This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040-ES

for the current year.

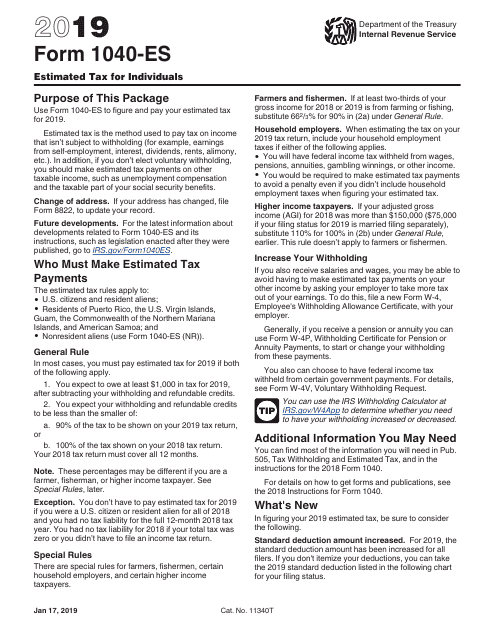

IRS Form 1040-ES Estimated Tax for Individuals

What Is Form 1040-ES Used For?

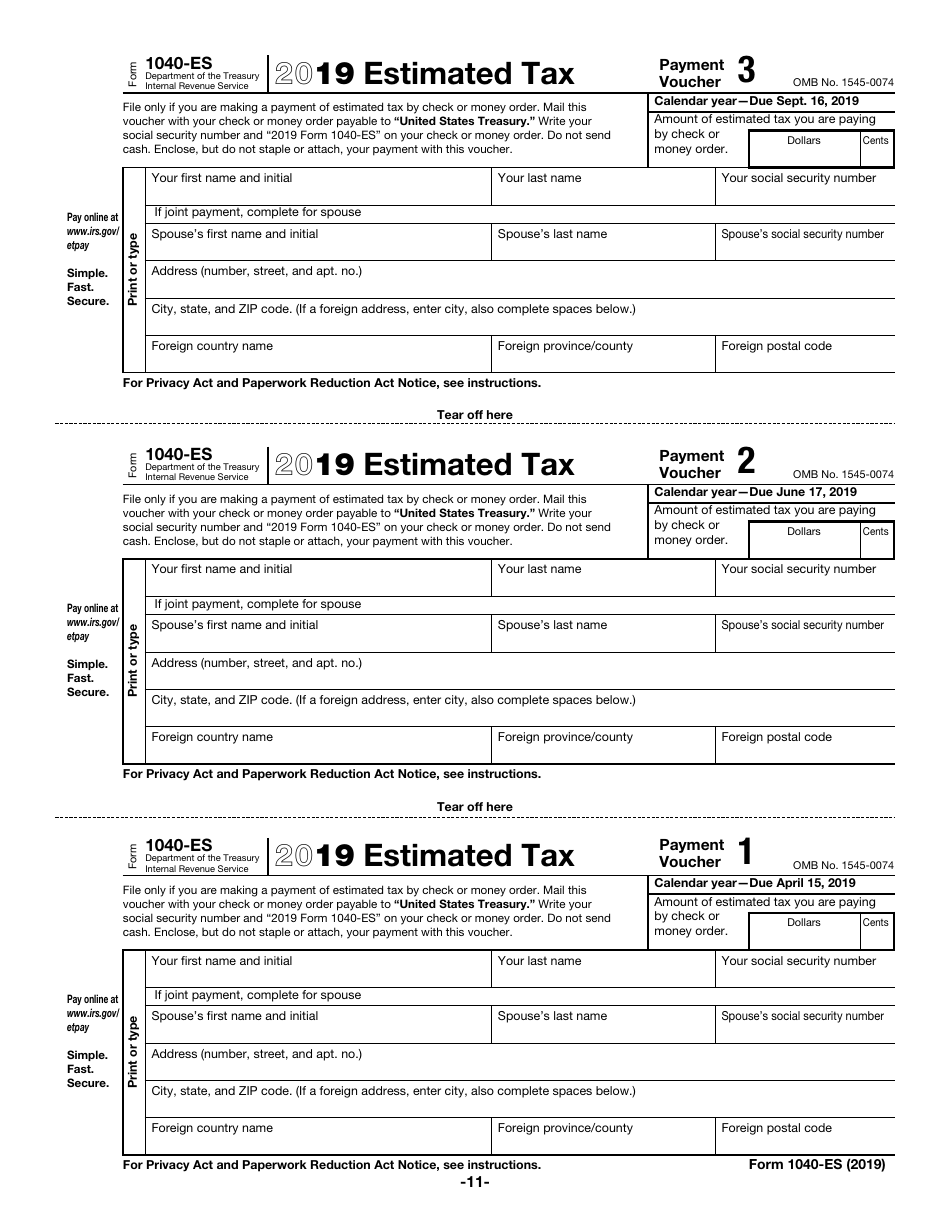

IRS Form 1040-ES, Estimated Tax for Individuals, is a package of payment vouchers and worksheets used to figure and pay estimated tax. It was issued by the Internal Revenue Service (IRS) . The form - also known as the IRS Estimated Tax Form - is revised annually. Download the latest fillable Form 1040-ES through the link below or order a paper version from the IRS website.

Use the estimated tax method to pay tax on income not subject to withholdings and on other taxable income like unemployment compensation or taxable part of the social security benefits (if you do not elect voluntary withholding). You must make the estimated tax payments if you are a United States citizen, resident or nonresident alien, or a resident of Puerto Rico, Guam, the Commonwealth of the Northern Mariana Islands, American Samoa, and the United States Virgin Island and both of the following applies:

- You expect to owe a minimum of $1,000 in tax after subtracting all the refundable credits and withholding.

- You expect the refundable credits and withholding to be less than 90% of the tax for the upcoming year or 100% of the tax shown on the tax return for the previous year.

