This version of the form is not currently in use and is provided for reference only. Download this version of

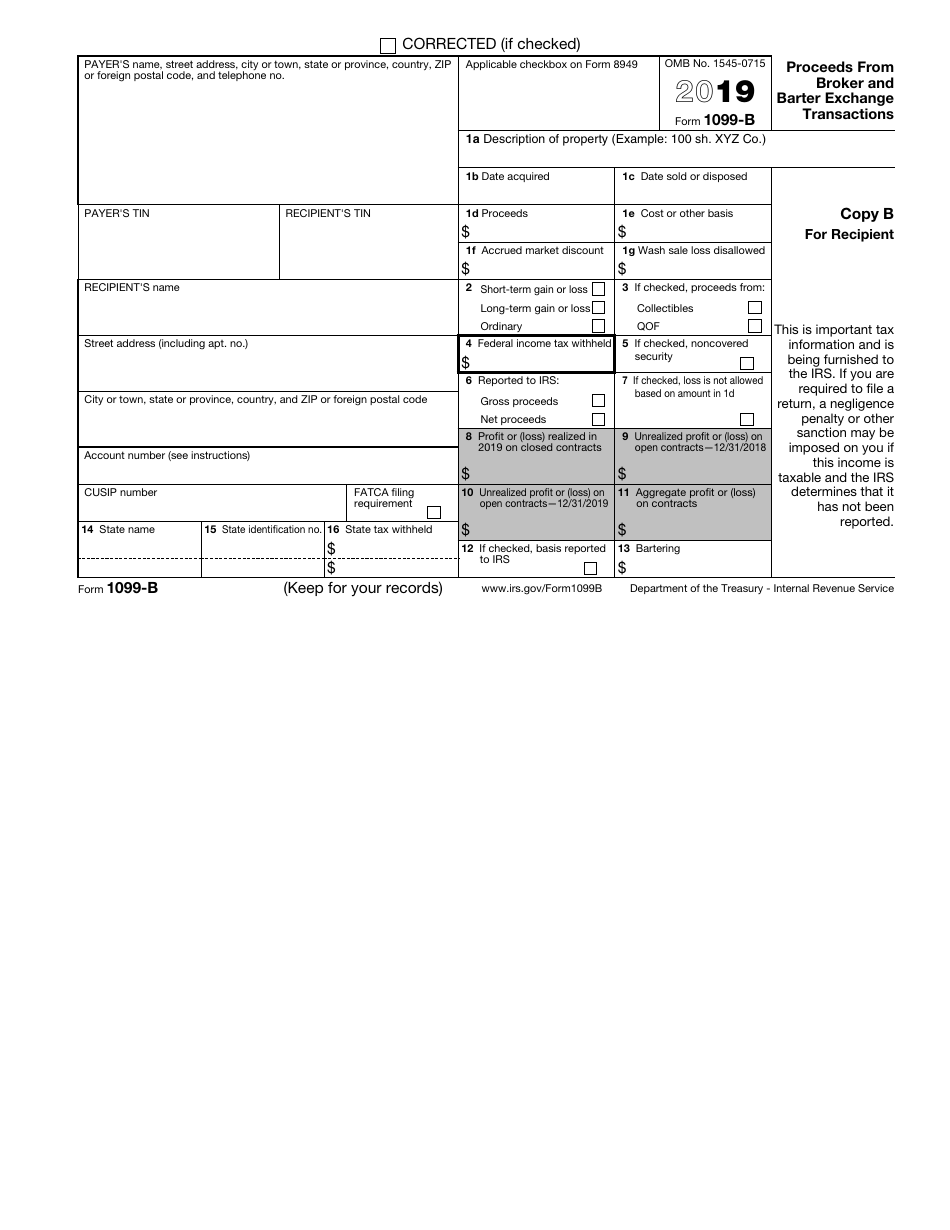

IRS Form 1099-B

for the current year.

