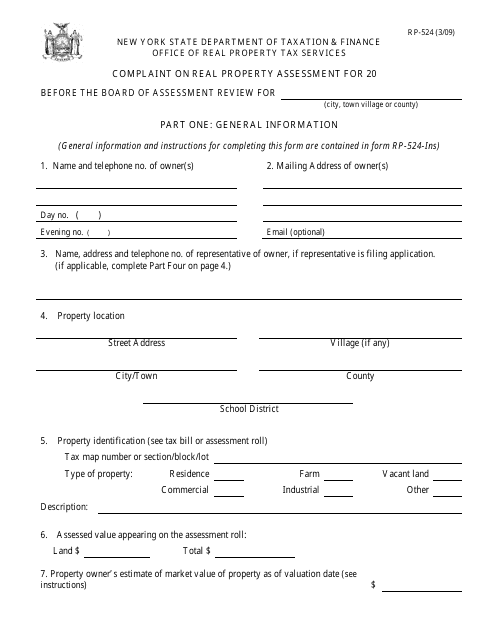

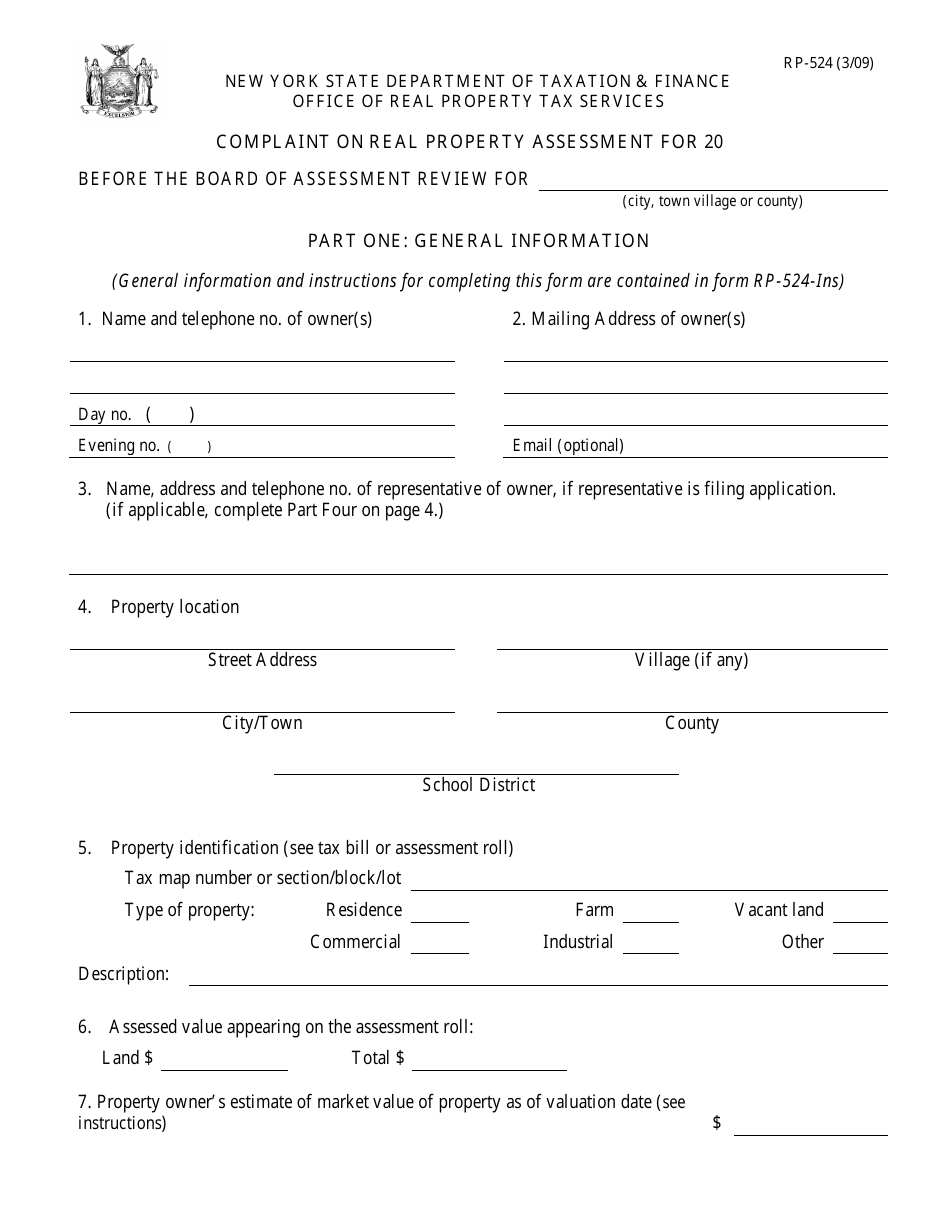

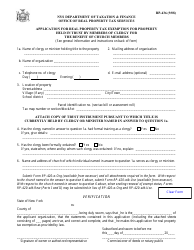

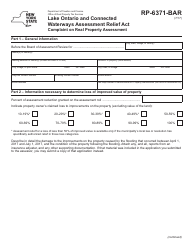

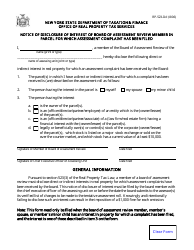

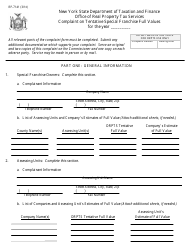

Form RP-524 Complaint on Real Property Assessment - New York

What Is Form RP-524?

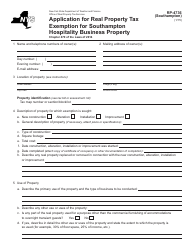

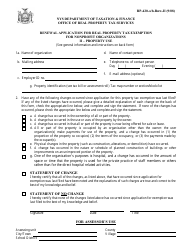

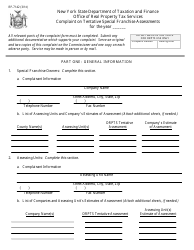

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RP-524?

A: Form RP-524 is a complaint form used in New York for challenging real property assessments.

Q: What is the purpose of Form RP-524?

A: The purpose of Form RP-524 is to initiate a complaint against the assessed value of real property.

Q: Who can file Form RP-524?