IRS Form 1040-ES Instructions

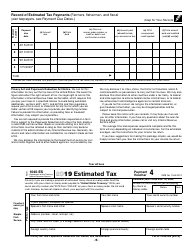

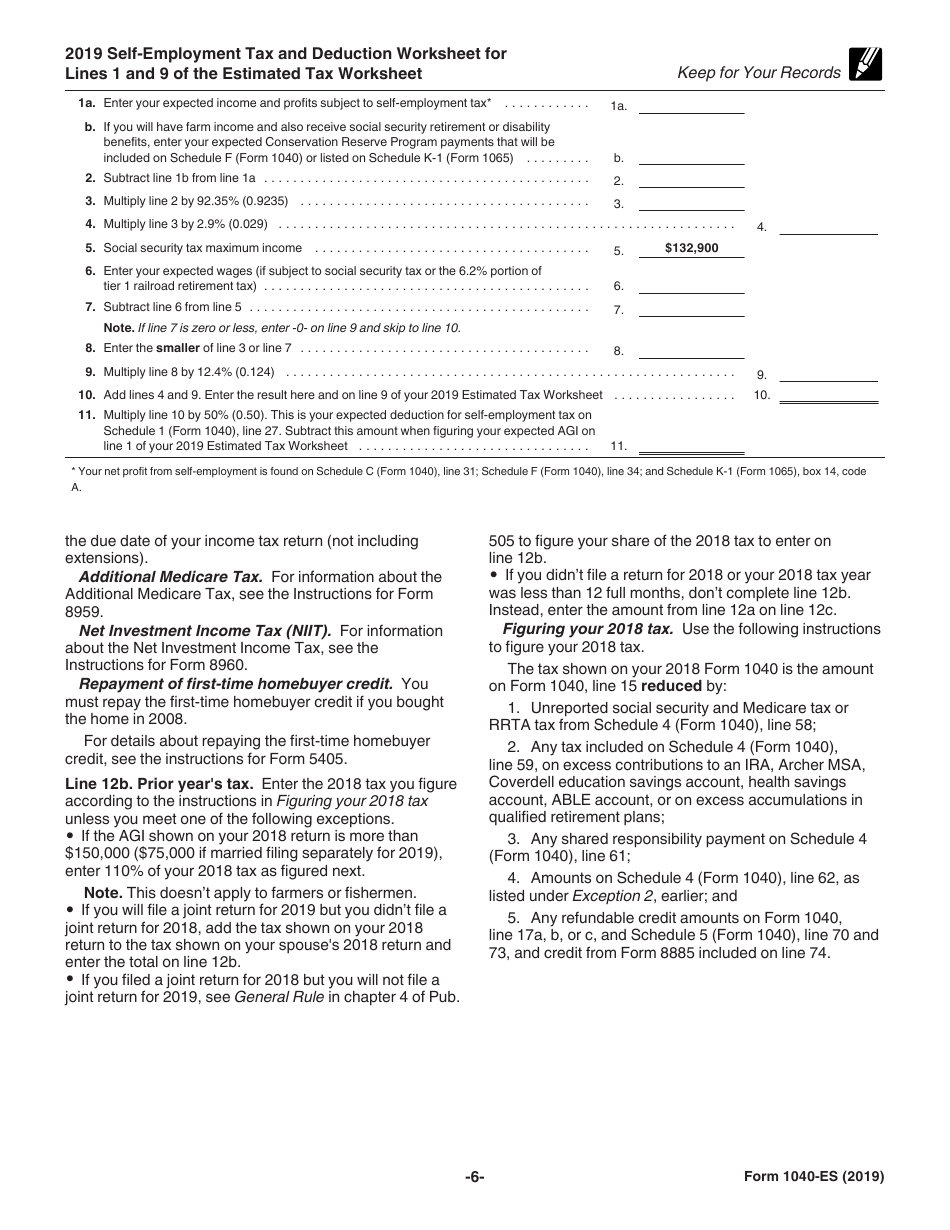

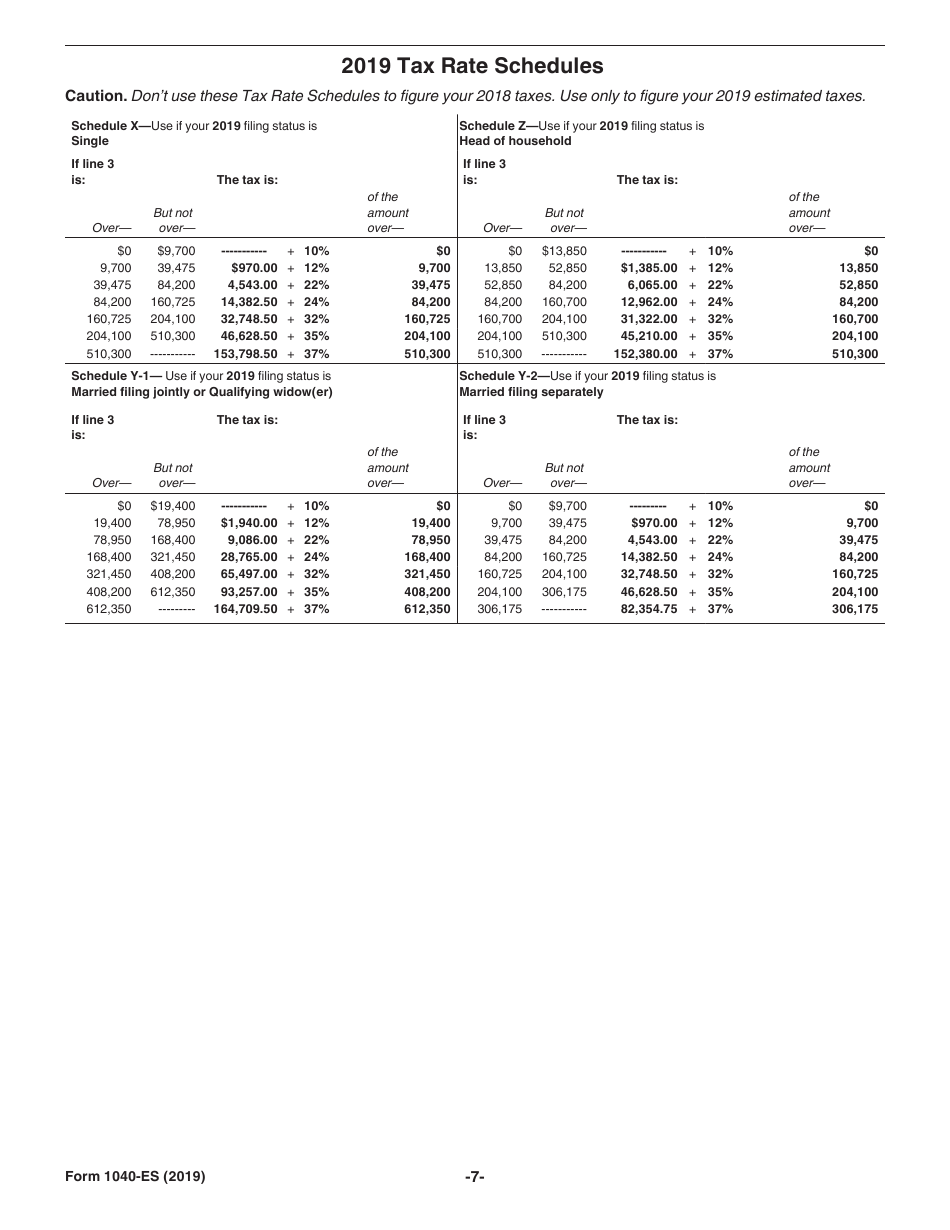

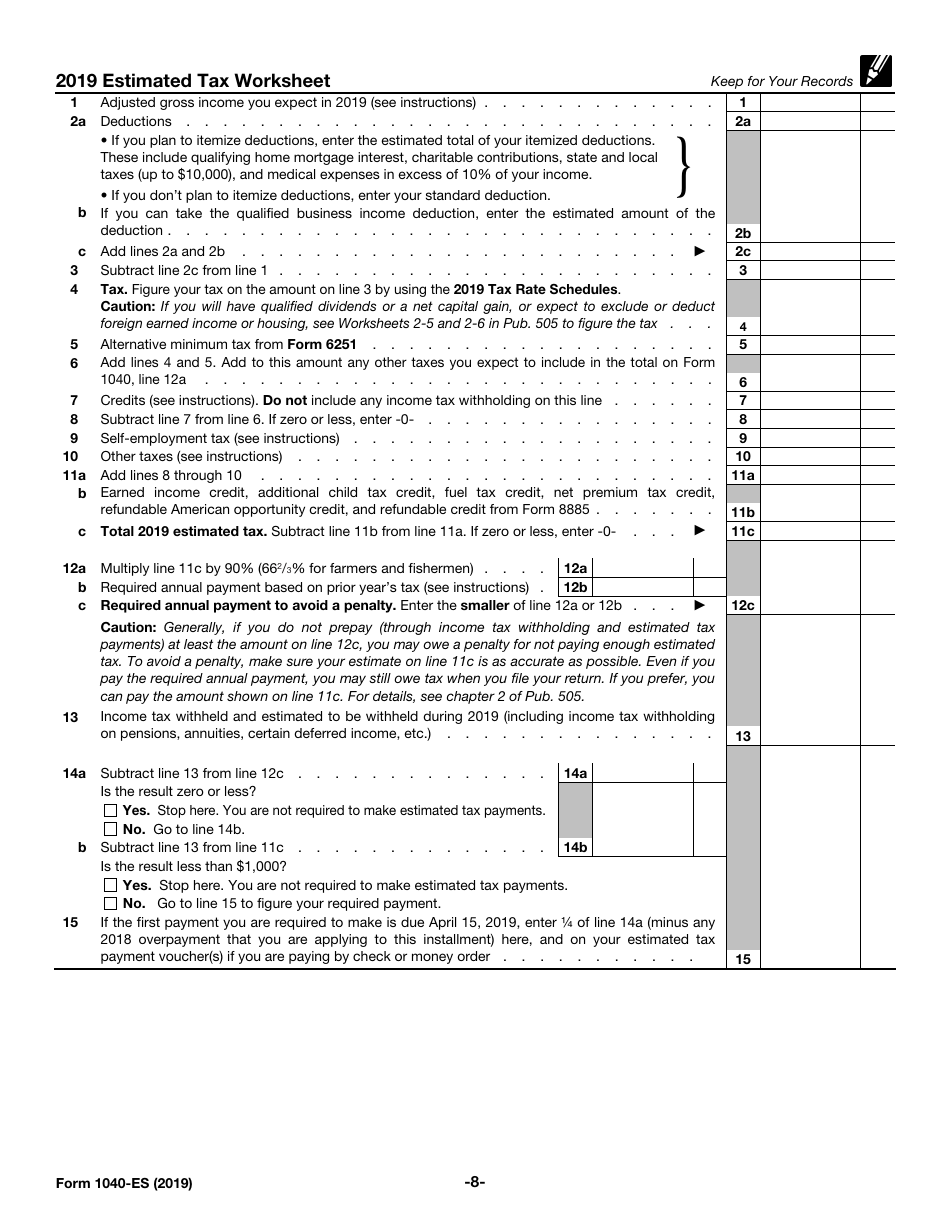

Form 1040-ES consists of detailed instructions, worksheets, tax rate schedules, and payment vouchers. Use the worksheets to determine your estimated tax amount. Fill out the payment vouchers, detach them, and mail to the IRS. Keep worksheets and instructions for your records.

According to the IRS 1040-ES Form, you can pay your estimated tax in several ways:

- Online;

- By phone;

- Using a mobile device;

- By cash;

- By check or money order.

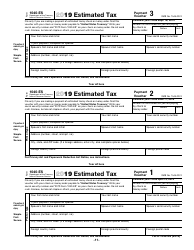

Submit the form only if you pay by check or money order. In this case, mail the payment voucher with the check or money order. The check or money order must contain your SSN and an inscription "201X Form 1040-ES". Do not staple or attach your voucher to the payment.

How to Fill Out Form 1040-ES?

- Complete the appropriate worksheets to calculate your estimated tax amount;

- Enter the amount on the payment voucher. Split it into four payments if necessary;

- Provide your and your spouse's name and SSNs (if filing jointly); and

- Enter your current address. If you are an alien, provide the foreign address, too.

When Are 1040-ES Payments Due?