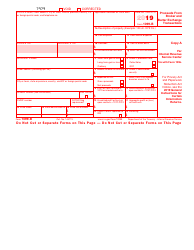

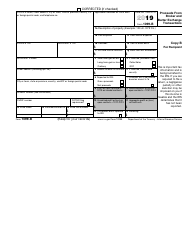

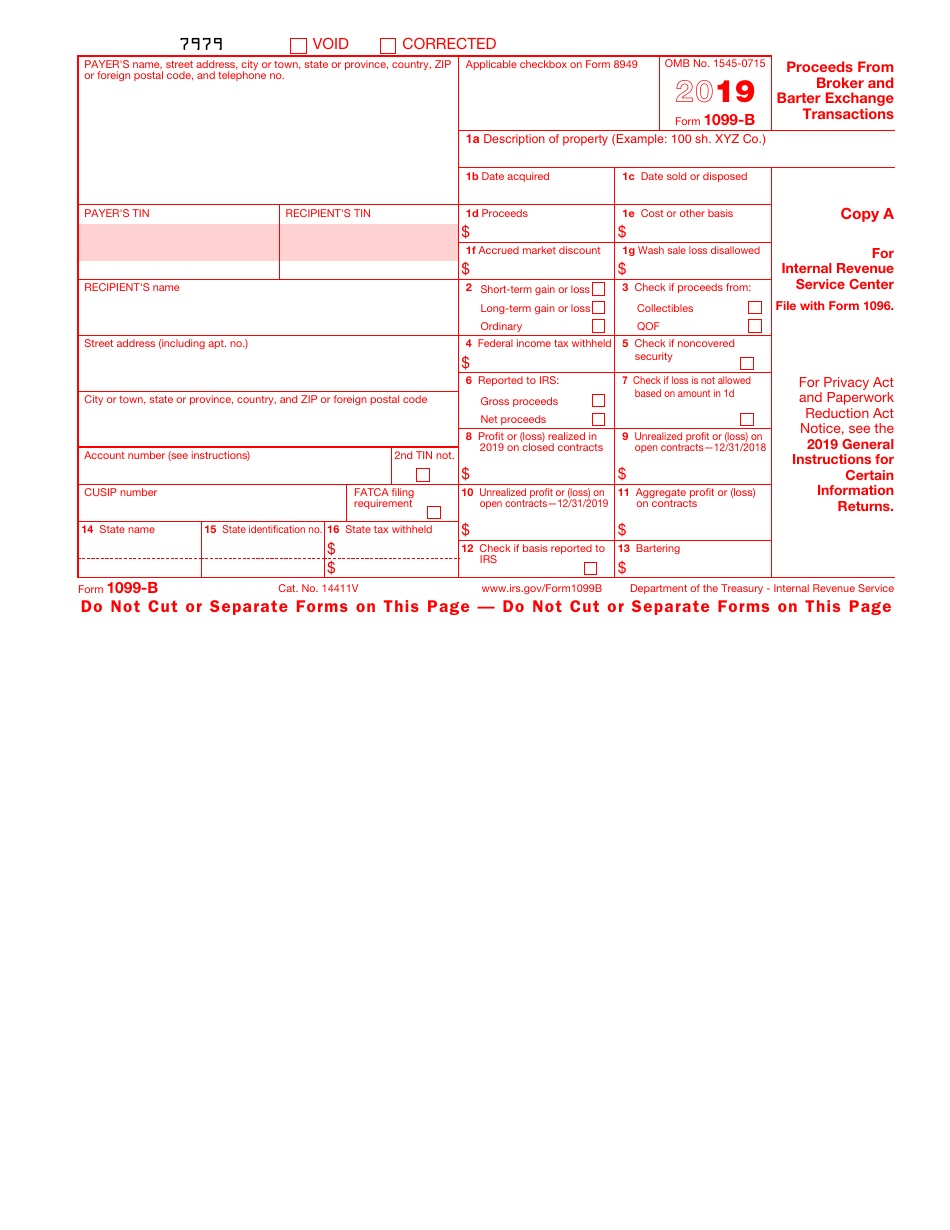

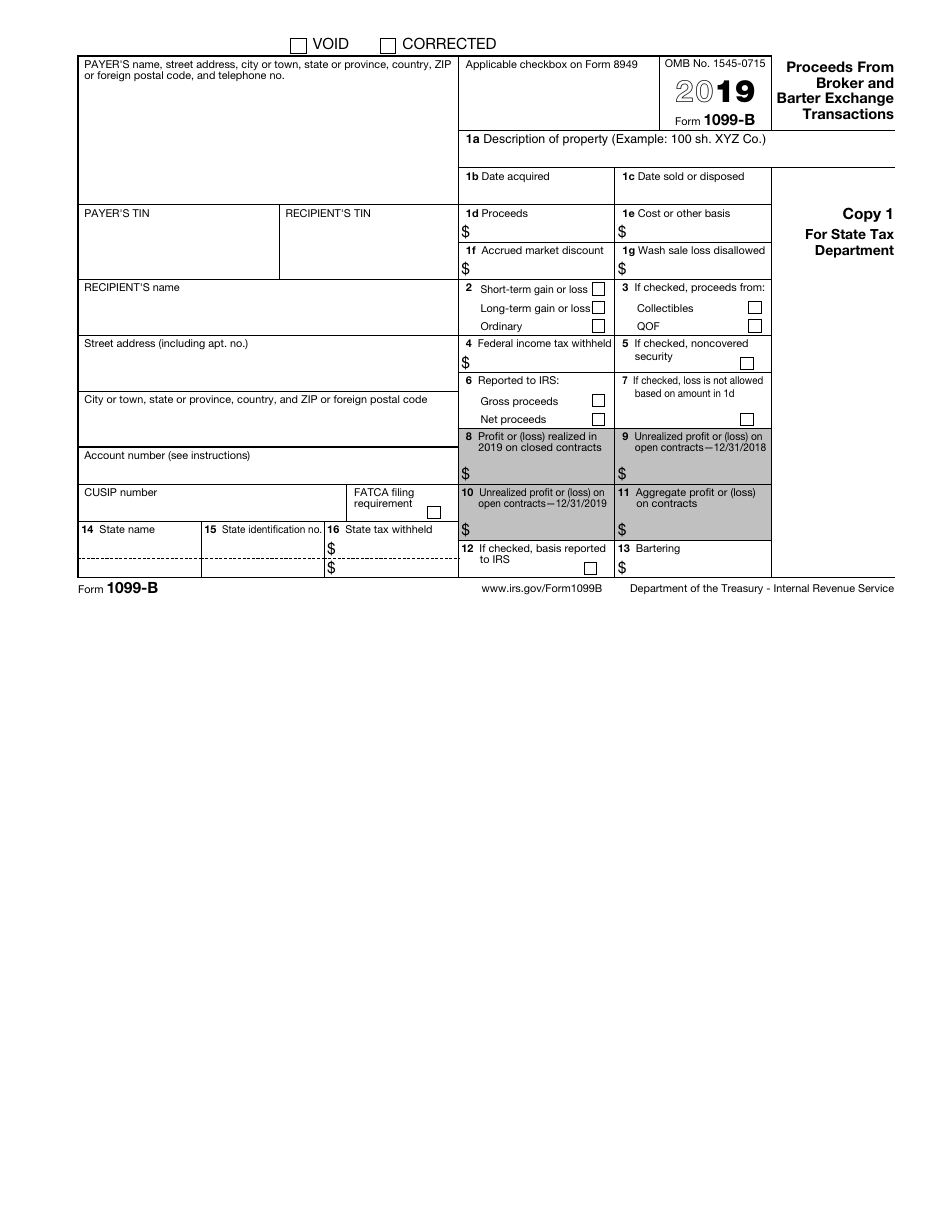

