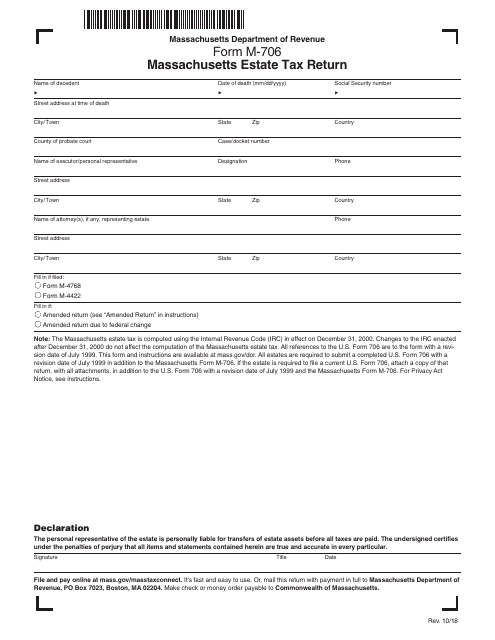

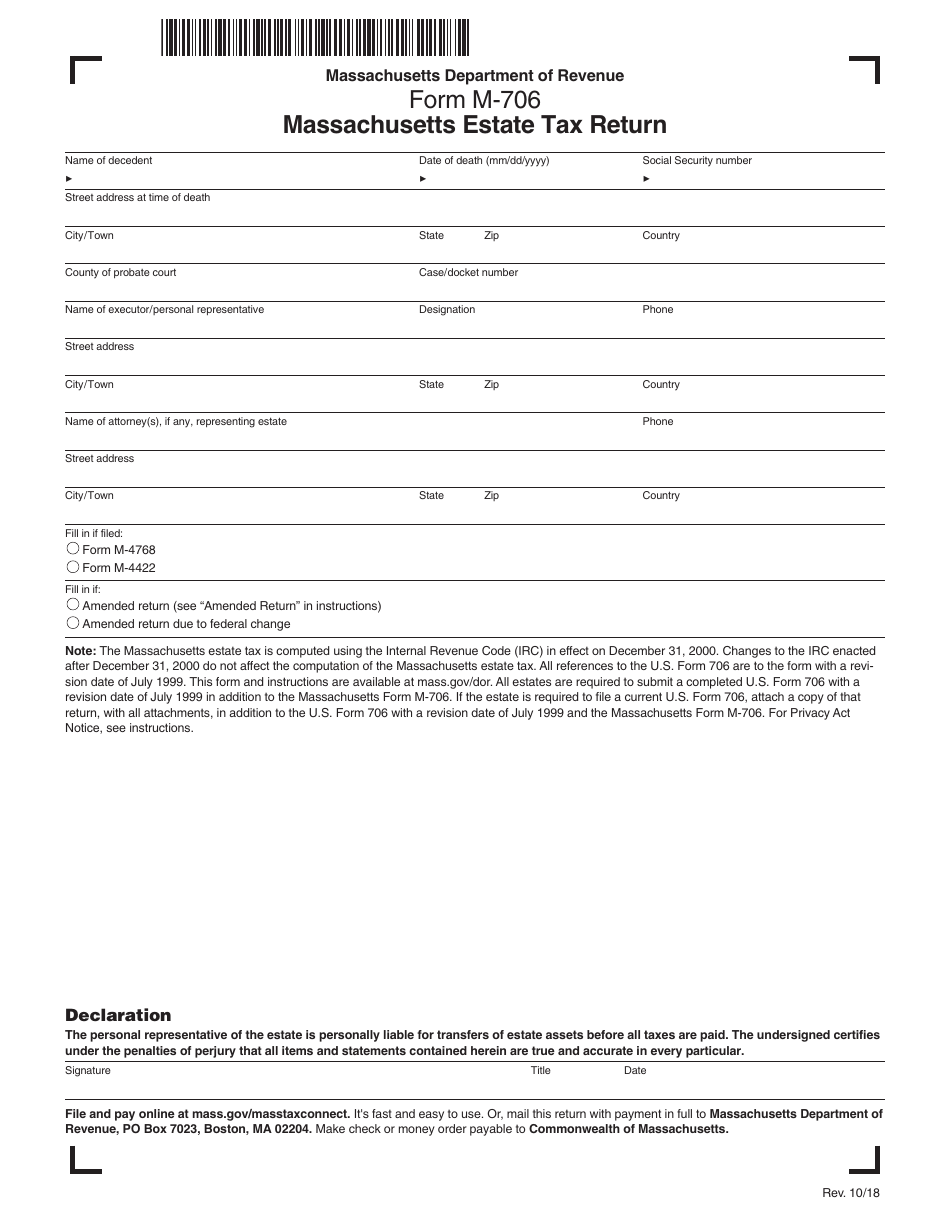

Form M-706 Massachusetts Estate Tax Return - Massachusetts

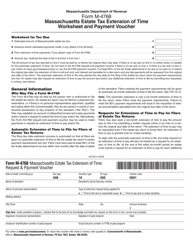

What Is Form M-706?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-706?

