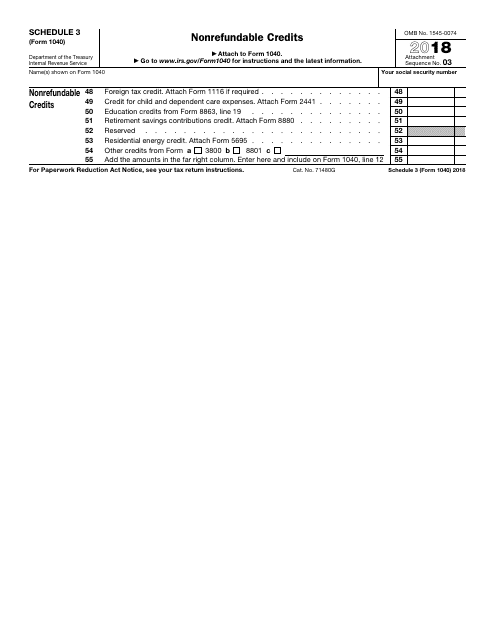

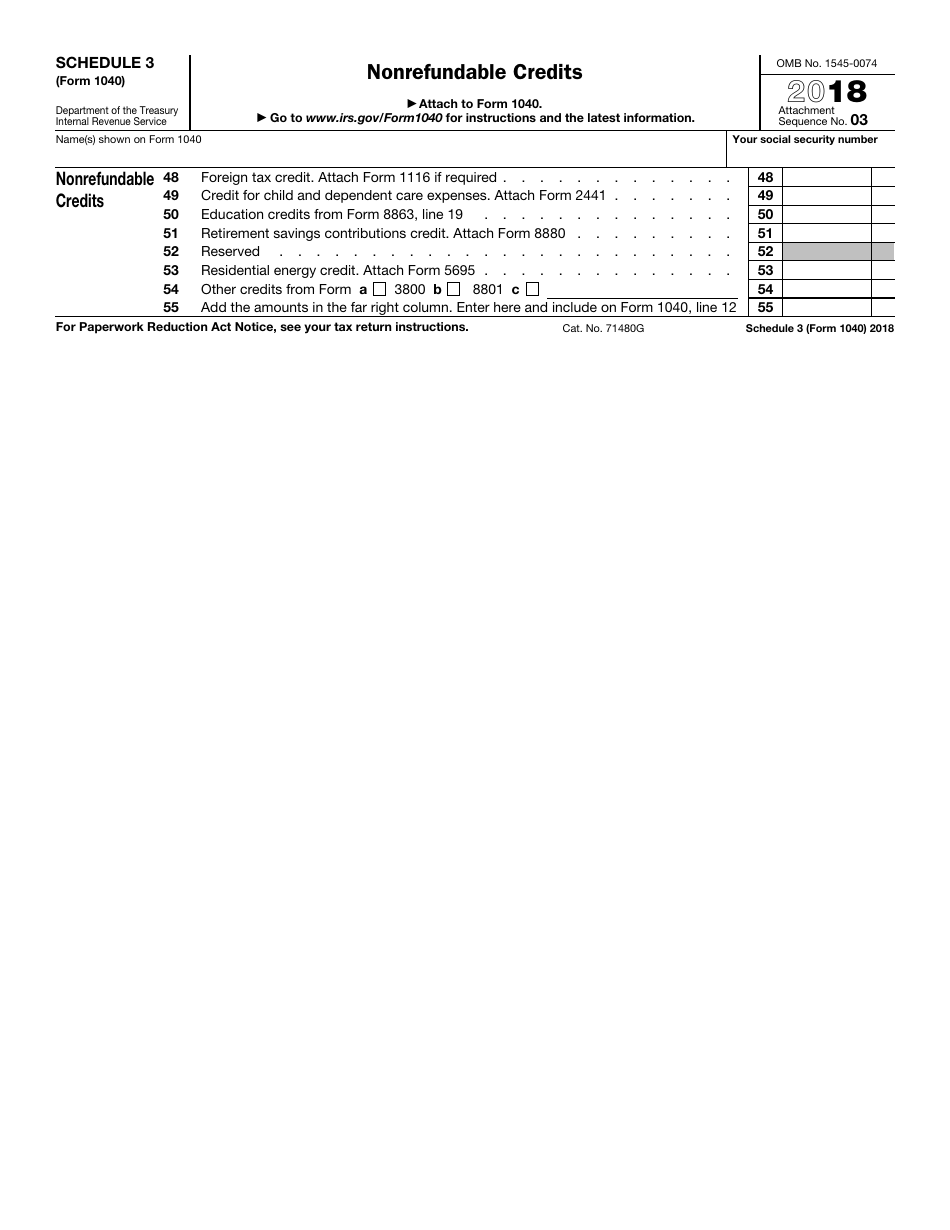

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040 Schedule 3

for the current year.

IRS Form 1040 Schedule 3 Nonrefundable Credits

What Is IRS Form 1040 Schedule 3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040 Schedule 3?

A: IRS Form 1040 Schedule 3 is a tax form used to claim nonrefundable credits.

Q: What are nonrefundable credits?

A: Nonrefundable credits are tax credits that can help reduce your overall tax liability but cannot result in a refund.

Q: What types of nonrefundable credits can be claimed on Schedule 3?

A: Some examples of nonrefundable credits that can be claimed on Schedule 3 include the Child and Dependent Care Credit and the Foreign Tax Credit.

Q: How do I fill out IRS Form 1040 Schedule 3?

A: You need to provide the necessary information and calculations for the specific nonrefundable credit you are claiming.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule 3 through the link below or browse more documents in our library of IRS Forms.