This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 706

for the current year.

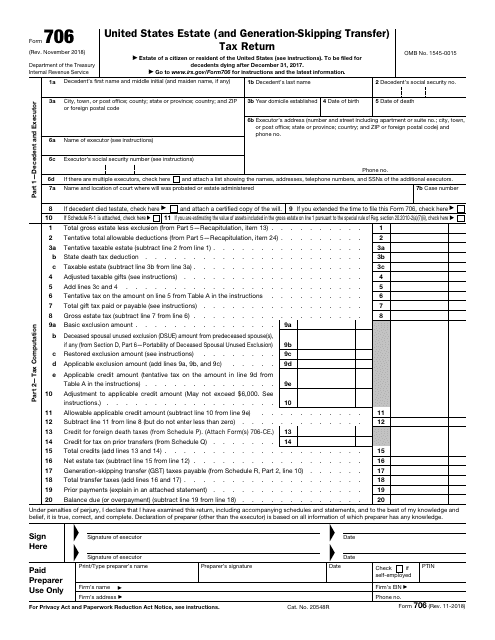

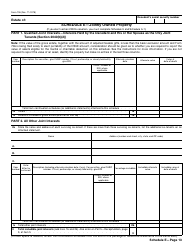

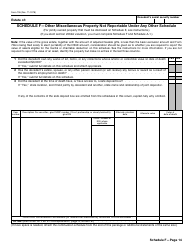

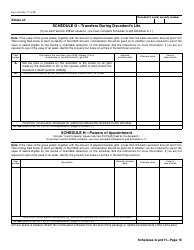

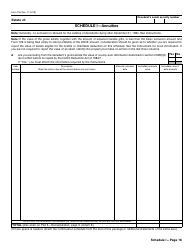

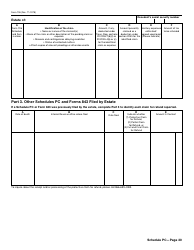

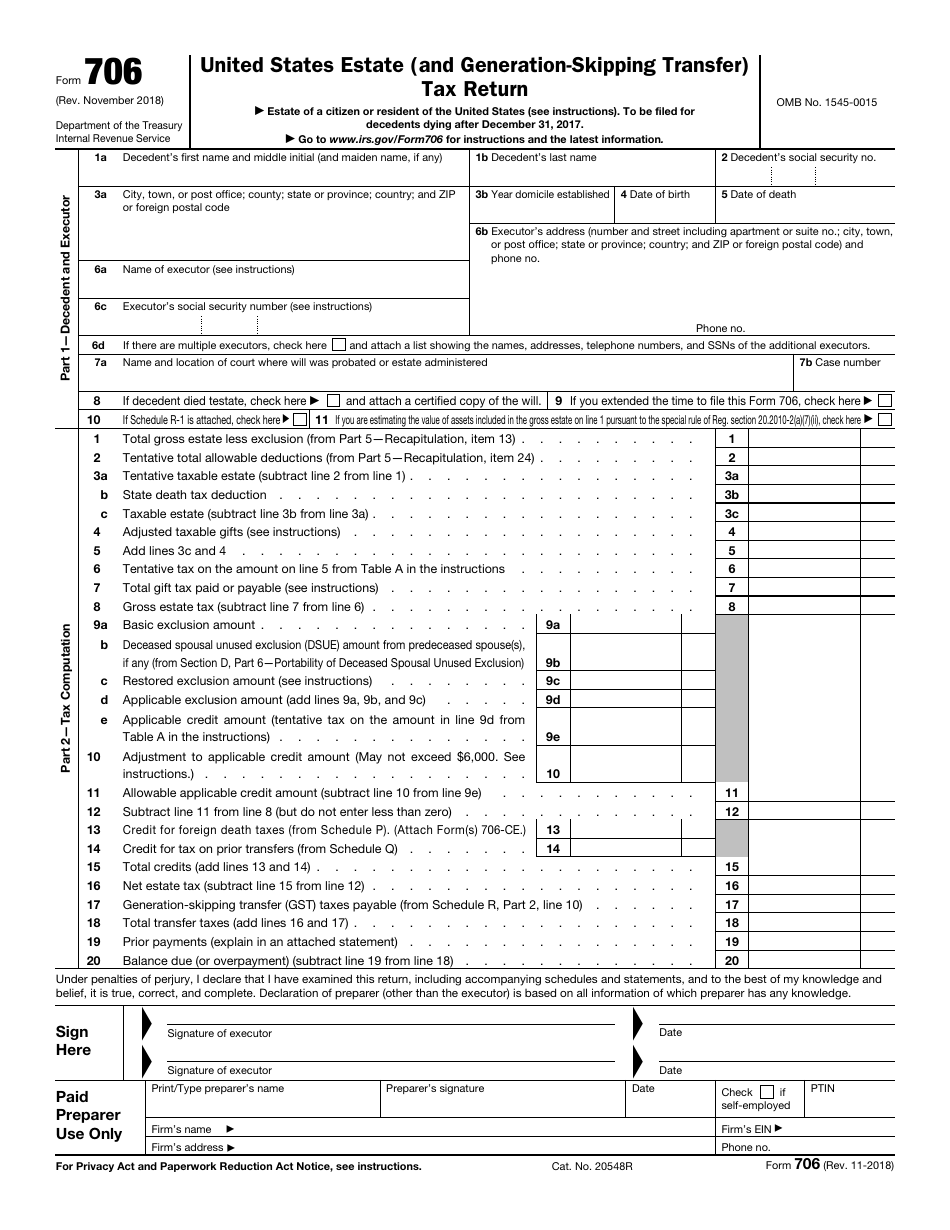