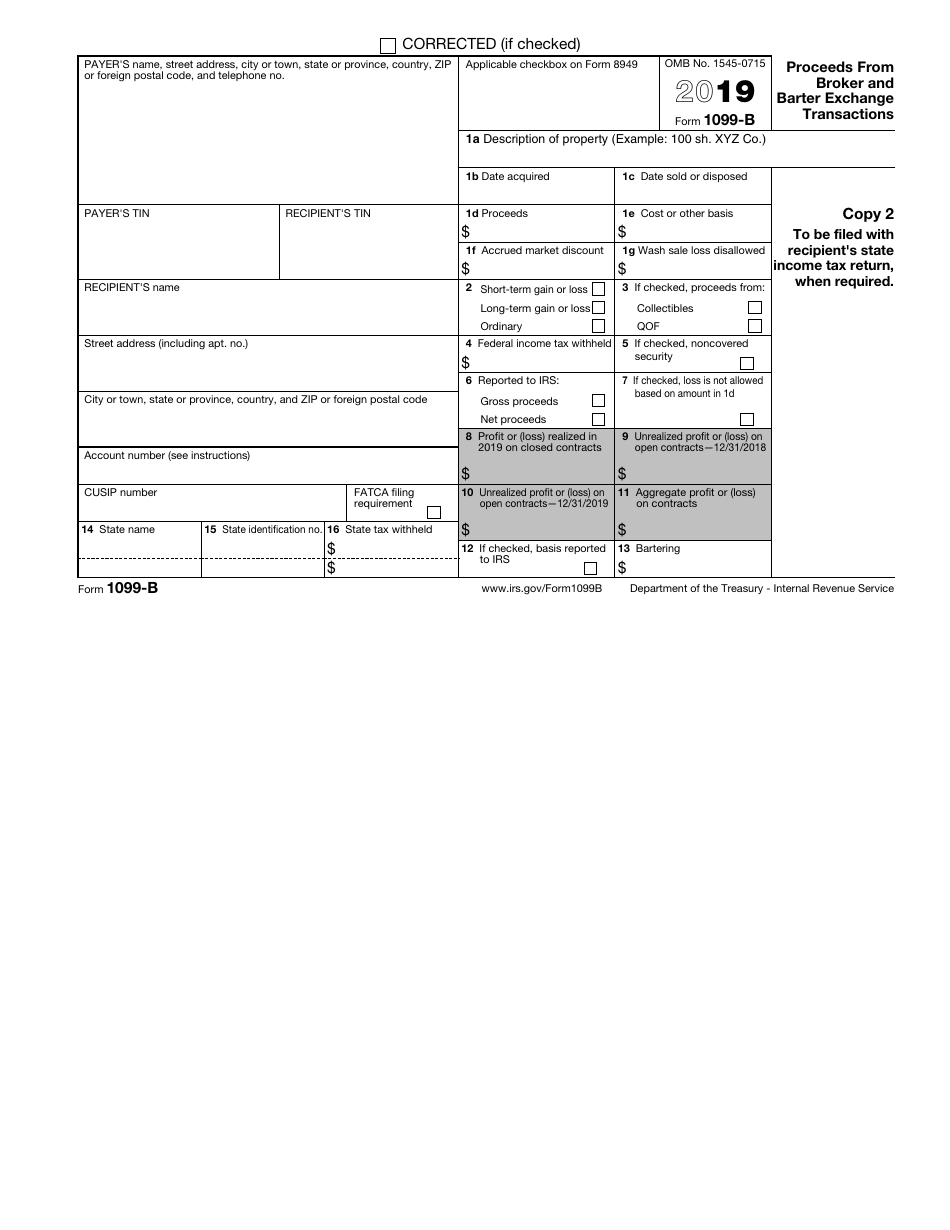

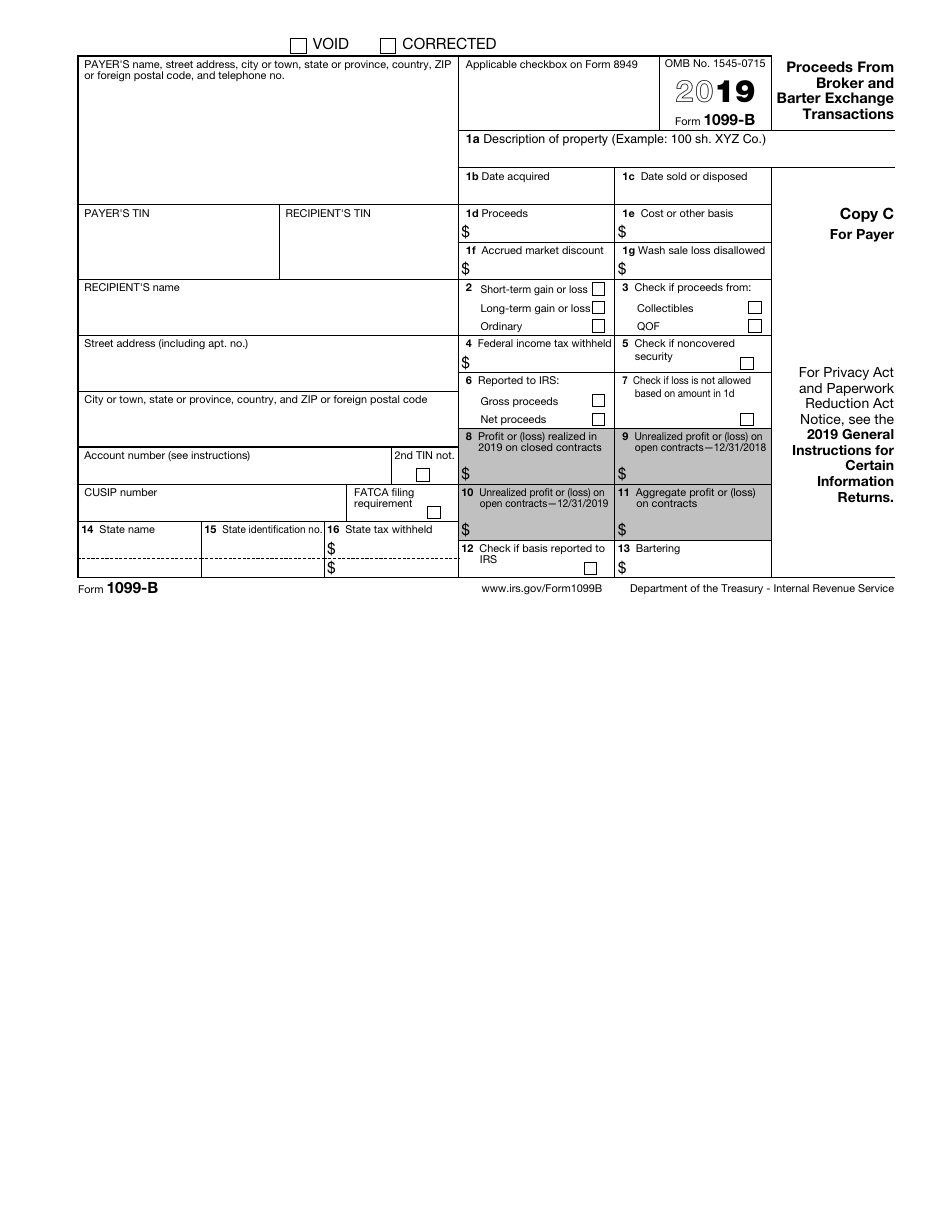

IRS Form 1099-B Proceeds From Broker and Barter Exchange Transactions

What Is IRS Form 1099-B?

