This version of the form is not currently in use and is provided for reference only. Download this version of

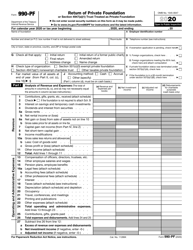

IRS Form 990-PF

for the current year.

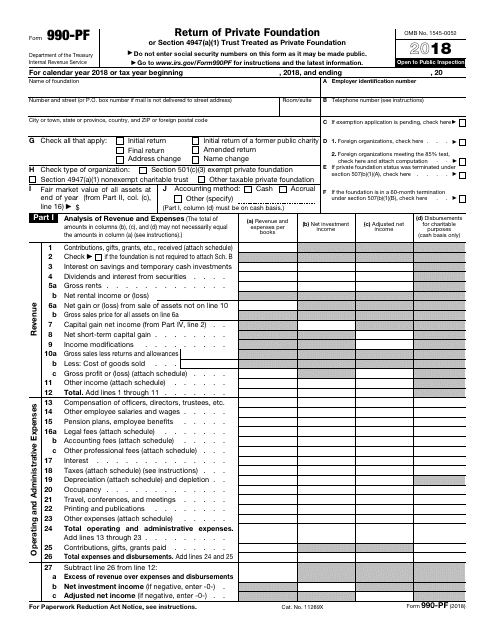

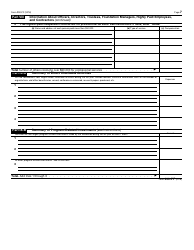

