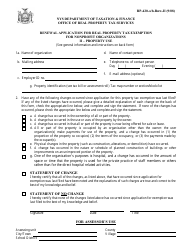

Instructions for Form RP-524 Complaints on Real Property Assessments - New York

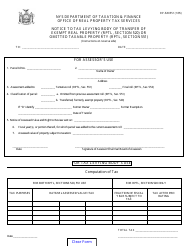

This document contains official instructions for Form RP-524 , Complaints on Real Property Assessments - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form RP-524 is available for download through this link.

FAQ

Q: What is Form RP-524?

A: Form RP-524 is a complaint form used to file a complaint about real property assessments in New York.

Q: Who can use Form RP-524?

A: Any property owner, school district, municipality, or other person with a legal interest in real property in New York can use Form RP-524.

Q: What can I file a complaint about using Form RP-524?

A: You can file a complaint about the assessed value of your property, inequitable assessments, or improper exemption denials using Form RP-524.

Q: How do I file a complaint using Form RP-524?

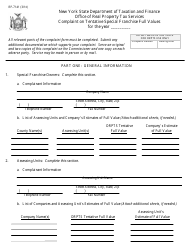

A: To file a complaint, complete and sign Form RP-524 and submit it to your local assessor's office, along with any supporting documentation.

Q: Is there a deadline for filing a complaint using Form RP-524?

A: Yes, the deadline for filing a complaint using Form RP-524 is the third Tuesday in May, or within 30 days of the filing of the final assessment roll, whichever is later.

Q: What happens after I file a complaint using Form RP-524?

A: After you file a complaint using Form RP-524, the local Board of Assessment Review will review your complaint and make a determination.

Q: Can I appeal the decision made by the local Board of Assessment Review?

A: Yes, if you are not satisfied with the decision made by the local Board of Assessment Review, you can appeal to the New York State Supreme Court within 30 days of receiving the Board's determination.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.