This version of the form is not currently in use and is provided for reference only. Download this version of

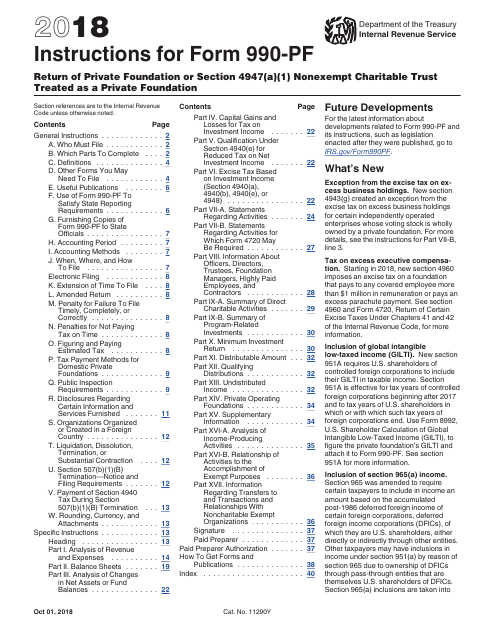

Instructions for IRS Form 990-PF

for the current year.

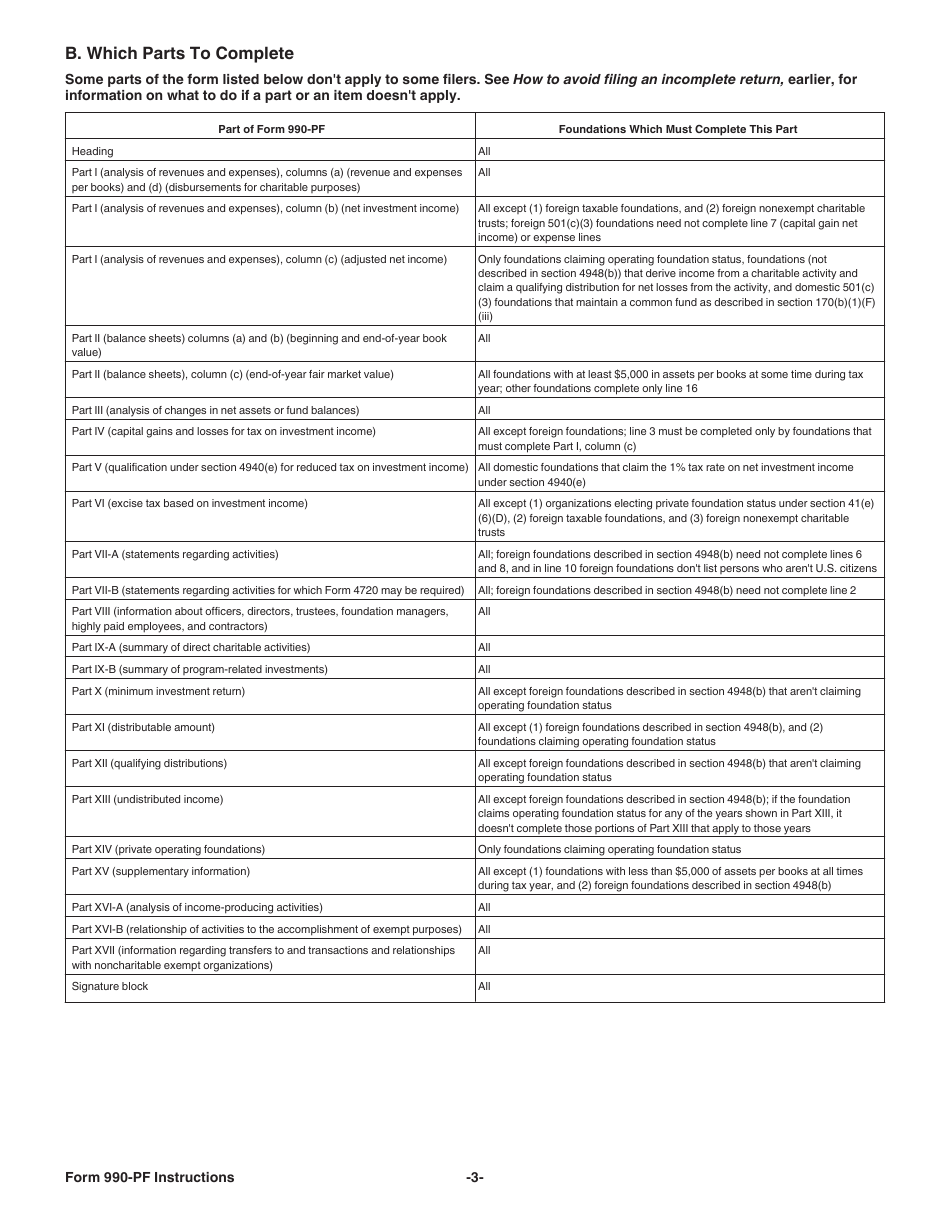

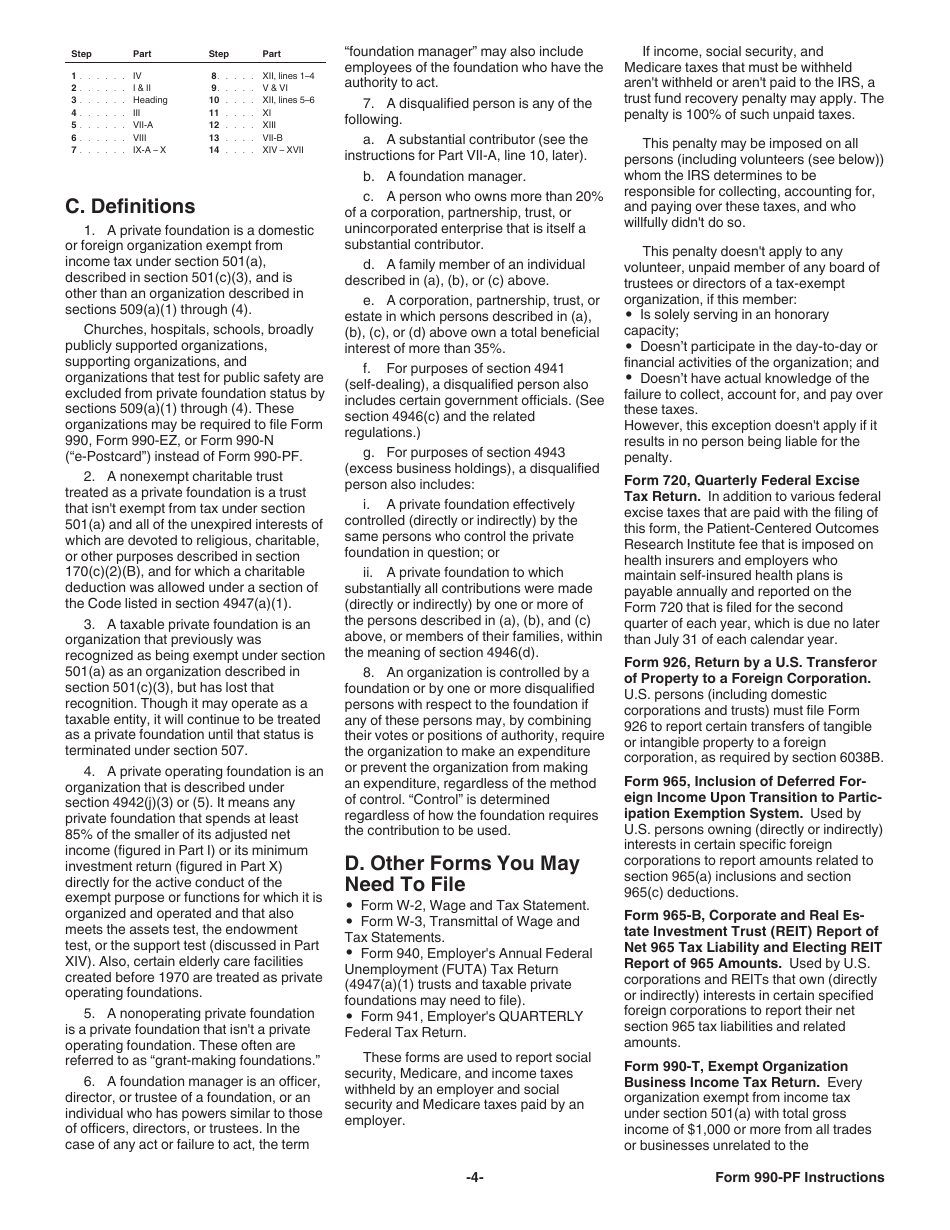

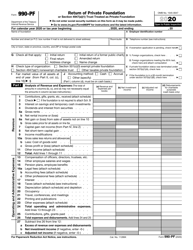

Instructions for IRS Form 990-PF Return of Private Foundation or Section 4947(A)(1) Nonexempt Charitable Trust Treated as a Private Foundation

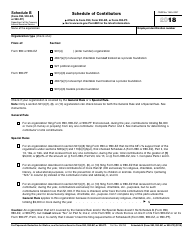

This document contains official instructions for IRS Form 990-PF , Return of Charitable Trust Treated as a Private Foundation - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 (990-PF; 990-EZ) Schedule B is available for download through this link.

FAQ

Q: What is IRS Form 990-PF?

A: IRS Form 990-PF is a tax return form specifically designed for private foundations or charitable trusts.

Q: Who needs to file IRS Form 990-PF?

A: Private foundations and charitable trusts that are treated as private foundations under Section 4947(A)(1) of the IRS code need to file IRS Form 990-PF.

Q: What is the purpose of filing IRS Form 990-PF?

A: The purpose of filing IRS Form 990-PF is to report the financial activities and operations of private foundations or charitable trusts.

Q: When is the deadline for filing IRS Form 990-PF?

A: The deadline for filing IRS Form 990-PF is the 15th day of the 5th month after the end of the foundation's fiscal year. For calendar year foundations, the deadline is May 15th.

Q: What information is required on IRS Form 990-PF?

A: IRS Form 990-PF requires information about the foundation's income, expenses, assets, grants, and other financial activities.

Q: Can IRS Form 990-PF be filed electronically?

A: Yes, IRS Form 990-PF can be filed electronically using the IRS's e-Postcard system or through approved electronic filing methods.

Q: Are there any penalties for not filing IRS Form 990-PF?

A: Yes, there may be penalties for not filing IRS Form 990-PF or for filing it late. It is important to adhere to the filing deadlines to avoid penalties.

Q: Is there a fee for filing IRS Form 990-PF?

A: No, there is no fee for filing IRS Form 990-PF. It is a tax return form and does not require any payment to the IRS.

Instruction Details:

- This 40-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.