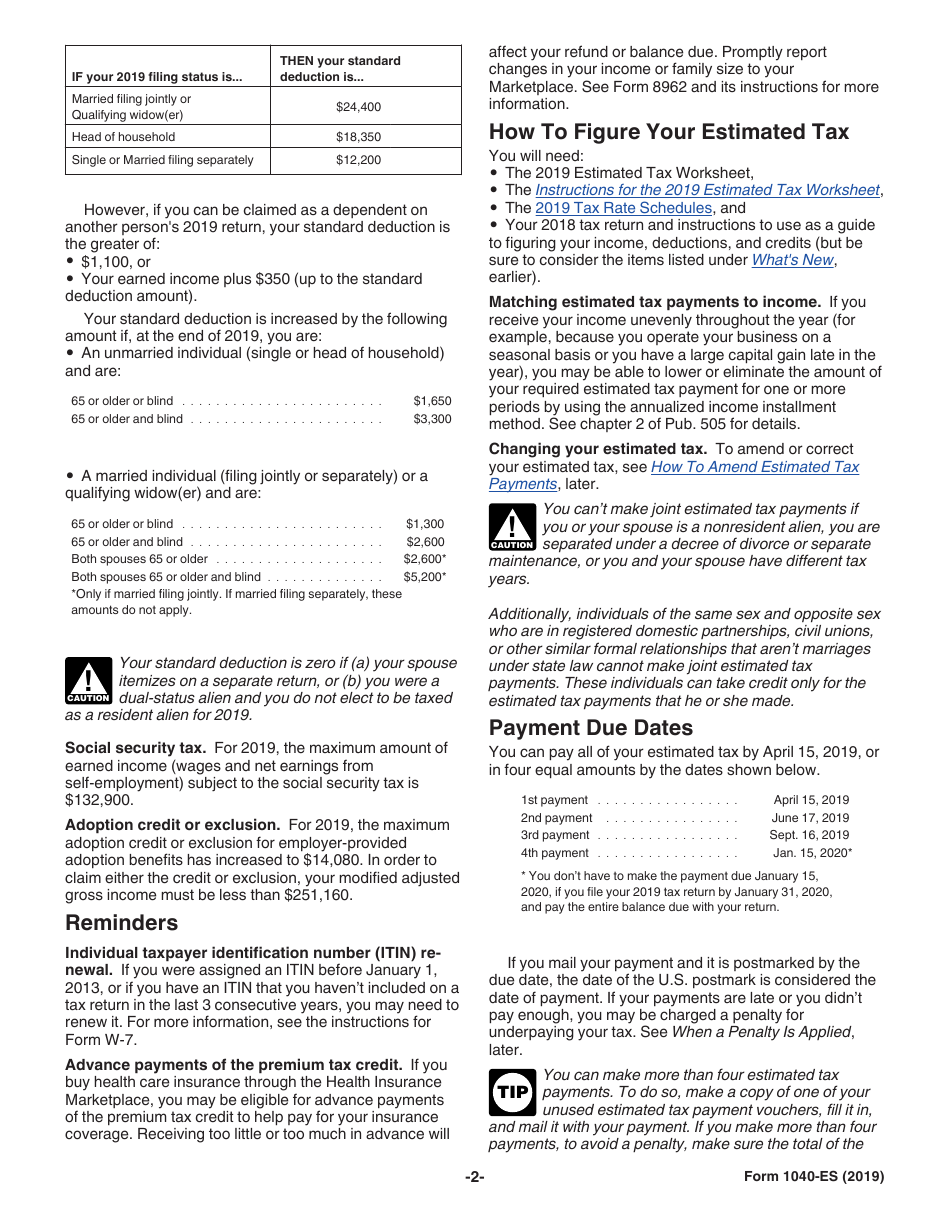

Pay all of your estimated tax by April 15, or split it into four equal payments. In this case, the Form 1040-ES due dates will be:

- April 15;

- June 17;

- September 16;

- January 15 (next year).

If you did not make your payments on time or in the required amount, the IRS may apply penalties. The amount of penalties is defined by the IRS.

What Is the Mailing Address for 1040-ES?

