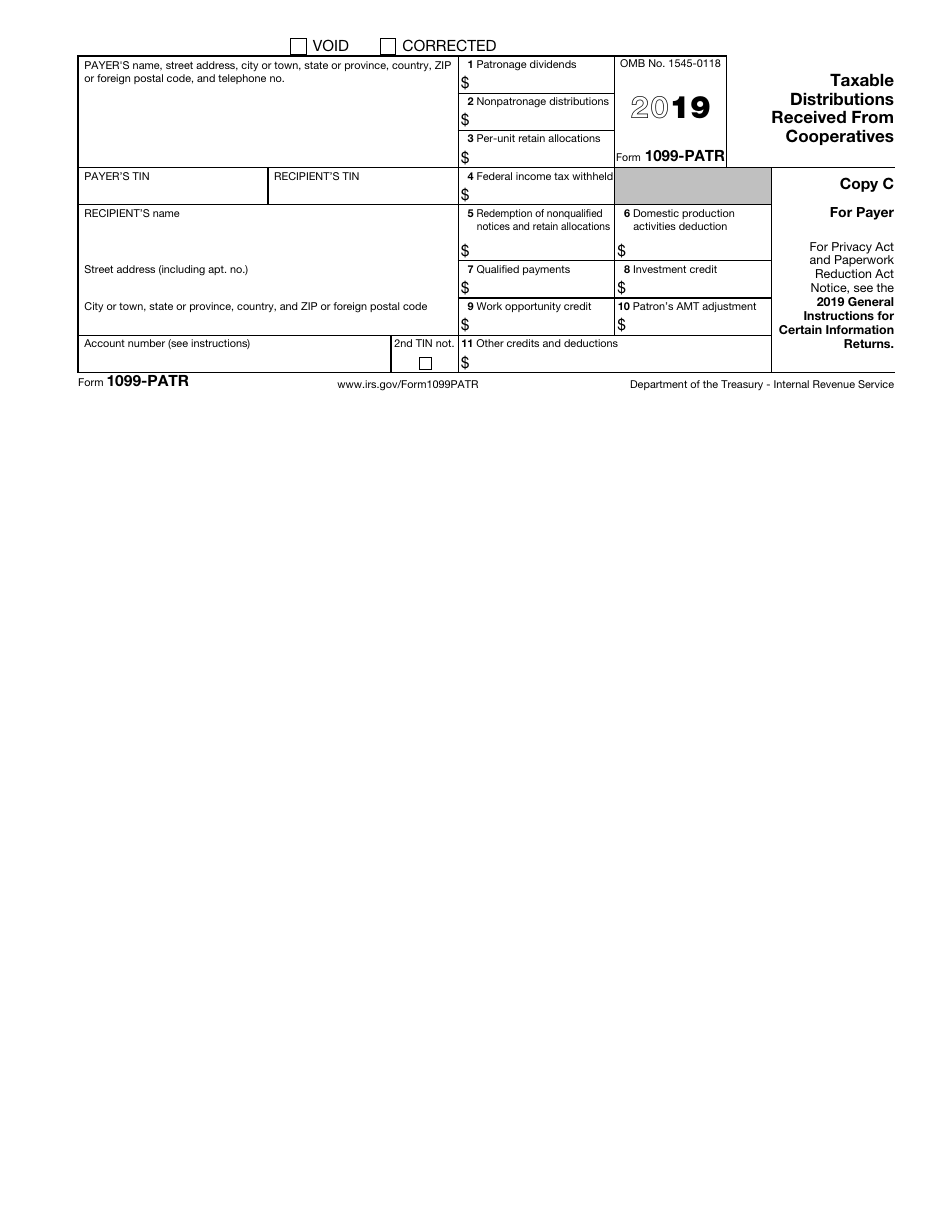

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1099-PATR

for the current year.

IRS Form 1099-PATR Taxable Distributions Received From Cooperatives

What Is IRS Form 1099-PATR?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 1099-PATR?

A: Form 1099-PATR is a tax form that reports taxable distributions received from cooperatives.

Q: Who receives Form 1099-PATR?

A: Individuals who receive taxable distributions from cooperatives will receive Form 1099-PATR.

Q: What are taxable distributions?

A: Taxable distributions are payments received from cooperatives that are subject to income tax.

Q: Do I need to report Form 1099-PATR on my tax return?

A: Yes, you need to report the information from Form 1099-PATR on your tax return.

Q: What if I don't receive a Form 1099-PATR?

A: If you do not receive Form 1099-PATR, you are still required to report any taxable distributions on your tax return.

Q: Are all distributions from cooperatives taxable?

A: Not all distributions from cooperatives are taxable. Some may be classified as patronage dividends or qualified written notices of allocation, which are not subject to tax.

Q: What is the deadline for filing Form 1099-PATR?

A: The deadline for filing Form 1099-PATR with the IRS is typically January 31st.

Q: Can I e-file Form 1099-PATR?

A: Yes, you can e-file Form 1099-PATR through the IRS's FIRE system or using approved tax software.

Form Details:

- A 6-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-PATR through the link below or browse more documents in our library of IRS Forms.