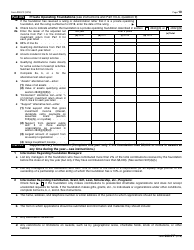

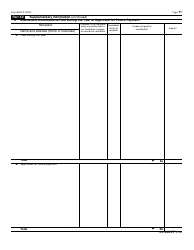

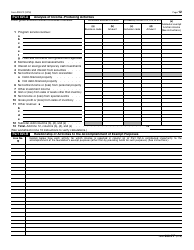

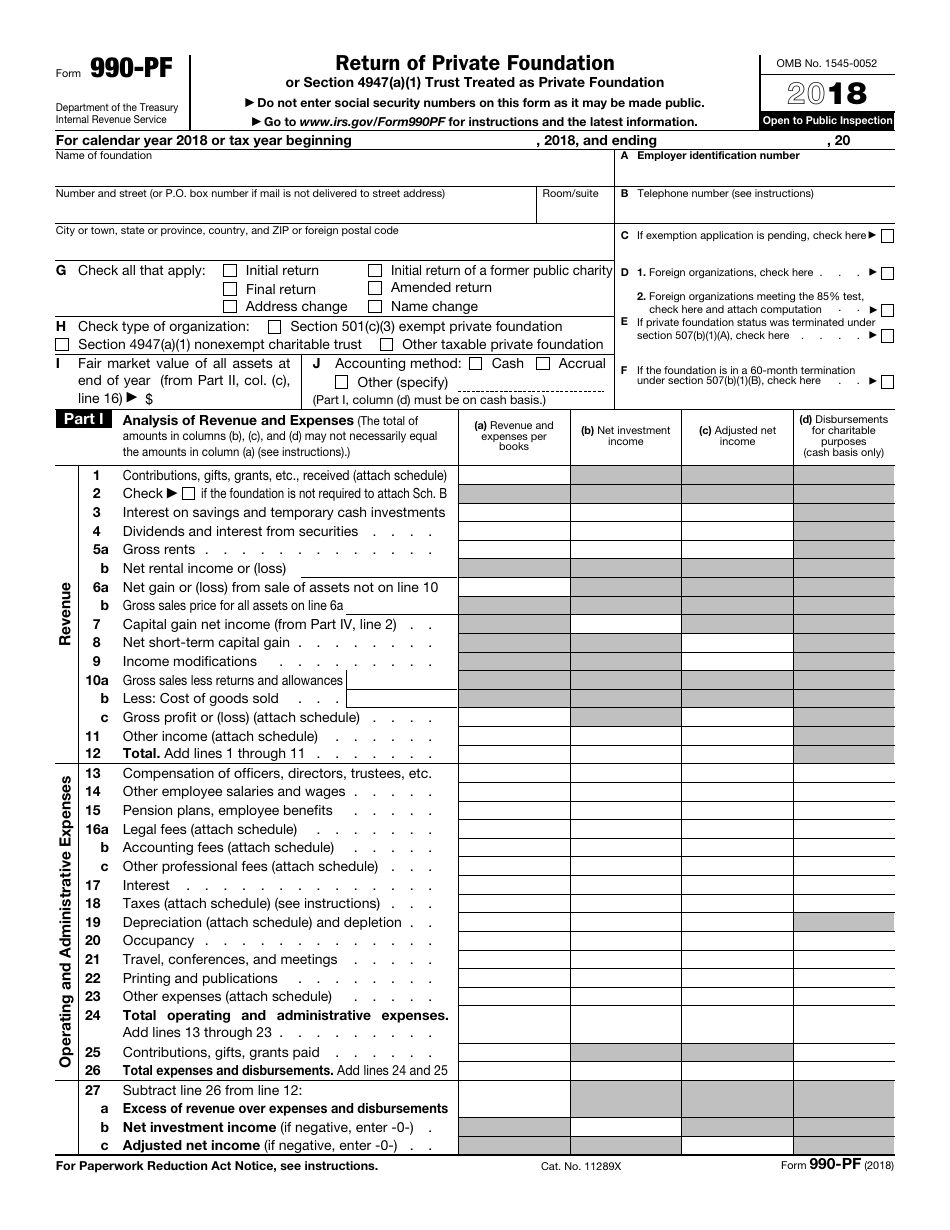

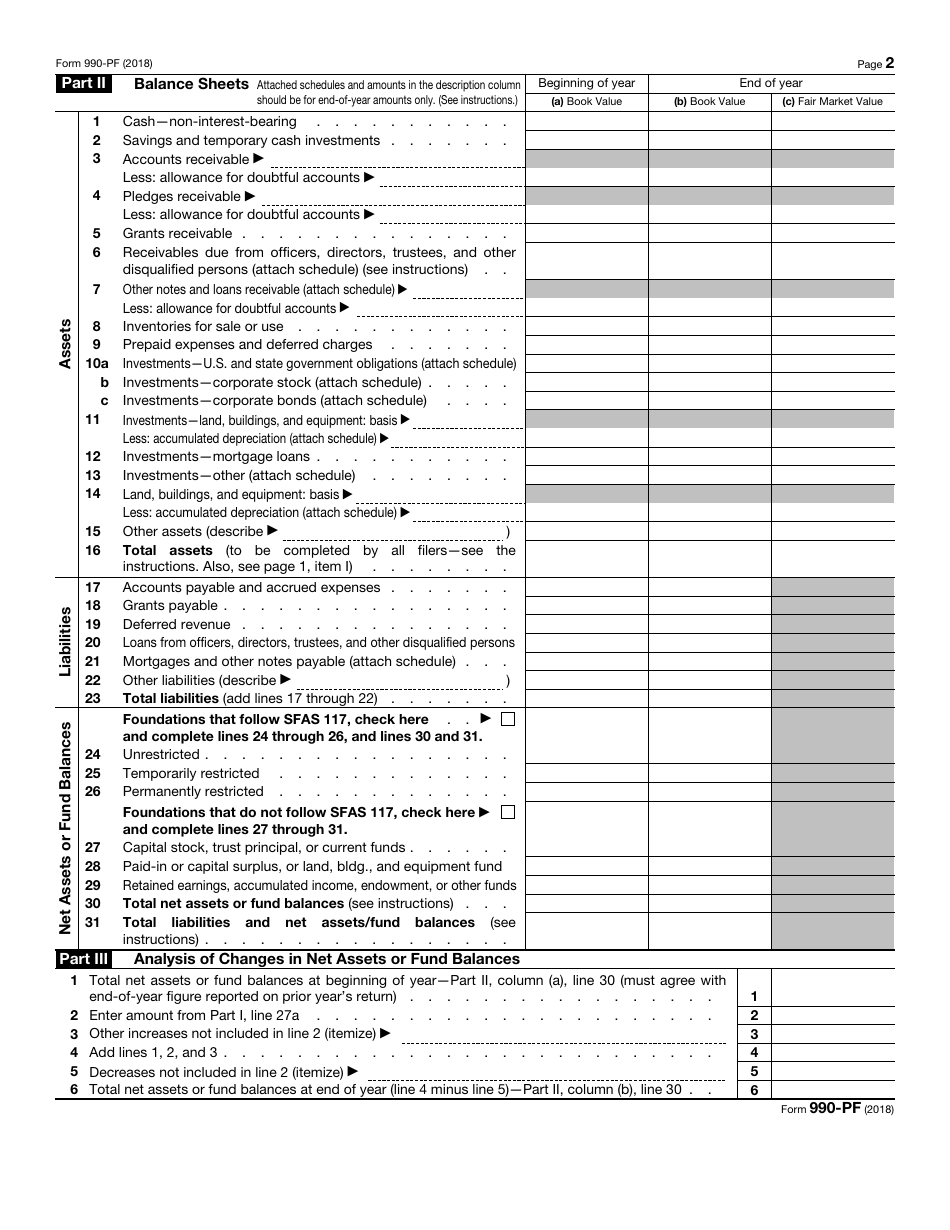

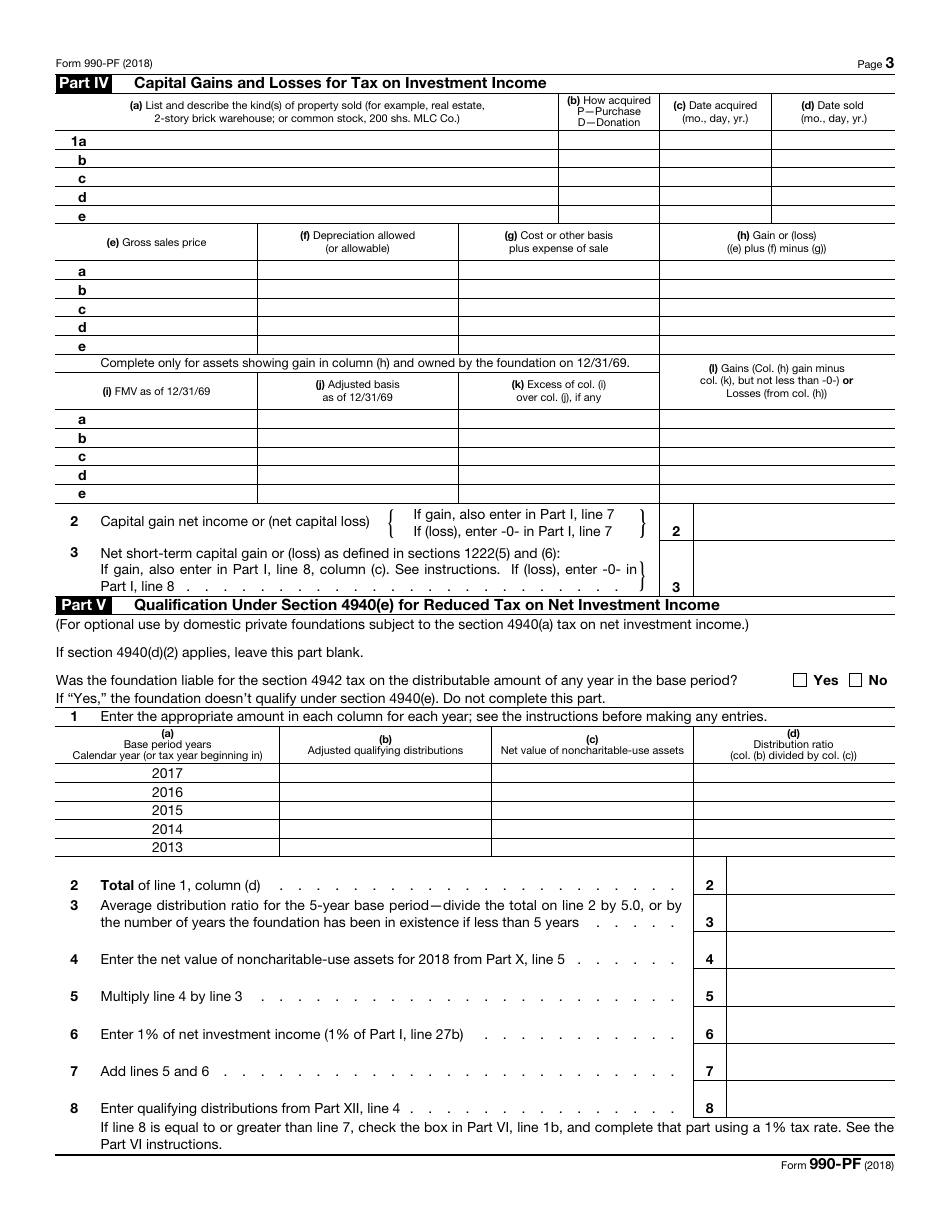

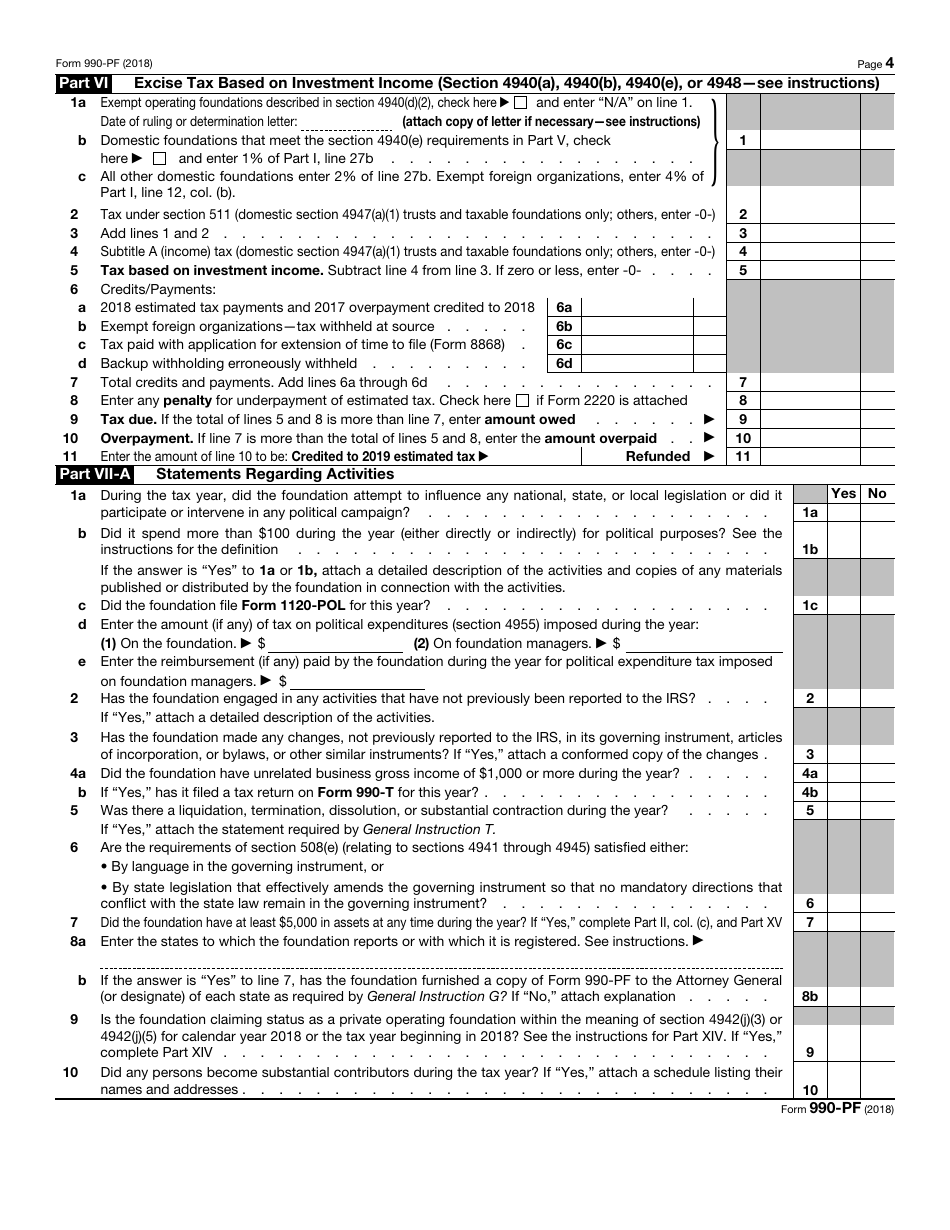

