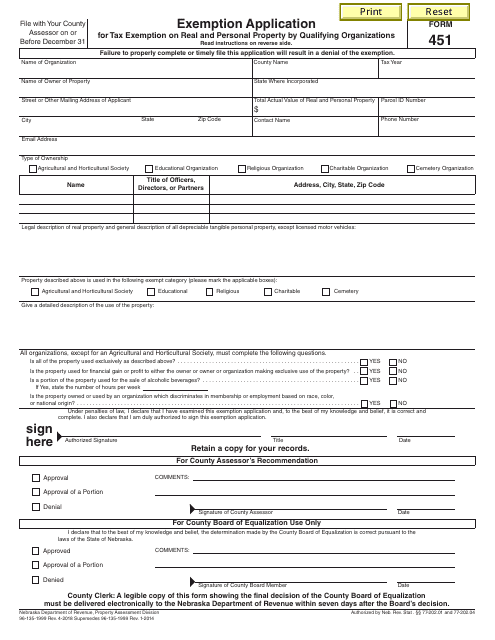

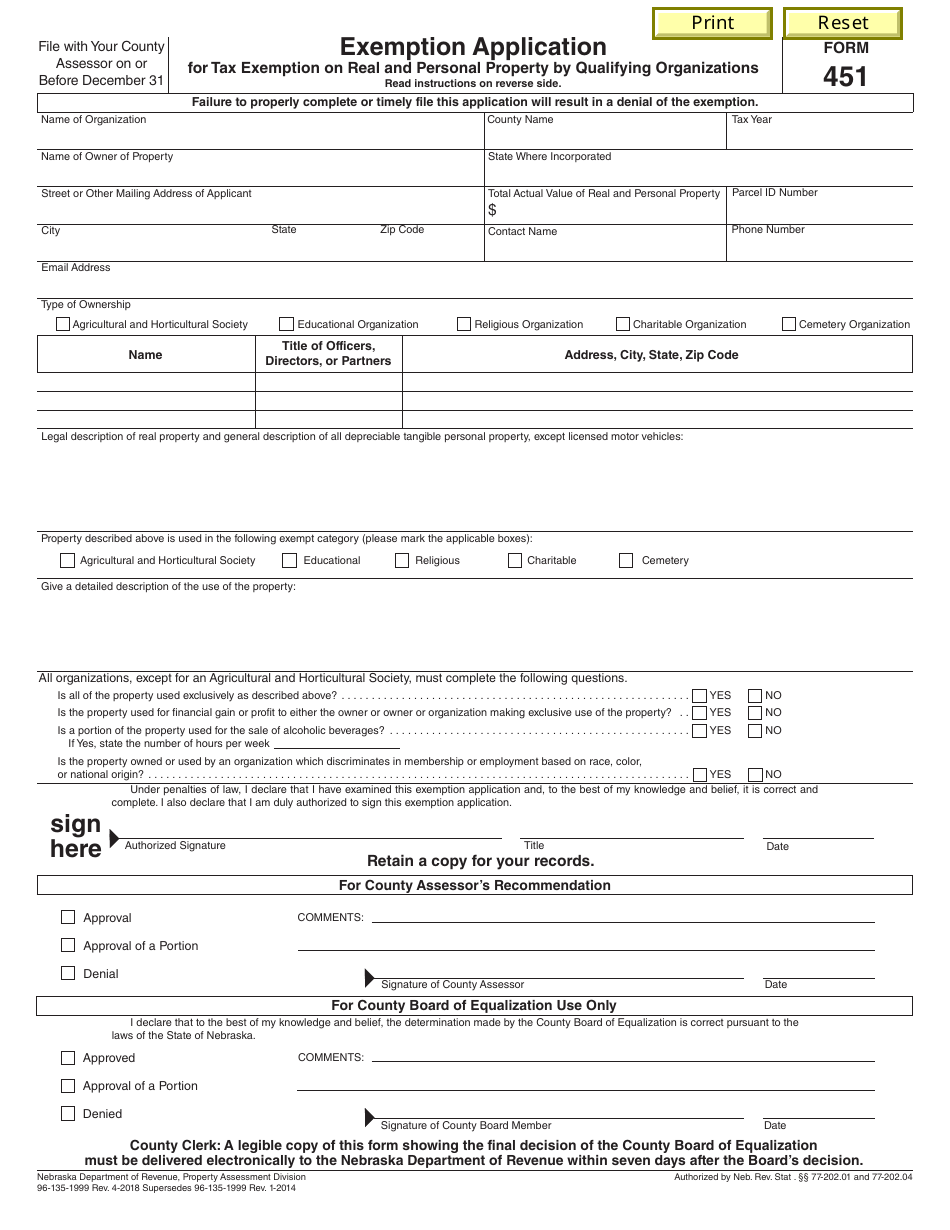

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 451

for the current year.

