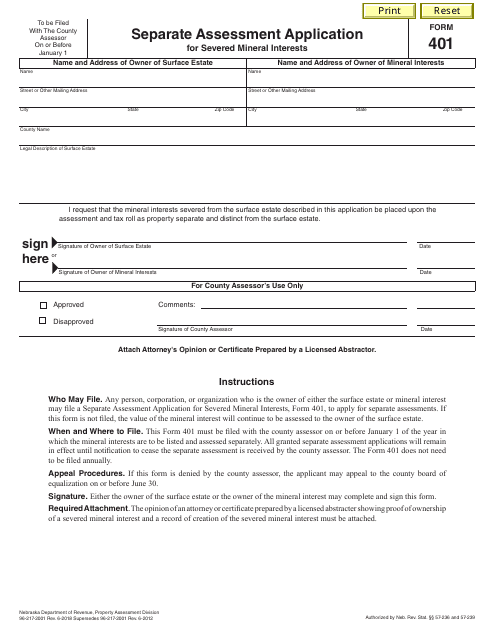

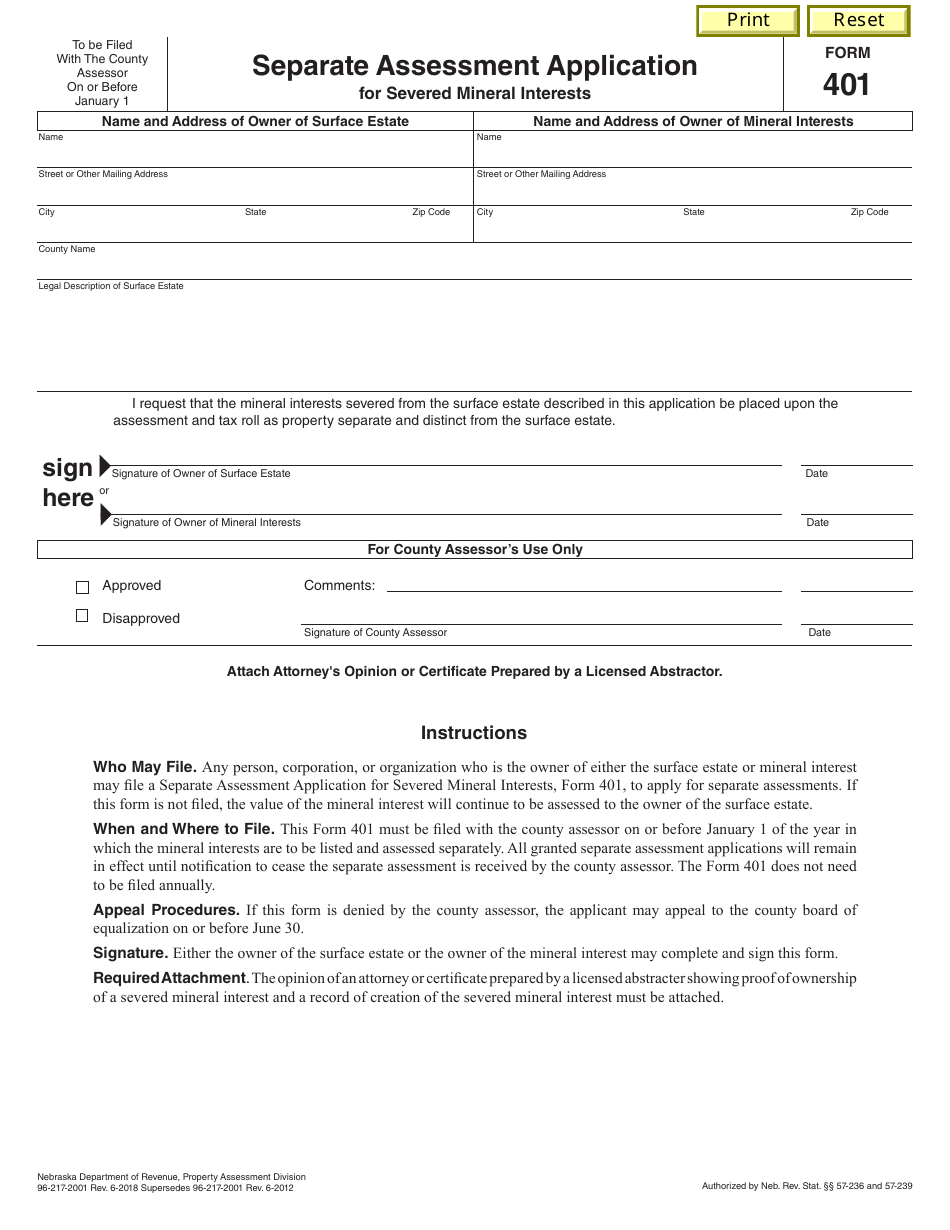

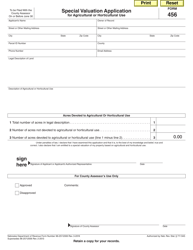

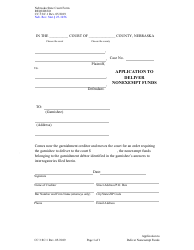

Form 401 Separate Assessment Application for Severed Mineral Interests - Nebraska

What Is Form 401?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 401?

A: Form 401 is an application for separate assessment for severed mineral interests in Nebraska.

Q: What is a severed mineral interest?

A: A severed mineral interest refers to the ownership of mineral rights separate from surface rights on a property.

Q: Why would someone need to file a Form 401?

A: Someone may need to file a Form 401 to request a separate assessment for their severed mineral interests, which can affect their property taxes.

Q: What information is required on the Form 401?

A: The Form 401 requires information about the property, the owner's contact information, and details about the severed mineral interests.

Q: Is there a fee to file a Form 401?

A: Yes, there is a filing fee for submitting a Form 401, which varies depending on the county.

Q: What is the deadline for filing a Form 401?

A: The deadline for filing a Form 401 is on or before June 30th of the assessment year.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 401 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.