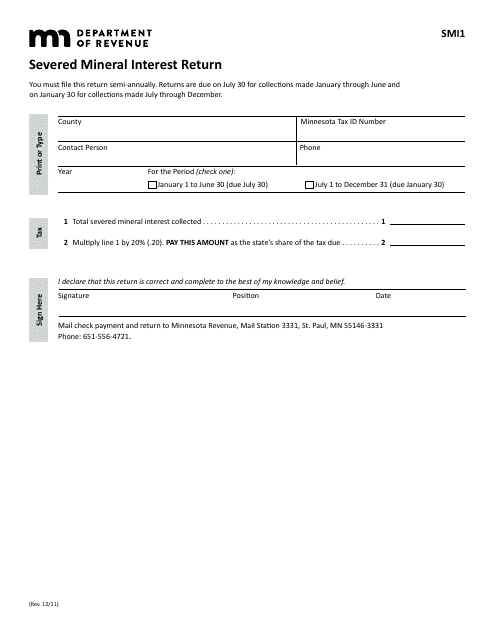

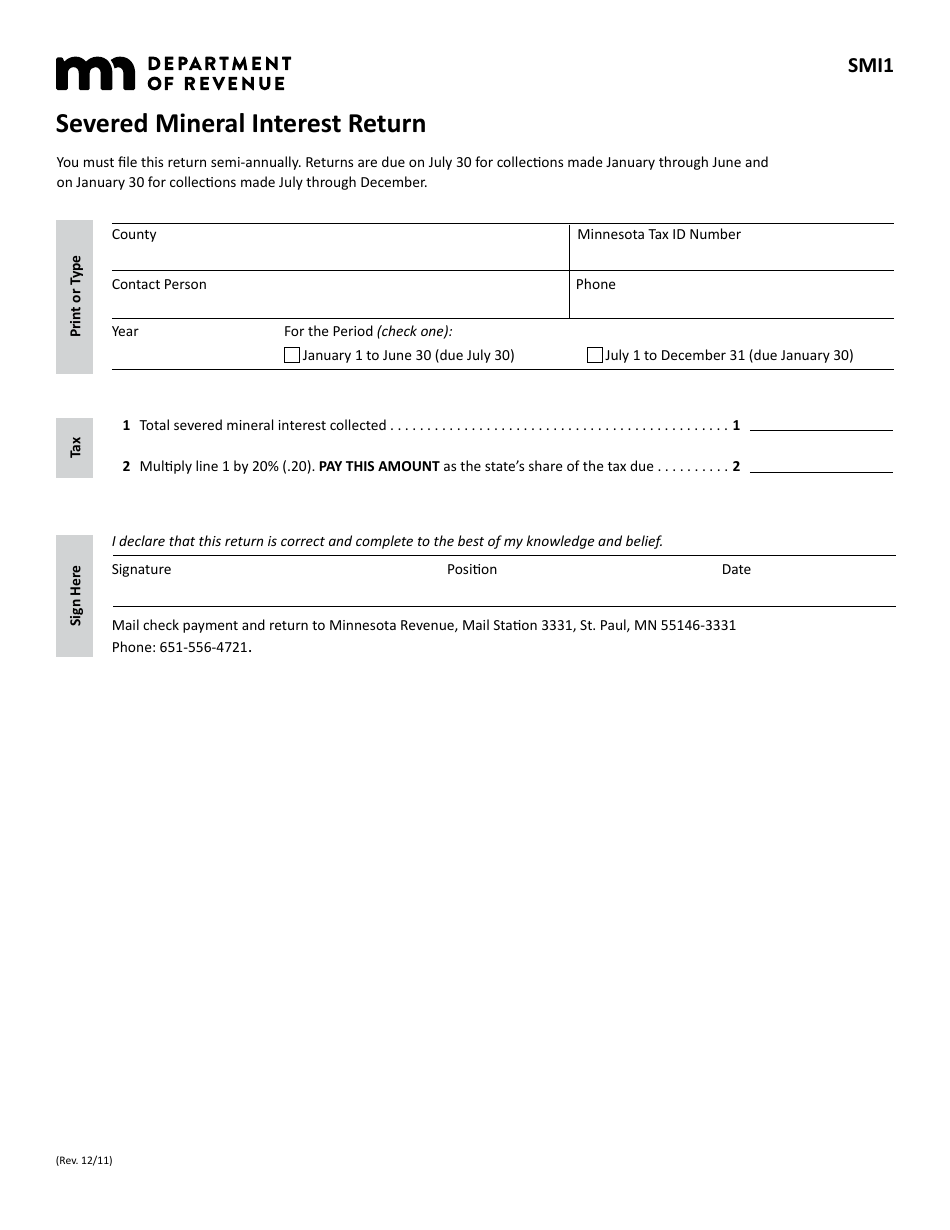

Form SMI1 Severed Mineral Interest Return - Minnesota

What Is Form SMI1?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SMI1?

A: Form SMI1 is the Severed Mineral Interest Return in Minnesota.

Q: Who needs to file Form SMI1?

A: Any person or entity with a severed mineral interest in Minnesota needs to file Form SMI1.

Q: What is a severed mineral interest?

A: A severed mineral interest is when the rights to the minerals below the surface of a property are owned separately from the surface rights.

Q: What information is required on Form SMI1?

A: Form SMI1 requires information about the owner of the severed mineral interest, the property where the interest is located, and details about the interest itself.

Q: When is Form SMI1 due?

A: Form SMI1 is due by the end of January following the calendar year in which the interest was severed.

Q: Are there any penalties for not filing Form SMI1?

A: Yes, there are penalties for not filing Form SMI1, including late filing penalties and interest on unpaid amounts.

Q: Can Form SMI1 be filed electronically?

A: Yes, Form SMI1 can be filed electronically through the Minnesota Department of Revenue's e-Services system.

Form Details:

- Released on December 1, 2011;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SMI1 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.