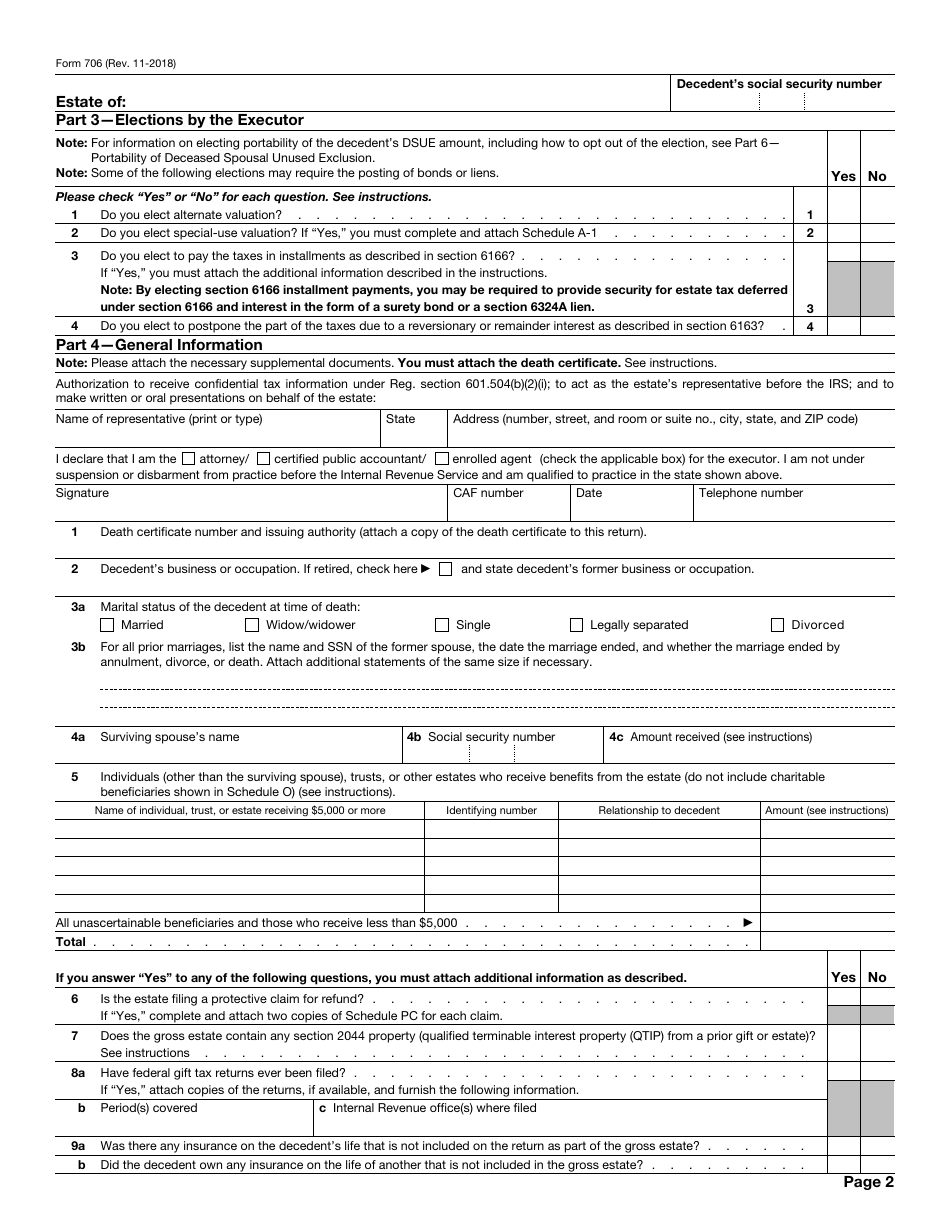

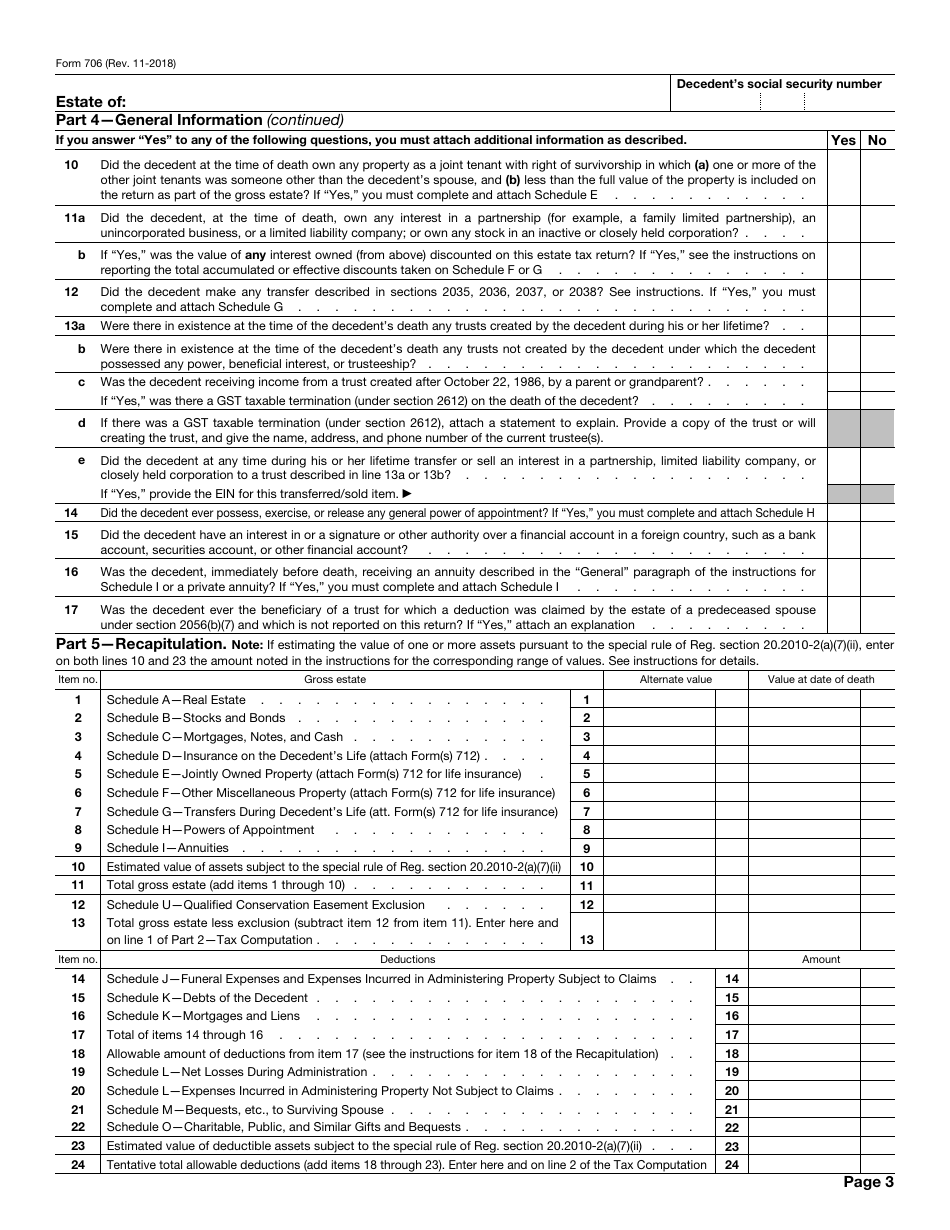

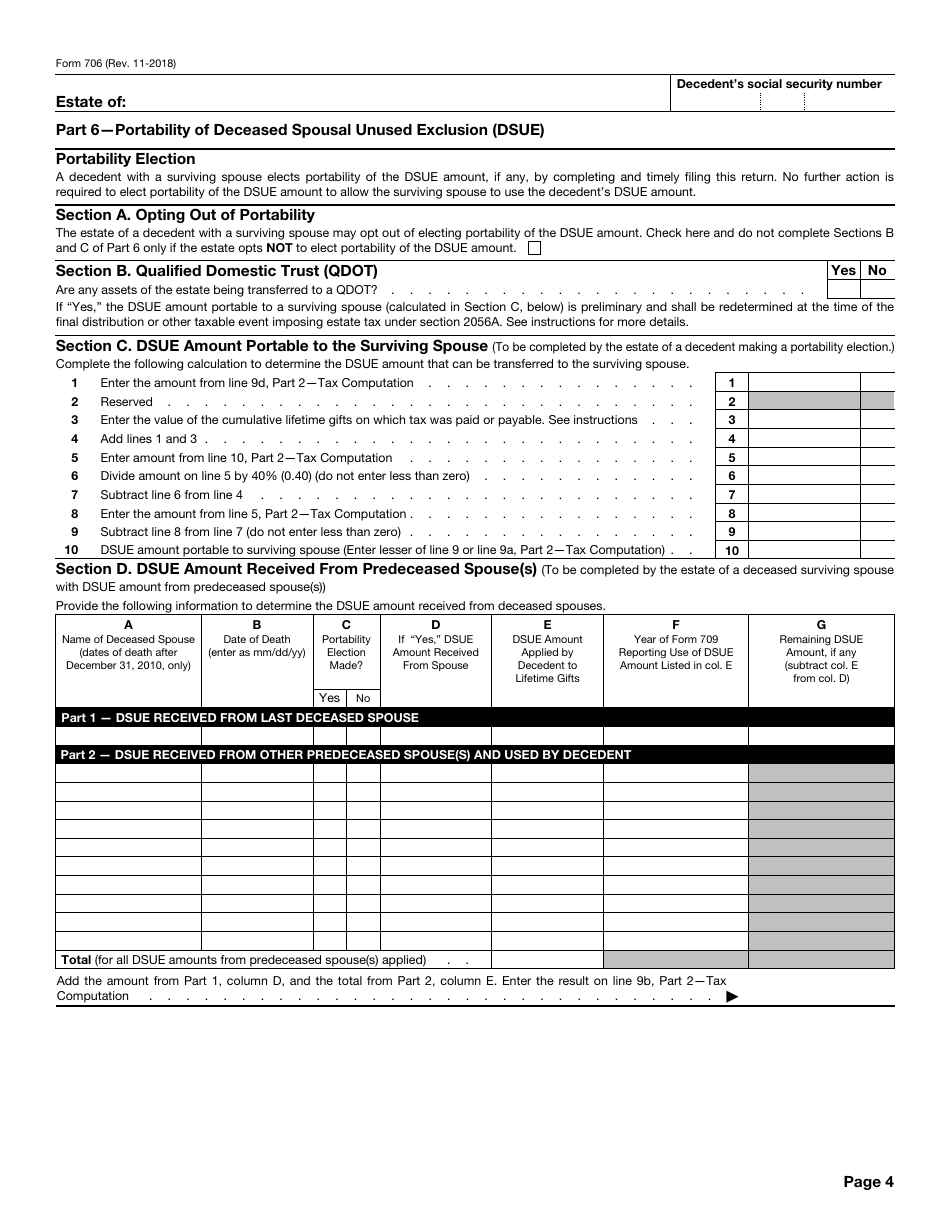

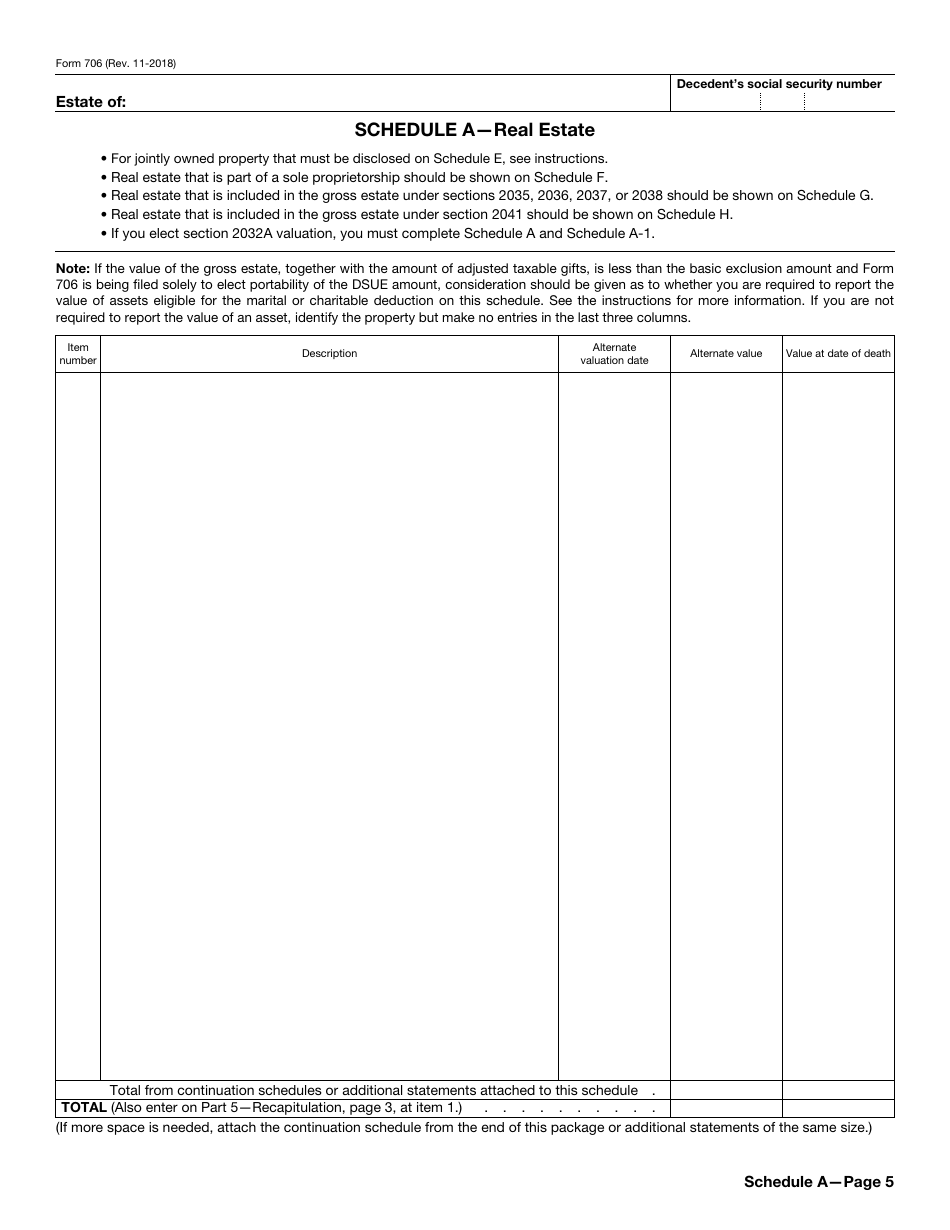

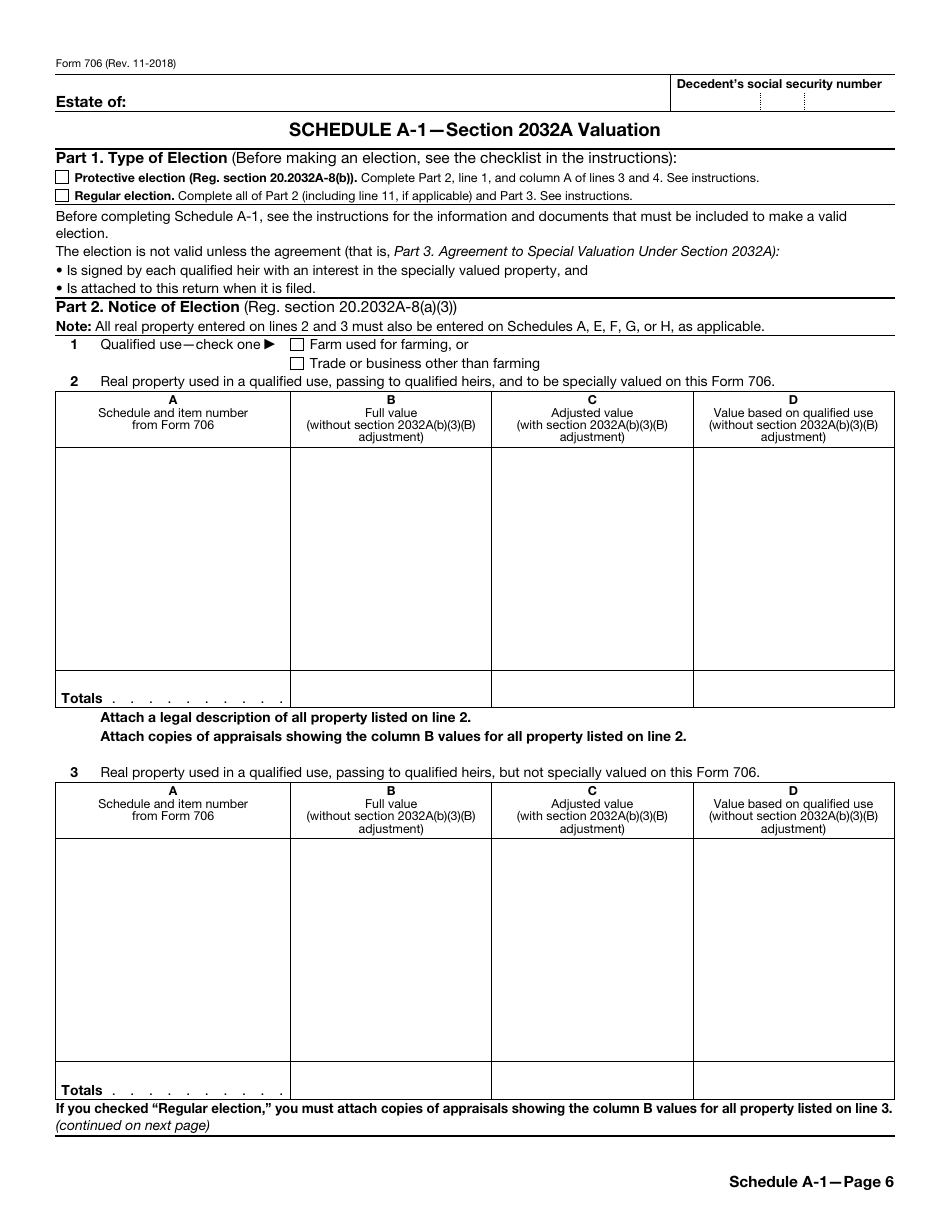

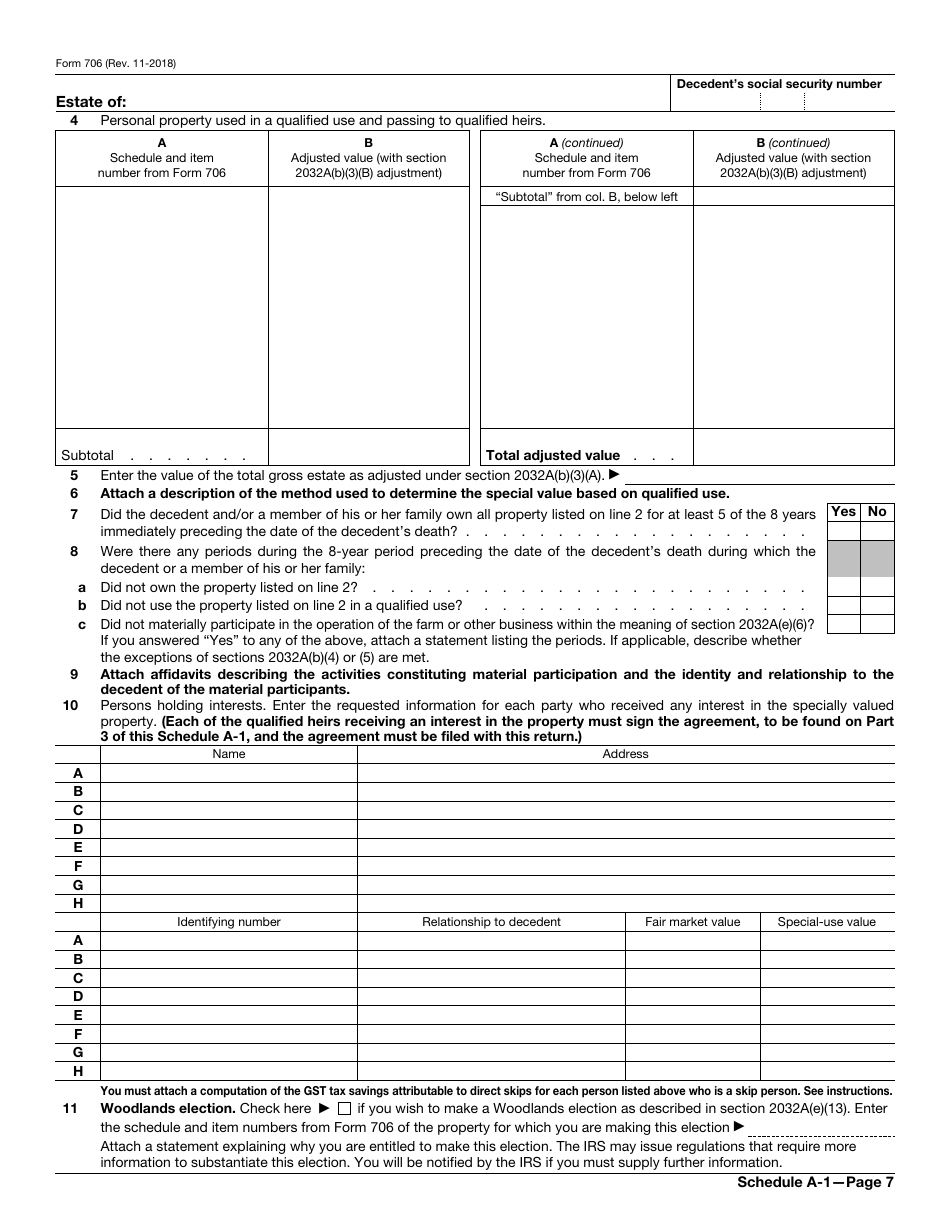

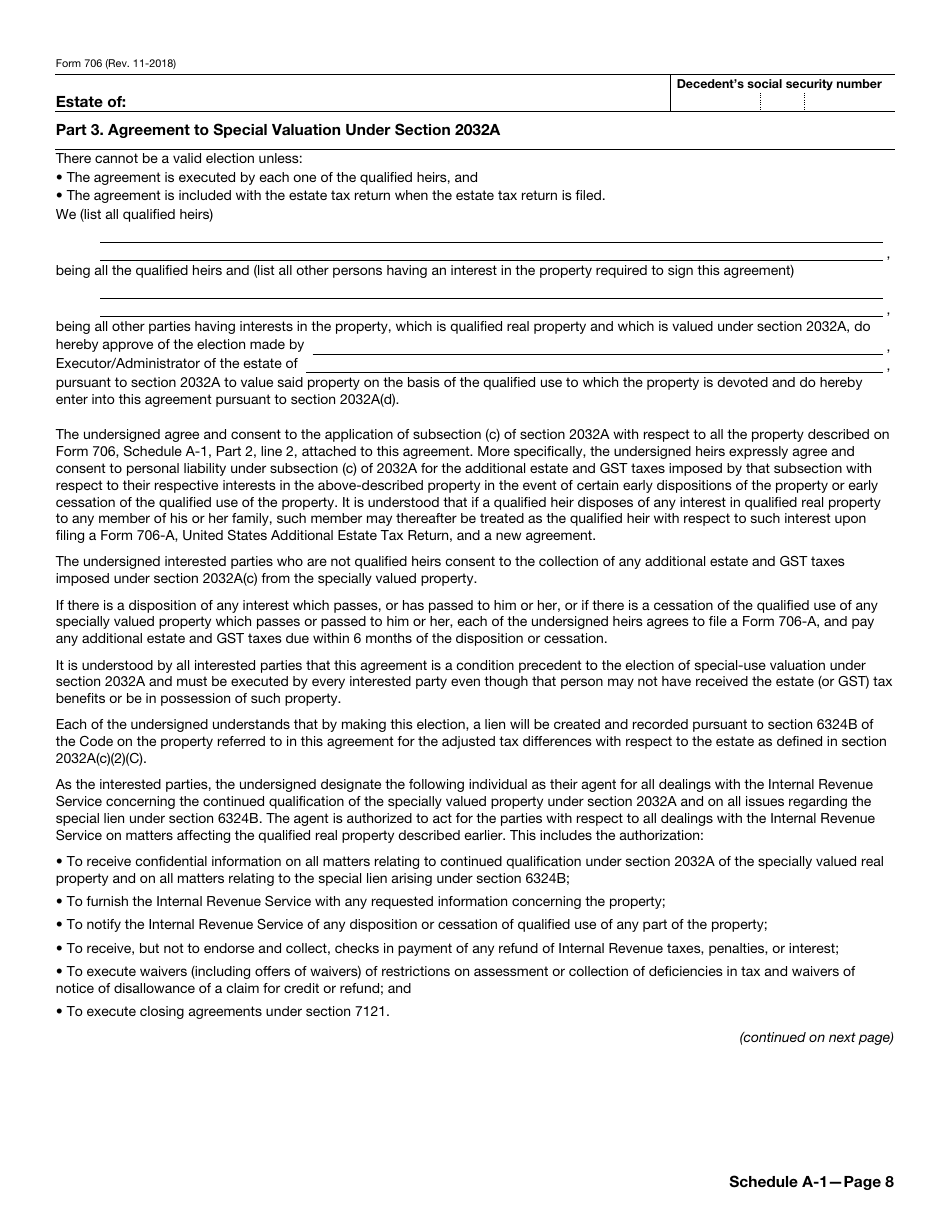

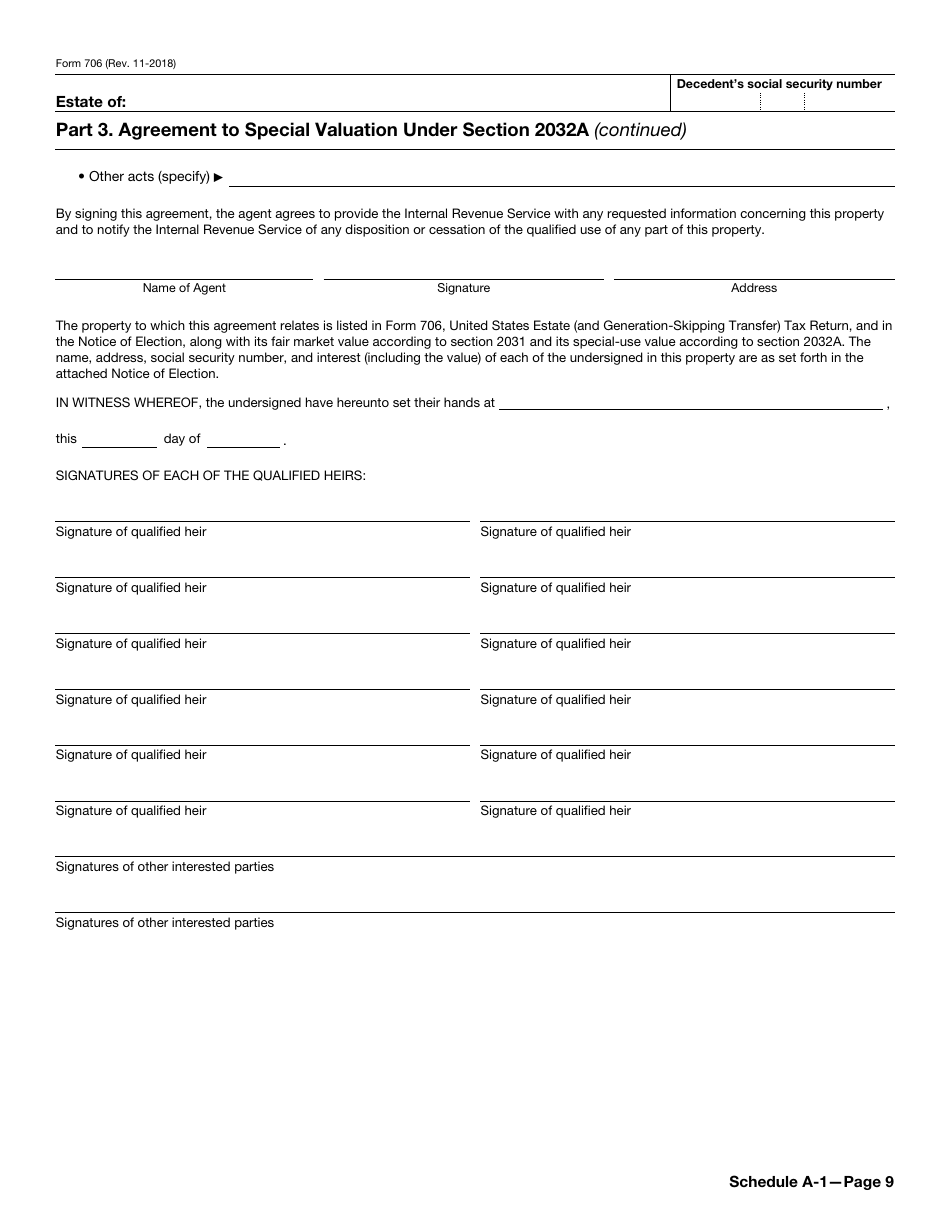

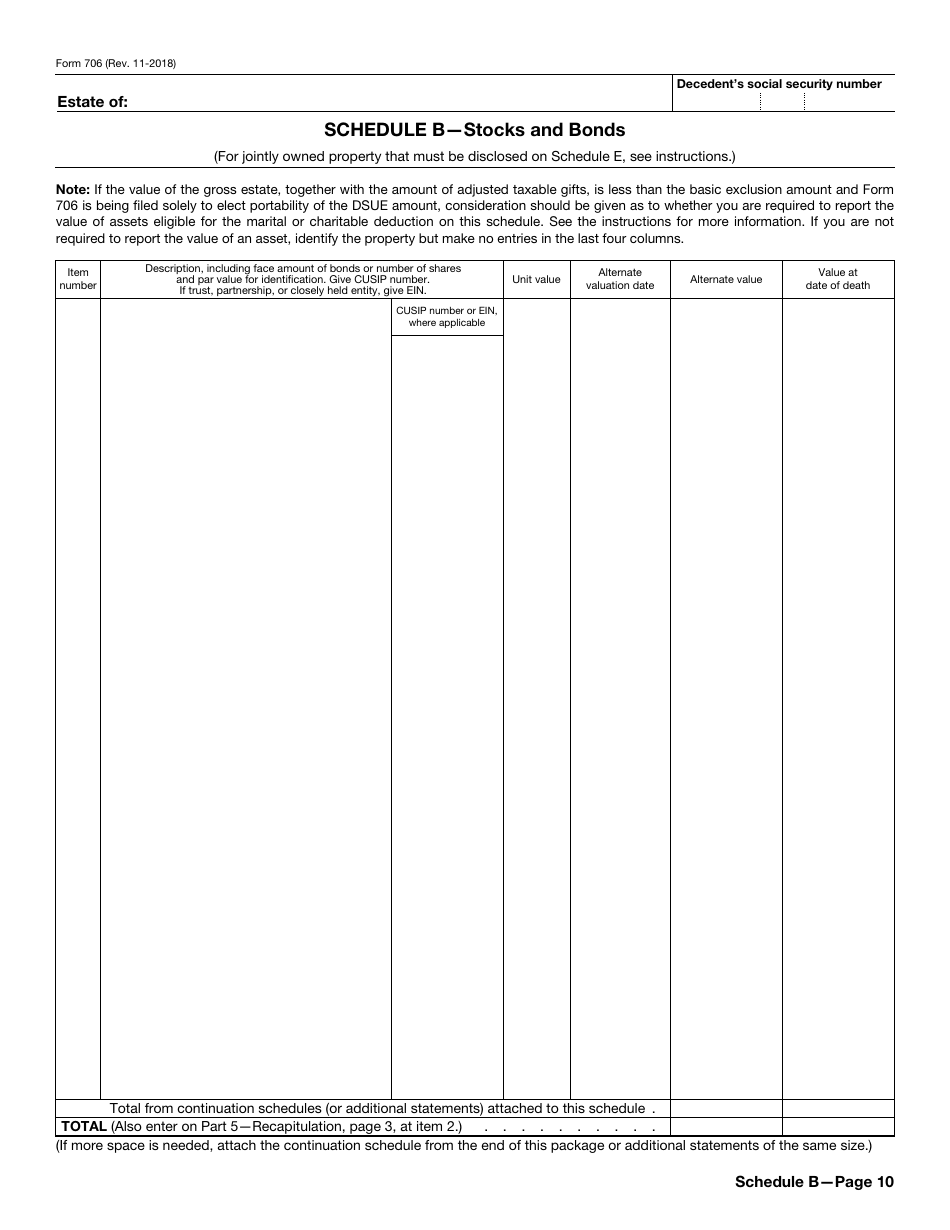

