This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1098-F

for the current year.

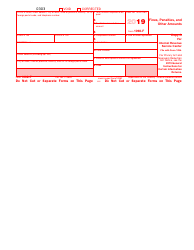

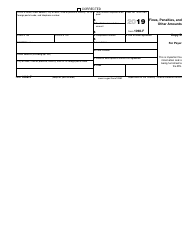

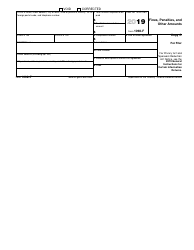

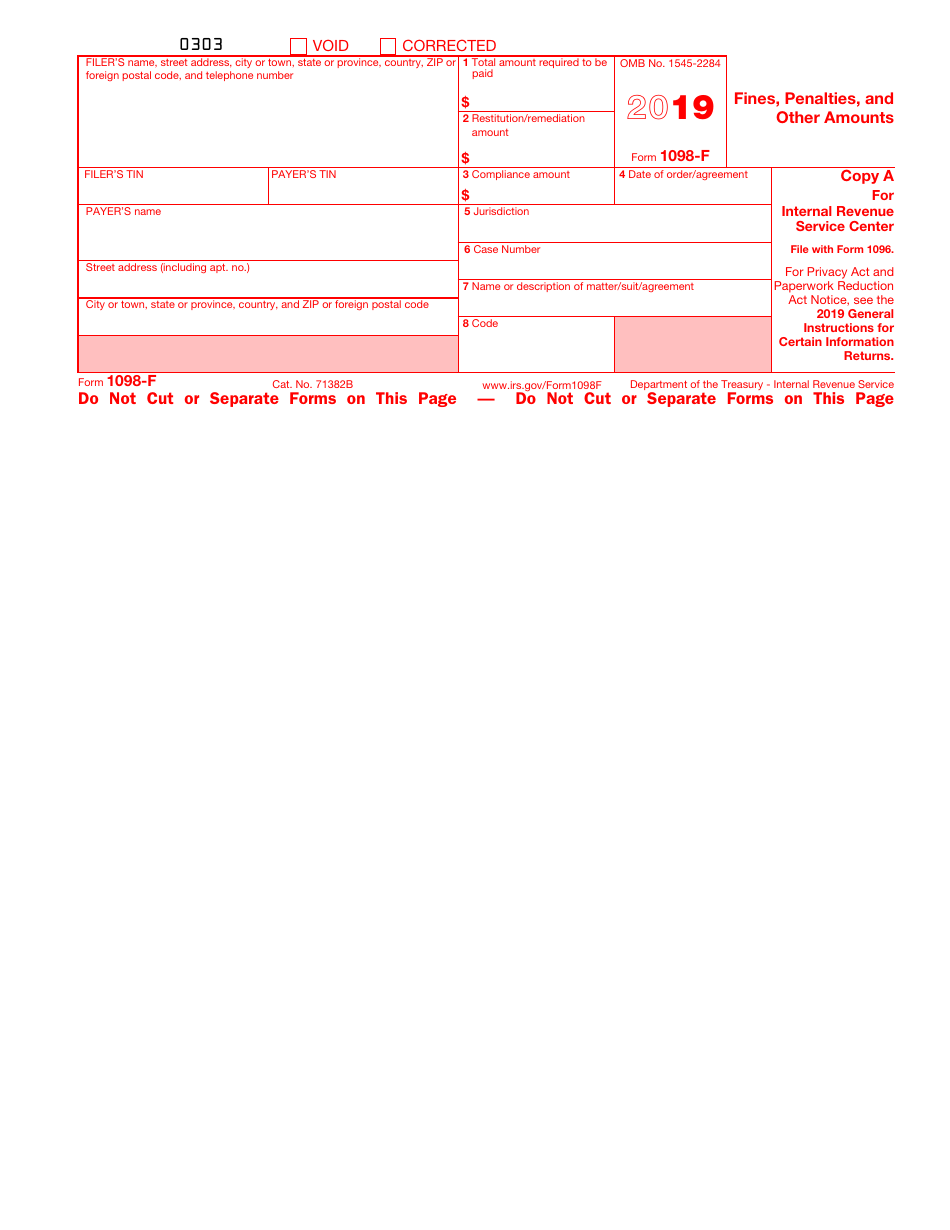

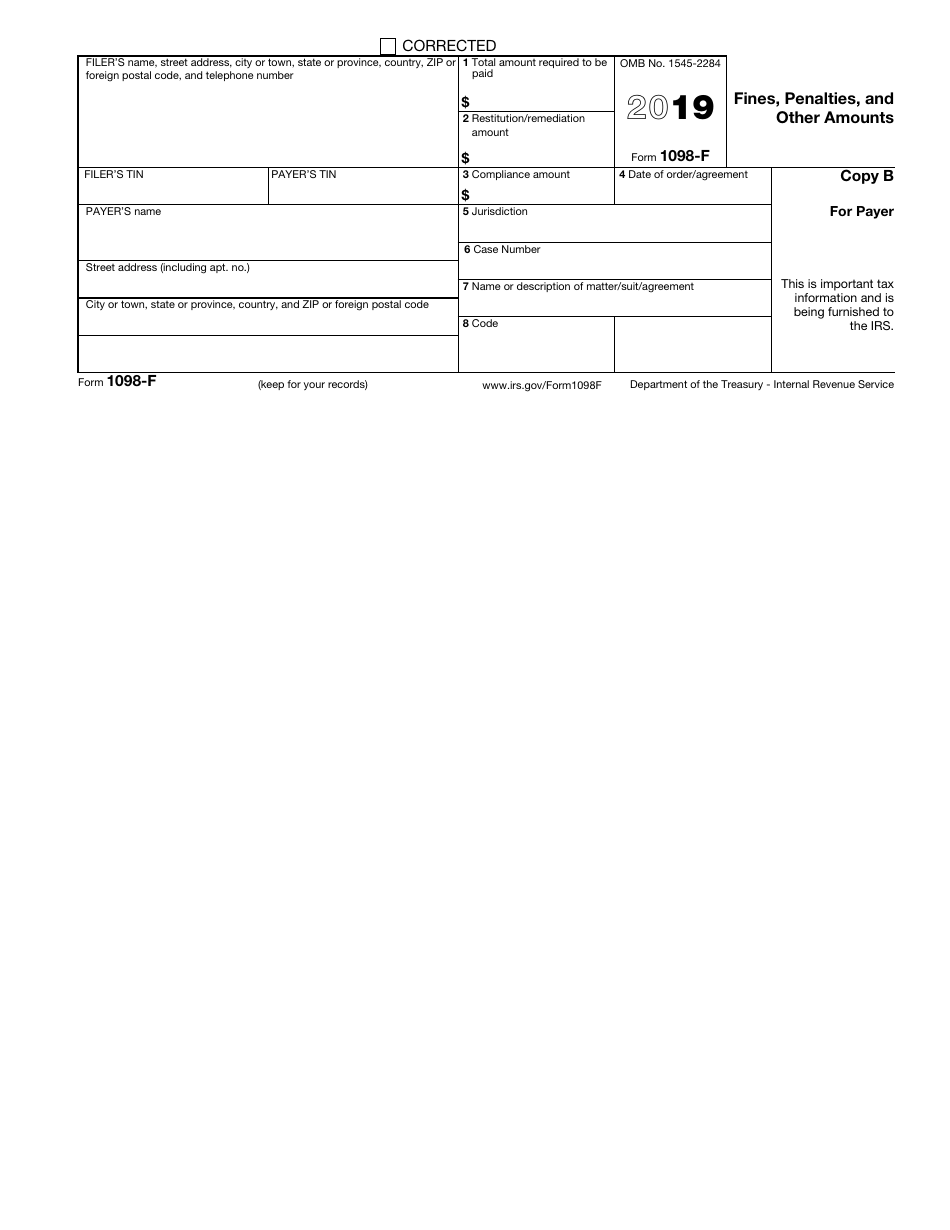

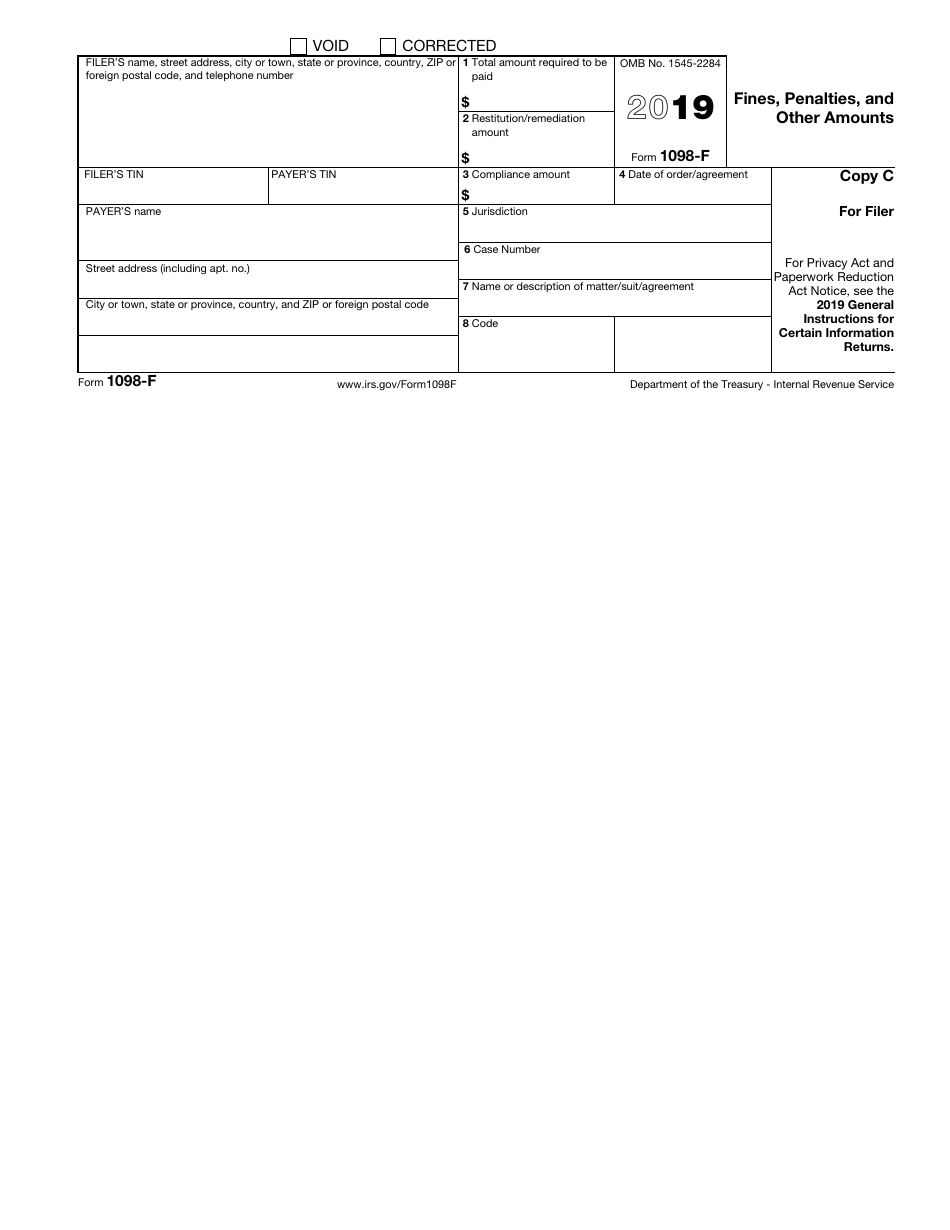

IRS Form 1098-F Fines, Penalties, and Other Amounts

What Is IRS Form 1098-F?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1098-F?

A: IRS Form 1098-F is a form used to report fines, penalties, and other amounts imposed by a government entity.

Q: Who needs to file IRS Form 1098-F?

A: Government entities that impose fines, penalties, and other amounts need to file IRS Form 1098-F.

Q: What is the purpose of filing IRS Form 1098-F?

A: The purpose of filing IRS Form 1098-F is to report the information to the Internal Revenue Service (IRS) and the respective payers.

Q: What types of amounts are reported on IRS Form 1098-F?

A: IRS Form 1098-F is used to report fines, penalties, and other amounts imposed by a government entity, including court-ordered restitution and community service obligations.

Q: How often does IRS Form 1098-F need to be filed?

A: IRS Form 1098-F is typically filed annually.

Q: Are there any penalties for not filing IRS Form 1098-F?

A: Yes, there can be penalties for not filing IRS Form 1098-F or for filing incorrect or incomplete information.

Form Details:

- A 6-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1098-F through the link below or browse more documents in our library of IRS Forms.