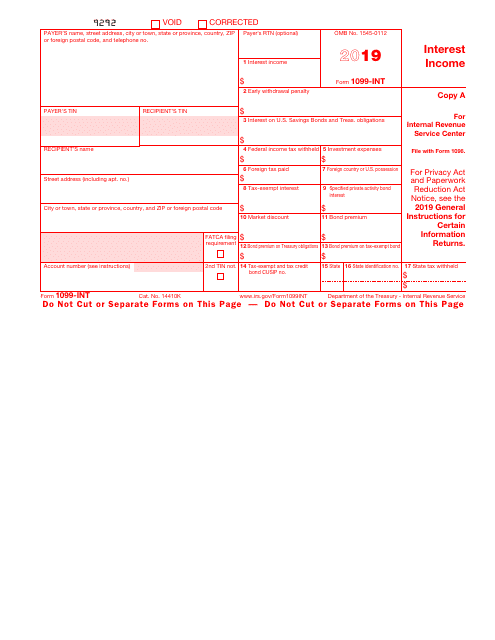

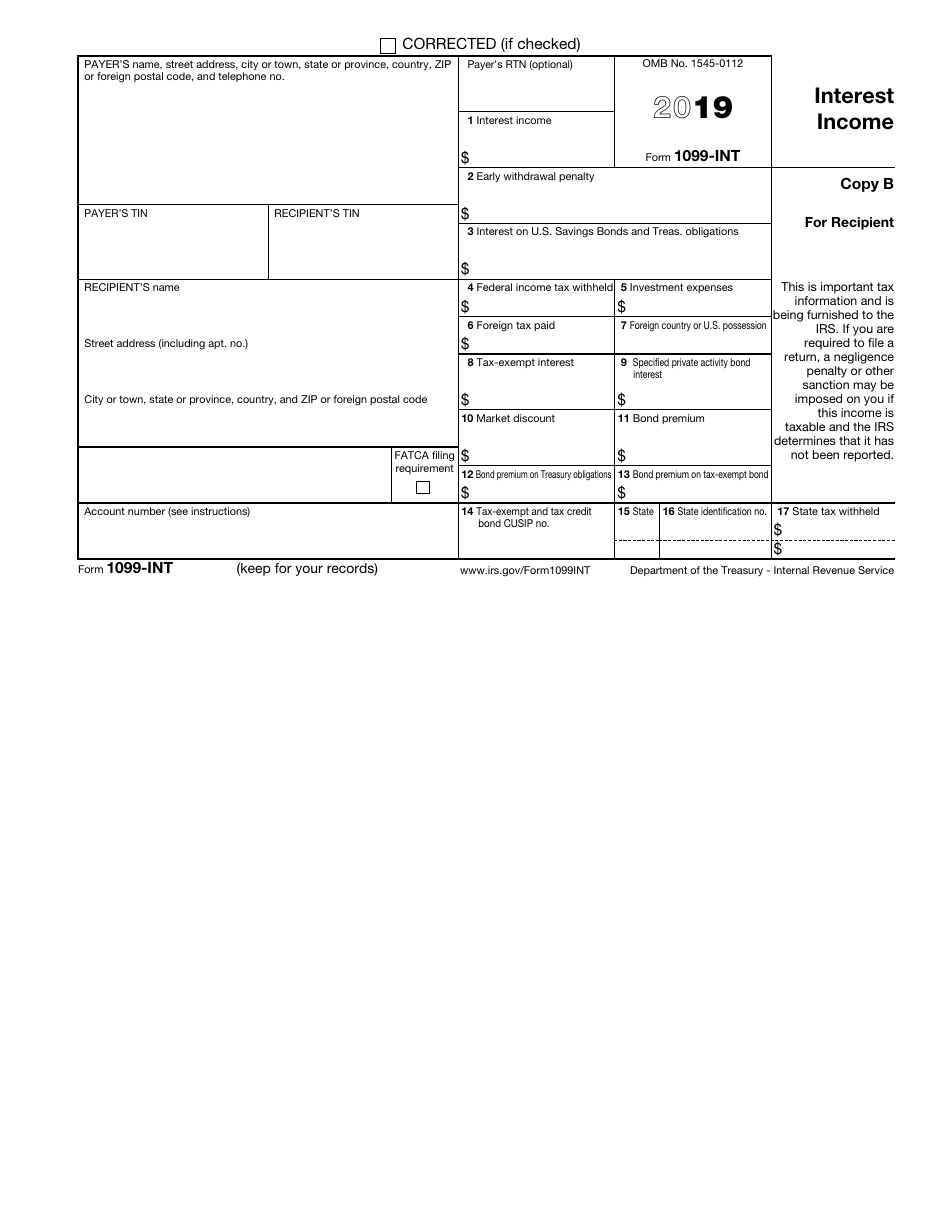

