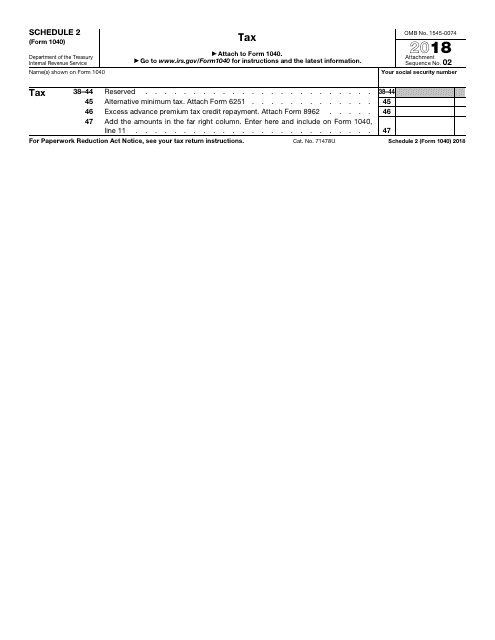

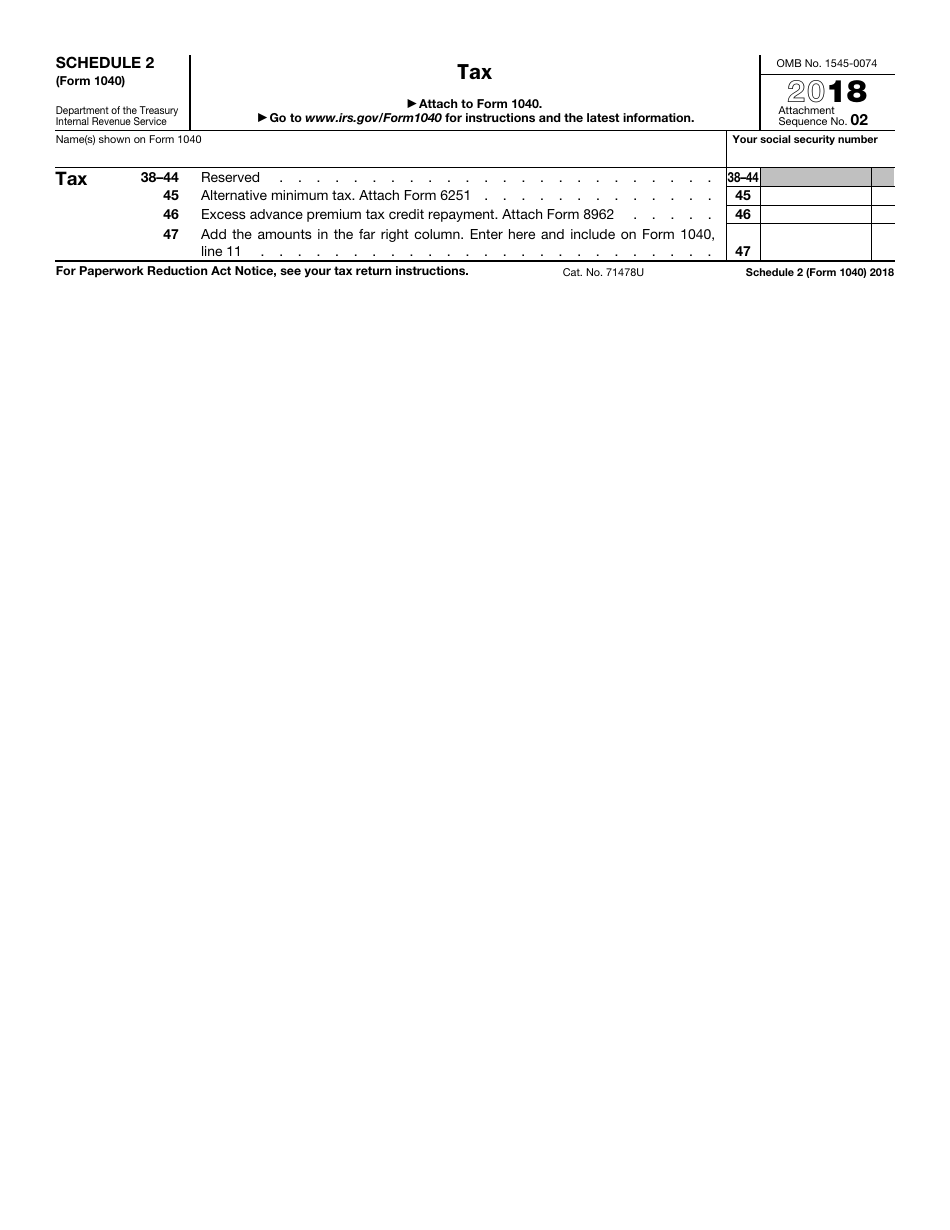

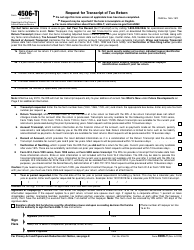

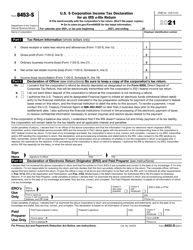

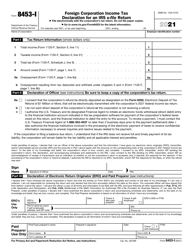

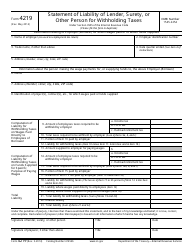

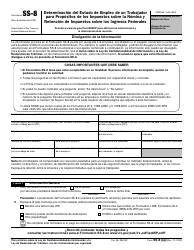

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040 Schedule 2

for the current year.

IRS Form 1040 Schedule 2 Tax

What Is IRS Form 1040 Schedule 2?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 1040 Schedule 2?

A: Form 1040 Schedule 2 is a supplemental tax form used to report additional taxes owed or payments made, such as for the Alternative Minimum Tax or excess Social Security tax.

Q: When do I need to use Form 1040 Schedule 2?

A: You need to use Form 1040 Schedule 2 if you have any additional taxes owed or payments made that are not reported on your main Form 1040.

Q: What types of additional taxes or payments may be reported on Form 1040 Schedule 2?

A: Some examples include the Alternative Minimum Tax, excess Social Security tax, self-employment taxes, and other additional taxes or payments required by the IRS.

Q: Can I e-file Form 1040 Schedule 2?

A: Yes, you can e-file Form 1040 Schedule 2 along with your main Form 1040 if you are using electronic tax filing software or a professional tax preparer.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule 2 through the link below or browse more documents in our library of IRS Forms.