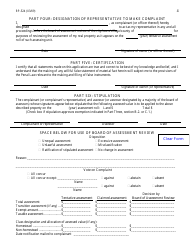

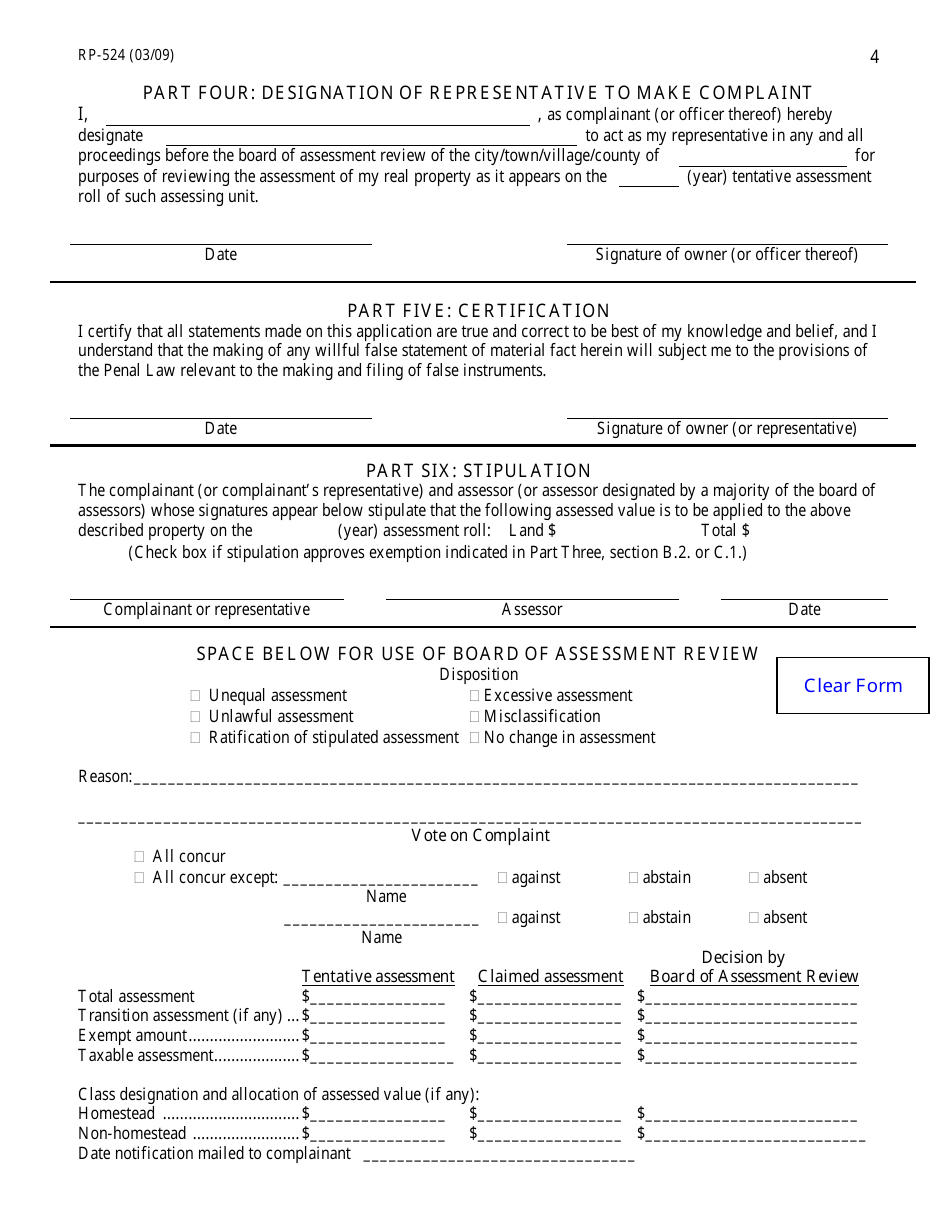

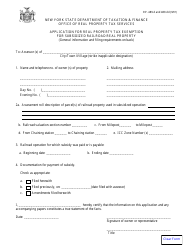

A: Property owners or their representatives can file Form RP-524.