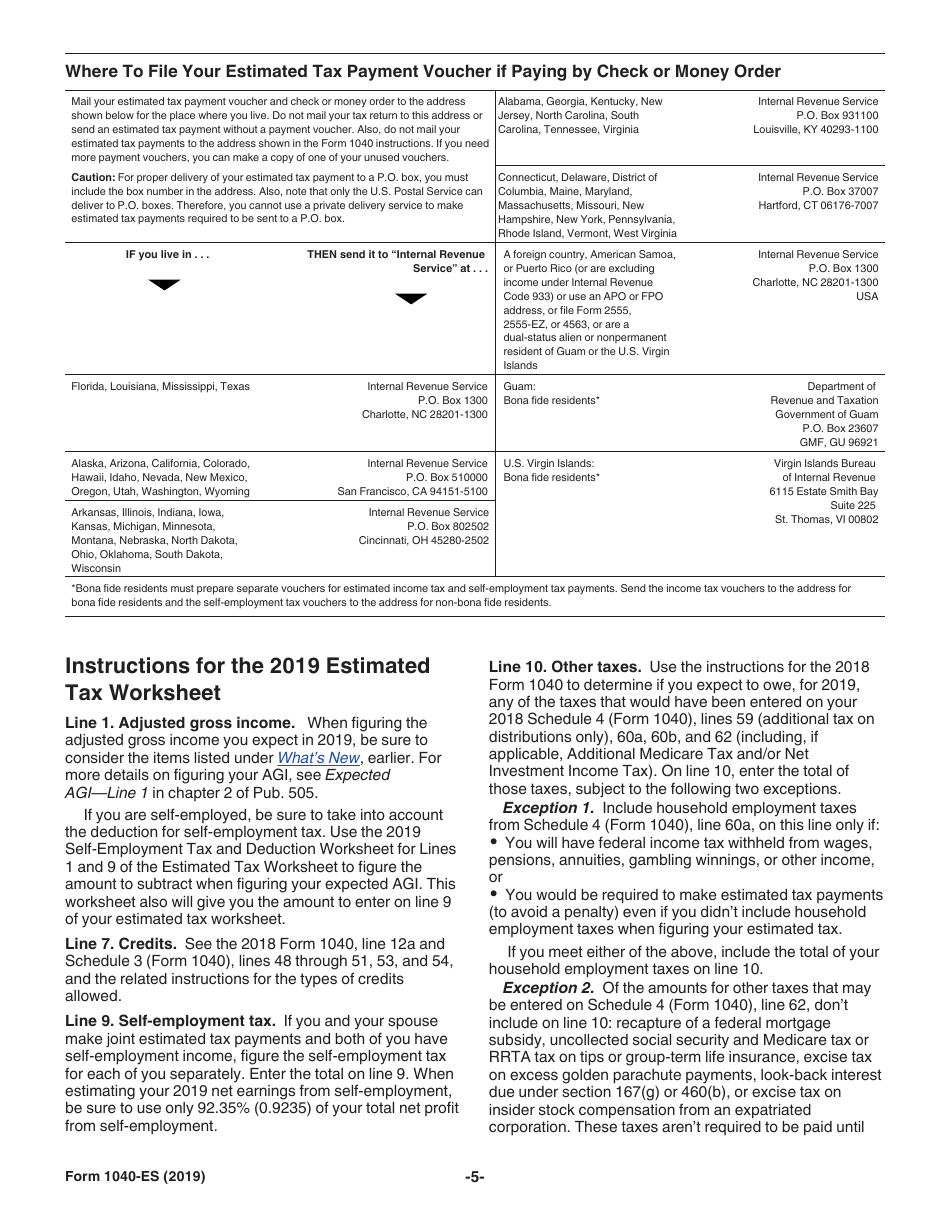

The address to send the form depends on your place of residence:

- If you live in Florida, Louisiana, Mississippi, or Texas, mail your form to Internal Revenue Service, P.O. Box 1300, Charlotte, NC 28201-1300;

- If you are the resident of Alaska, Arizona, California, Colorado, Hawaii, Idaho, Nevada, New Mexico, Oregon, Utah, Washington, or Wyoming, send your IRS Form 1040-ES to Internal Revenue Service, P.O. Box 510000, San Francisco, CA 94151-5100;

- The taxpayers who live in Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, and Wisconsin must mail their vouchers to Internal Revenue Service, P.O. Box 802502, Cincinnati, OH 45280-2502;

- If you live in Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, or Virginia use this address: Internal Revenue Service, P.O. Box 931100, Louisville, KY 40293-1100;

- For Connecticut, Delaware, District of Columbia, Maine, Maryland, Massachusetts, Missouri, New Hampshire, New York, Pennsylvania, Rhode Island, Vermont, and West Virginia, the mailing address is Internal Revenue Service, P.O. Box 37007, Hartford, CT 06176-7007;

- Foreign country, American Samoa, or Puerto Rico residents, as well as dual-status aliens and nonpermanent residents of the United States Virgin Islands and Guam, mail your vouchers to Internal Revenue Service, P.O. Box 1300, Charlotte, NC 28201-1300, USA;