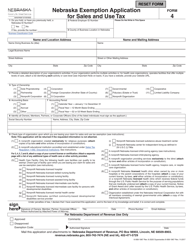

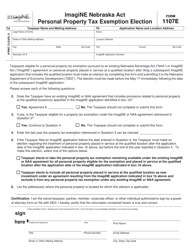

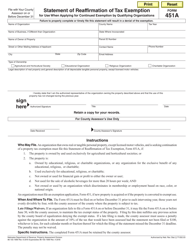

Form 451 Exemption Application for Tax Exemption on Real and Personal Property by Qualifying Organizations - Nebraska

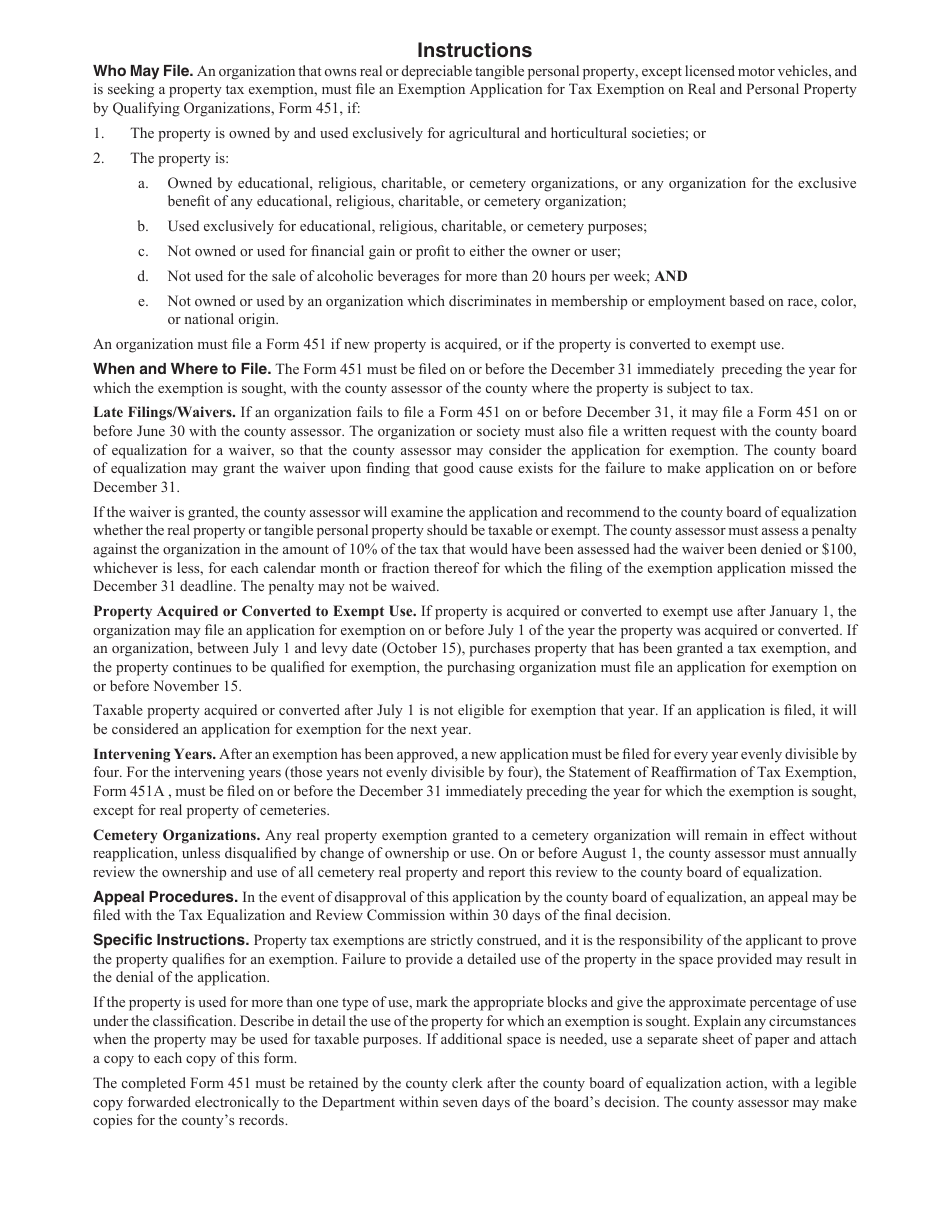

What Is Form 451?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 451?

A: Form 451 is an application for tax exemption on real and personal property in Nebraska.

Q: Who can use Form 451?

A: Qualifying organizations in Nebraska can use Form 451 to apply for tax exemption.

Q: What is tax exemption on real and personal property?

A: Tax exemption on real and personal property means that qualifying organizations do not have to pay property taxes on their properties.

Q: Are all organizations eligible for tax exemption?

A: No, only qualifying organizations are eligible for tax exemption.

Q: What are qualifying organizations?

A: Qualifying organizations include non-profit organizations, religious organizations, and certain educational and charitable organizations.

Q: What is the purpose of Form 451?

A: The purpose of Form 451 is to apply for tax exemption on real and personal property in Nebraska.

Q: Is there a deadline for filing Form 451?

A: Yes, Form 451 must be filed on or before December 31st of the year preceding the tax year for which the exemption is being sought.

Q: What information is required on Form 451?

A: Form 451 requires information about the organization, the property being claimed for exemption, and the reasons for seeking tax exemption.

Q: Who should I contact for more information about Form 451?

A: You should contact the Nebraska Department of Revenue for more information about Form 451.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 451 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.