This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040X

for the current year.

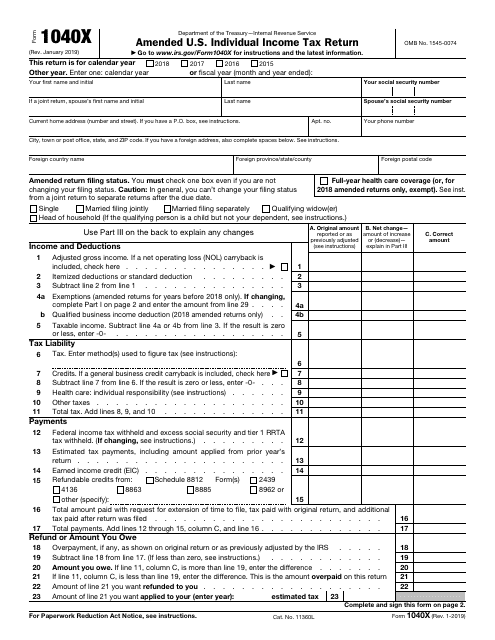

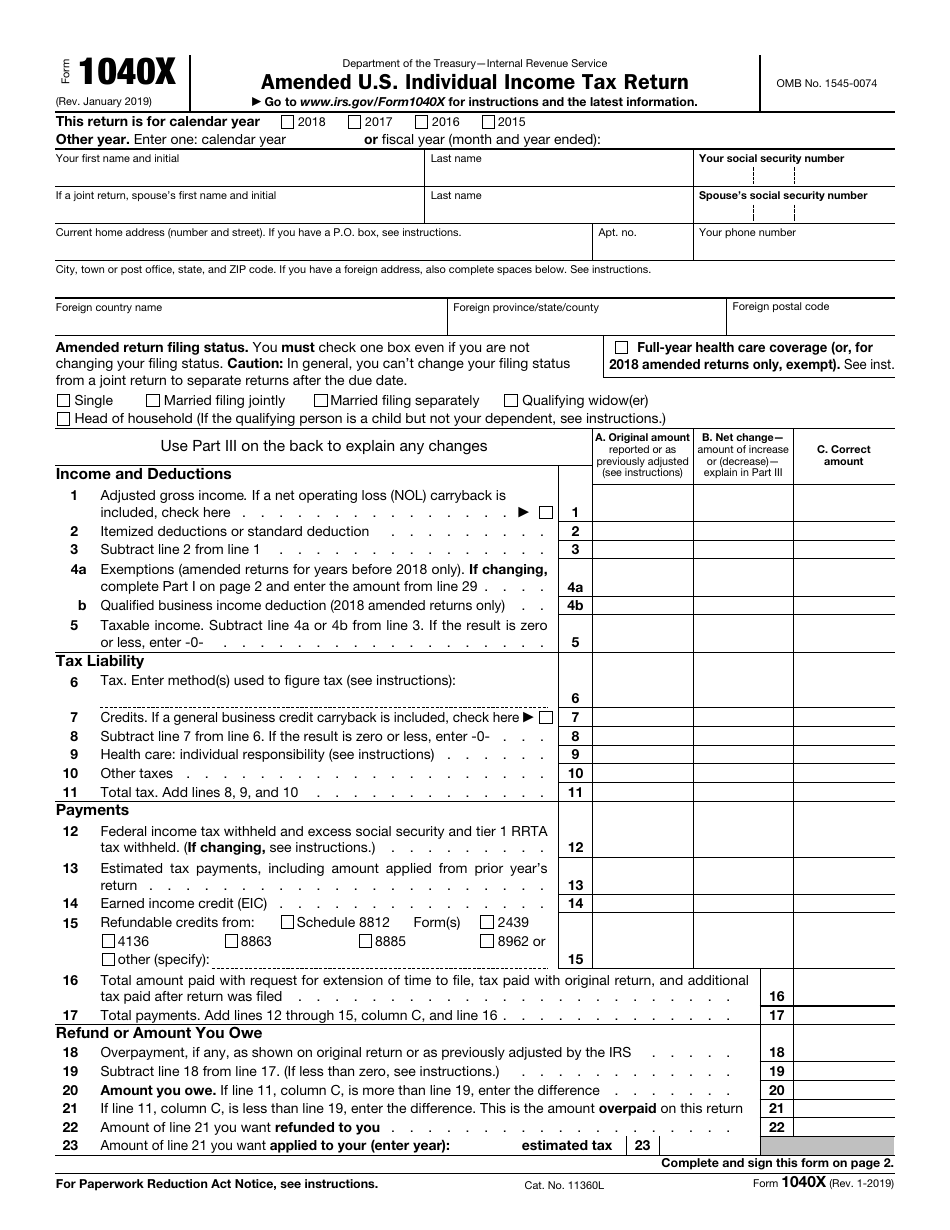

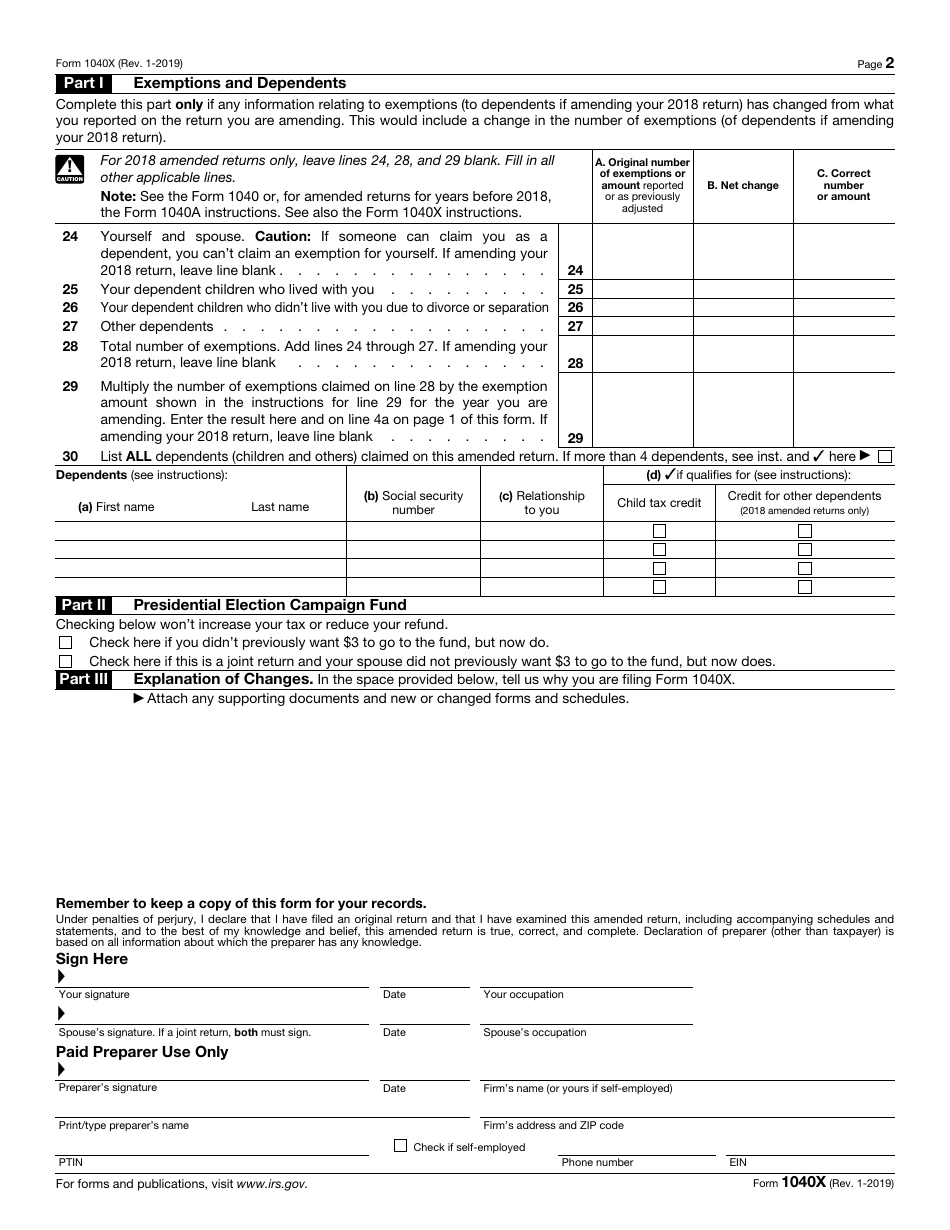

IRS Form 1040X Amended U.S. Individual Income Tax Return

What Is Form 1040-X?

IRS Form 1040-X, Amended U.S. Individual Income Tax Return is a document used to correct records on your tax return form. The form is updated on a yearly basis by the Internal Revenue Service (IRS) . The last revision of the document was on January 1, 2019 . Use this link to download Form 1040-X to file for the previous year.

Fill out the IRS Form 1040-X to:

- Amend information on already submitted Forms 1040, 1040-NR, and 1040-NR-EZ;

- Make some elections after the due date;

- Change the amounts adjusted by the IRS (do not include any penalties or interest on this form as they are adjusted separately); and

- Claim a carryback because of a loss or unused credit.

When you submit an amendment on the 1040-X tax return, it is considered your tax return form for that year. Fill out a separate form for every year you are changing information for. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid. File Form 843, Claim for Refund and Request for Abatement instead.

How to Amend My Tax Return?

