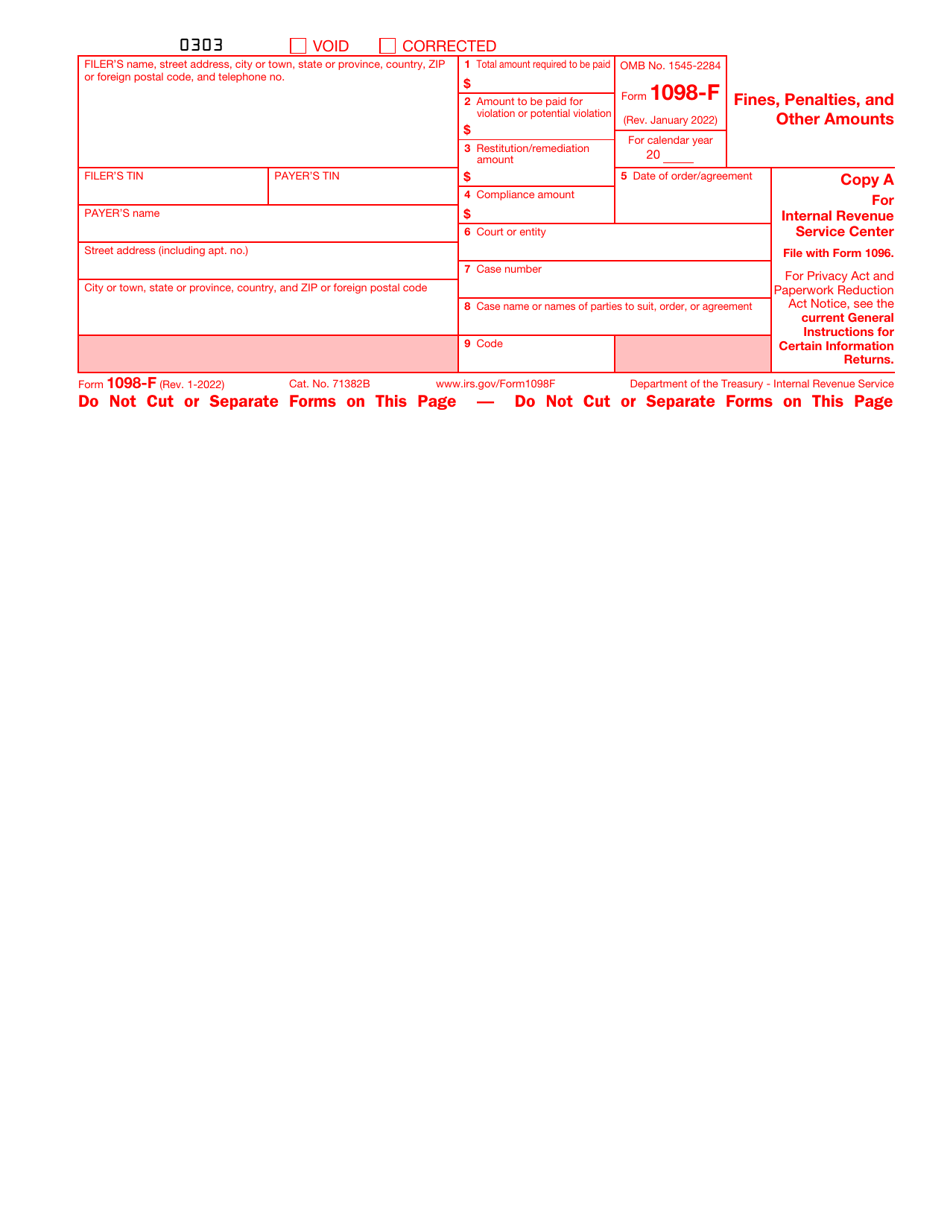

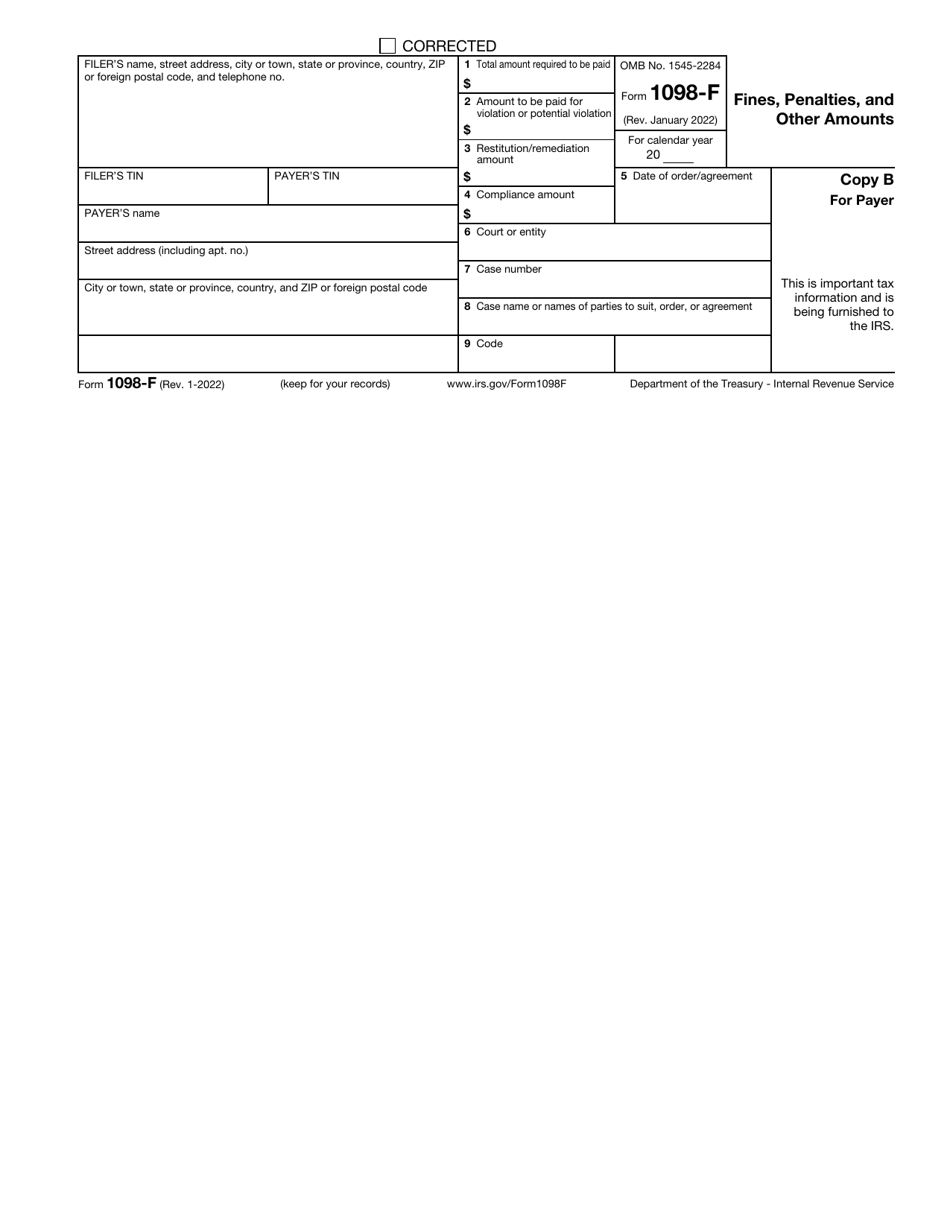

IRS Form 1098-F Fines, Penalties and Other Amounts

What Is IRS Form 1098-F?

IRS Form 1098-F, Fines, Penalties, and Other Amounts , is a formal instrument governmental entities prepare and file in order to inform the government about deductible payments like fines and penalties they have made during a particular calendar year. Certain nongovernmental entities that are treated by the fiscal authorities like governmental entities also need to submit this form. Note that it is only obligatory to file the paperwork if the entity collected the penalty or fine that equals or exceeds $600 and the payment in question is deductible in line with the current tax legislation.

This document was released by the Internal Revenue Service (IRS) on January 1, 2022 , making older editions obsolete. You can find an IRS Form 1098-F fillable version via the link below.