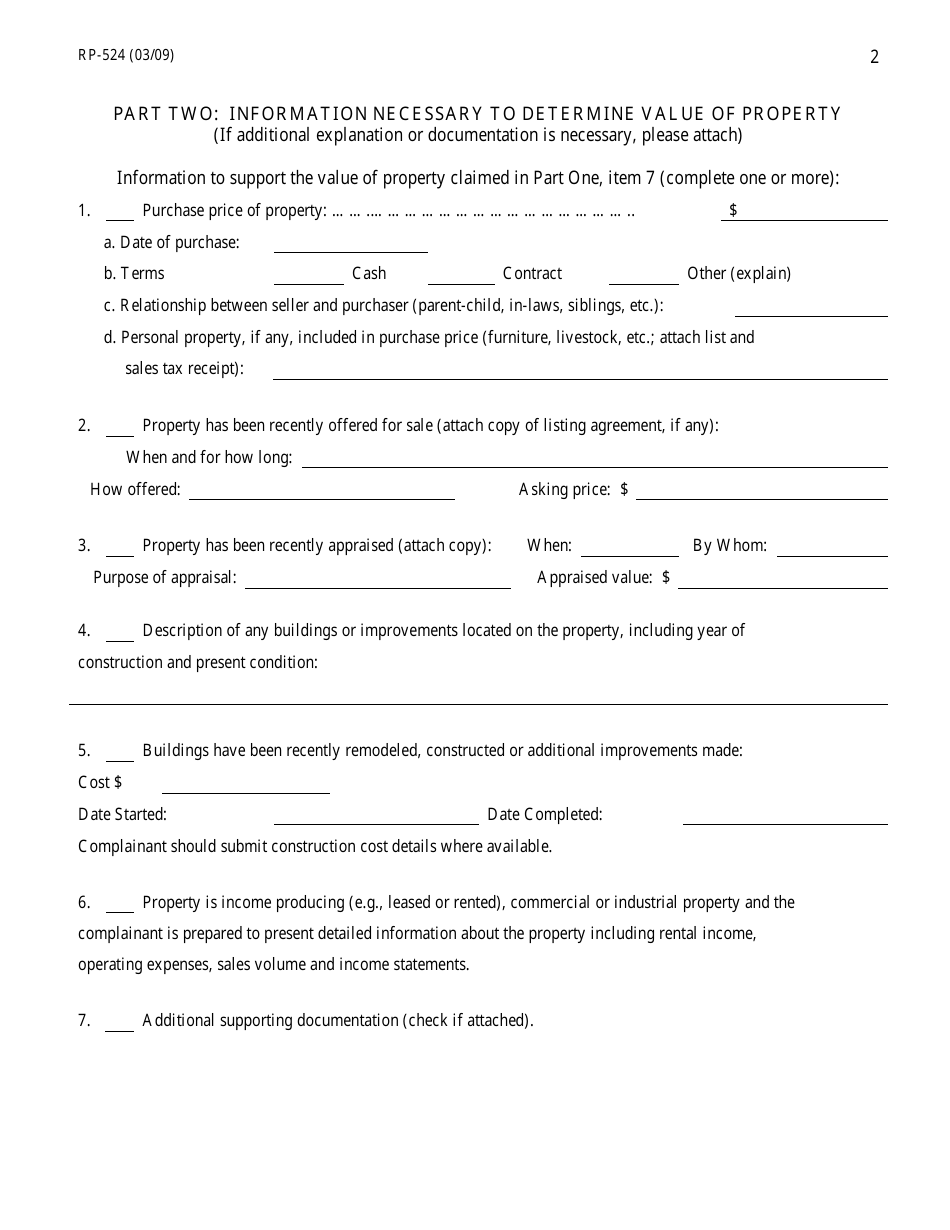

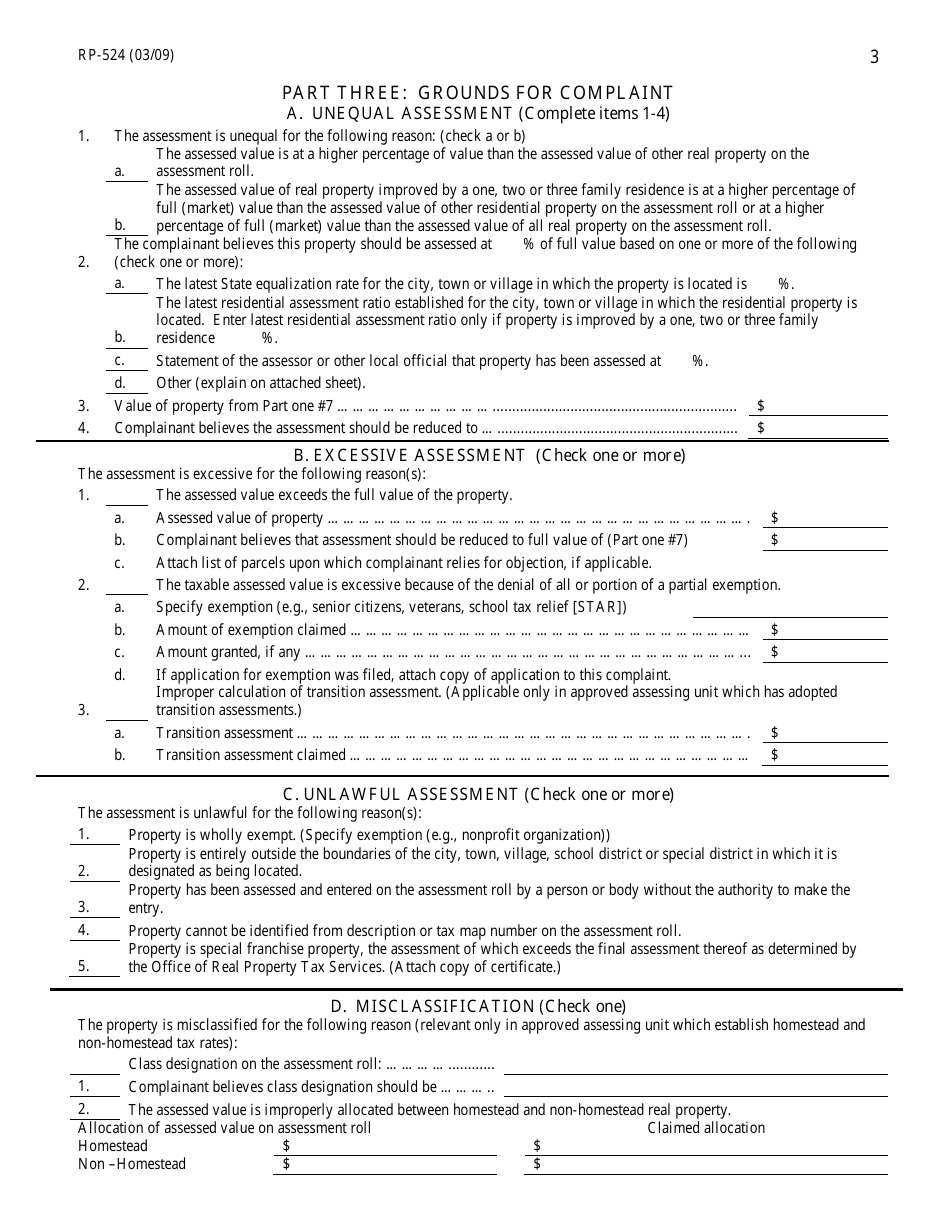

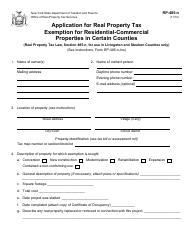

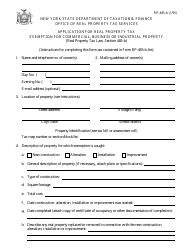

Q: What information is required on Form RP-524?

A: Form RP-524 requires information such as the property description, reasons for the complaint, and supporting documentation.

Q: Are there any fees associated with filing Form RP-524?

A: There is no fee to file Form RP-524 in New York.

Q: What happens after filing Form RP-524?

A: After filing Form RP-524, the assessor will review the complaint and a hearing may be scheduled to resolve the dispute.

Q: What should I do if I disagree with the determination of my complaint?

A: If you disagree with the determination, you may have the option to further appeal the decision.

Q: Can I file Form RP-524 for multiple properties?

A: Yes, you can file Form RP-524 for multiple properties if you have complaints against their assessed values.

Q: Is there a deadline for filing Form RP-524?

A: Yes, there is usually a deadline for filing Form RP-524, which is typically on or before Taxable Status Date.

Form Details:

- Released on March 1, 2009;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-524 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.