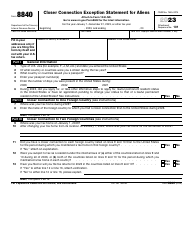

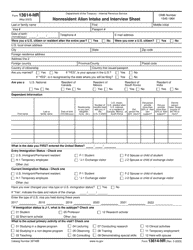

This version of the form is not currently in use and is provided for reference only. Download this version of

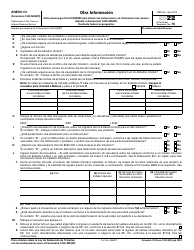

IRS Form 1040-NR-EZ

for the current year.

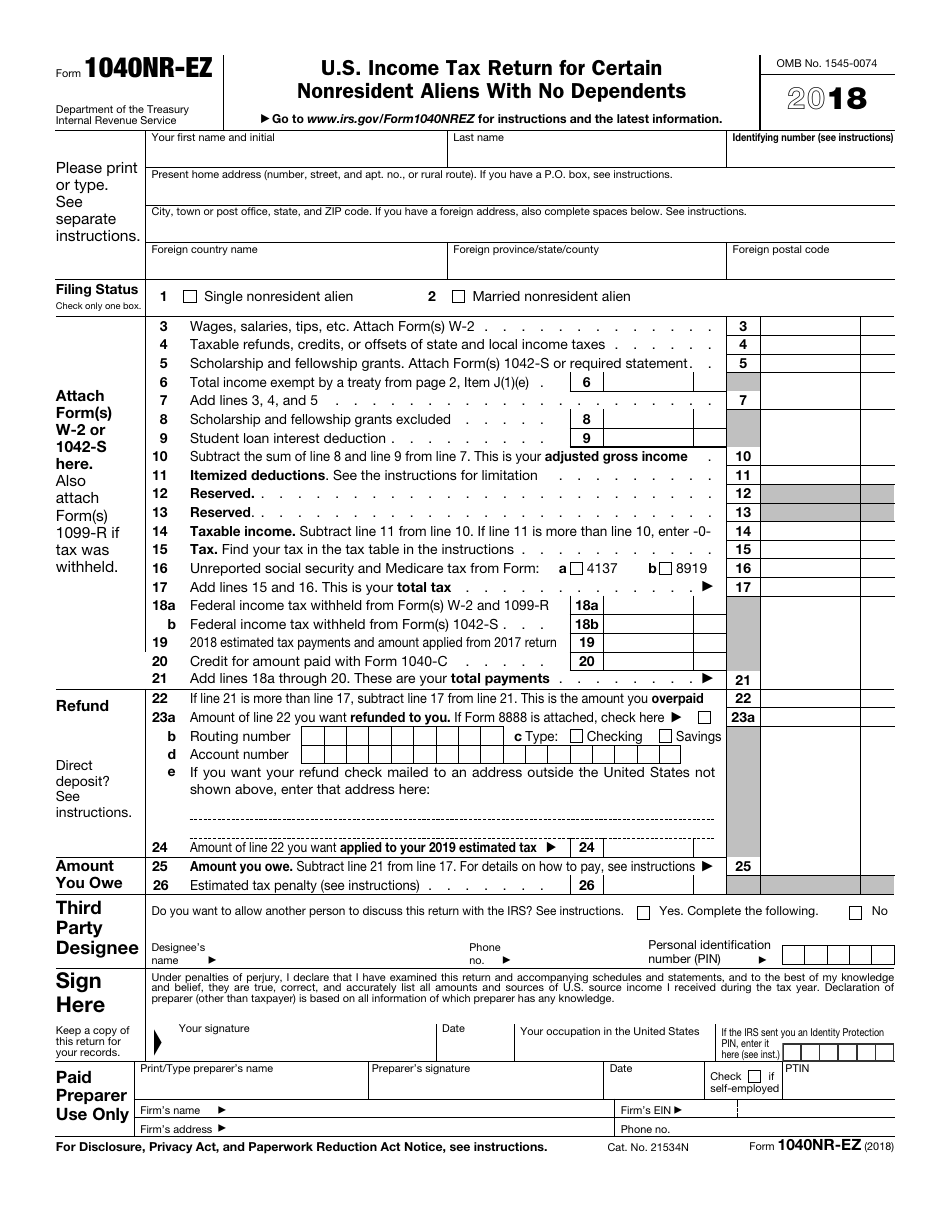

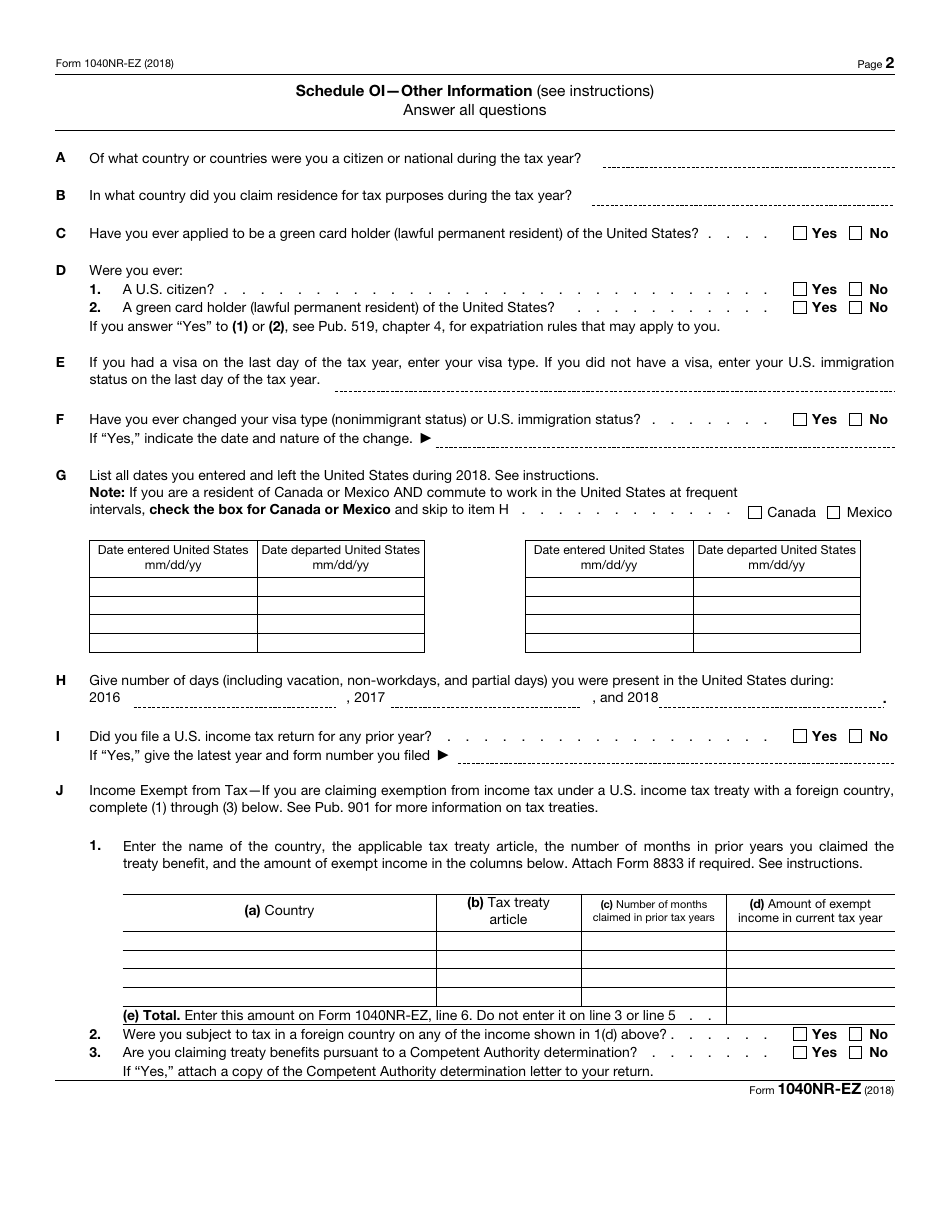

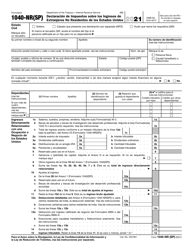

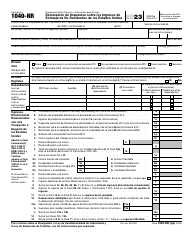

IRS Form 1040-NR-EZ U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents

What Is IRS Form 1040-NR-EZ?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040-NR-EZ?

A: IRS Form 1040-NR-EZ is the U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents.

Q: Who should use IRS Form 1040-NR-EZ?

A: IRS Form 1040-NR-EZ should be used by nonresident aliens who have no dependents and have income from U.S. sources.

Q: What is the purpose of IRS Form 1040-NR-EZ?

A: The purpose of IRS Form 1040-NR-EZ is to report and calculate the income tax liability of nonresident aliens with no dependents.

Q: Can everyone use IRS Form 1040-NR-EZ?

A: No, only nonresident aliens with no dependents and specific types of income from U.S. sources can use IRS Form 1040-NR-EZ.

Q: What is the deadline for filing IRS Form 1040-NR-EZ?

A: The deadline for filing IRS Form 1040-NR-EZ is generally April 15th, but it may be extended if you are residing outside the United States.

Q: Is IRS Form 1040-NR-EZ available for e-filing?

A: Yes, IRS Form 1040-NR-EZ can be e-filed.

Q: Are there any deductions or credits available on IRS Form 1040-NR-EZ?

A: No, IRS Form 1040-NR-EZ does not allow for deductions or credits.

Q: What should I do if I have dependents or other types of income?

A: If you have dependents or other types of income, you will need to use a different form, such as IRS Form 1040-NR.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-NR-EZ through the link below or browse more documents in our library of IRS Forms.