This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 943

for the current year.

IRS Form 943 Employer's Annual Federal Tax Return for Agricultural Employees

What Is Form 943?

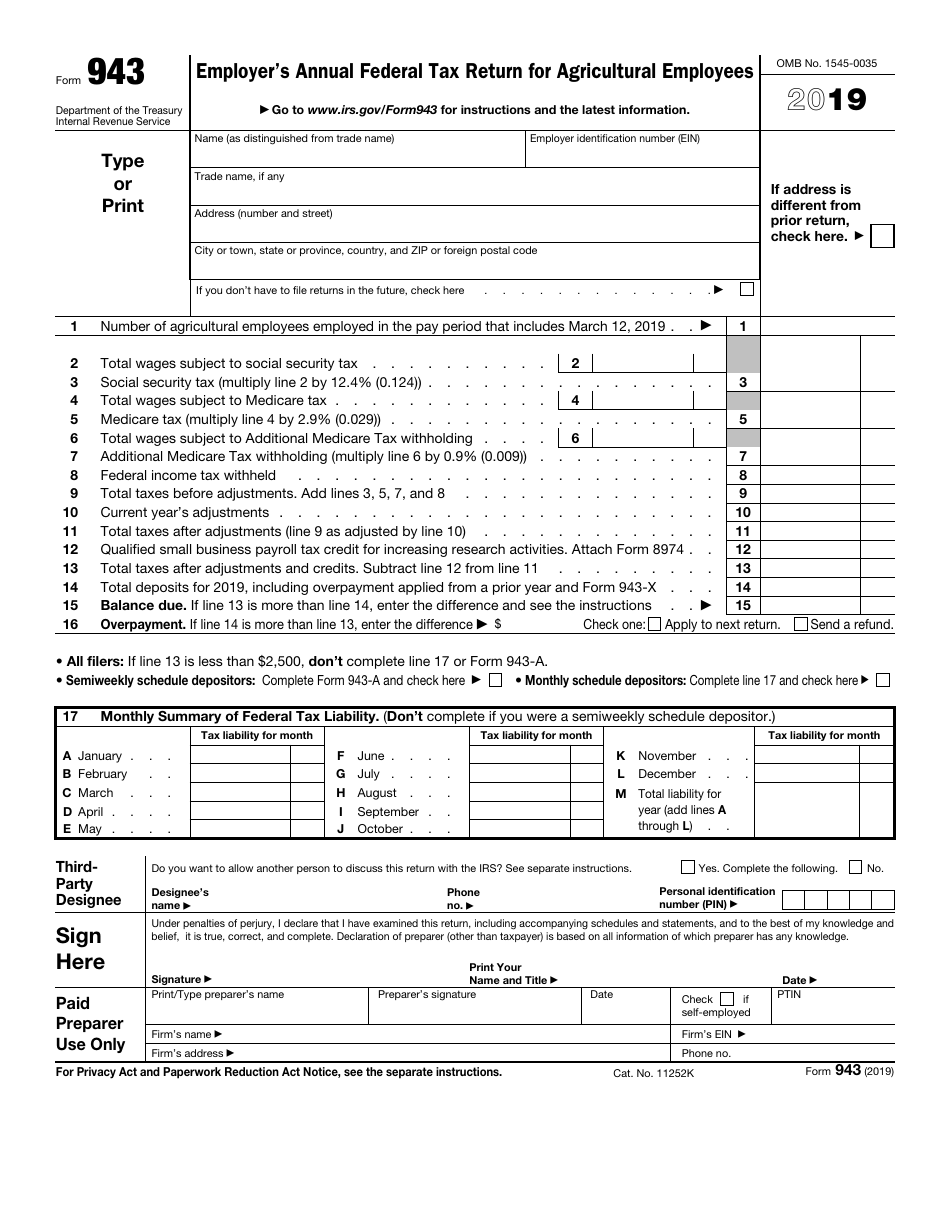

IRS Form 943, Employer's Annual Federal Tax Return for Agricultural Employees is a document you need to file if you paid wages in the reported tax year to one or more farmworkers. It was issued by the Internal Revenue Service (IRS) and was last revised in 2019 . Download the latest Form 943 fillable version through the link below.