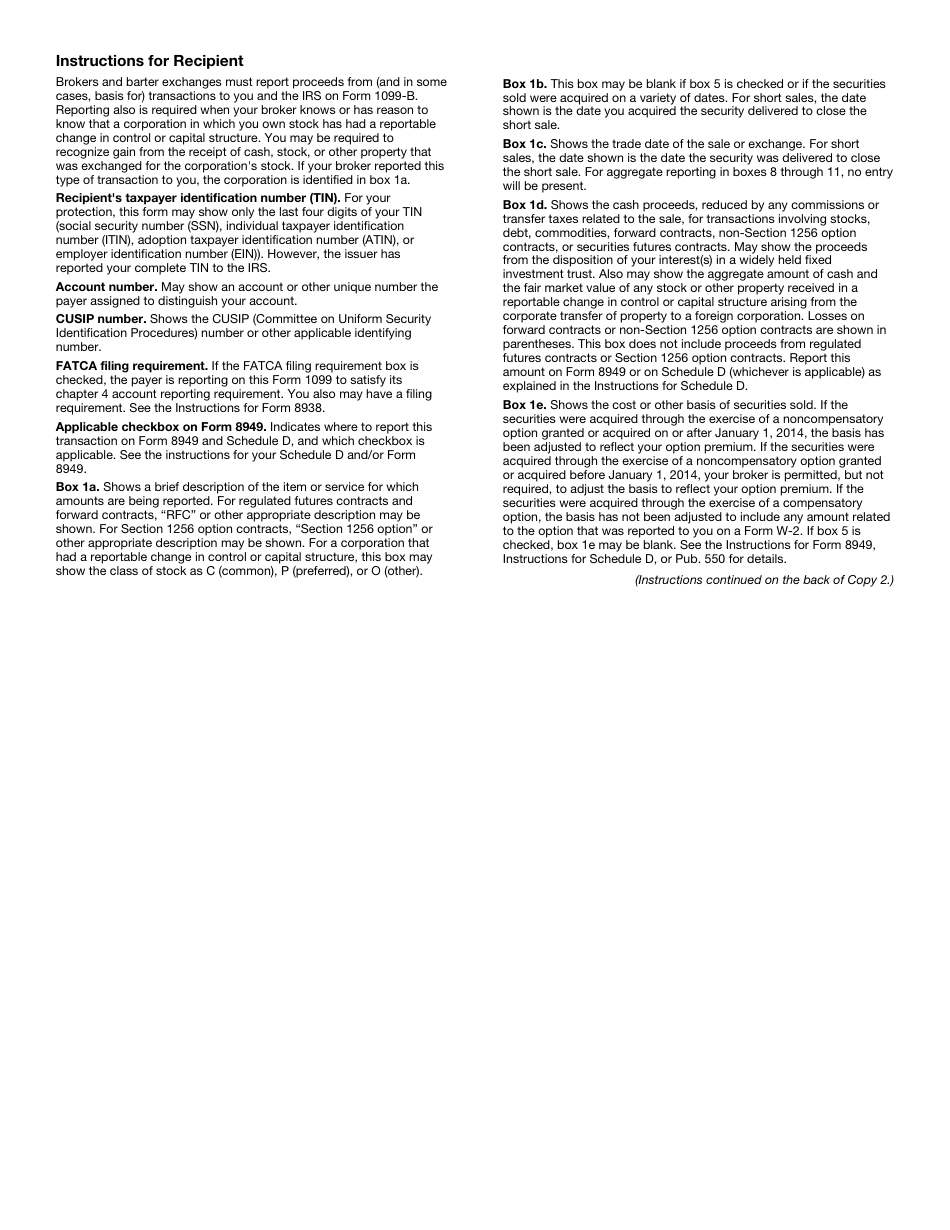

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1099-B?

A: IRS Form 1099-B is a tax form used to report proceeds from broker and barter exchange transactions.

Q: Who needs to file IRS Form 1099-B?

A: Brokers and barter exchanges need to file IRS Form 1099-B.

Q: What transactions are reported on IRS Form 1099-B?

A: IRS Form 1099-B is used to report transactions such as stock sales, option trades, mutual fund sales, and barter exchanges.

Q: Do individuals need to file IRS Form 1099-B?

A: No, individuals do not need to file IRS Form 1099-B. It is the responsibility of the brokers and barter exchanges to file this form.

Q: What information is included on IRS Form 1099-B?

A: IRS Form 1099-B includes information about the transaction, such as the date of sale, proceeds, and cost basis.

Q: When is the deadline to file IRS Form 1099-B?

A: The deadline to file IRS Form 1099-B is usually January 31st of the following year.

Q: What should I do if I receive an IRS Form 1099-B?

A: If you receive an IRS Form 1099-B, you should review it for accuracy and use it when filing your tax return.

Q: Are there any penalties for not filing IRS Form 1099-B?

A: Yes, there can be penalties for not filing IRS Form 1099-B. It is important to comply with tax reporting requirements.

Q: Can I e-file IRS Form 1099-B?

A: Yes, brokers and barter exchanges can e-file IRS Form 1099-B. It is the preferred method of filing.

Form Details:

- A 9-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-B through the link below or browse more documents in our library of IRS Forms.