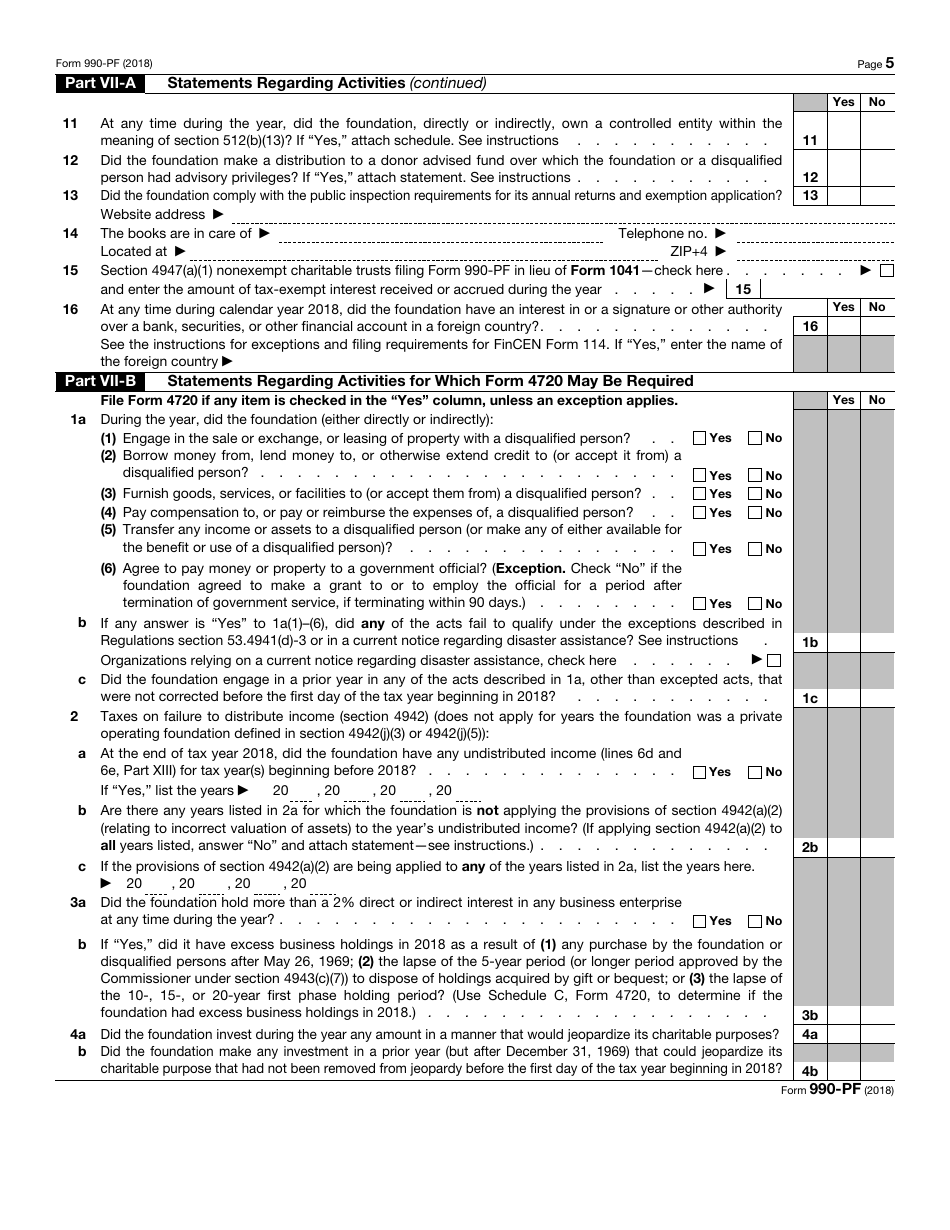

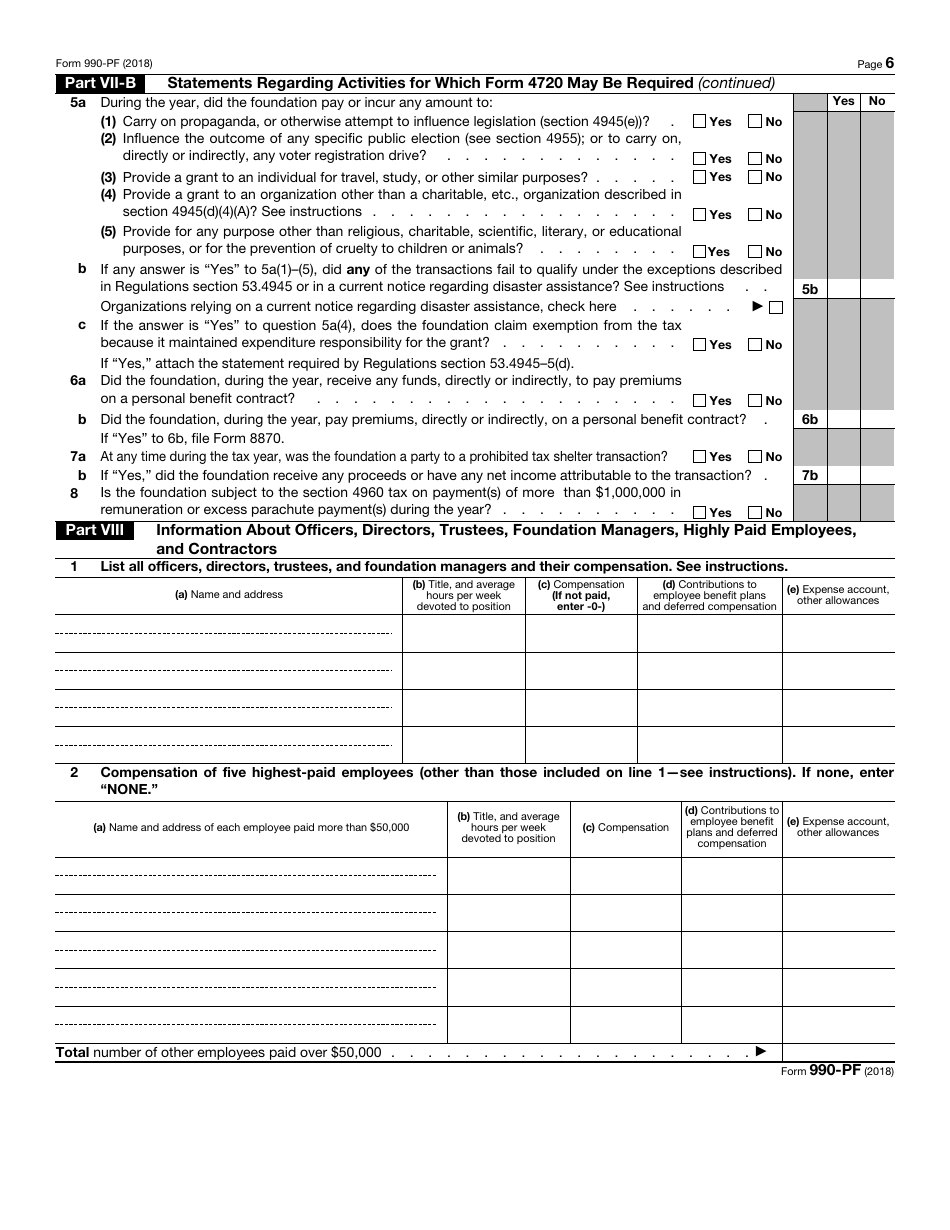

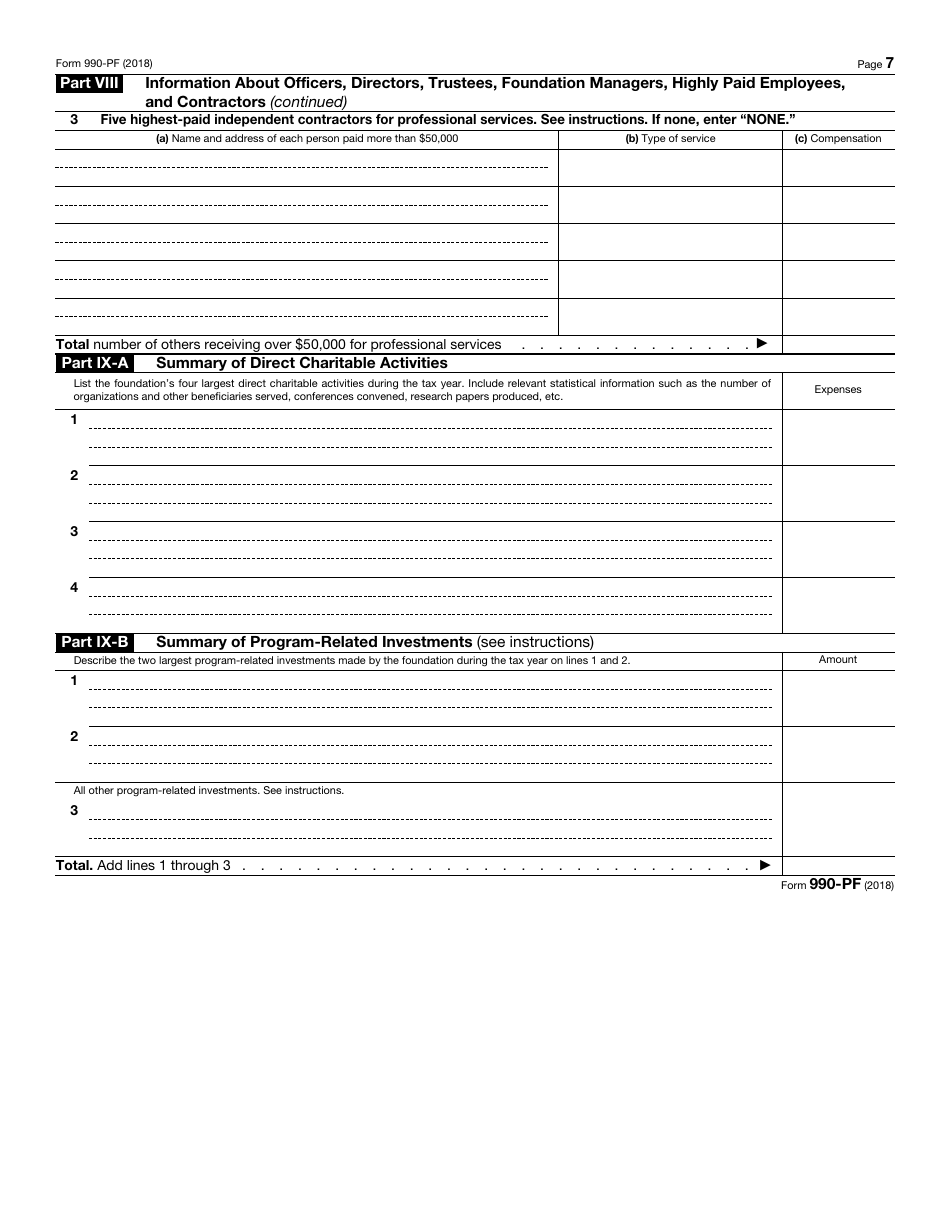

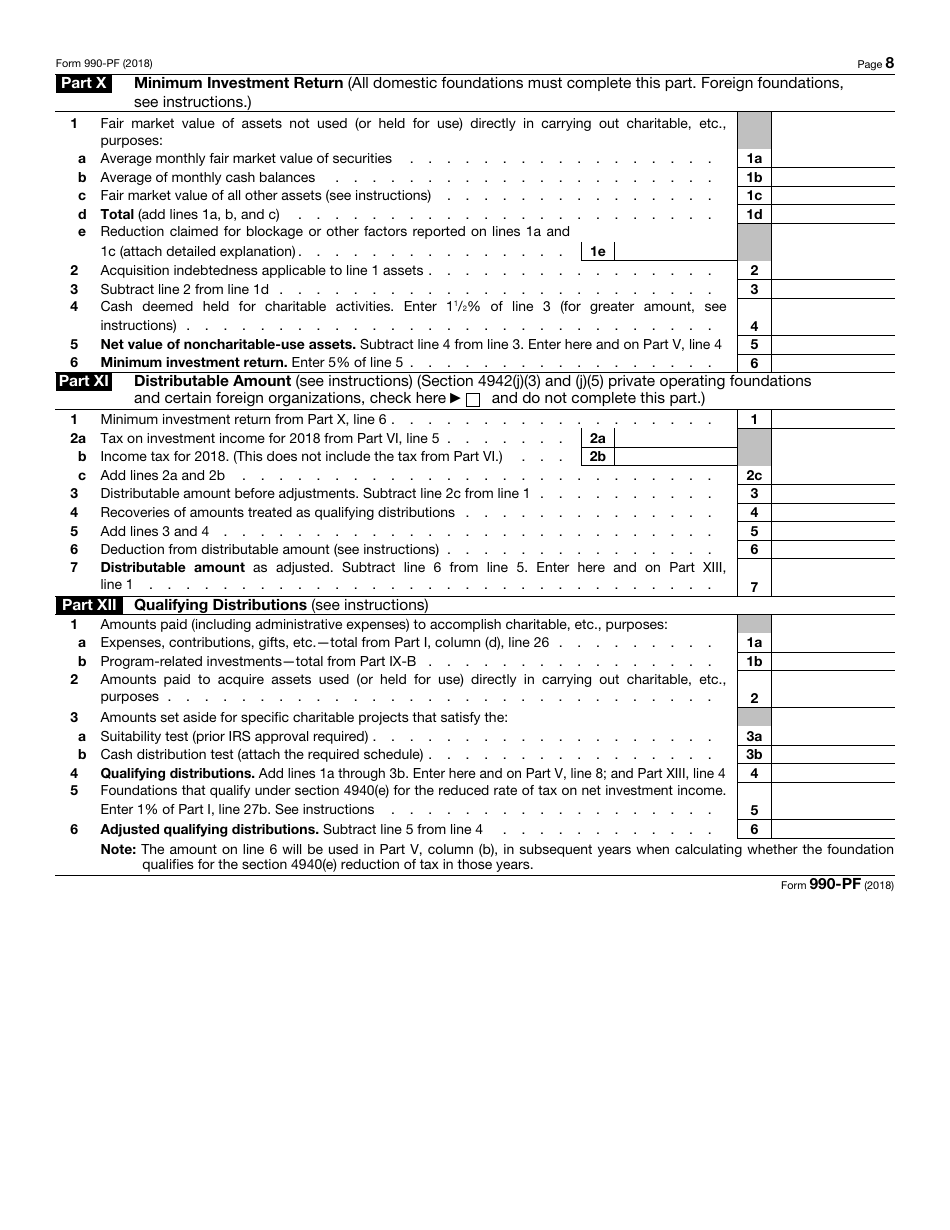

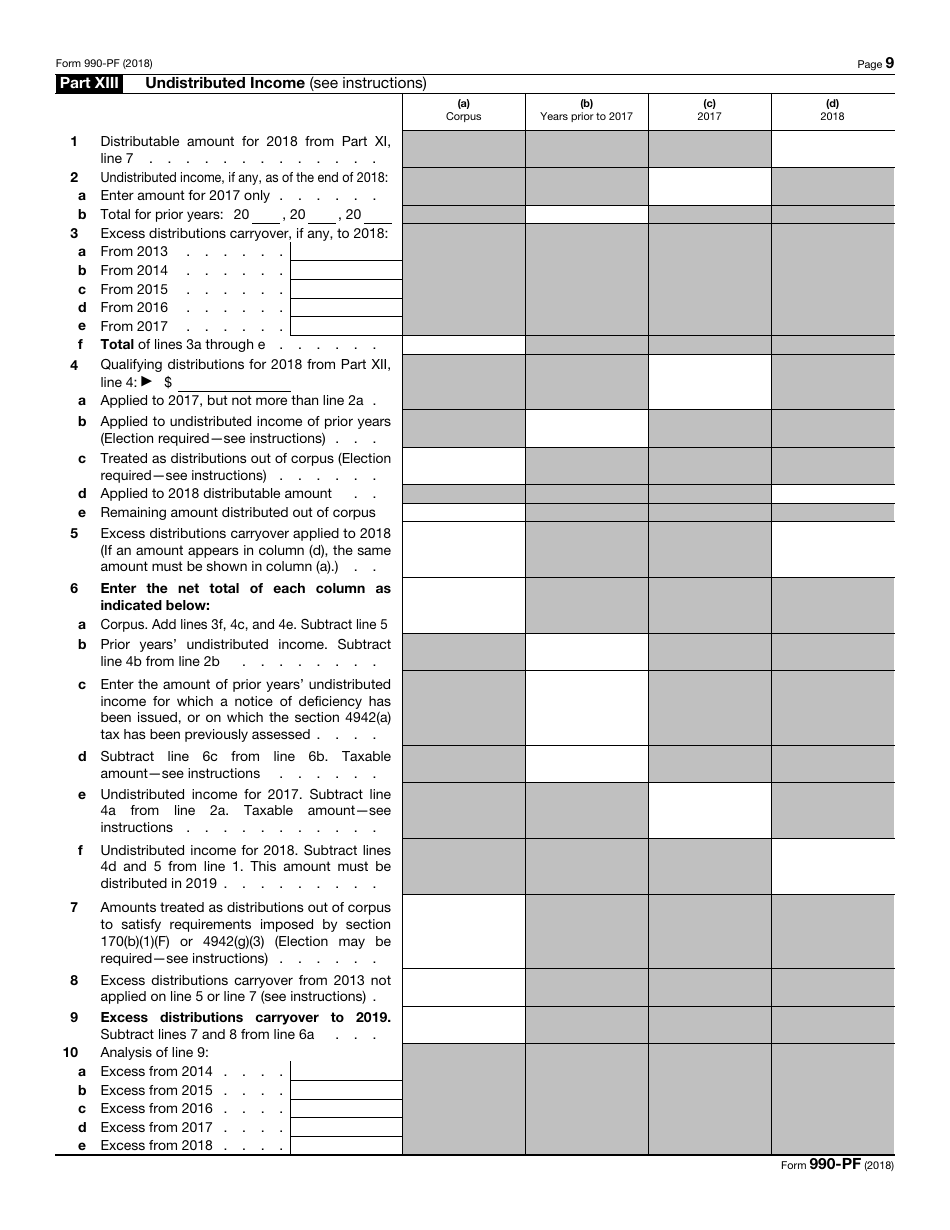

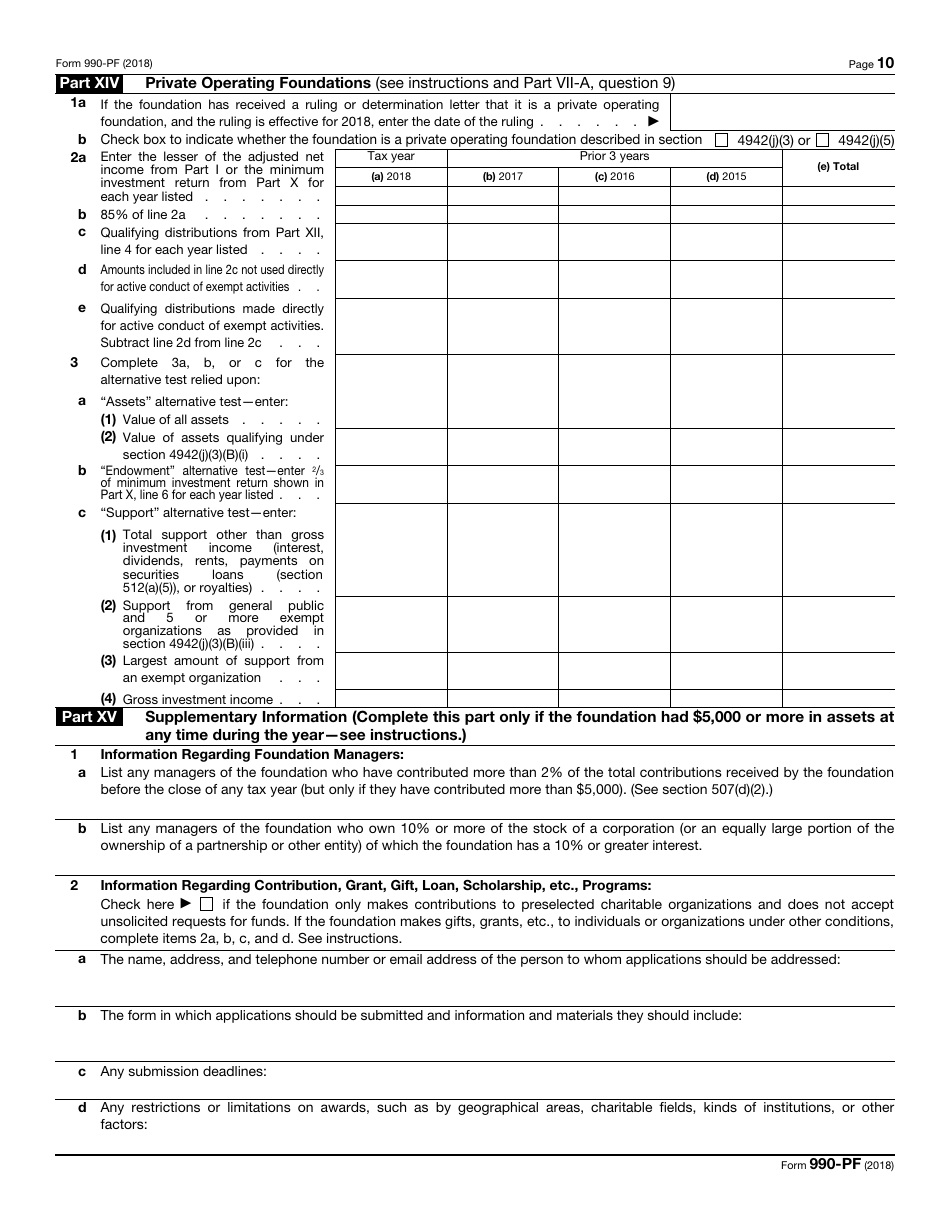

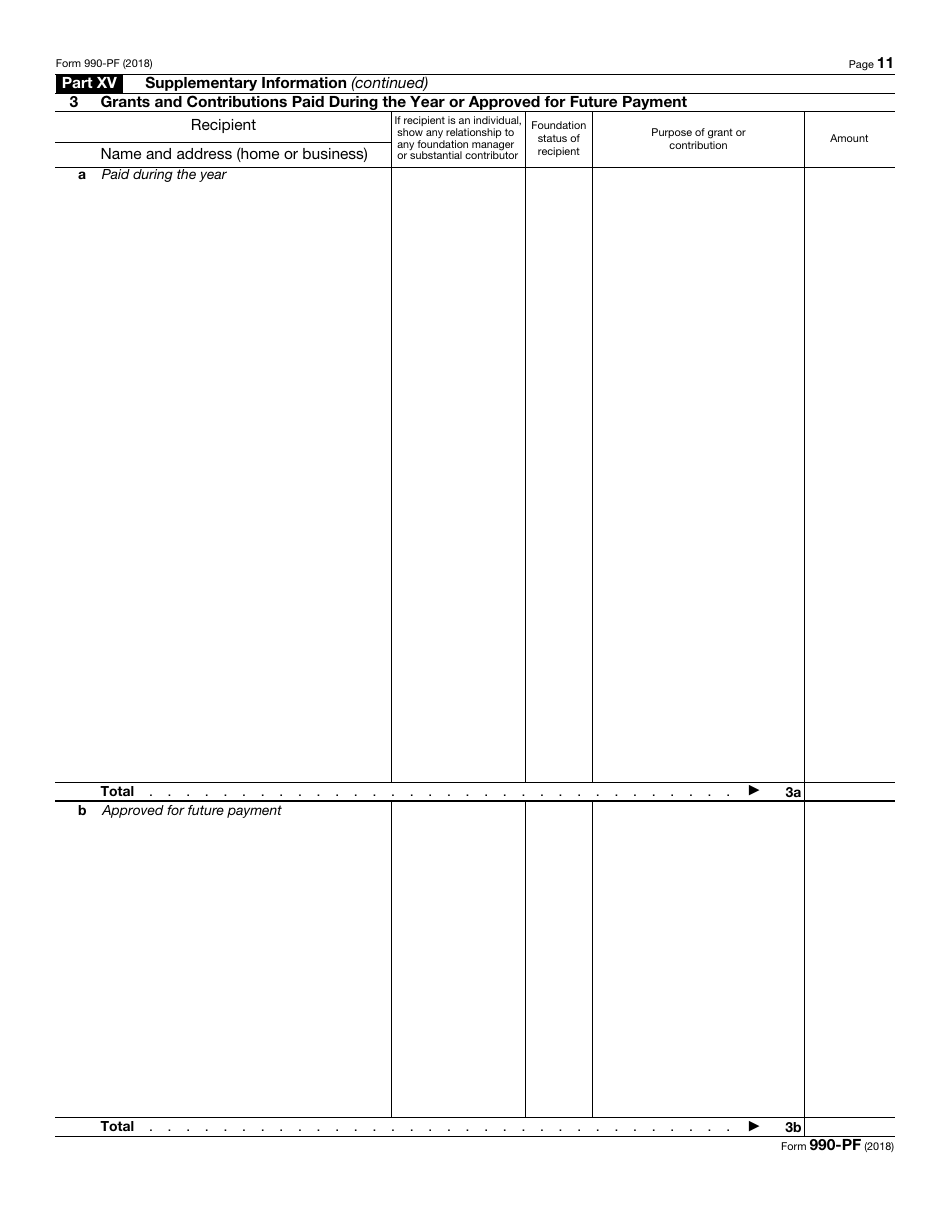