- If you are a bona fide resident of Guam, mail to this address: Department of Revenue and Taxation, Government of Guam, P.O. Box 23607, GMF, GU 96921;

- Bonafide residents of the United States Virgin Islands, use the following address: Virgin Islands Bureau of Internal Revenue, 6115 Estate Smith Bay, Suite 225, St. Thomas, VI 00802.

IRS 1040-ES Related Forms:

- Form 1040, U.S. Individual Income Tax Return;

- Form 1040-C, U.S. Departing Alien Income Tax Return;

- IRS Form 1040-ES (NR), U.S. Estimated Tax for Nonresident Alien Individuals;

- Form 1040-NR, U.S. Nonresident Alien Income Tax Return;

- Form 1040-NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens with No Dependents;

- Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico);

- Form 1040-V, Payment Voucher;

- Form 1040X, Amended U.S. Individual Income Tax Return;

- Form 5405, Repayment of the First-Time Homebuyer Credit;

- Form 8822, Change of Address;

- Form 8959, Additional Medicare Tax;

- Form 8960, Net Investment Income Tax Individuals, Estates, and Trusts;

- Form 8962, Premium Tax Credit;

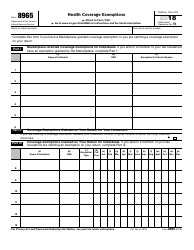

- Form 8965, Health Coverage Exemptions;

- Form W-4V, Voluntary Withholding Request.