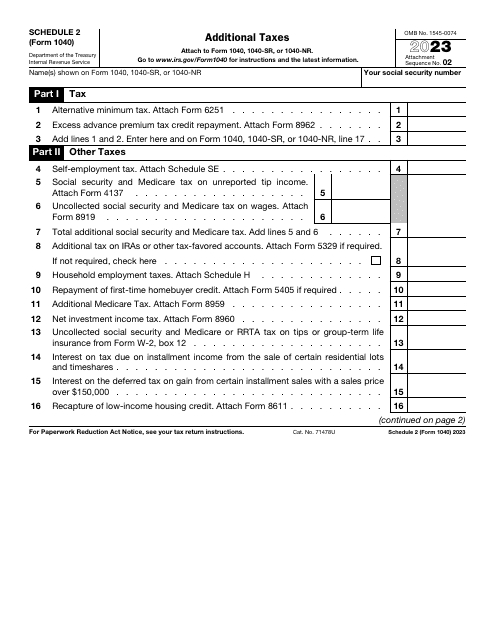

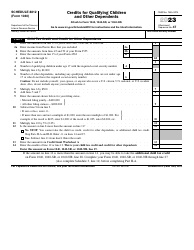

IRS Form 1040 Schedule 2 Additional Taxes

What Is IRS Form 1040 Schedule 2?

IRS Form 1040 Schedule 2, Additional Taxes , is a supplementary document designed to allow taxpayers to list taxes they do not outline on the main income statement they are supposed to file annually.

Alternate Names:

- Tax Form 1040 Schedule 2;

- Additional Taxes Form.

The taxes in question include the tax sole proprietors and freelancers owe, household employment tax, and other taxes people with higher income as well as individuals that hire someone to work in their homes are expected to pay. If you fail to notify tax organs about specific taxes you owe, you will be subject to interest and penalties so do your best to elaborate on extra taxes you have to pay once the tax period is over.

This schedule was released by the Internal Revenue Service (IRS) in 2023 , making older editions of the form obsolete. You can download an IRS Form 1040 Schedule 2 fillable version through the link below.

The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return.

IRS Form 1040 Schedule 2 Instructions

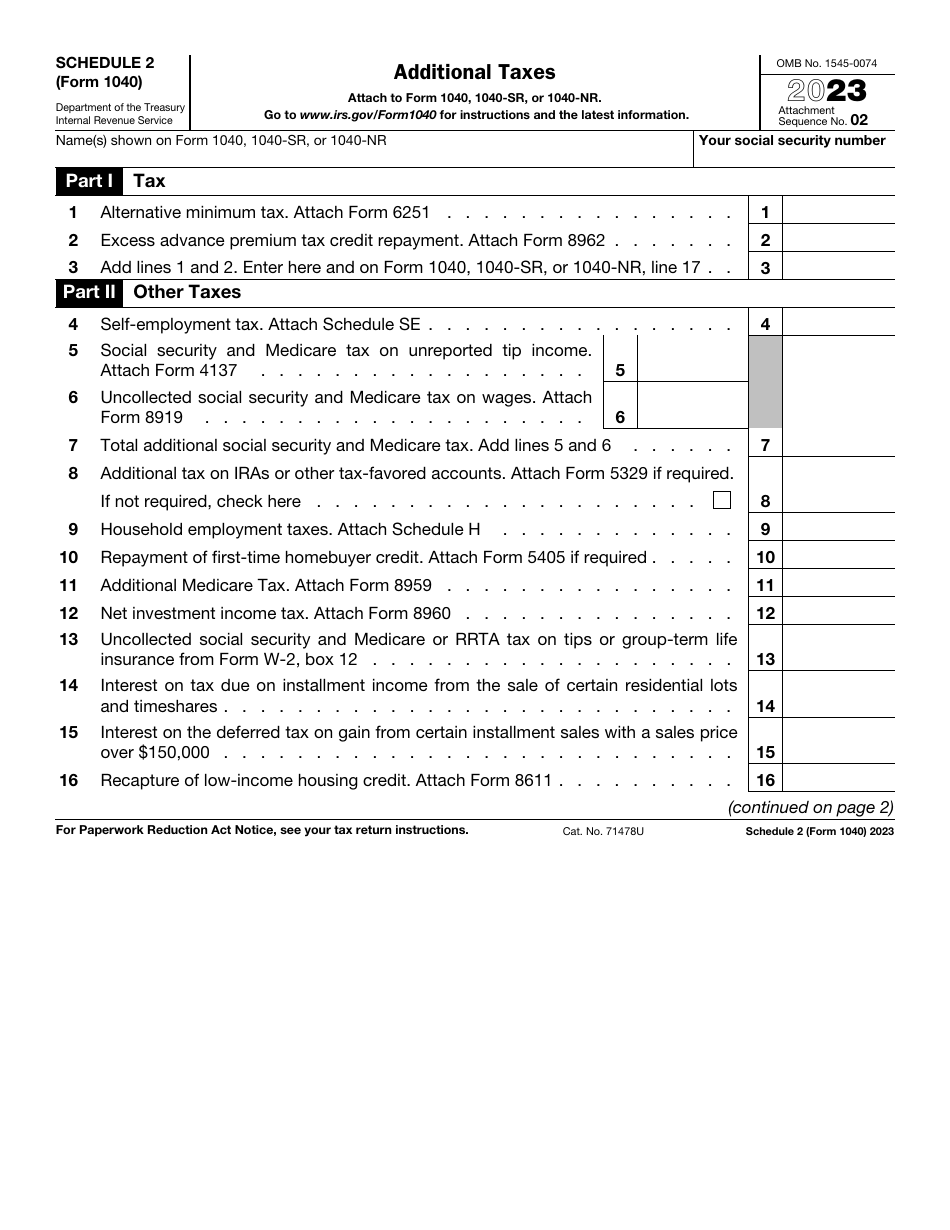

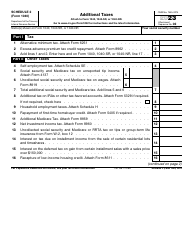

When you submit IRS Form 1040, U.S. Individual Income Tax Return, you may have to prepare an Additional Taxes Form as well and attach it to the income statement. Follow these Form 1040 Schedule 2 guidelines to inform the authorities about the taxes you do not include in basic tax documentation:

-

Identify yourself by recording your full name and social security number . Ensure the name you include in the form matches the one you write down on your income statement.