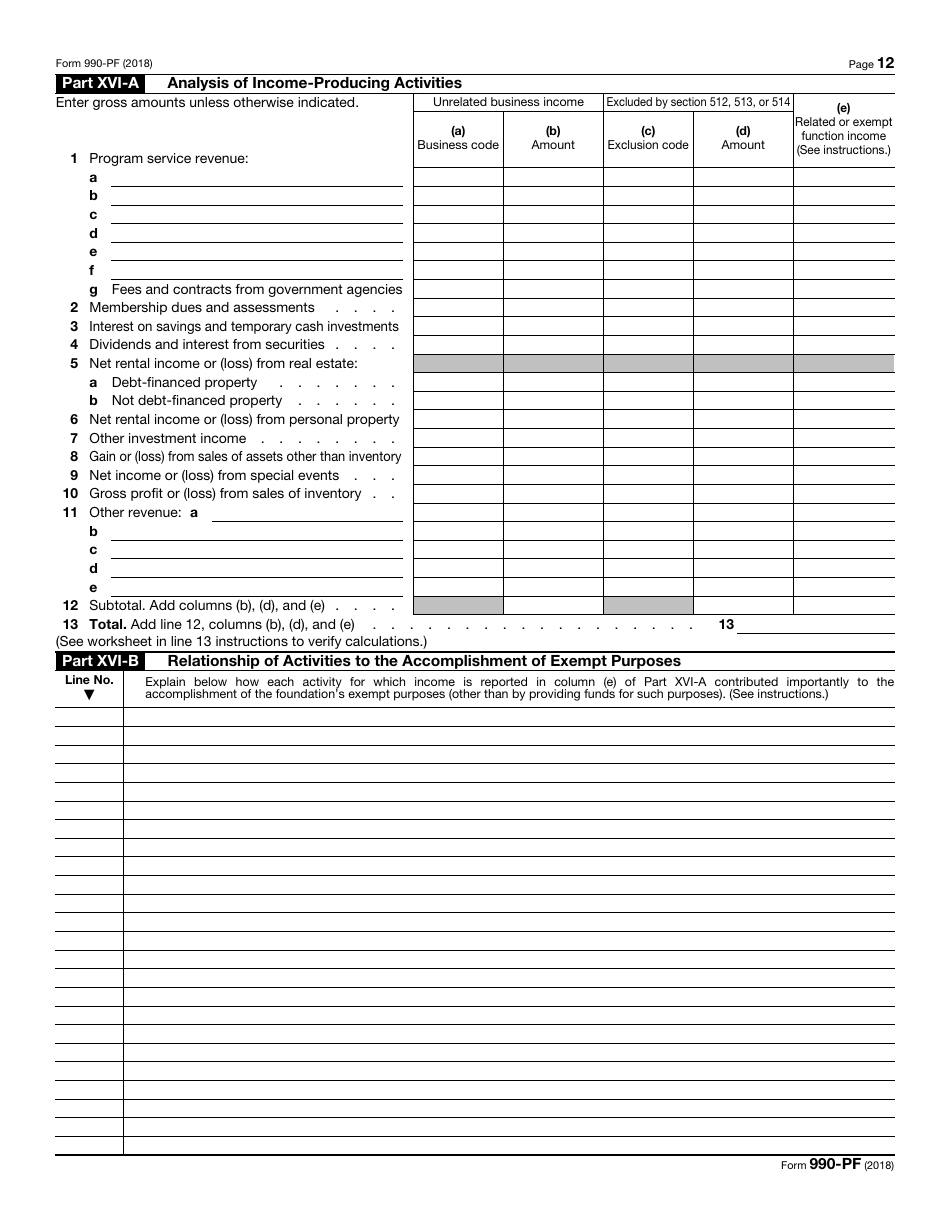

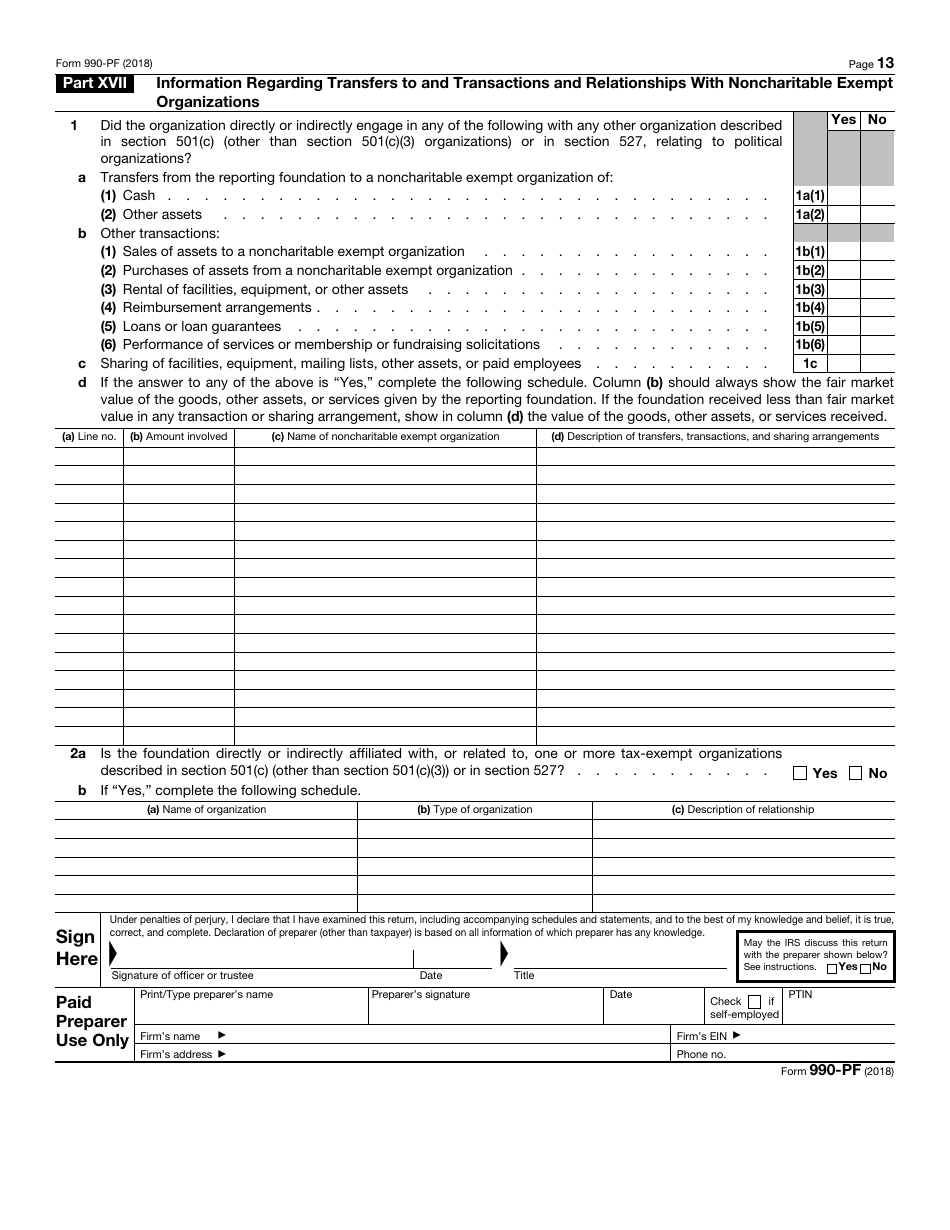

IRS Form 990-PF Return of Private Foundation or Section 4947(A)(1) Trust Treated as Private Foundation

What Is IRS Form 990-PF?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 990-PF?