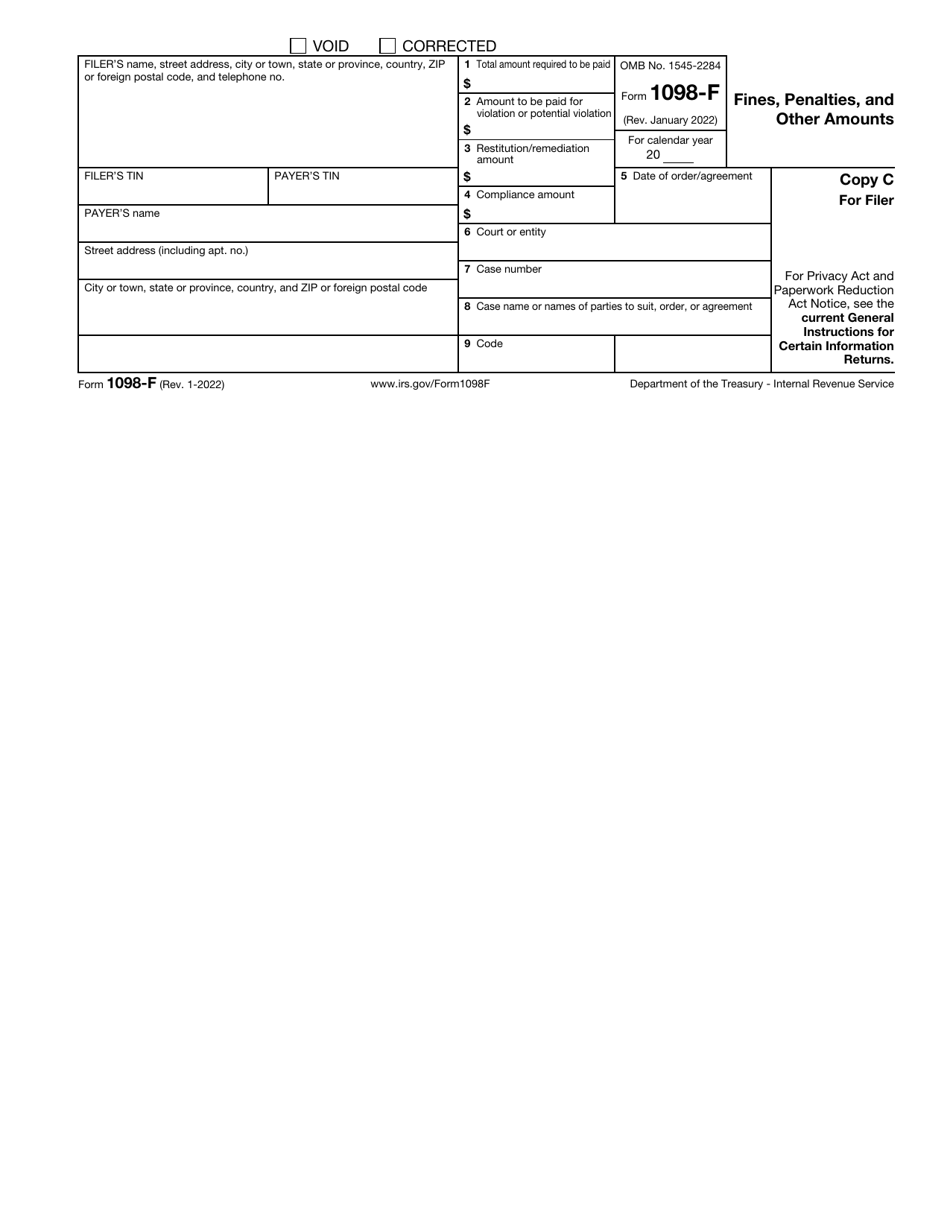

Identify yourself and the payer and specify the total amount of money you paid, the amount you owed as a result of a violation or potential infringement of the law, the amount that serves as restitution, and the summarized costs the agreement or suit led to. Write down the date the order or agreement was signed, state the name of the entity or court that approved the arrangement, add the case number and the names of parties involved, and indicate a code that describes the payment whether you are making several payments or dealing with multiple payees. Remember to keep a copy of Form 1098-F for the records of your institution as well as send a copy to the payer that was a part of the agreement, suit, or order.

Check the official IRS-issued instructions before completing and submitting the form.