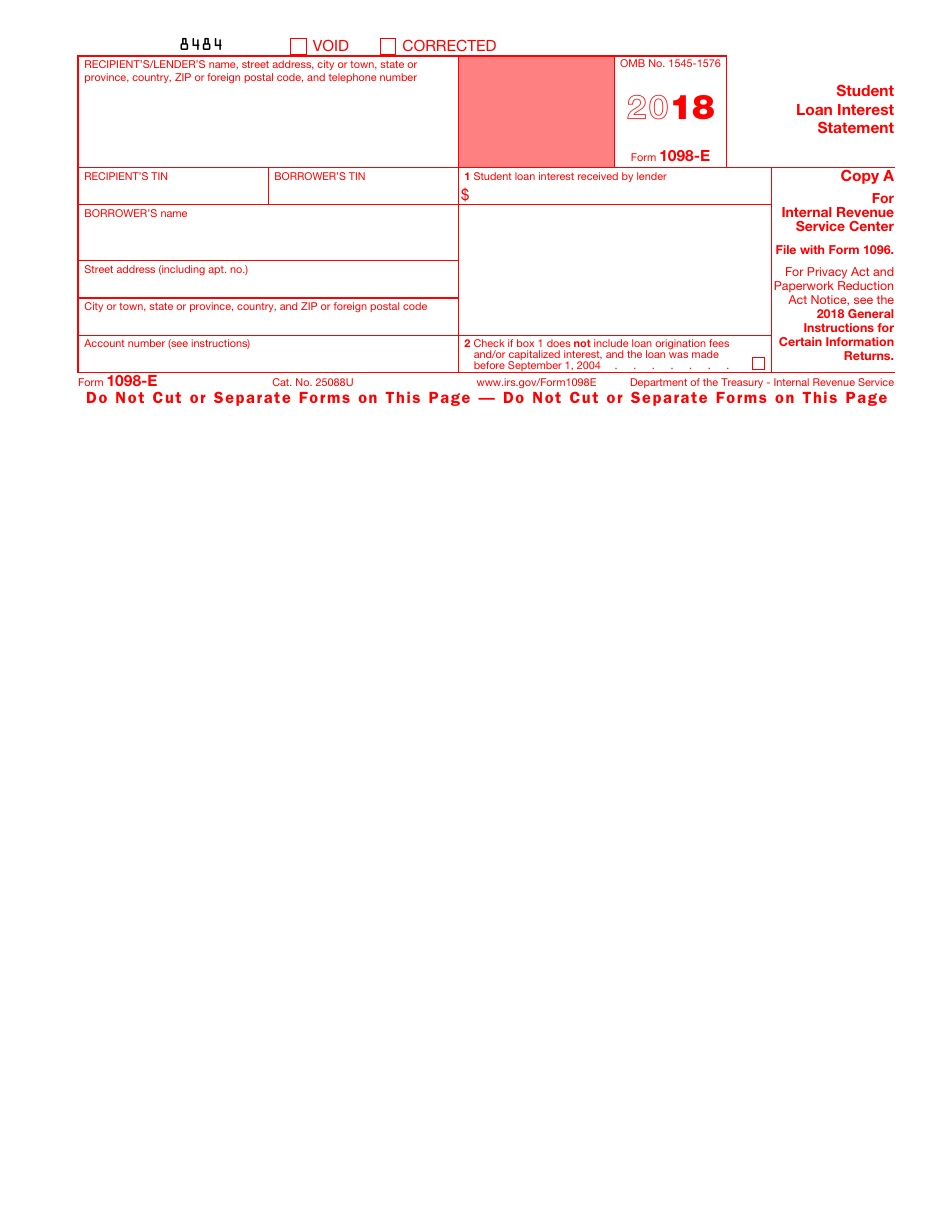

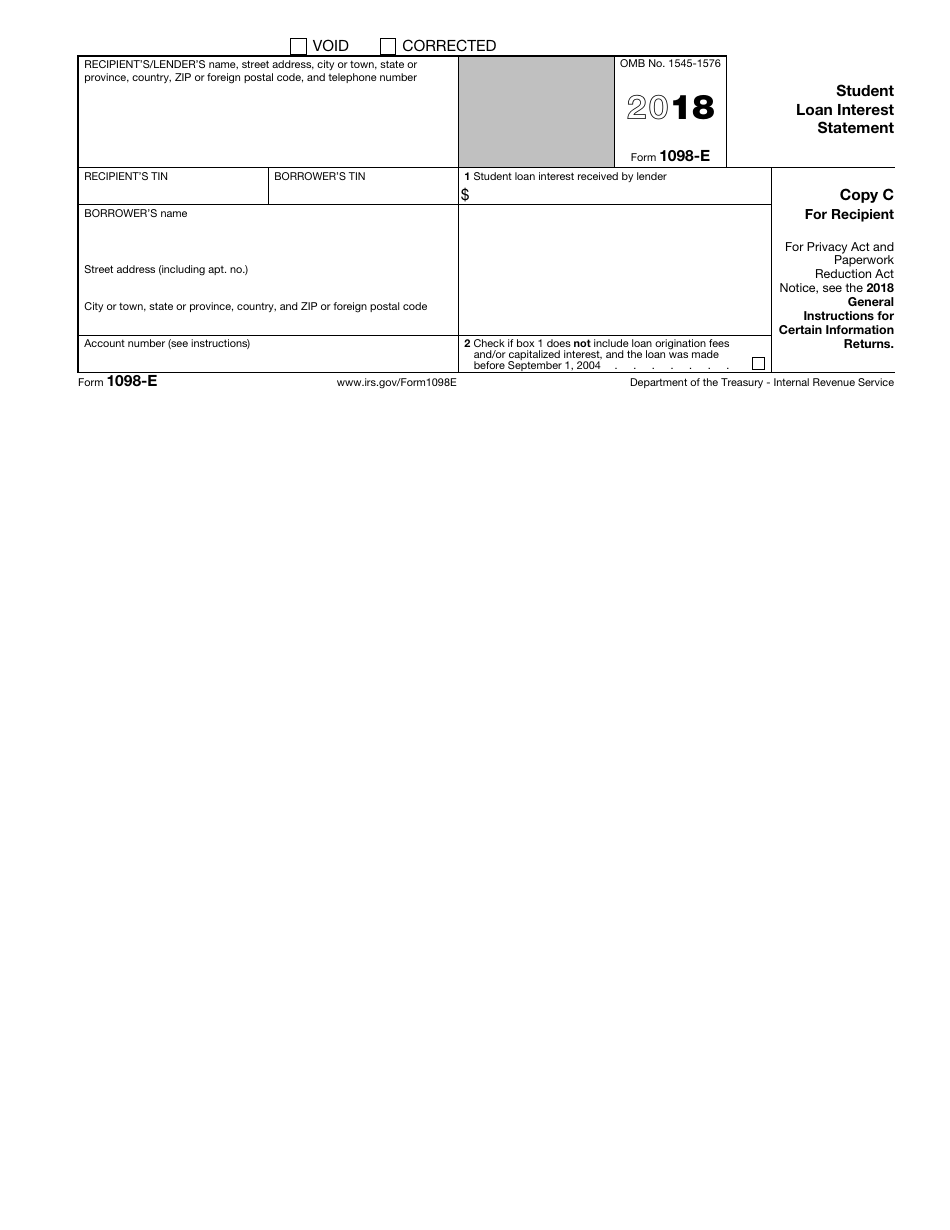

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1098-E

for the current year.

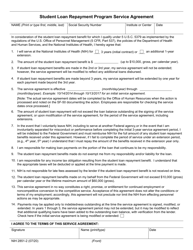

IRS Form 1098-E Student Loan Interest Statement

What Is IRS Form 1098-E?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1098-E?

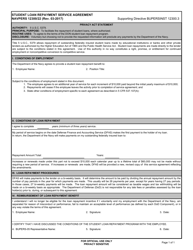

A: IRS Form 1098-E is a form used to report the amount of student loan interest paid by the borrower.

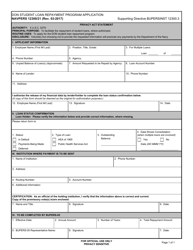

Q: Who receives IRS Form 1098-E?

A: The borrower of a qualified student loan receives IRS Form 1098-E from the lender.

Q: Why is IRS Form 1098-E important?

A: IRS Form 1098-E is important because it allows borrowers to deduct the student loan interest paid during the tax year on their federal income tax return.

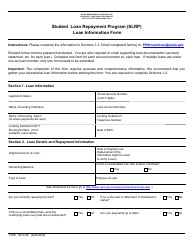

Q: What information is included in IRS Form 1098-E?

A: IRS Form 1098-E includes the amount of student loan interest paid by the borrower, the name and address of the lender, and the borrower's name and Social Security number.

Q: When is IRS Form 1098-E issued?

A: IRS Form 1098-E is typically issued by January 31st of each year for the previous tax year.

Q: Do I need to include IRS Form 1098-E with my tax return?

A: No, you do not need to include IRS Form 1098-E with your tax return. However, you should keep it for your records in case of an audit.

Q: Can I claim a deduction for student loan interest if I did not receive IRS Form 1098-E?

A: Yes, you can still claim a deduction for student loan interest even if you did not receive IRS Form 1098-E. You should keep records of the student loan interest paid, such as bank statements or cancelled checks, to support your deduction.

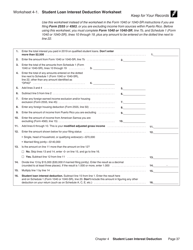

Q: Is there a limit to how much student loan interest I can deduct?

A: Yes, there is a limit to how much student loan interest you can deduct. The maximum deduction for the tax year is $2,500, and there are income limits that may reduce or eliminate the deduction.

Q: Can I deduct student loan interest if my parents are paying my loans?

A: No, you cannot deduct student loan interest if your parents are paying your loans. Only the person who is legally obligated to repay the loan can claim the deduction.

Q: Are there any other requirements for claiming the student loan interest deduction?

A: Yes, there are a few other requirements for claiming the student loan interest deduction. The loan must be a qualified student loan, the borrower's modified adjusted gross income must be within certain limits, and the borrower cannot be claimed as a dependent on someone else's tax return.

Form Details:

- A 6-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1098-E through the link below or browse more documents in our library of IRS Forms.