This version of the form is not currently in use and is provided for reference only. Download this version of

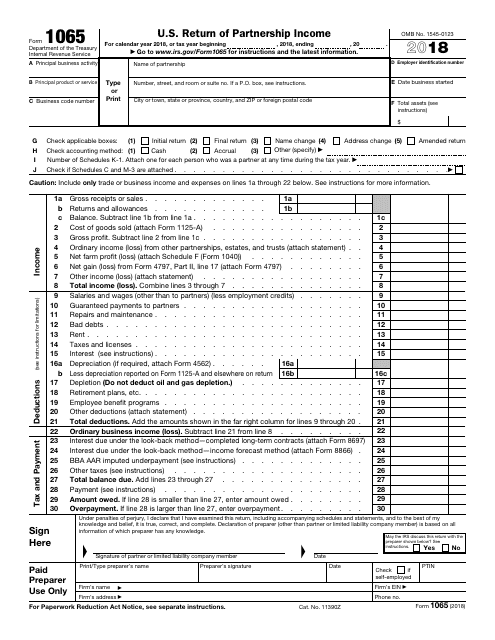

IRS Form 1065

for the current year.

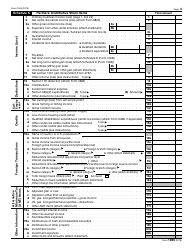

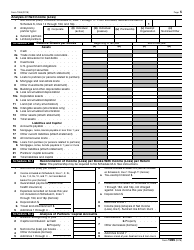

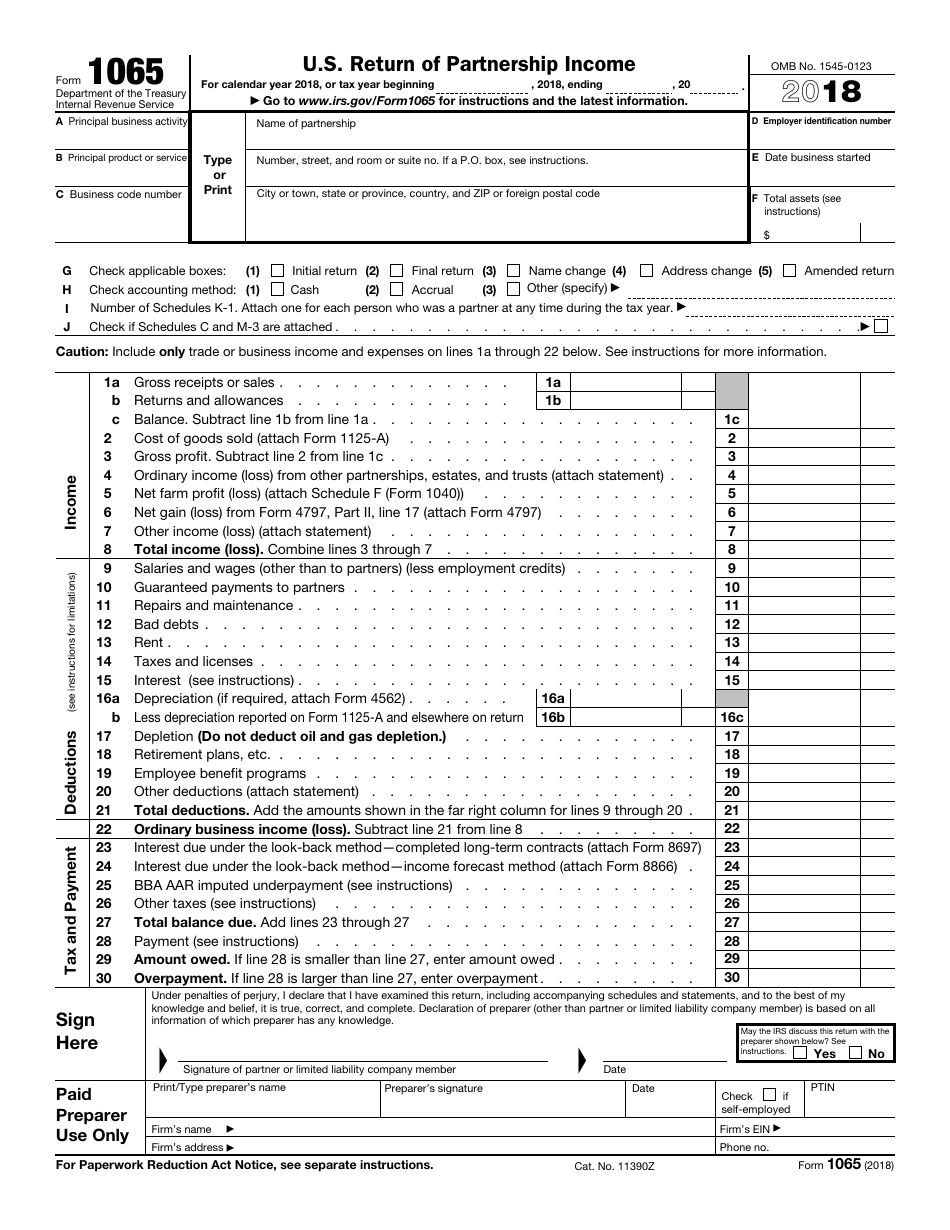

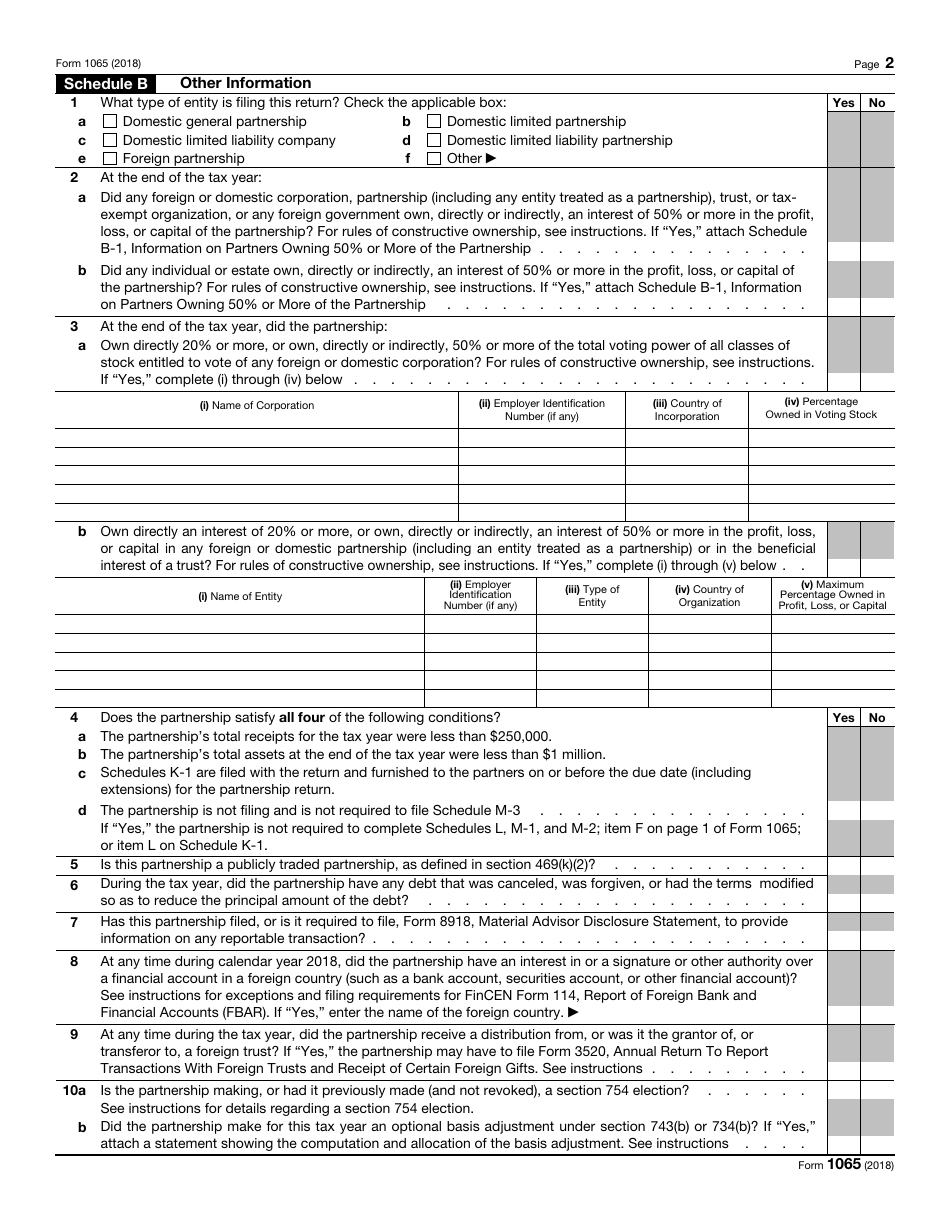

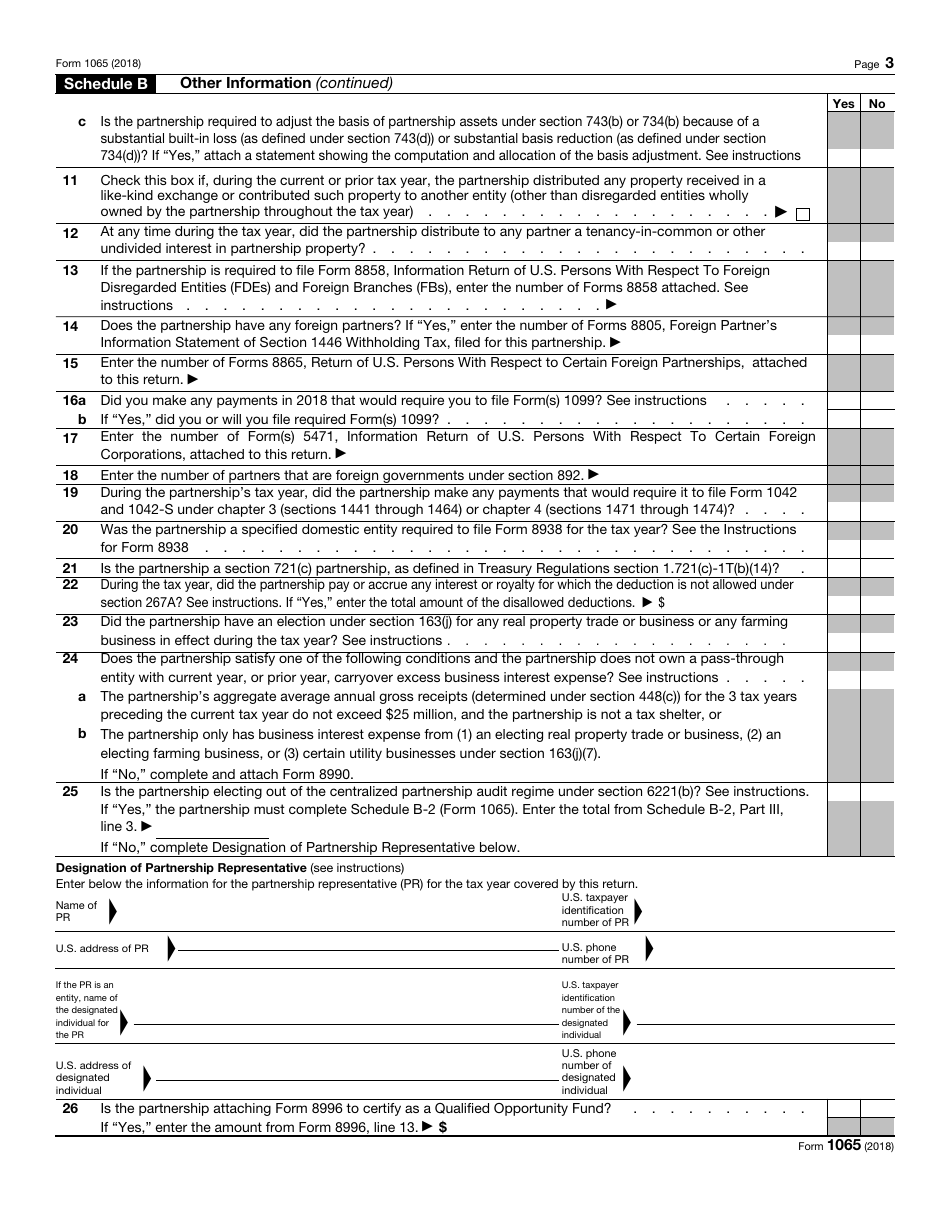

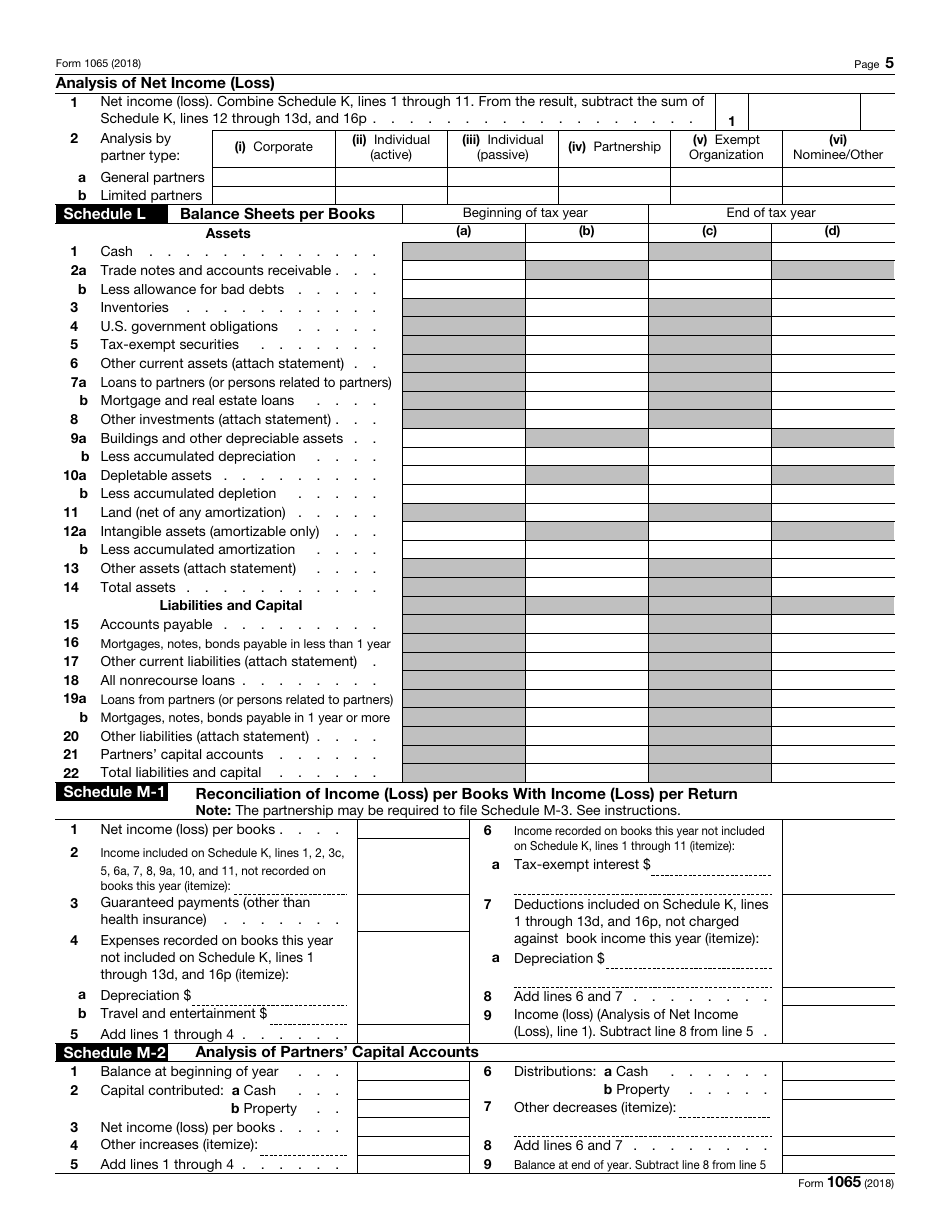

IRS Form 1065 U.S. Return of Partnership Income

What Is IRS Form 1065?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1065?