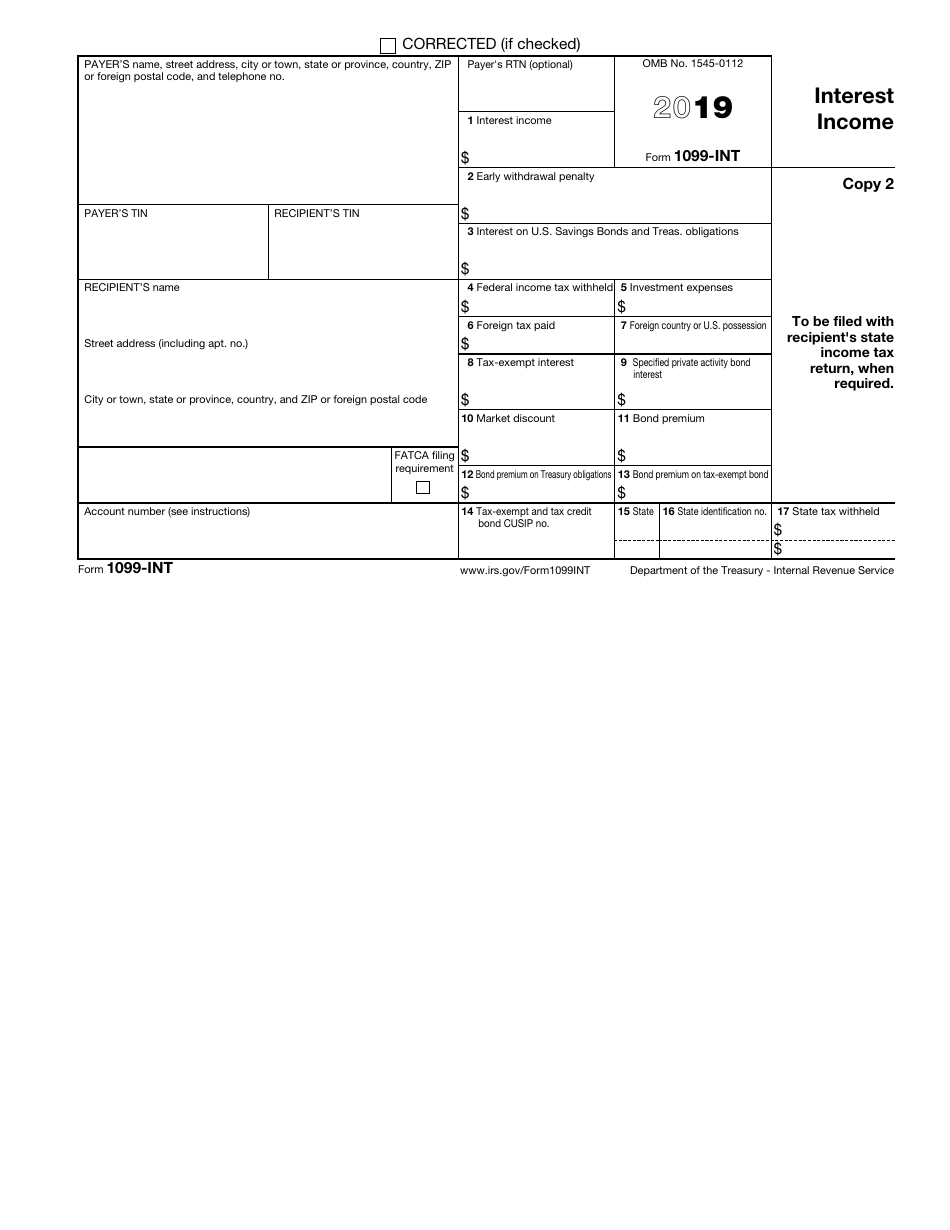

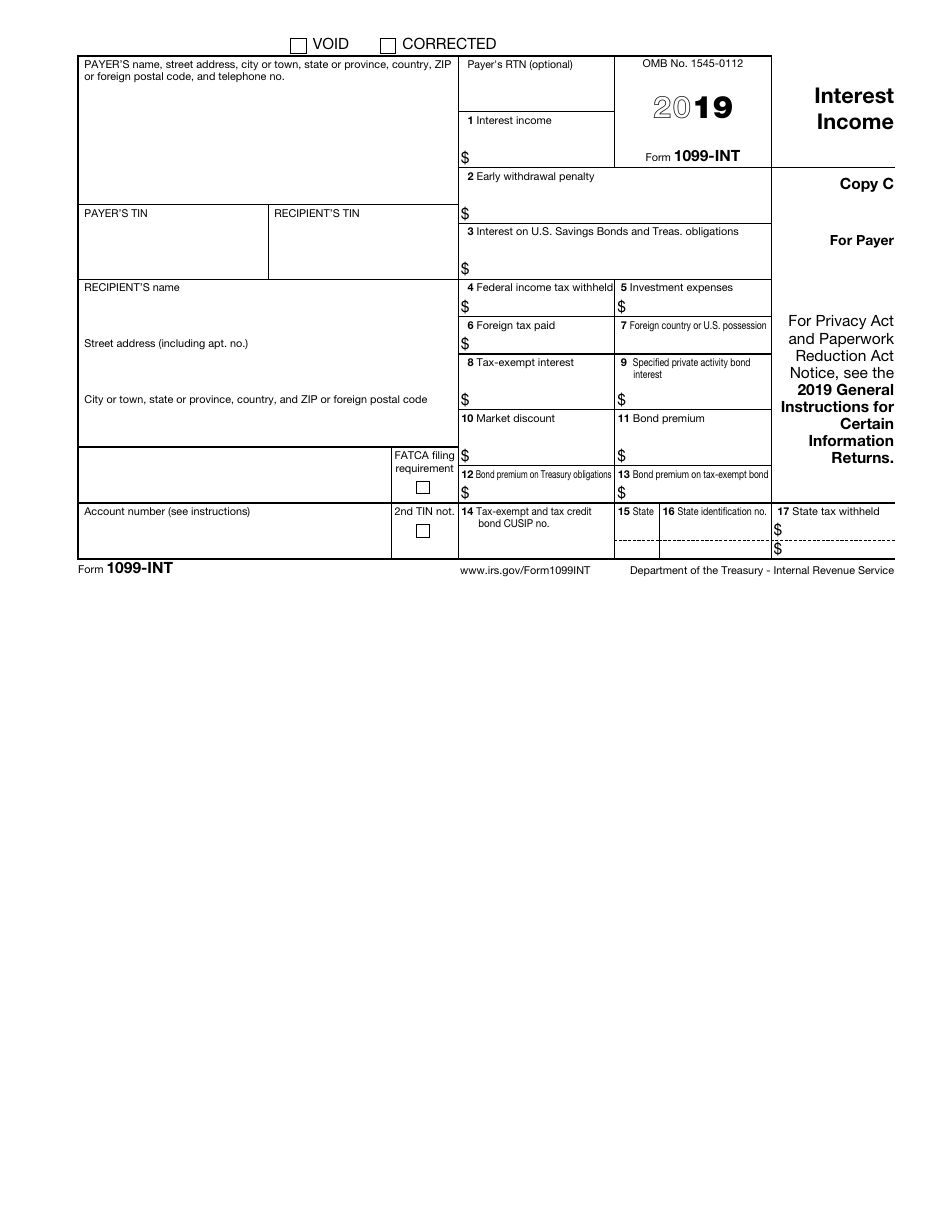

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1099-INT

for the current year.