You are required to file this form for your annual federal tax return if the wages you paid to your farmworkers were subject to federal income, Medicare, or social security tax withholdings:

- $150 test: you paid cash wages of $150 or more per year to one employee. If you employ a family, each member is treated as a separate worker;

- $2,500 test: you paid $2,500 or more total wages (including cash and non-cash payments) to all the farmworkers you employed.

If one of the above-mentioned payments applies to you, file the IRS 943 Form.

IRS Form 943 Instructions

The IRS provides separate Form 943 instructions with the detailed line-by-line filling out guide. Most fields of the form are self-explanatory. The general instructions for completing and filing the document are as follows:

- After filing the first form, submit it every year until filing your final report, no matter if you have any taxes to report or not;

- If you are an IRS approved agent or a Certified Professional Employer Organization, complete and submit IRS Form Schedule R, Allocation Schedule for Aggregate Form 943 Filers each time you submit your aggregate IRS 943 Form;

- The form requires entering the Employer Identification Number (EIN). If you do not have an EIN, apply for it online, or via Form SS-4. Do not use your individual taxpayer identification number or Social Security number instead;

- Enter the legal name you used to apply for your EIN in the box "Name";

- Make sure you have checked the box above the Line 1 if you are not going to pay any wages in the future;

- If you have sold or transferred your business to another person, attach a statement containing the name and address of this person, and the date of sale or transfer to your form;

- Do not include pensioners, members of Armed Forces, household employees, and employees who received no payments during the reporting period when reporting the number of agricultural employees;

- Enter the cent amounts to the right of the preprinted line, and dollar amounts to the left. Do not round the amounts you enter to the whole dollar. Always make an entry for cents, even if the cent amount is zero;

- If you cannot pay the full amount you owe, apply for an installment agreement (permission to pay the tax in monthly installments) online;

- Do not make entries in both Lines 15 and 16; and

- Fill out Line 17 only if you are a monthly tax depositor.

The due date for Form 943 is January 31 . You may submit it by February 11 if you made deposits on time and in full payment of the due taxes. If you fail to file your form on time, the IRS will send you a notice containing a penalty you have to pay. Reply to it providing an explanation of the late filing, and the IRS will determine if you meet the reasonable-cause criteria. Do not submit the explanation with your return form.

Where Do I Mail Form 943?