A: Form 990-PF is a tax form used by private foundations and certain trusts to report their financial information to the IRS.

Q: Who needs to file Form 990-PF?

A: Private foundations and certain trusts that are treated as private foundations under section 4947(A)(1) of the IRS code need to file Form 990-PF.

Q: What information is required on Form 990-PF?

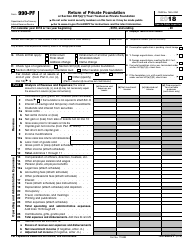

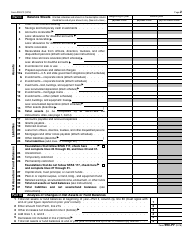

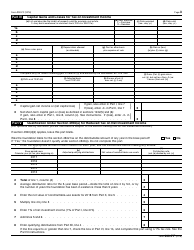

A: Form 990-PF requires information about the foundation's finances, including its income, expenses, grants, investments, and assets.

Q: When is Form 990-PF due?

A: Form 990-PF is due on the 15th day of the 5th month after the end of the foundation's fiscal year.

Q: Are there any penalties for late or incorrect filing of Form 990-PF?

A: Yes, there are penalties for late or incorrect filing of Form 990-PF. The penalties vary depending on the size of the foundation's assets.

Form Details:

- A 13-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990-PF through the link below or browse more documents in our library of IRS Forms.