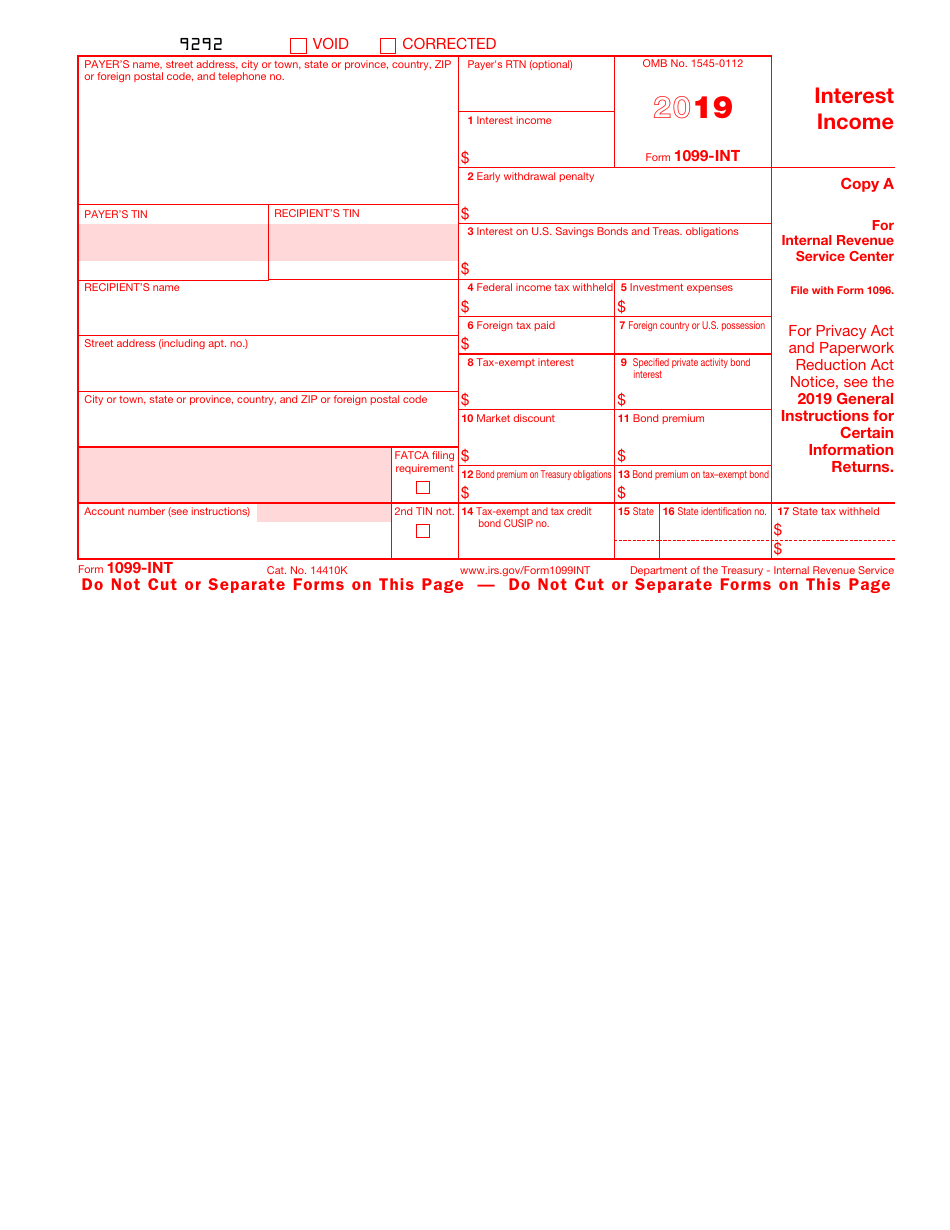

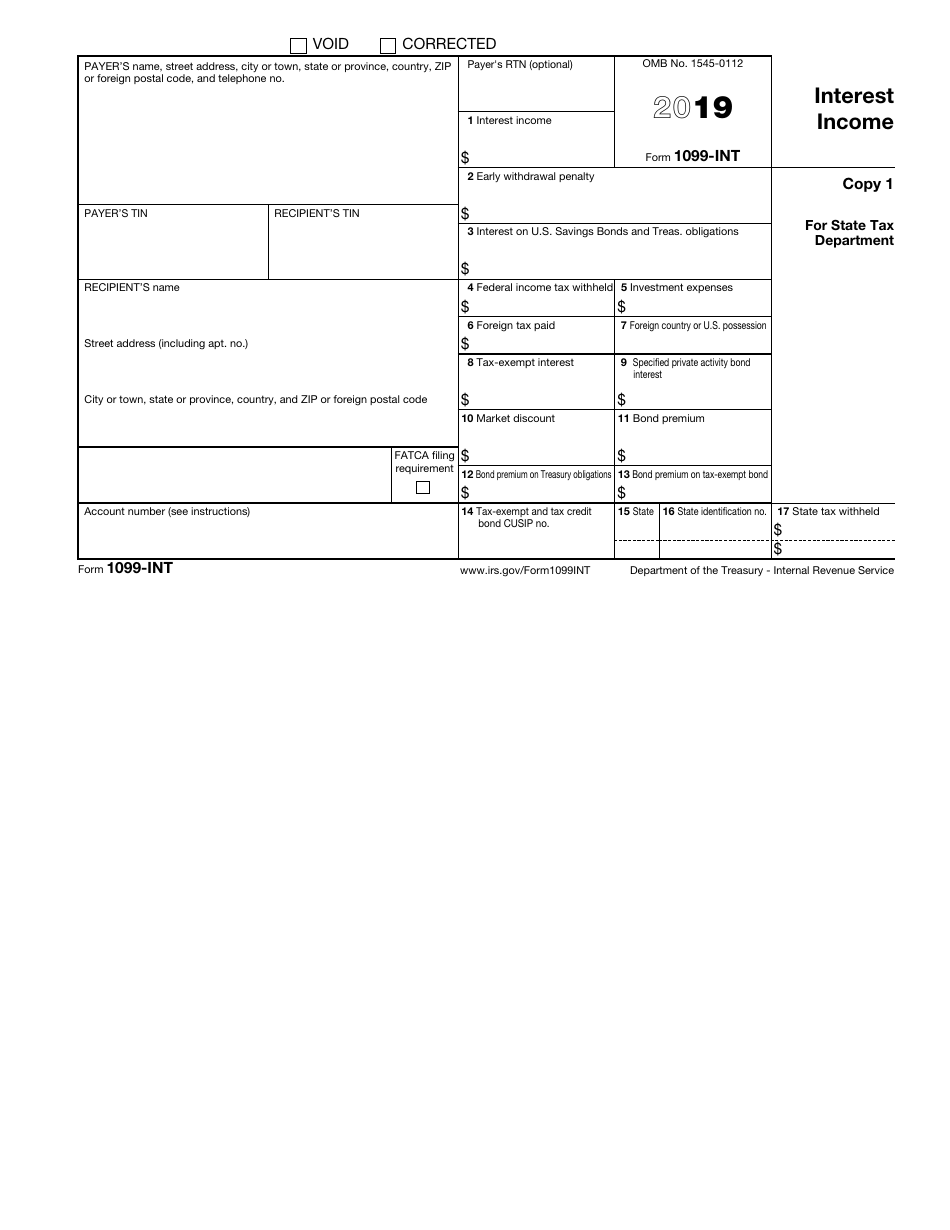

IRS Form 1099-INT Interest Income

What Is IRS Form 1099-INT?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1099-INT?

A: IRS Form 1099-INT is used to report interest income.

Q: Who receives Form 1099-INT?

A: Individuals or businesses who receive interest income from banks, financial institutions, or other sources.

Q: What information is reported on Form 1099-INT?

A: Form 1099-INT reports the total amount of interest income earned during the year.

Q: Do I need to include Form 1099-INT with my tax return?

A: Yes, you should include Form 1099-INT with your tax return to accurately report your interest income.

Q: What should I do if I don't receive a Form 1099-INT?

A: If you don't receive a Form 1099-INT, you should still report any interest income you earned on your tax return.

Q: Are there any exceptions to reporting interest income on Form 1099-INT?

A: Yes, there are some exceptions for certain types of interest income, such as tax-exempt interest.

Q: What is the deadline for filing Form 1099-INT?

A: The deadline for filing Form 1099-INT is January 31st.

Q: Can I file Form 1099-INT electronically?

A: Yes, you can file Form 1099-INT electronically through the IRS's e-file system.

Q: What happens if I fail to file Form 1099-INT?

A: Failing to file Form 1099-INT or reporting incorrect information may result in penalties imposed by the IRS.

Form Details:

- A 8-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-INT through the link below or browse more documents in our library of IRS Forms.