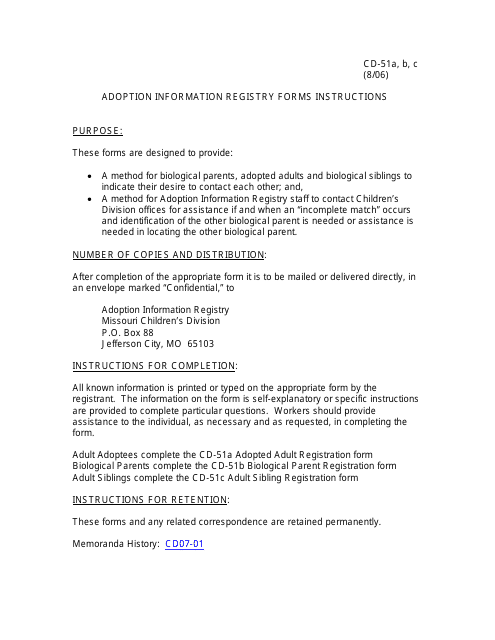

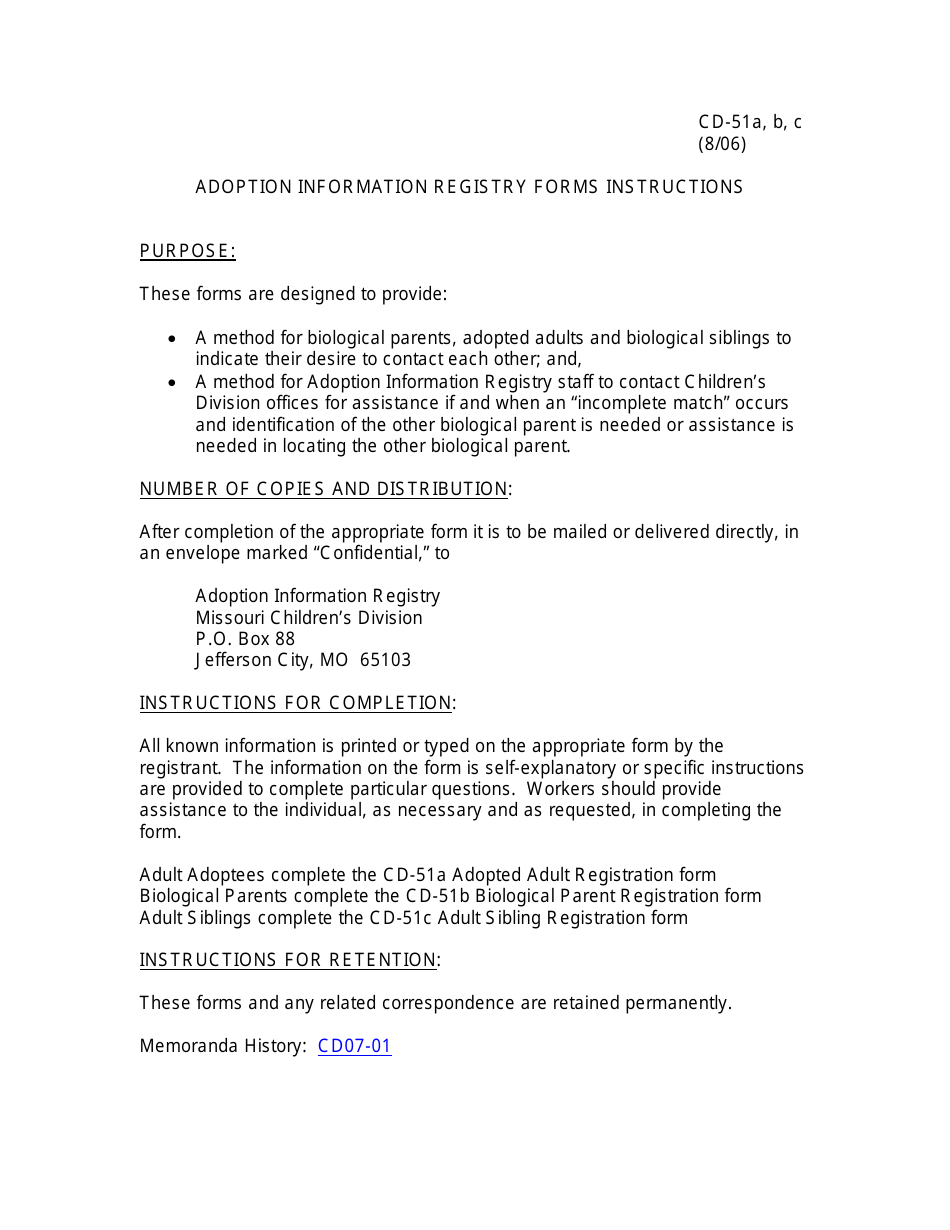

Instructions for Form CD-51A, CD-51B, CD-51C - Missouri

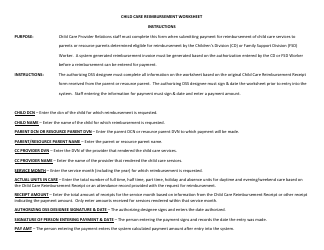

This document contains official instructions for Form CD-51A , Form CD-51B , and Form CD-51C . All forms are released and collected by the Missouri Department of Social Services.

FAQ

Q: What are Forms CD-51A, CD-51B, and CD-51C?

A: Forms CD-51A, CD-51B, and CD-51C are Missouri state tax forms.

Q: Who needs to fill out these forms?

A: These forms need to be filled out by taxpayers in Missouri.

Q: What is the purpose of Form CD-51A?

A: Form CD-51A is used to report Missouri income tax withheld from employees.

Q: What is the purpose of Form CD-51B?

A: Form CD-51B is used to report Missouri income tax withheld from non-employees.

Q: What is the purpose of Form CD-51C?

A: Form CD-51C is used to report Missouri income tax withheld by employers from nonresident entertainers and athletes.

Q: When are these forms due?

A: The due date for these forms varies. It is best to check the instructions provided with the forms or consult the Missouri Department of Revenue.

Q: Is there a penalty for late filing?

A: There may be penalties for late filing. It is recommended to file these forms on time to avoid any penalties.

Q: Are there any specific requirements for filling out these forms?

A: Yes, there are specific requirements and instructions provided with each form. It is important to carefully read and follow the instructions to fill out these forms accurately.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Missouri Department of Social Services.