A: IRS Form 1065 is the U.S. Return of Partnership Income.

Q: Who needs to file IRS Form 1065?

A: Partnerships are required to file IRS Form 1065.

Q: What information is reported on IRS Form 1065?

A: IRS Form 1065 reports the income, deductions, and credits of the partnership.

Q: When is IRS Form 1065 due?

A: IRS Form 1065 is due on the 15th day of the 3rd month after the end of the partnership's tax year.

Q: Are there any penalties for late filing of IRS Form 1065?

A: Yes, there are penalties for late filing of IRS Form 1065. The penalty is $205 for each month or part of a month the return is late, multiplied by the number of partners in the partnership for any part of the tax year.

Q: Can I e-file IRS Form 1065?

A: Yes, you can e-file IRS Form 1065.

Q: Do I need to include any attachments with IRS Form 1065?

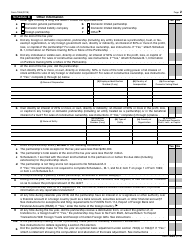

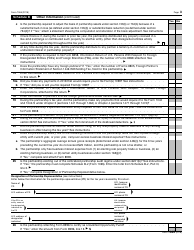

A: Yes, you need to include Schedule K-1, which reports each partner's share of income, deductions, and credits.

Q: Is there a separate form for foreign partnerships?

A: Yes, there is a separate form called IRS Form 1065-B for foreign partnerships.

Q: Can I get an extension to file IRS Form 1065?

A: Yes, you can request an extension to file IRS Form 1065. The extension provides an additional six months to file the return, but it does not extend the time to pay any taxes owed.

Form Details:

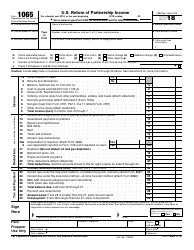

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1065 through the link below or browse more documents in our library of IRS Forms.