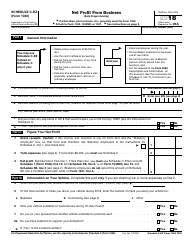

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1041

for the current year.

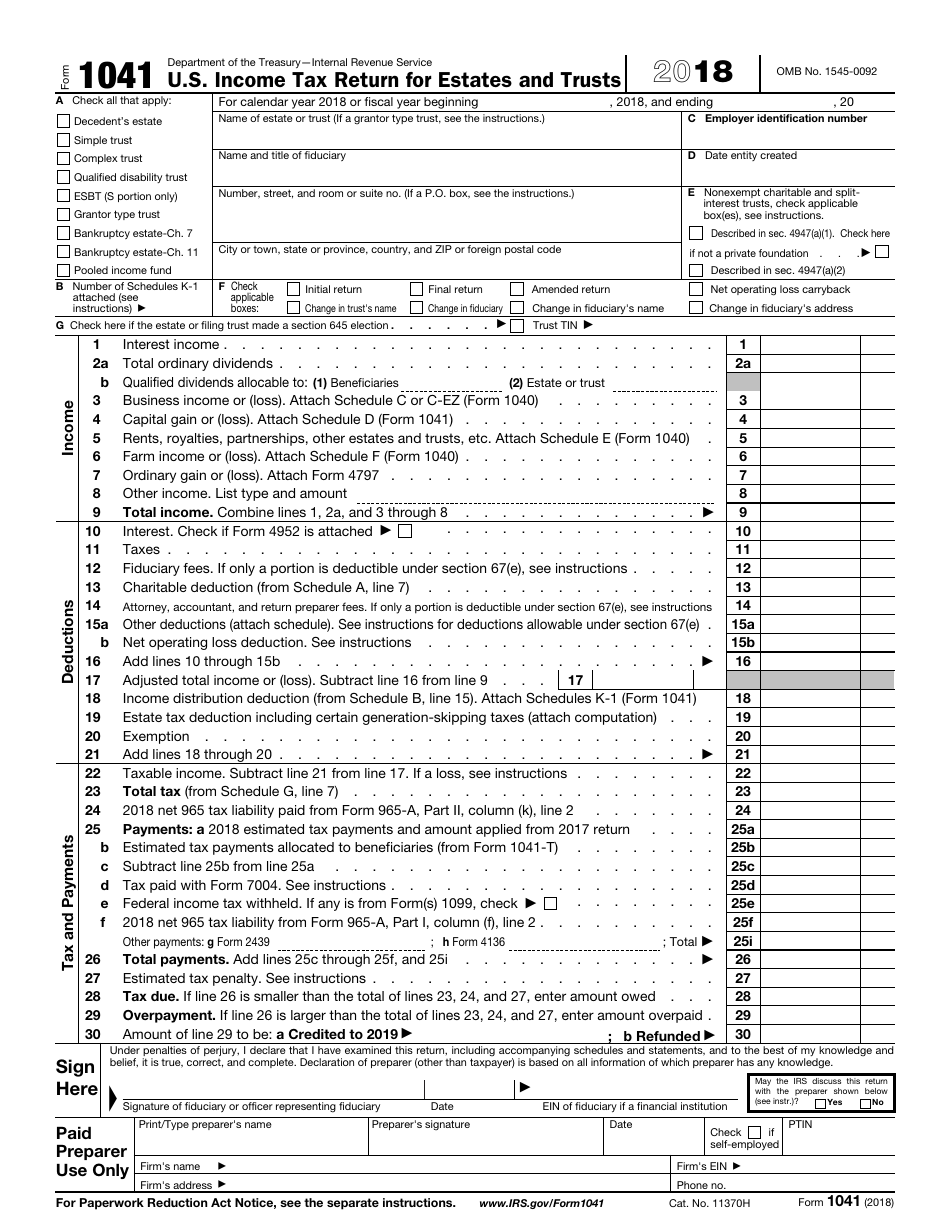

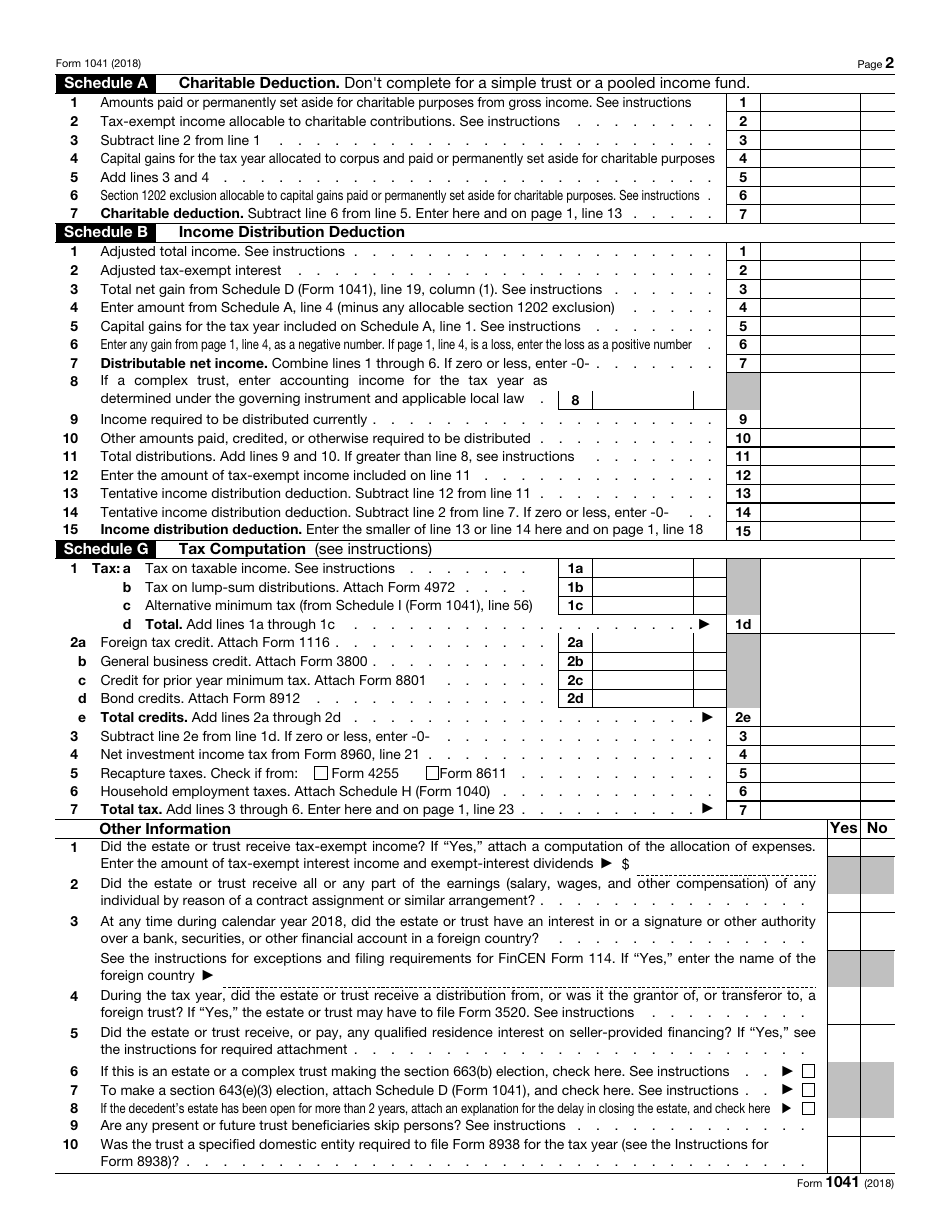

IRS Form 1041 U.S. Income Tax Return for Estates and Trusts

What Is IRS Form 1041?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 1041?

A: Form 1041 is the U.S. Income Tax Return for Estates and Trusts.

Q: Who needs to file Form 1041?

A: Estates and trusts that have gross income of $600 or more in a tax year must file Form 1041.

Q: When is Form 1041 due?

A: Form 1041 is due on the 15th day of the 4th month following the end of the tax year.

Q: How do I file Form 1041?

A: Form 1041 can be filed electronically using tax software or by mailing a paper return to the IRS.

Q: What expenses can be deducted on Form 1041?

A: Allowable deductions on Form 1041 include administration expenses, charitable contributions, and distributions to beneficiaries.

Q: What is the tax rate for estates and trusts?

A: The tax rate for estates and trusts is generally a progressive rate structure, with rates ranging from 10% to 37%.

Q: Can I request an extension to file Form 1041?

A: Yes, you can request an extension to file Form 1041 by filing Form 7004.

Q: Are there any penalties for late filing of Form 1041?

A: Yes, there are penalties for late filing of Form 1041, which can be avoided by timely filing or requesting an extension.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1041 through the link below or browse more documents in our library of IRS Forms.