-

Specify the amount of tax you owe if you are a taxpayer in a higher tax bracket and state how much tax credit must be repaid . Combine two numbers and replicate this information on your tax return.

-

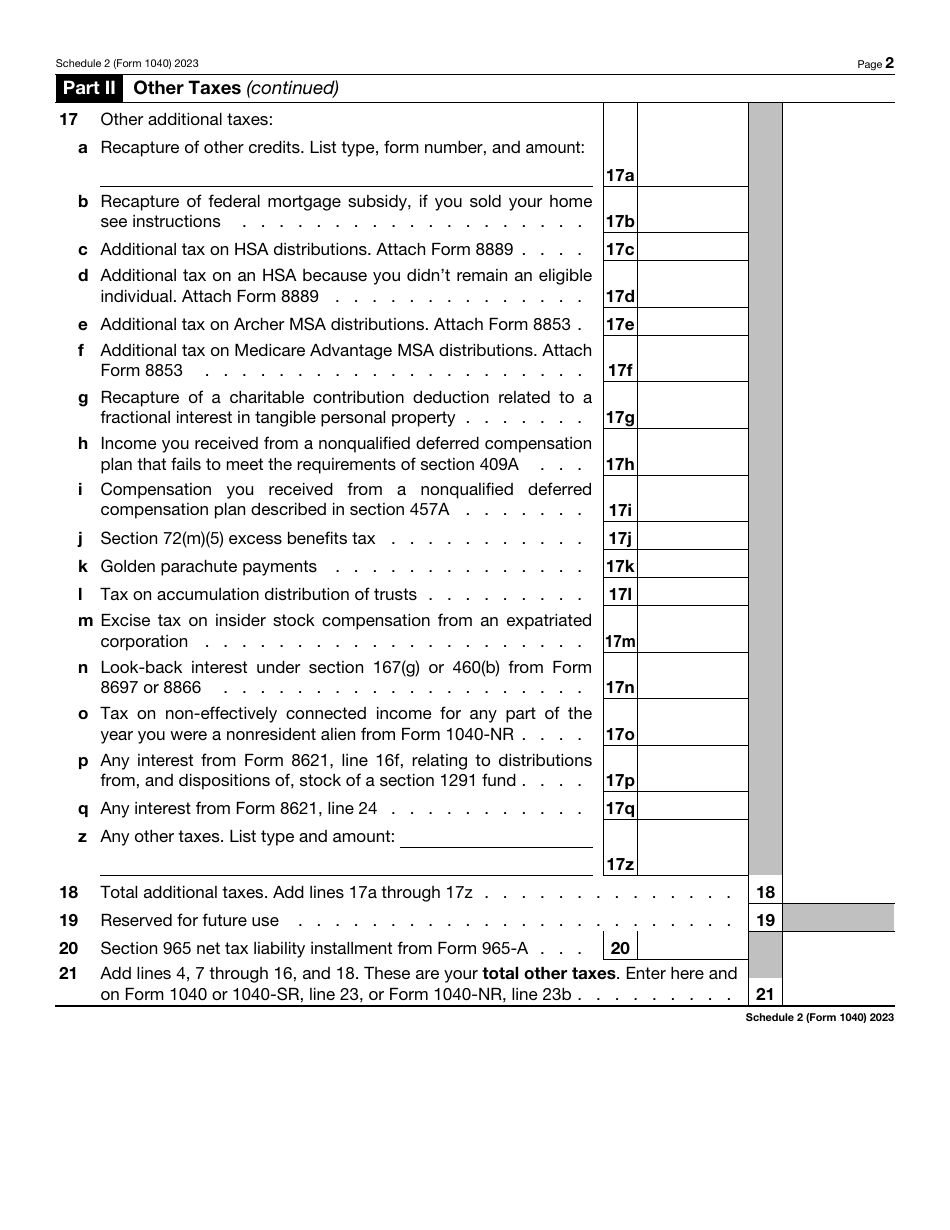

Read the document to figure out what categories of tax apply in your situation . There will be fields you can skip - leave them blank if you are not required to pay certain taxes. The taxes listed include Medicare and social security tax, tax you have to pay after generating investment income, tax on particular distributions, and interest you received as a shareholder. It will be rather easy to complete the form since you are only asked to calculate the total amount of every type of tax and later compute the total amount of taxes you have to enter on your tax return.

-

If you recaptured credits, it is needed to clarify the type of credit, the number of the tax form that describes it, and the total amount of the credit . You also have an opportunity to inform fiscal authorities about other taxes not mentioned directly in the statement - make sure you point out the type of tax and the accurate amount you need to pay.

-

Do not forget to enclose extra documentation with your paperwork in line with the guidelines established in the instrument . For example, if you have to pay taxes because during the tax period covered in writing you hired a household employee and paid them for their services, you will have to file IRS Form 1040 Schedule H, Household Employment Taxes.