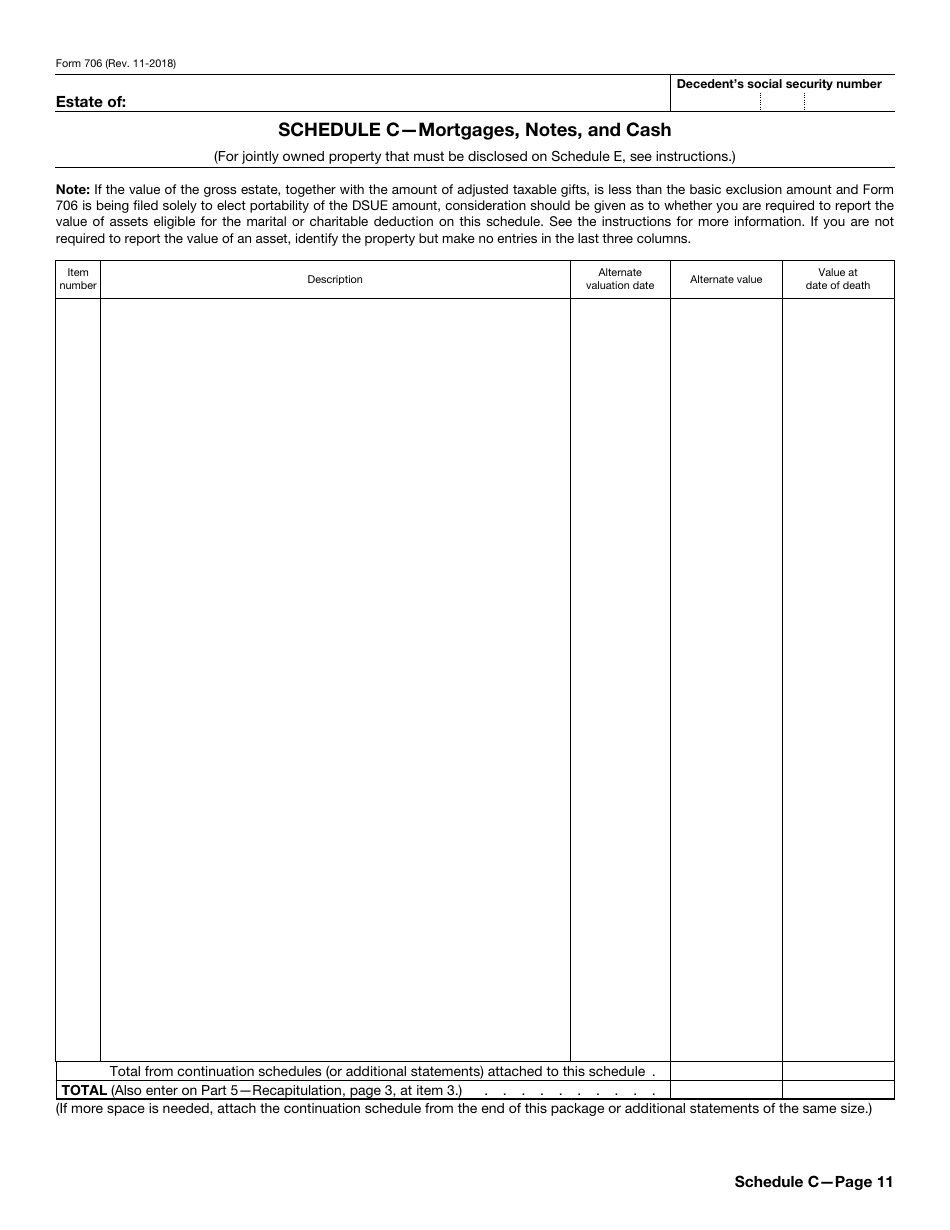

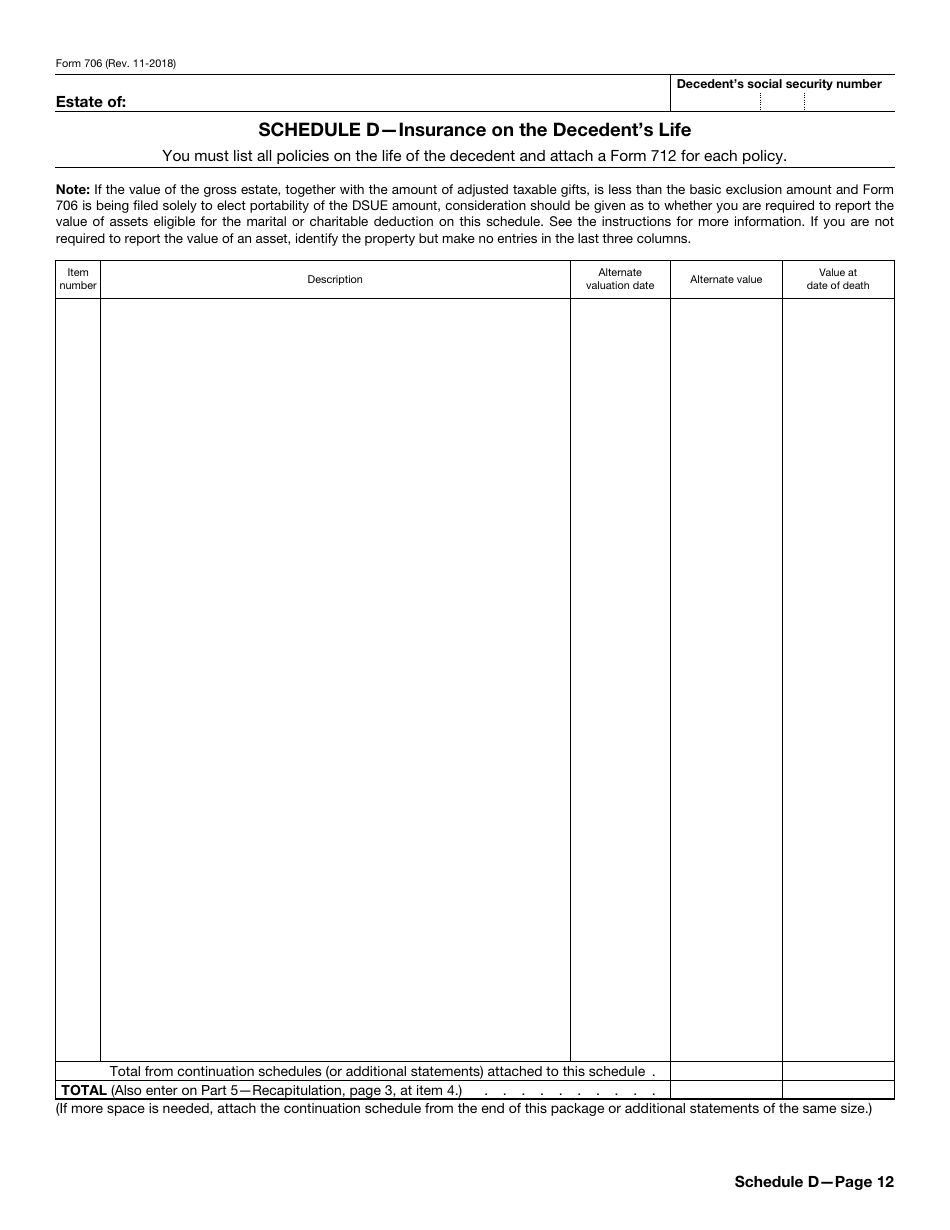

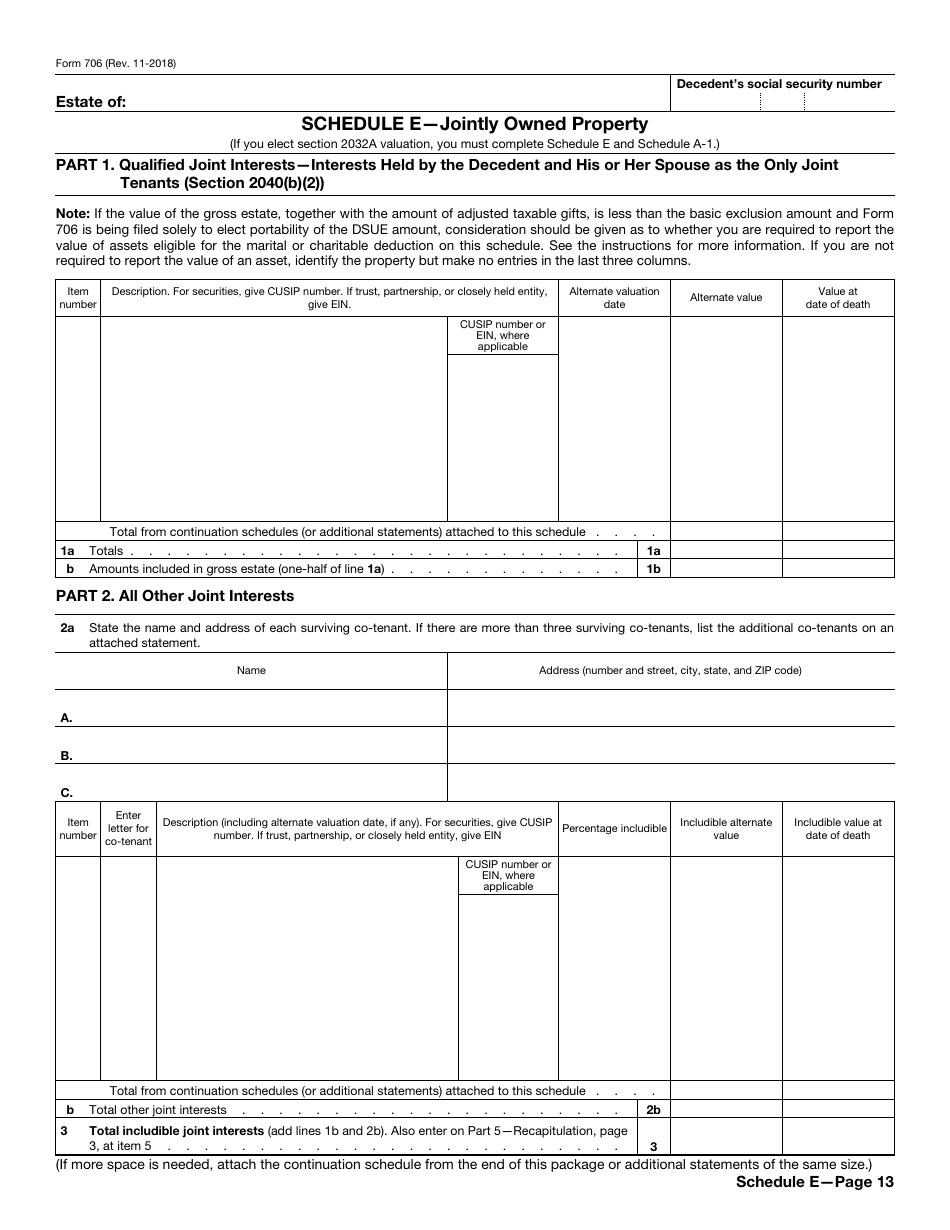

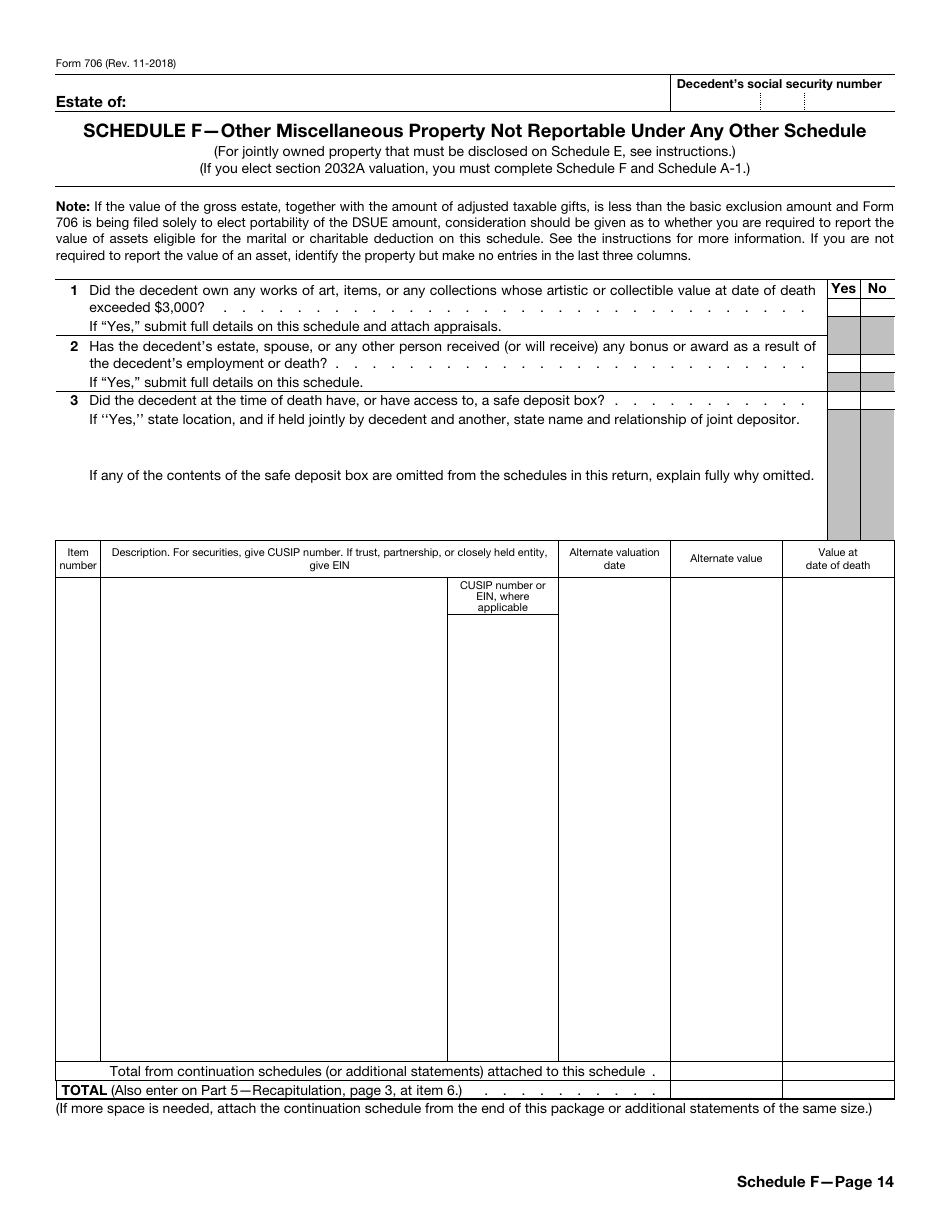

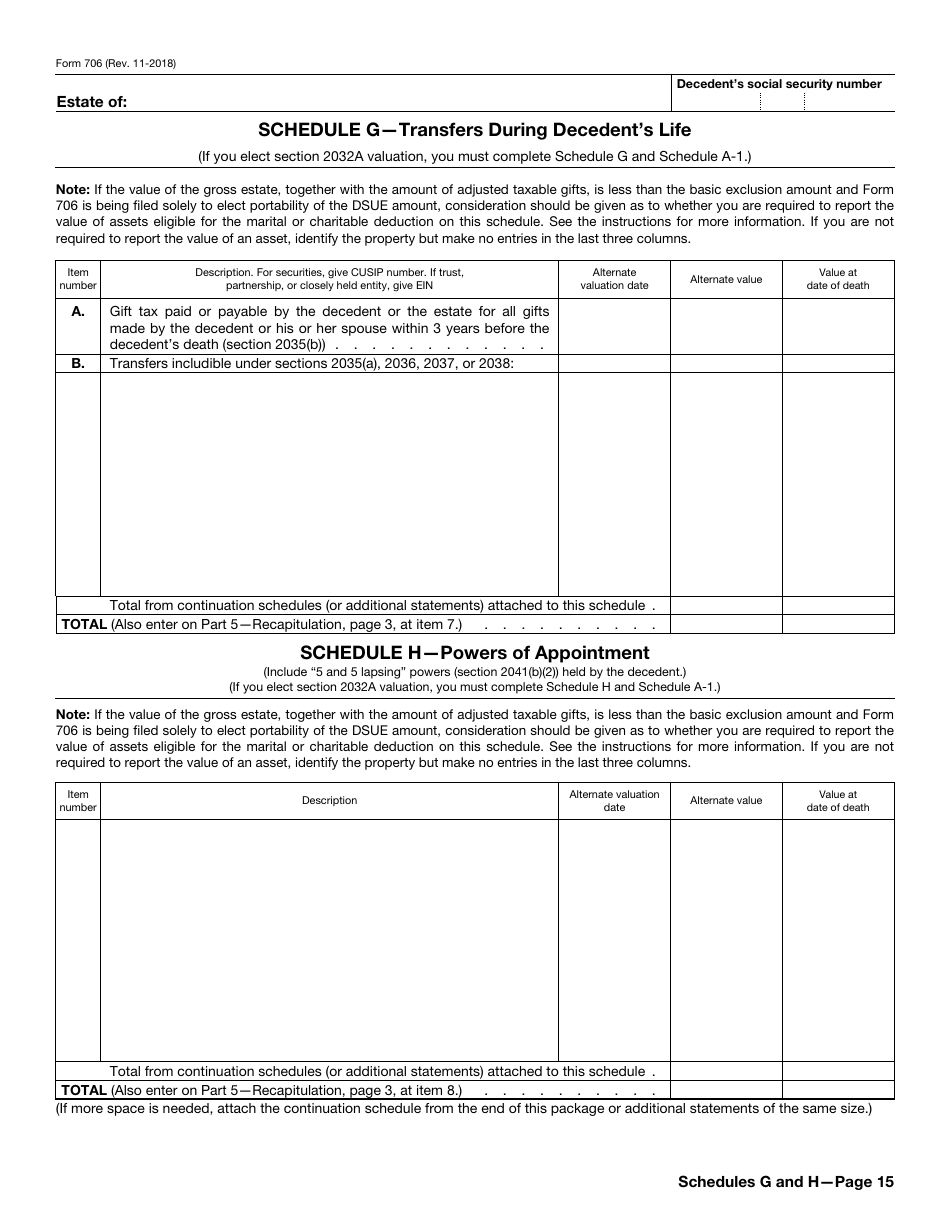

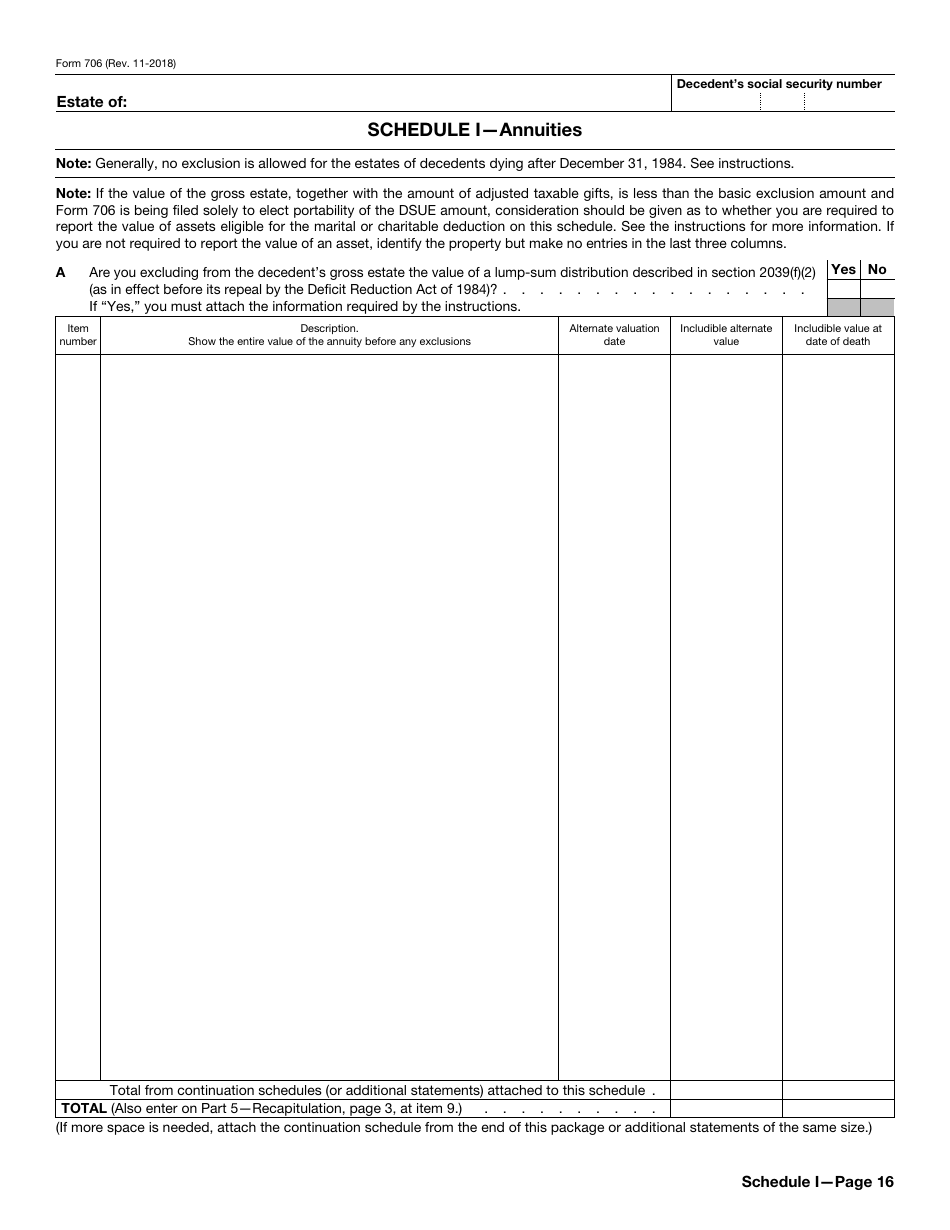

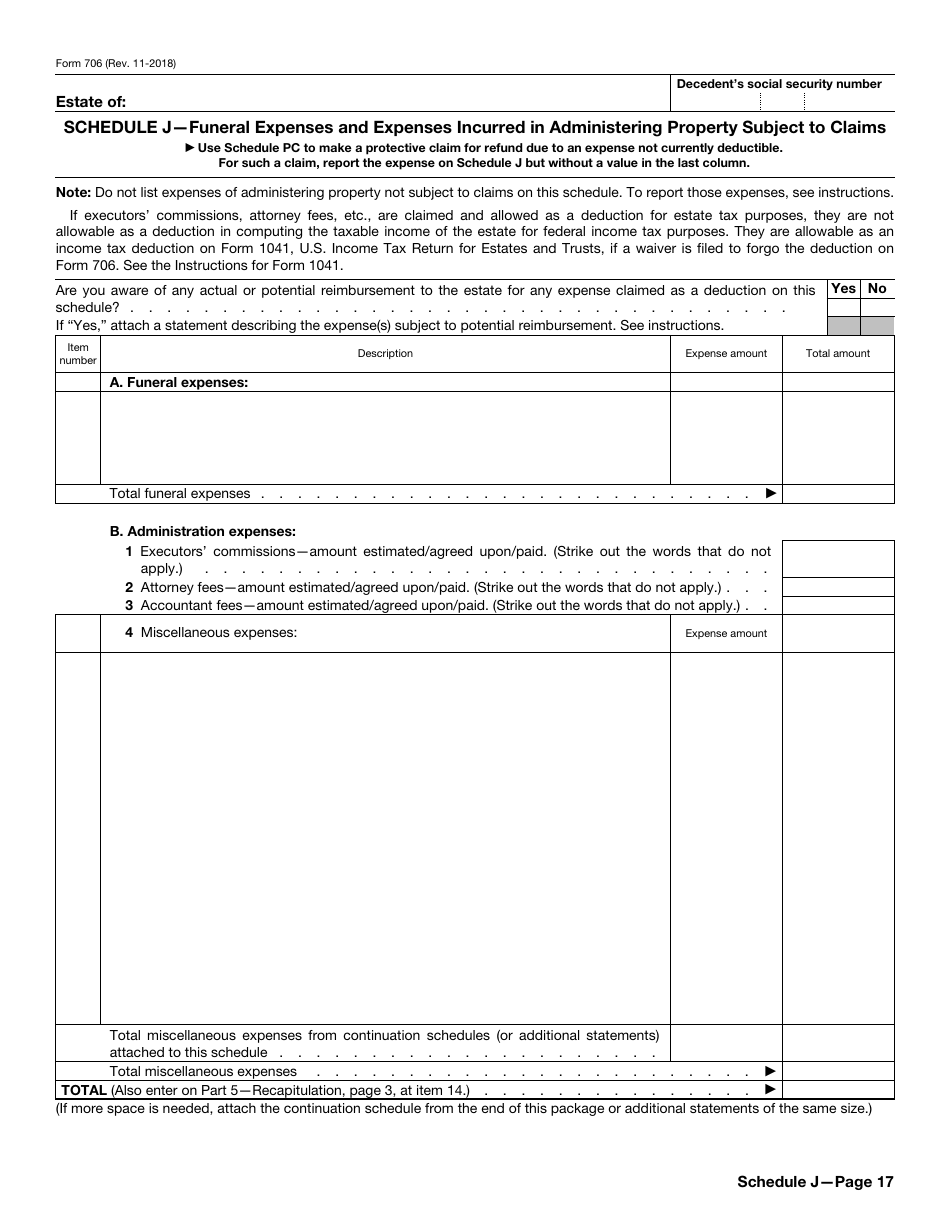

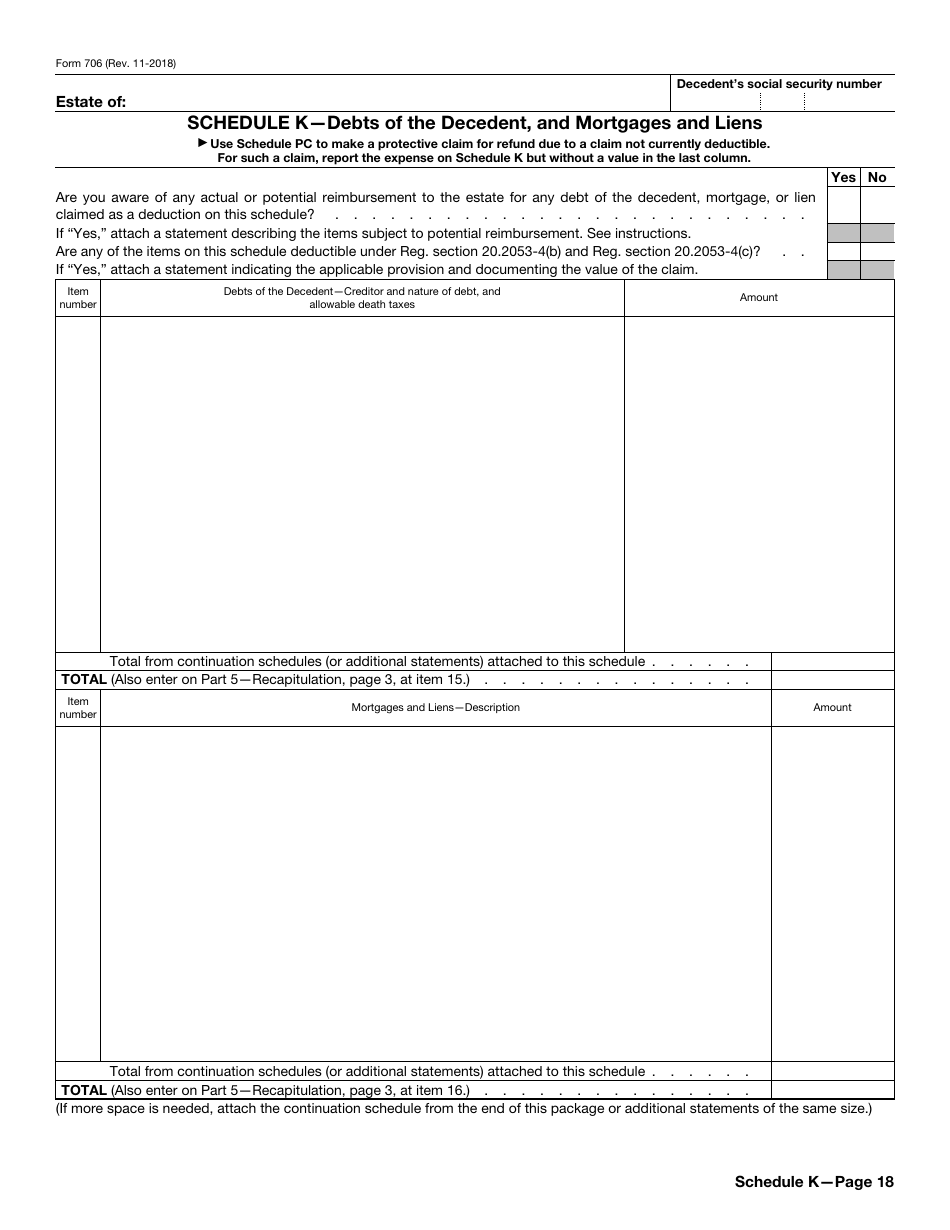

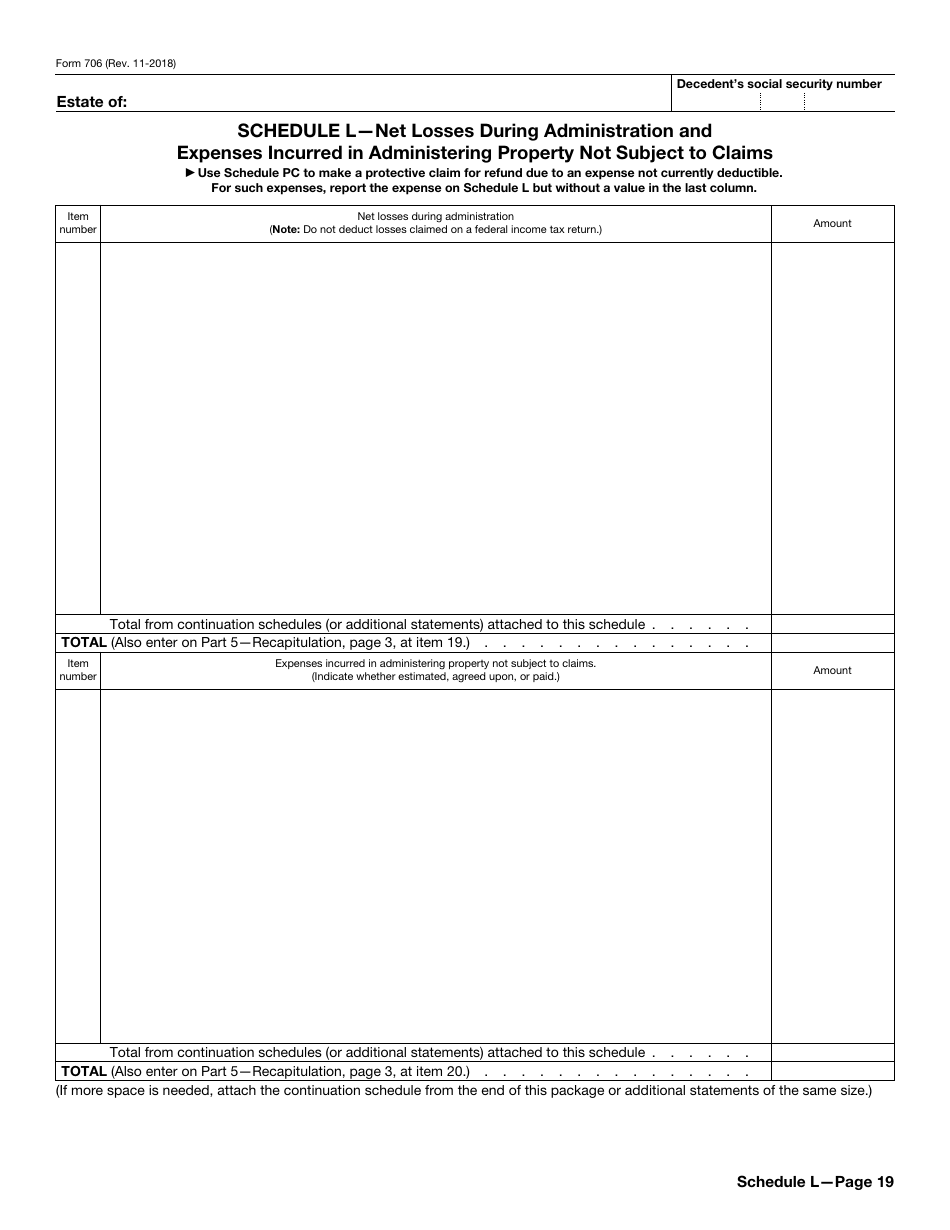

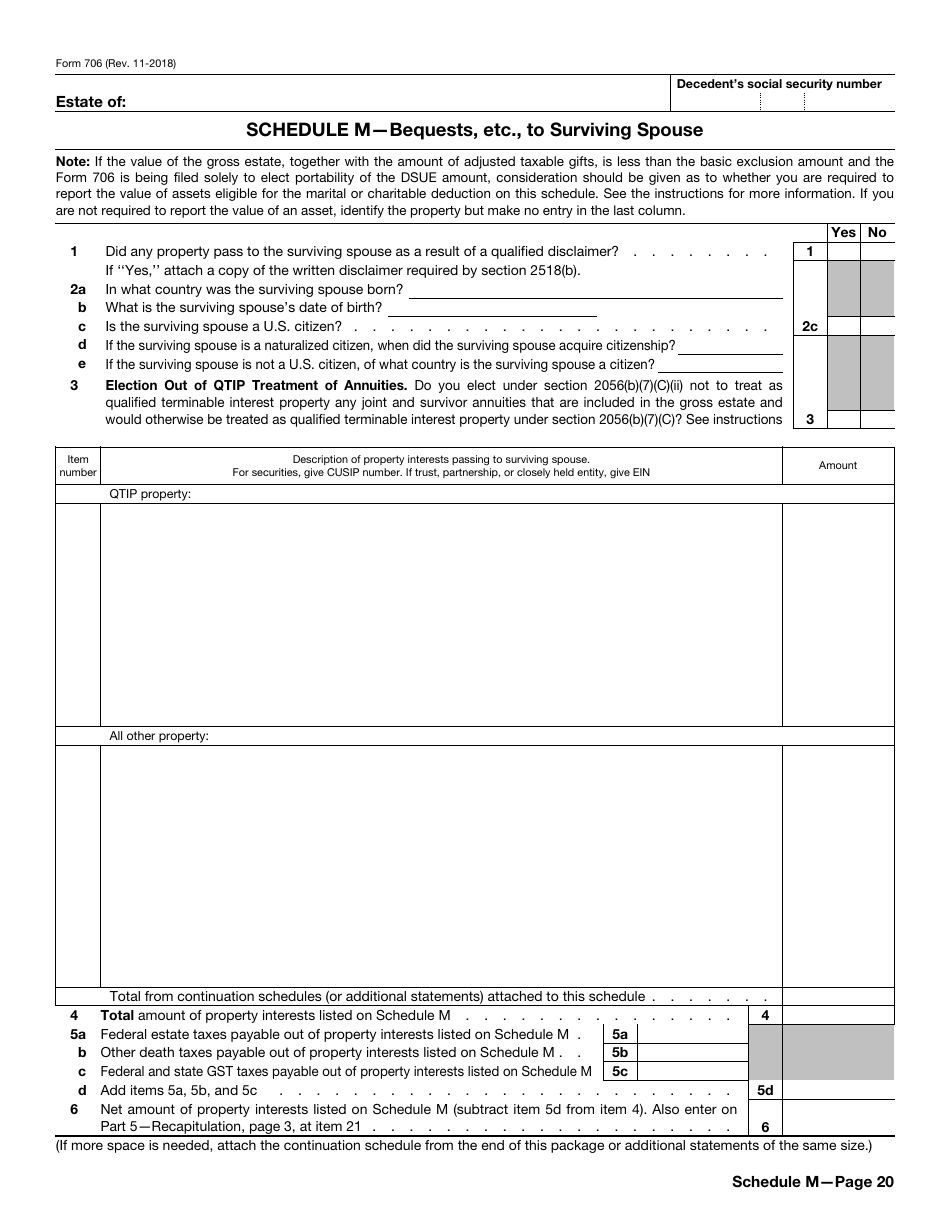

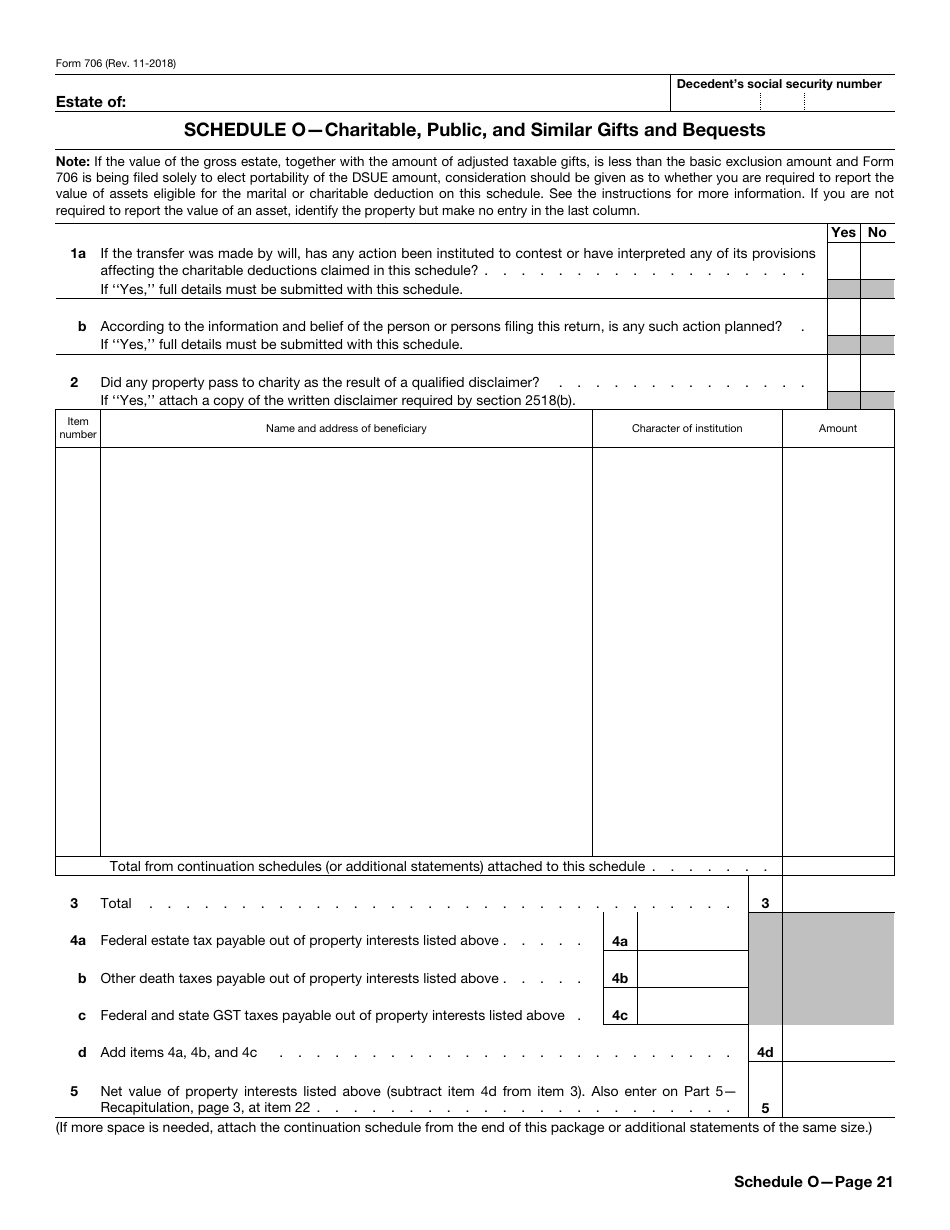

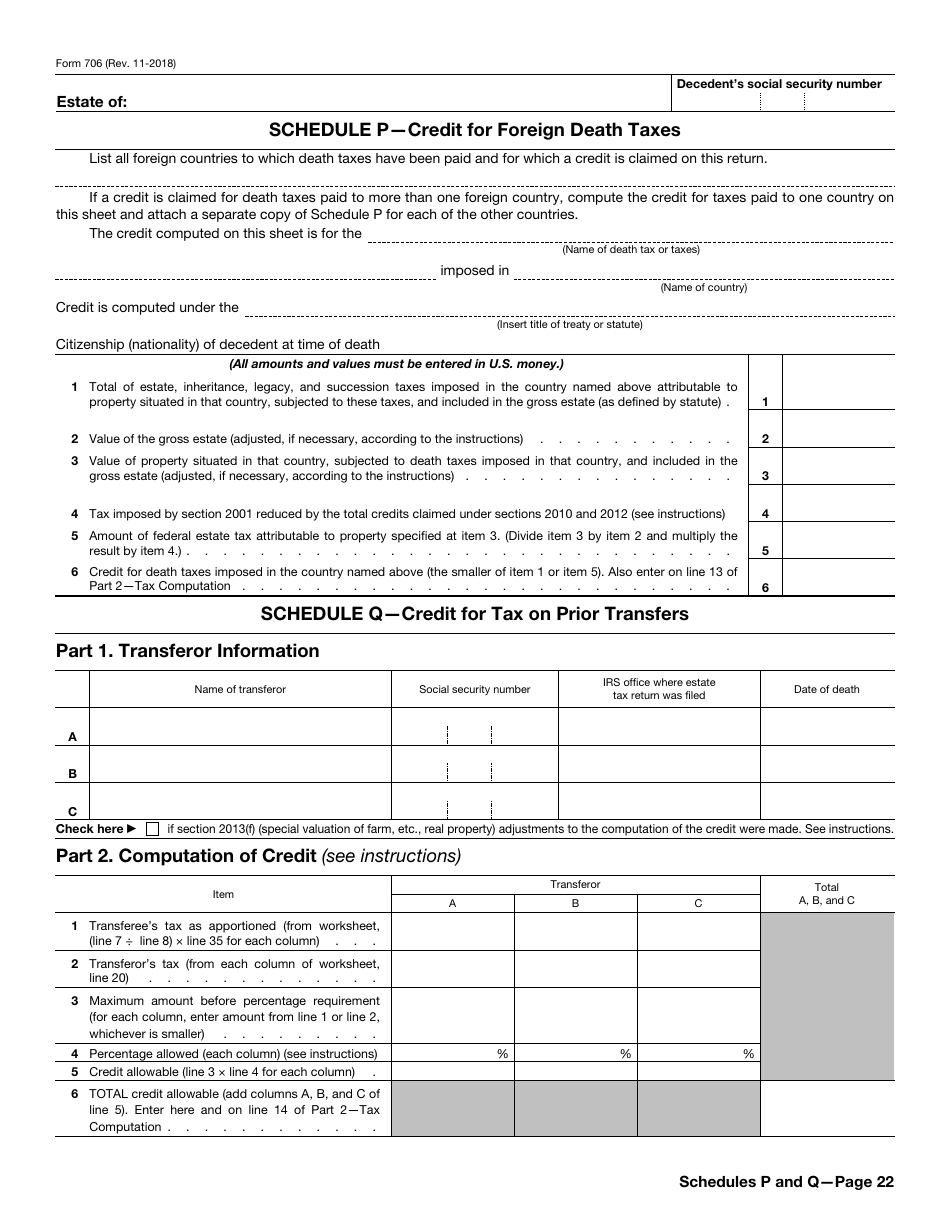

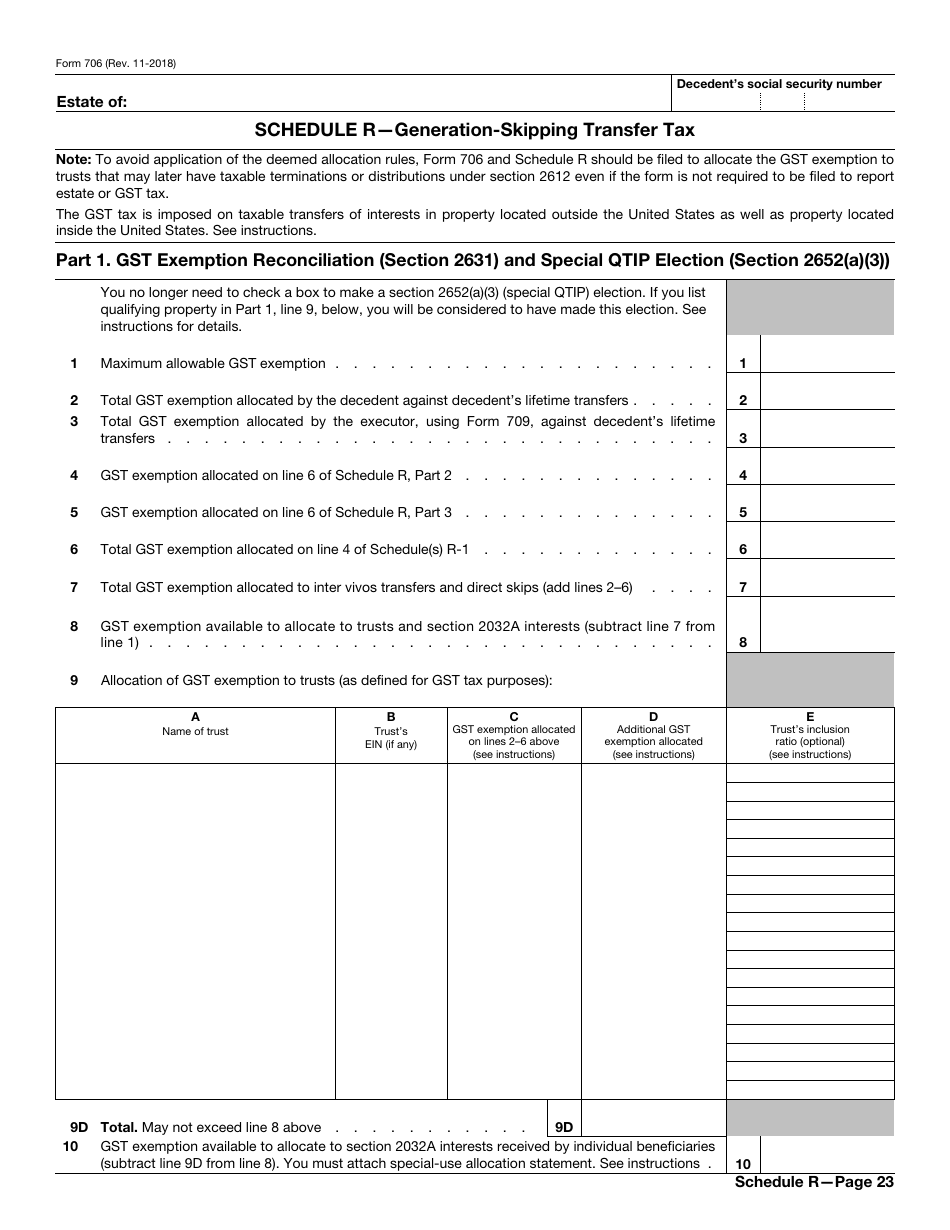

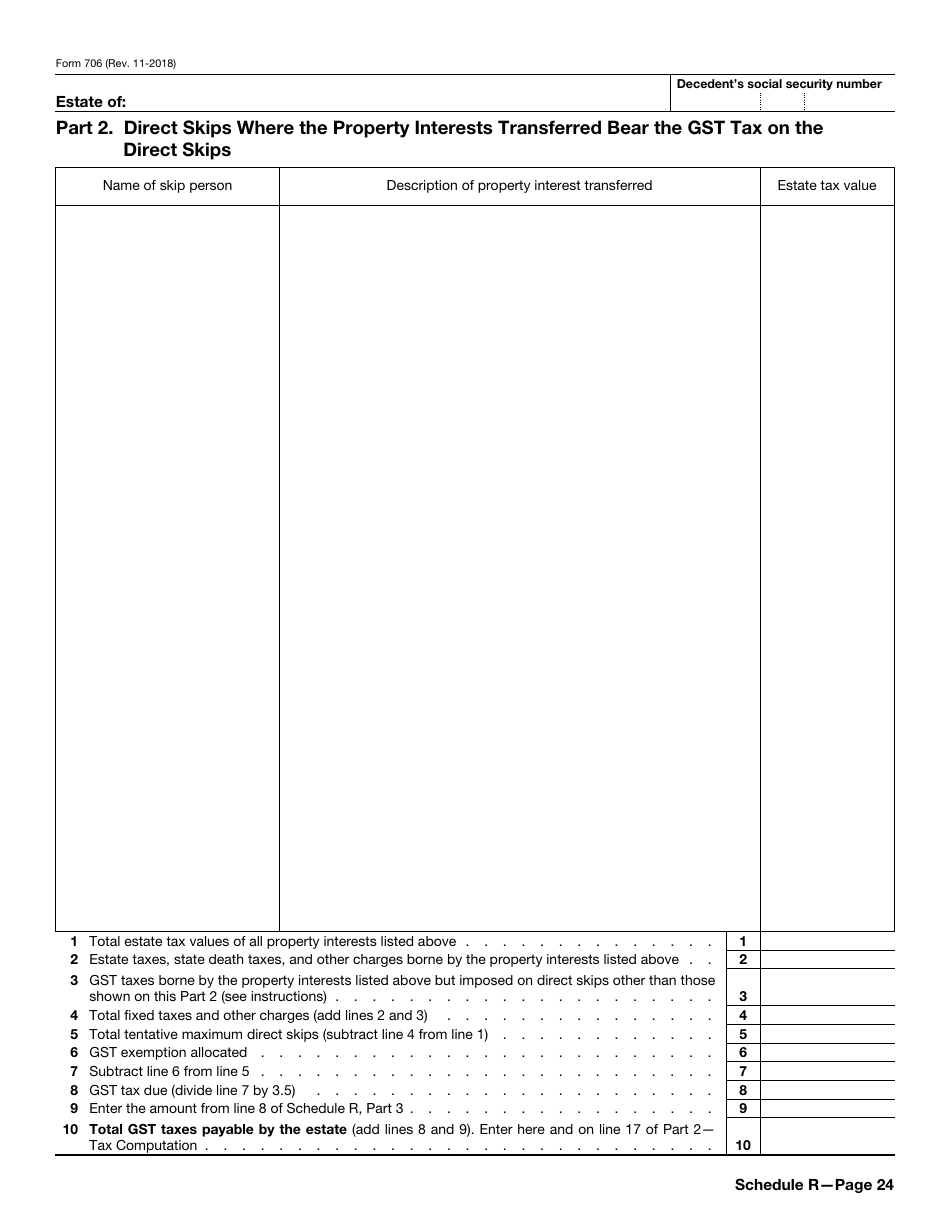

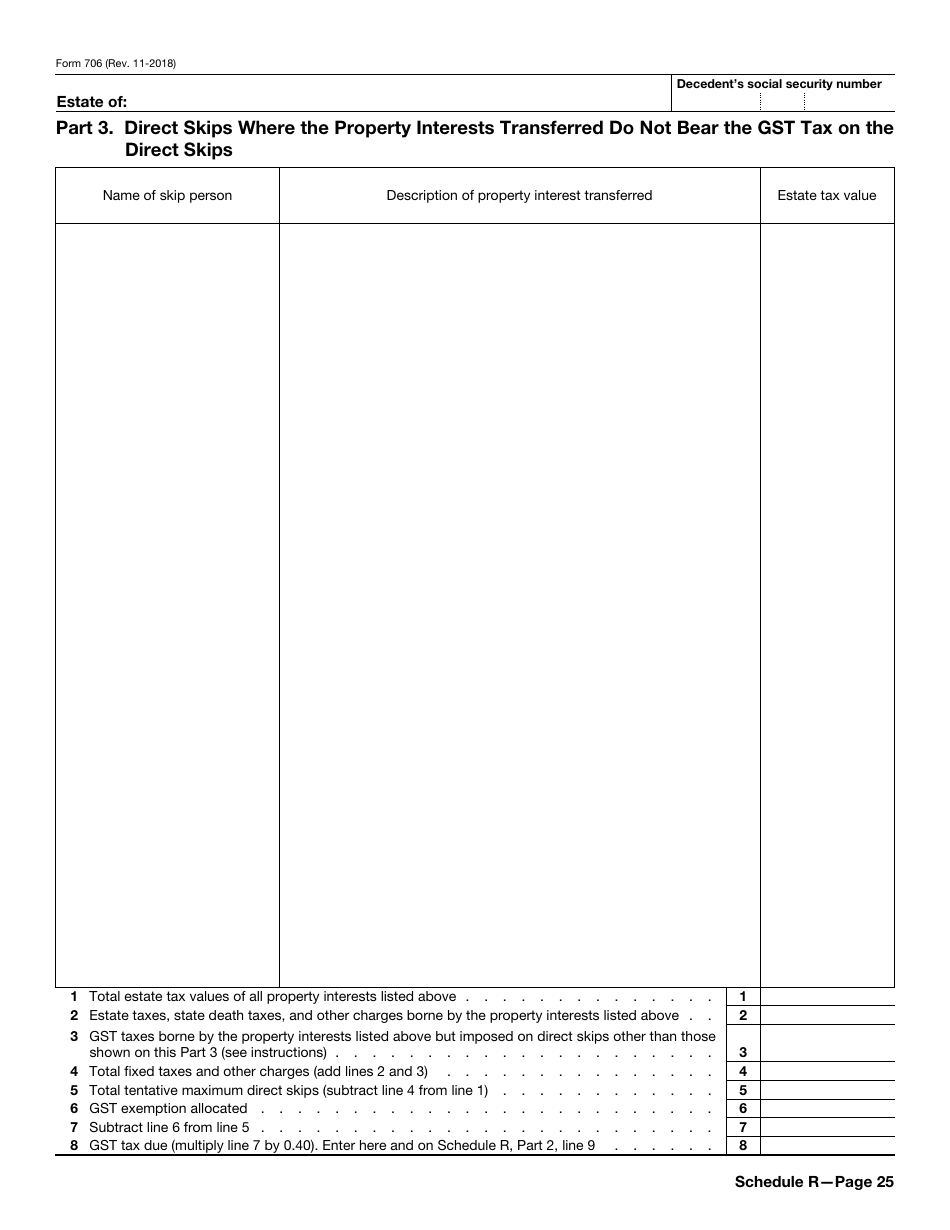

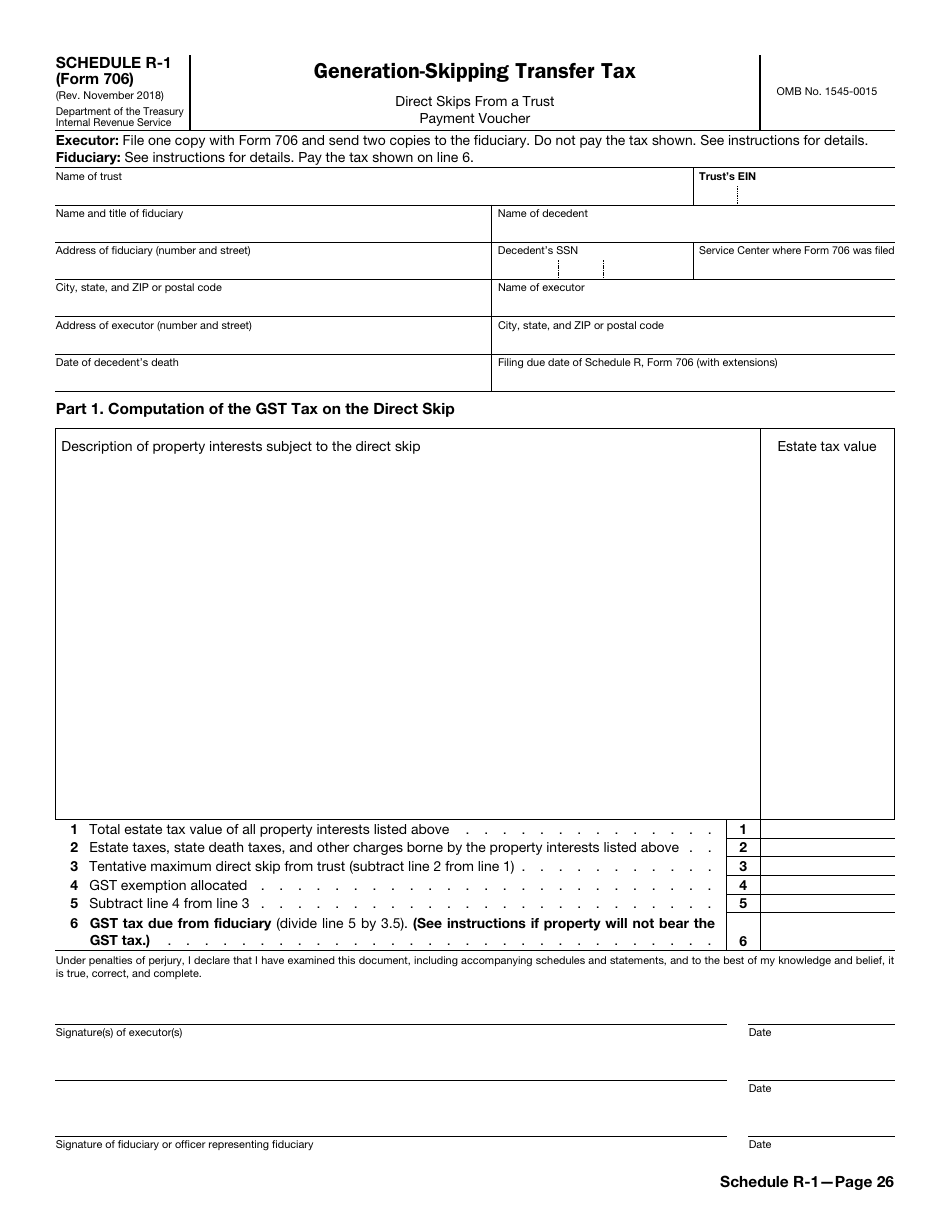

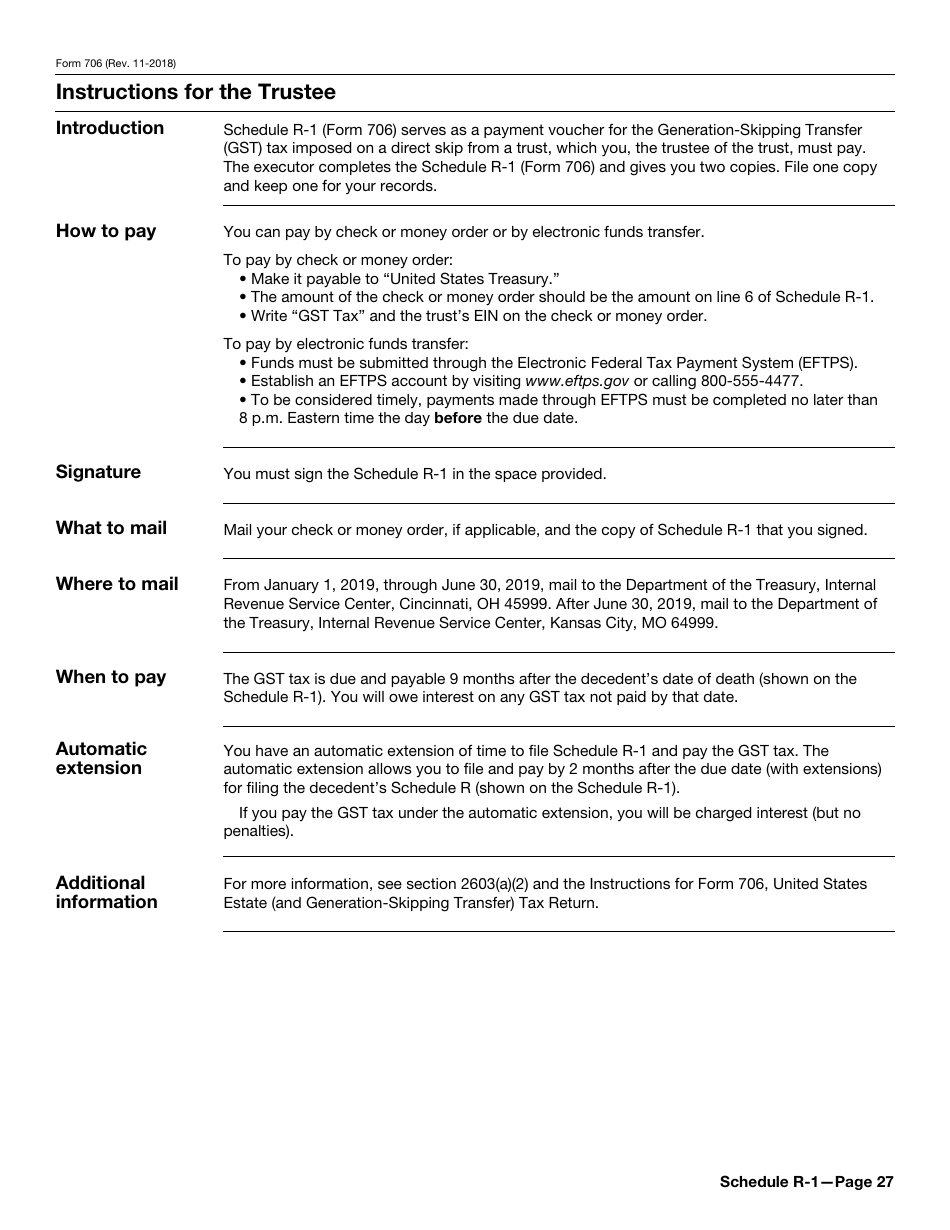

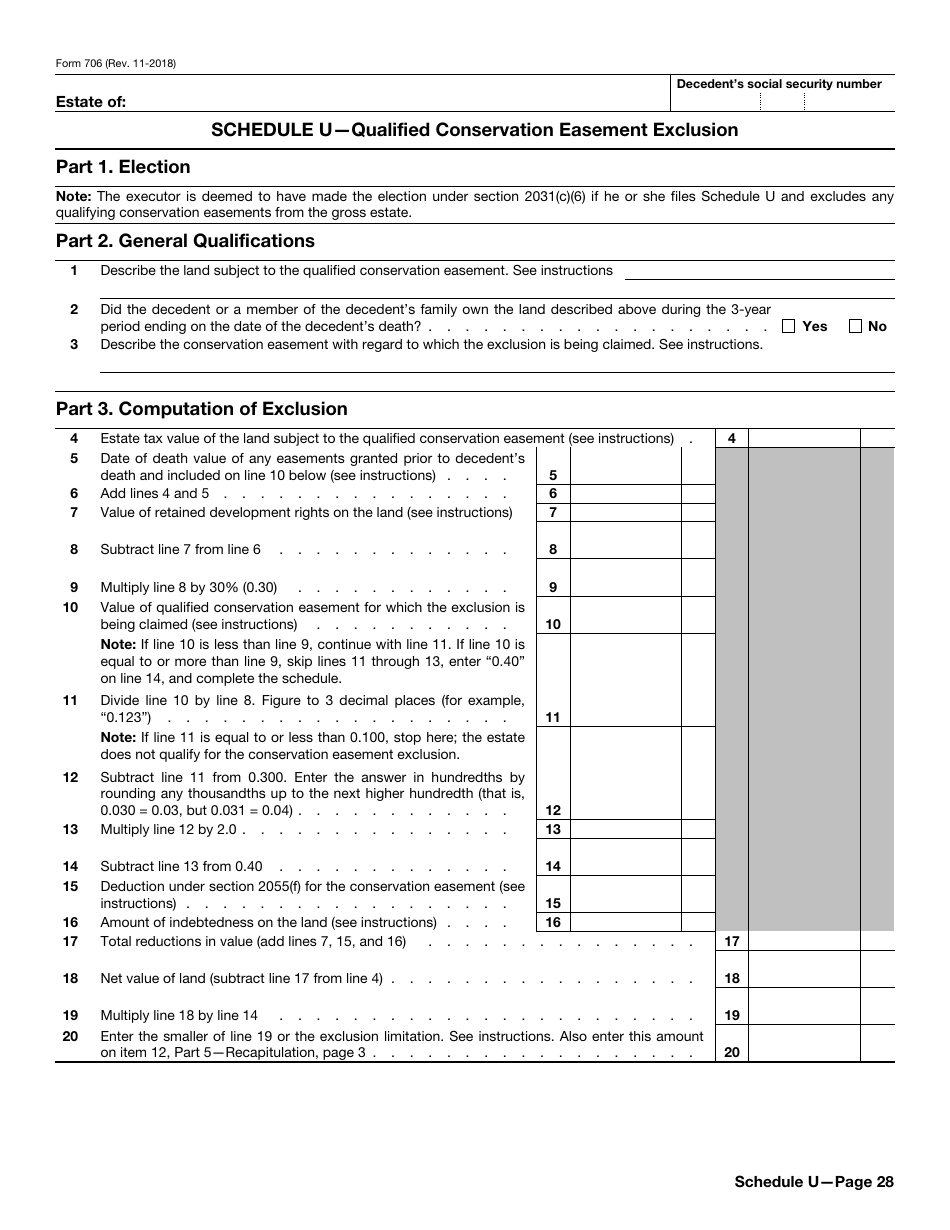

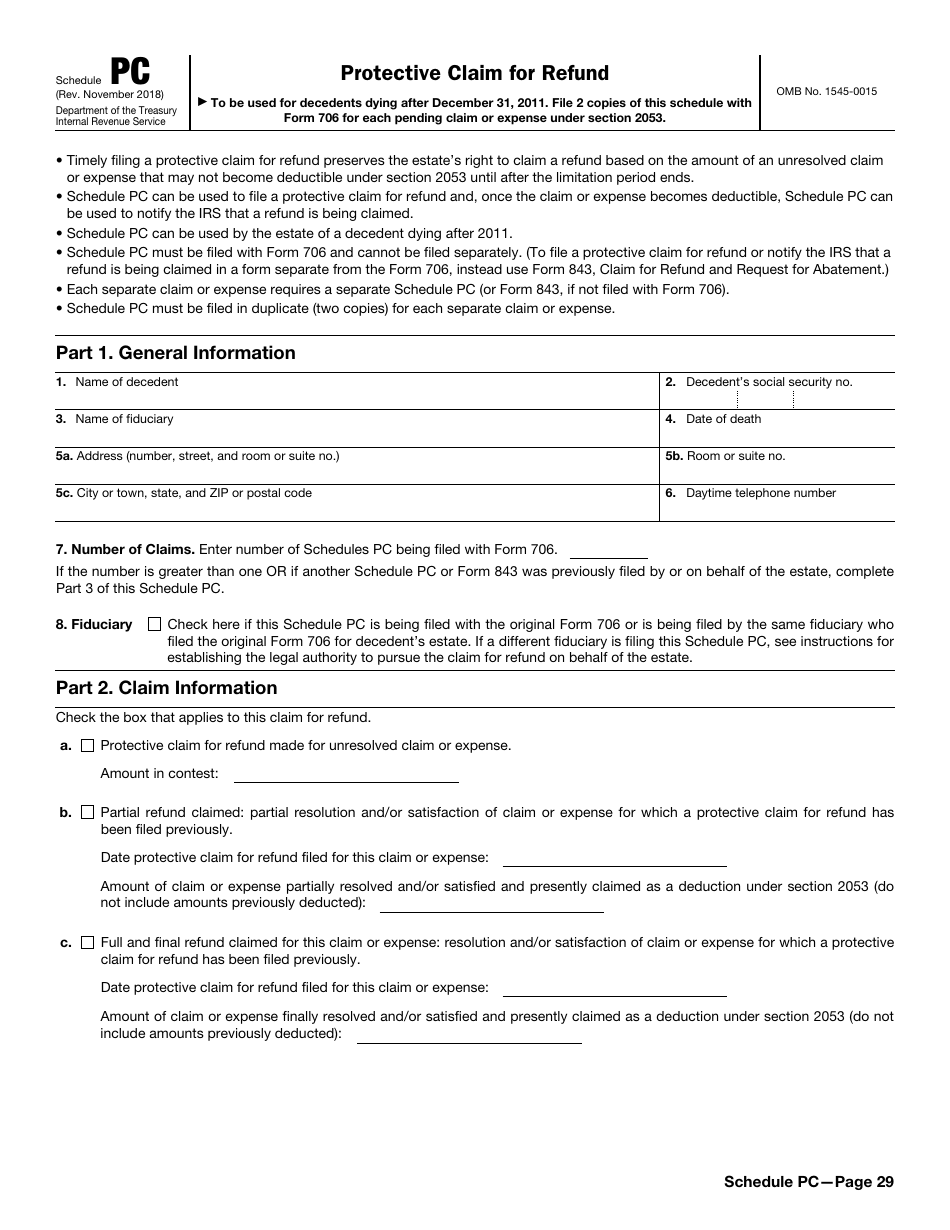

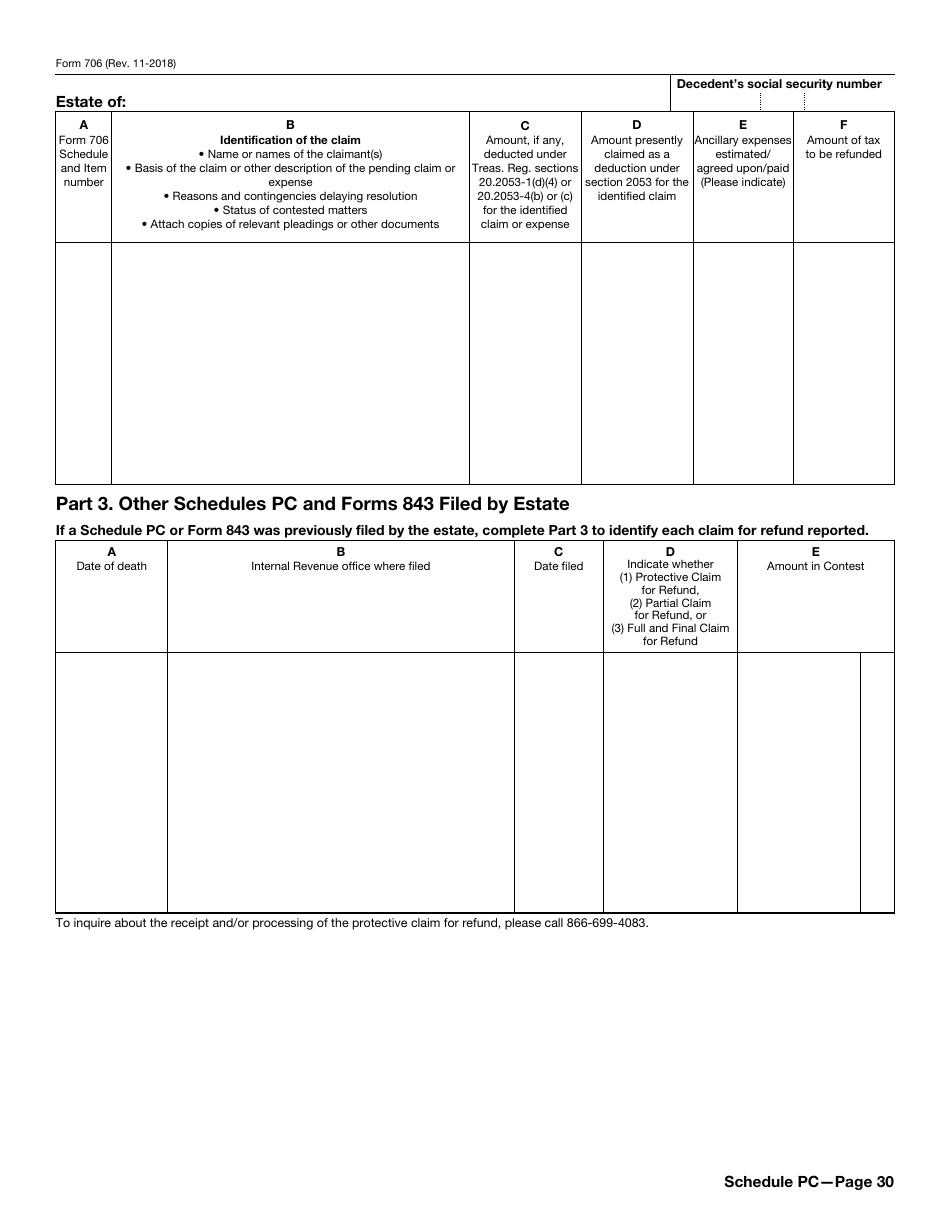

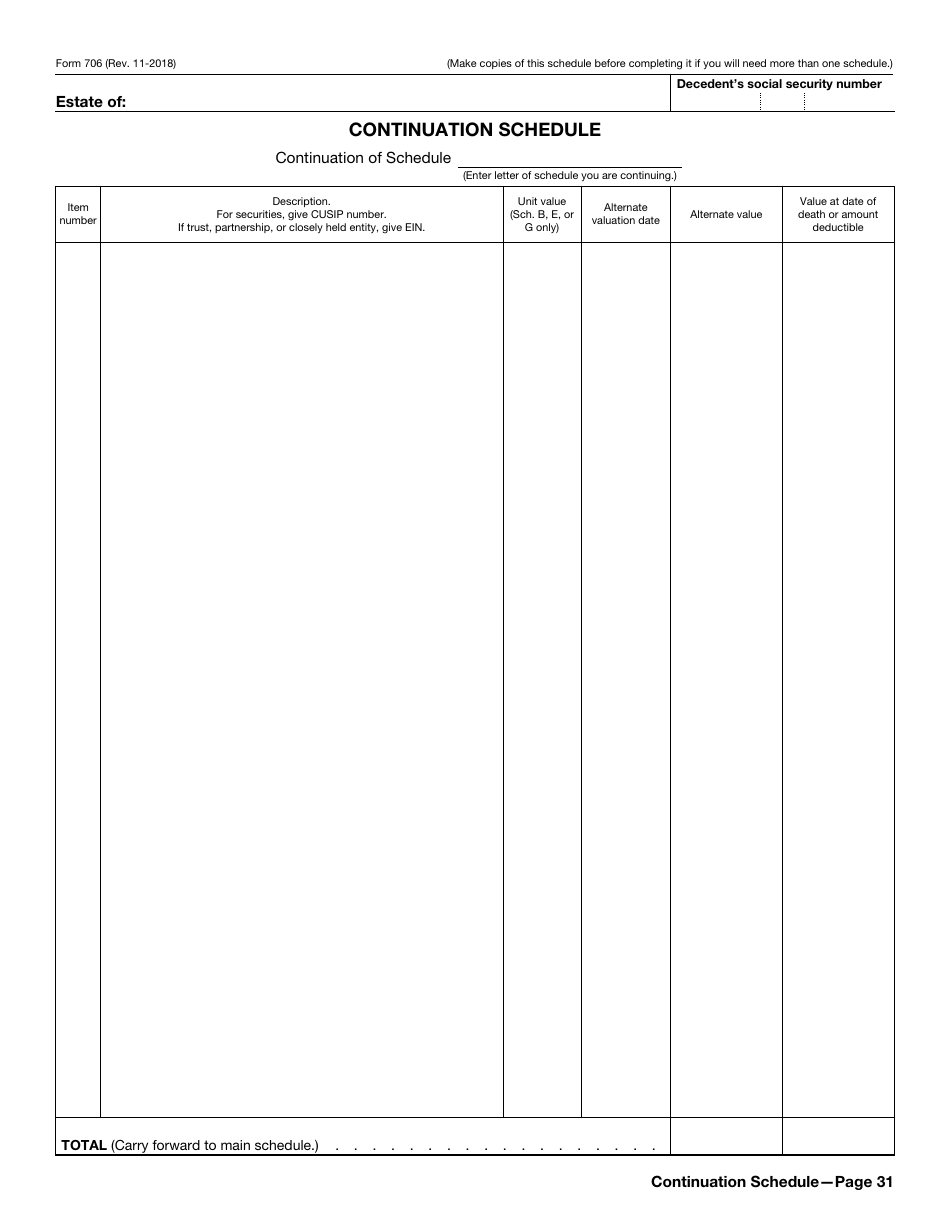

IRS Form 706 United States Estate (And Generation-Skipping Transfer) Tax Return

What Is IRS Form 706?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 706?

A: IRS Form 706 is the United States Estate (And Generation-Skipping Transfer) Tax Return.

Q: Who needs to file IRS Form 706?

A: IRS Form 706 needs to be filed by the executor of the estate of a deceased person.

Q: What is the purpose of IRS Form 706?

A: The purpose of IRS Form 706 is to calculate and report any estate taxes and generation-skipping transfer taxes that may be owed.

Q: When is IRS Form 706 due?

A: IRS Form 706 is generally due within 9 months after the date of the decedent's death.

Q: What information is required to complete IRS Form 706?

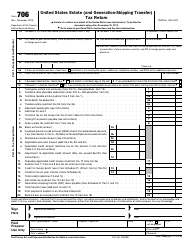

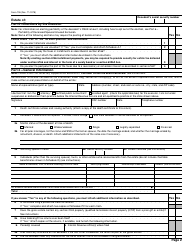

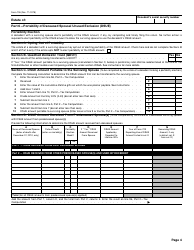

A: To complete IRS Form 706, you will need information about the decedent's assets, debts, and other relevant financial information.

Q: Are there any penalties for not filing IRS Form 706?

A: Yes, there may be penalties for not filing IRS Form 706 or for filing it late. It is important to meet the deadline and submit the form accurately to avoid penalties.

Form Details:

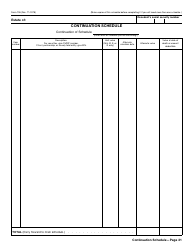

- A 31-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 706 through the link below or browse more documents in our library of IRS Forms.