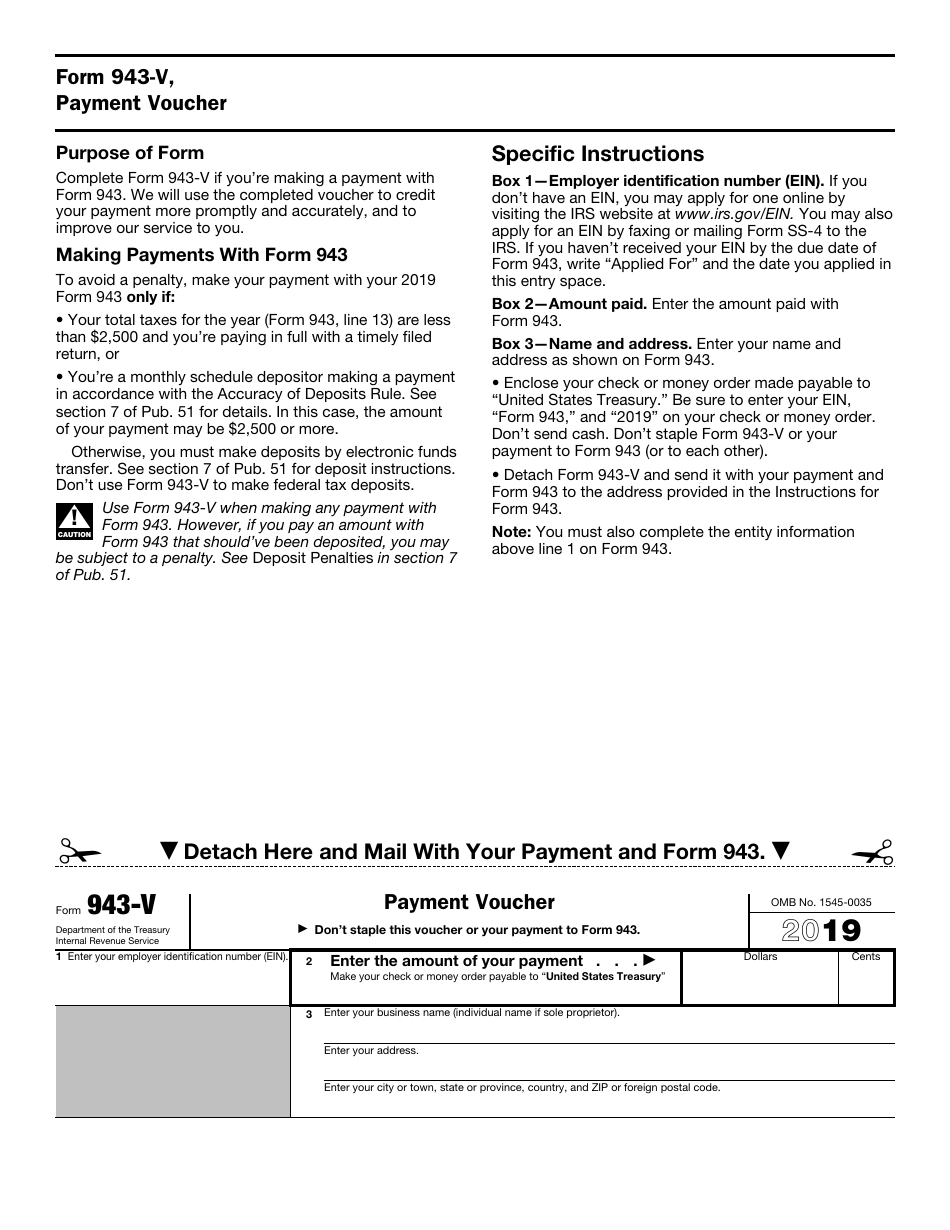

The address you use to mail the form depends on the state and the date you file your form. Besides, it is important whether you file your tax return with or without payment. Find where to mail the completed form in the Instructions for Form 943 issued by the IRS. The Instructions contain two tables with the mailing addresses. If you file the form after June 17, 2019, use the appropriate address from the second table.

Can Form 943 Be Filed Electronically?

To speed up the processing, file your IRS Form 943 electronically. You can do it by e-file or by using the Electronic Federal Tax Payment System (EFTPS). To e-file, you will need to purchase the IRS-approved software or use an authorized IRS e-file provider. The e-filing may require paying a fee. To use the EFTPS you need to enroll and receive your credentials first. You can use this system for free.

IRS 943 Related Forms:

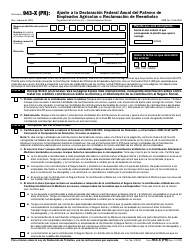

- Complete the related IRS Form 943-A, Agricultural Employer's Record of Federal Tax Liability if you are a semi-weekly schedule depositor. The form is used to report only tax liability: federal income tax withheld, as well as employer and employee Medicare and Social Security taxes. Do not enter federal tax deposits on this form. The IRS uses the information you provide via this form to determine if you have timely deposited tax liabilities indicated on the document. The semi-weekly depositors who do not fill out and submit Form 943-A with IRS 943 Form may be subject to penalties. IRS Form 943-X (PR) is a Spanish version of the form.

- IRS Form 943-X, Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refundis used to correct errors on a previously filed Form 943.

- IRS Form 943-PR, Planilla Para La Declaracion Anual De La Contribucion Federal Del Patrono De Empleados Agricolas is a Spanish version of the main form.