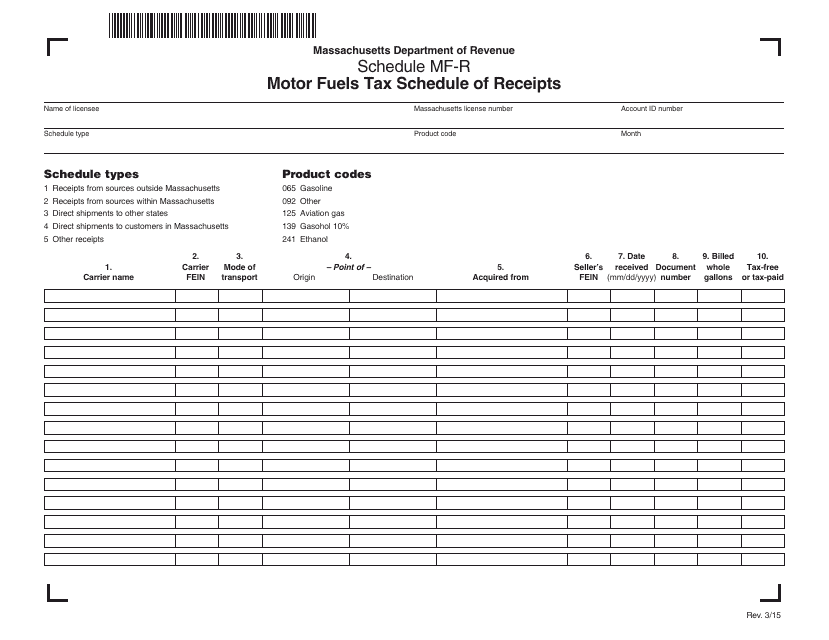

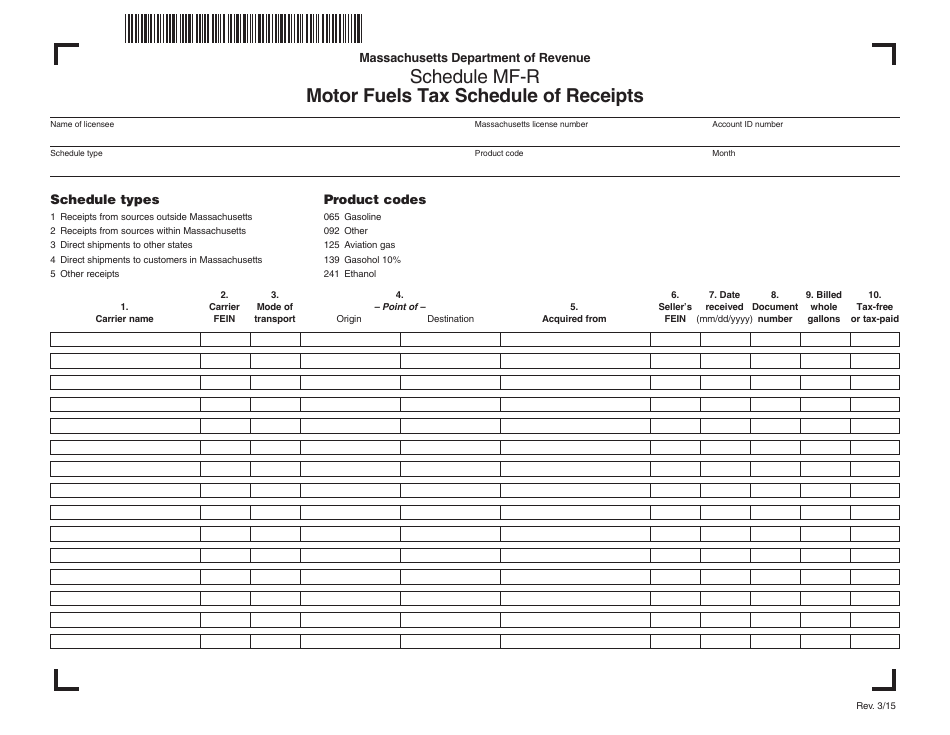

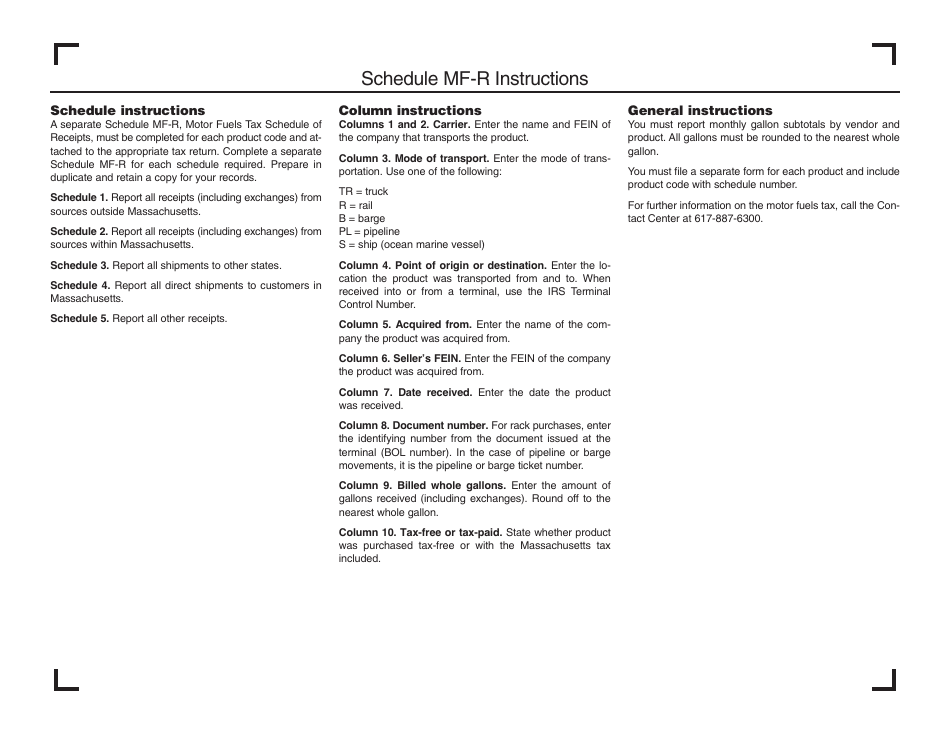

Schedule MF-R Motor Fuels Tax Schedule of Receipts - Massachusetts

What Is Schedule MF-R?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MF-R Motor Fuels Tax Schedule of Receipts?

A: The MF-R Motor Fuels Tax Schedule of Receipts is a schedule that tracks the receipts and distributions of motor fuels tax in Massachusetts.

Q: What is the purpose of the Schedule of Receipts?

A: The purpose of the Schedule of Receipts is to provide transparency and accountability in the collection and use of motor fuels tax revenues.

Q: Who is responsible for maintaining the Schedule of Receipts?

A: The Massachusetts Department of Revenue is responsible for maintaining the MF-R Motor Fuels Tax Schedule of Receipts.

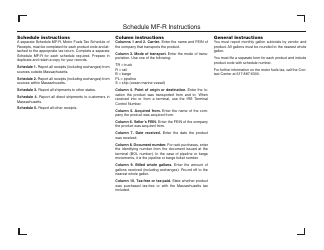

Q: What information is included in the Schedule of Receipts?

A: The Schedule of Receipts includes information on the total receipts collected, distributions to various funds, and any transfers or adjustments made.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule MF-R by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.