In order to amend your tax return you need:

- Fillable Form 1040-X and its instructions;

- Copy of the return form you are amending, including copies of all the supporting forms, worksheets, and schedules you have completed it with;

- All notices you have received from the IRS on any adjustments to the return you are amending; and

- Instructions to the return you are amending. Find the filling out instructions for current and prior years on the IRS official website.

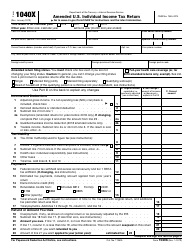

If you use the amended individual income tax return to change the information provided via the Form 1040-NR or 1040-NR-EZ, or if you have filed Form 1040 instead of Form 1040-NR or Form 1040-NR-EZ or vice versa, do the following:

- Enter your name, current address, and SSN or individual taxpayer number. Do not provide here any other information;

- Skip Part I and Part II on the second page of the form;

- Provide the reason why you are filing the form in Part III;

- Fill out a new or corrected tax return form (Form 1040, Form 1040-NR, or Form 1040-NR-EZ);

- Write "Amended" across the top part of the new or corrected form;

- Attach it to the back of the IRS 1040-X Form and submit.

IRS Form 1040-X Instructions

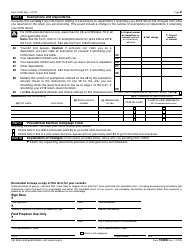

Step-by-step Form 1040-X instructions can be downloaded by clicking this link. For a credit or refund, file the amended individual income tax return within 3 years after the date you filed the original return form (including extensions) or 2 years after you paid the tax, whichever comes later. Form 1040-X time limit can be suspended for certain individuals who cannot manage their financial affairs due to physical or mental disabilities.

Pay the additional tax due on IRS 1040-X Form within 21 calendar days from the date of receiving the notice. Otherwise, you will have to pay a penalty 0.5 or 1% of the unpaid amount for every month of delay. If you do not wish to use an e-version of the form, you can order a paper copy from the IRS website.

IRS 1040-X Related Forms:

- Form 1040, U.S. Individual Income Tax Return;

- Form 1040-C, U.S. Departing Alien Income Tax Return;

- Form 1040-NR, U.S. Nonresident Alien Income Tax Return;

- Form 1040-NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens with No Dependents;

- Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico);

- Form 1040-V, Payment Voucher;

- Form 1040-ES, Estimated Tax for Individuals;

- Form 843, Claim for Refund and Request for Abatement;

- Form 1045, Application for Tentative Refund;

- Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer.