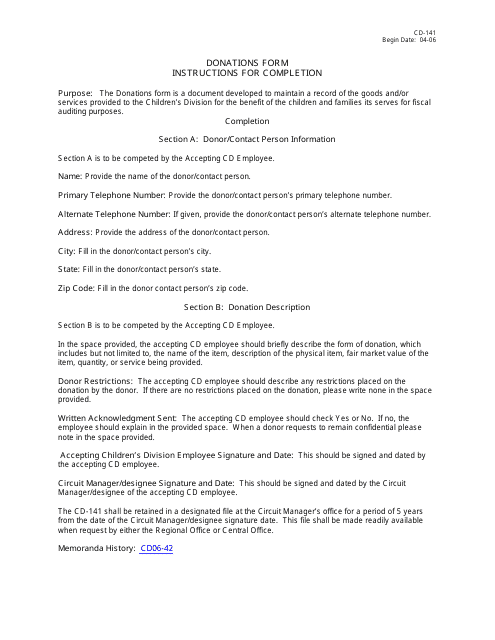

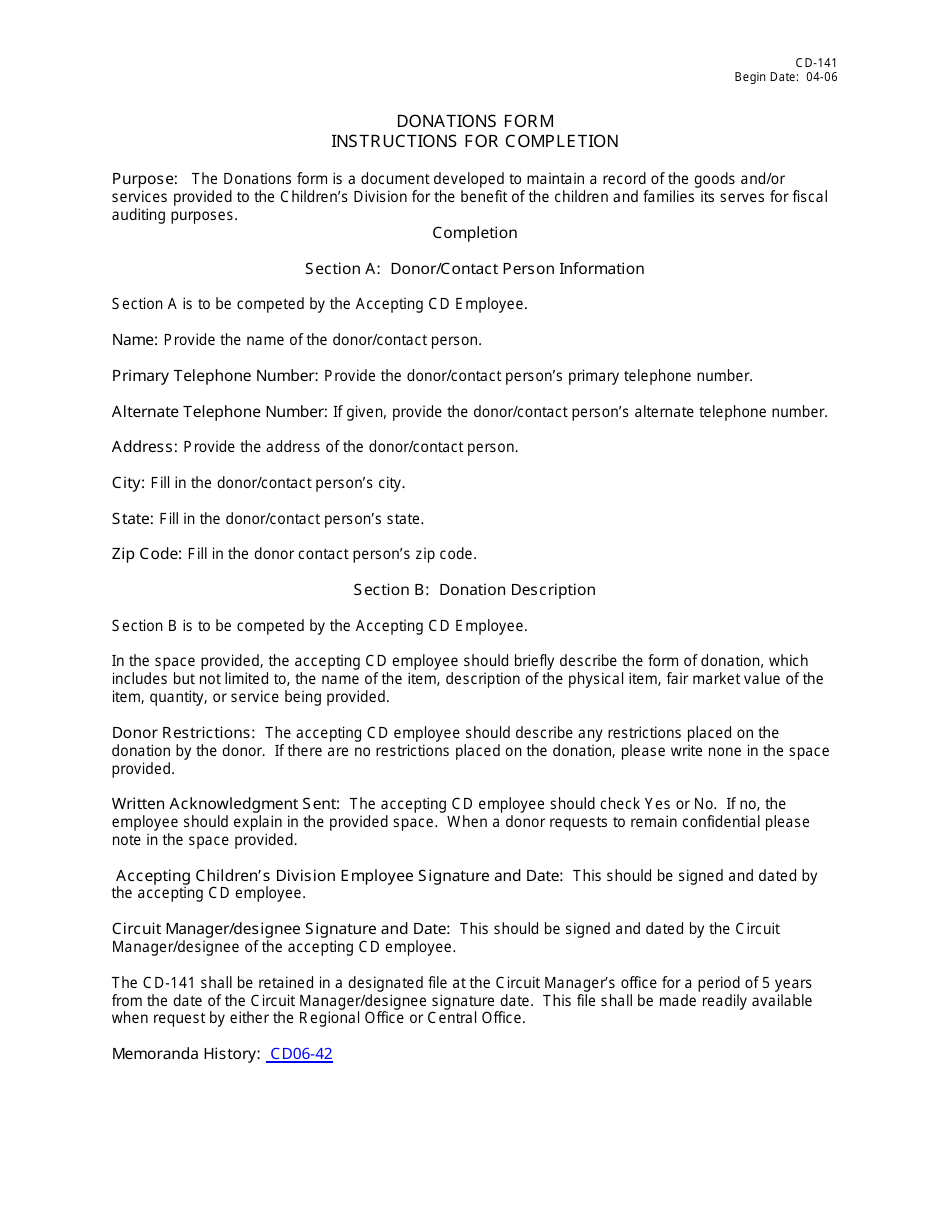

Instructions for Form CD-141 Donations Form - Missouri

This document contains official instructions for Form CD-141 , Donations Form - a form released and collected by the Missouri Department of Social Services.

FAQ

Q: What is Form CD-141?

A: Form CD-141 is a Donations Form for the state of Missouri.

Q: Who needs to file Form CD-141?

A: Individuals or organizations that make qualified donations in the state of Missouri need to file Form CD-141.

Q: What qualifies as a donation?

A: A donation is considered qualified if it is made to an eligible Missouri charitable organization.

Q: What information do I need to provide on Form CD-141?

A: You will need to provide your personal information, details of the donation, and information about the recipient charitable organization.

Q: When is the deadline to file Form CD-141?

A: Form CD-141 must be filed with the Missouri Department of Revenue by April 15th of the following year.

Q: Is there a fee to file Form CD-141?

A: There is no fee to file Form CD-141.

Q: Can I claim a deduction for my donations on my federal tax return?

A: Yes, you may be eligible to claim a deduction for your donations on your federal tax return.

Q: Are there any limitations to the donation deduction?

A: Yes, there are limitations based on your adjusted gross income.

Q: Do I need to include supporting documentation with Form CD-141?

A: You do not need to include supporting documentation with Form CD-141, but you should keep it for your records in case of an audit.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Missouri Department of Social Services.