A: Form M-706 is the Massachusetts Estate Tax Return.

Q: Who needs to file Form M-706?

A: Anyone who is responsible for paying the Massachusetts estate tax must file Form M-706.

Q: What is the purpose of Form M-706?

A: The purpose of Form M-706 is to calculate and report the Massachusetts estate tax owed.

Q: When is Form M-706 due?

A: Form M-706 is generally due nine months after the date of the decedent's death.

Q: Are there any penalties for filing Form M-706 late?

A: Yes, if you fail to file Form M-706 by the due date, you may be subject to penalties and interest.

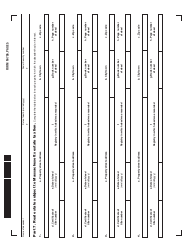

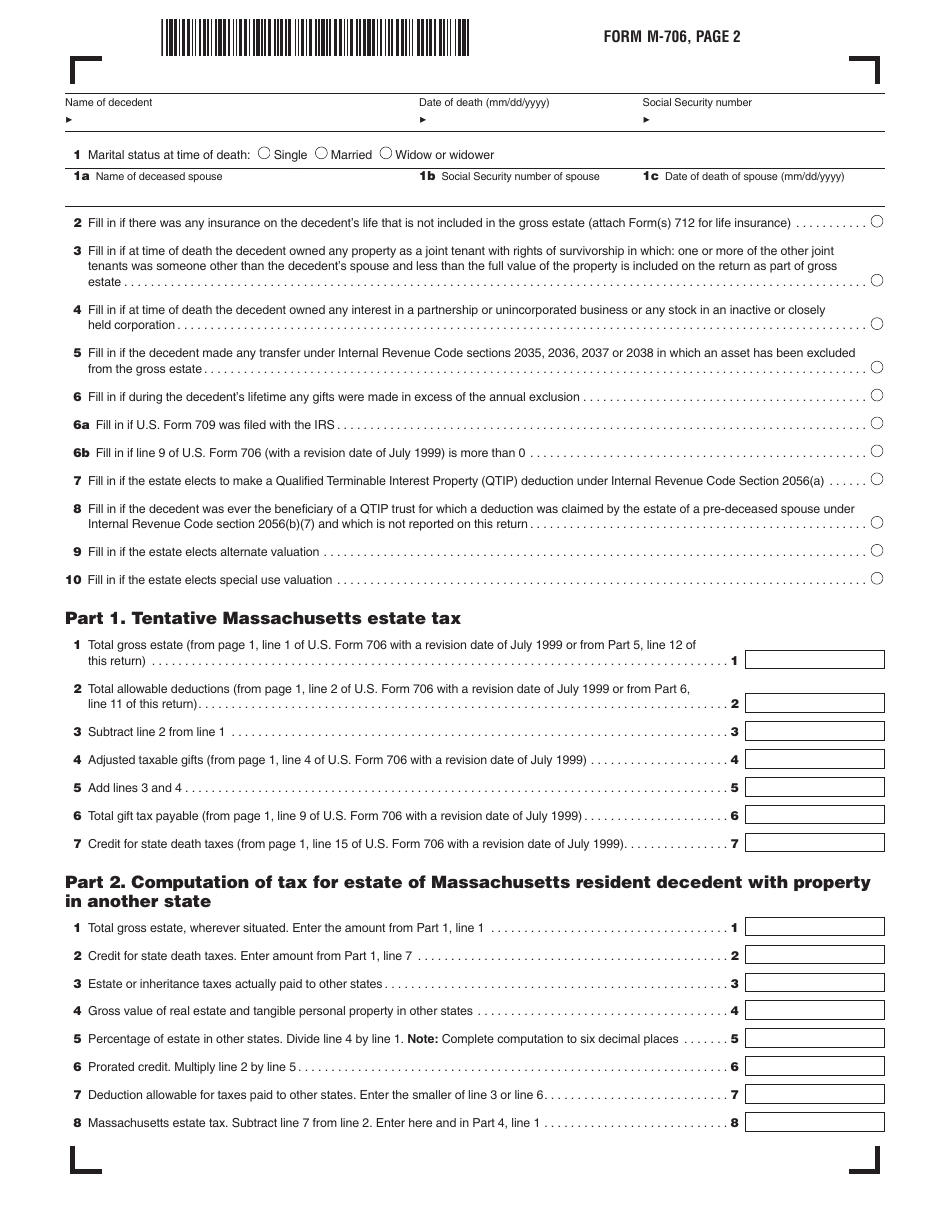

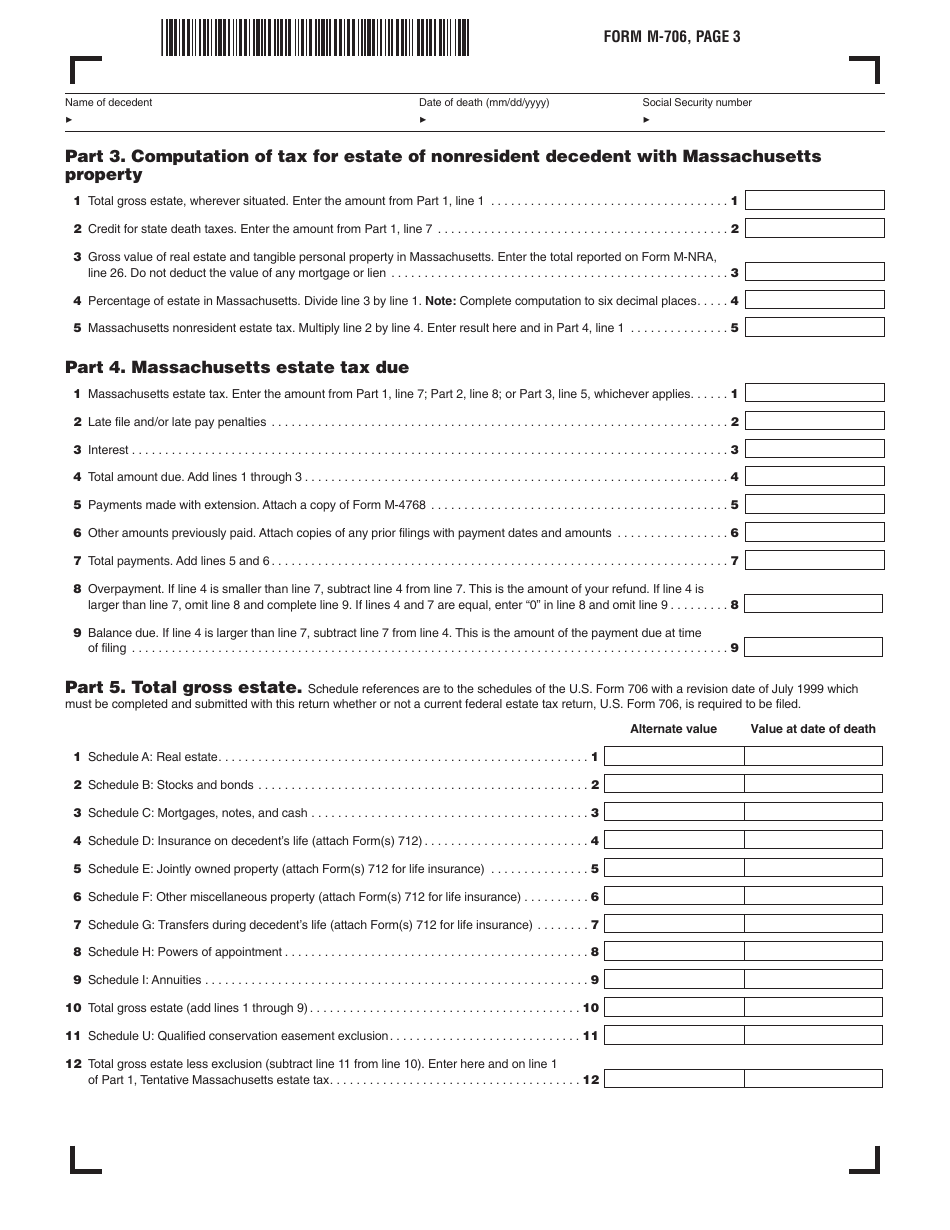

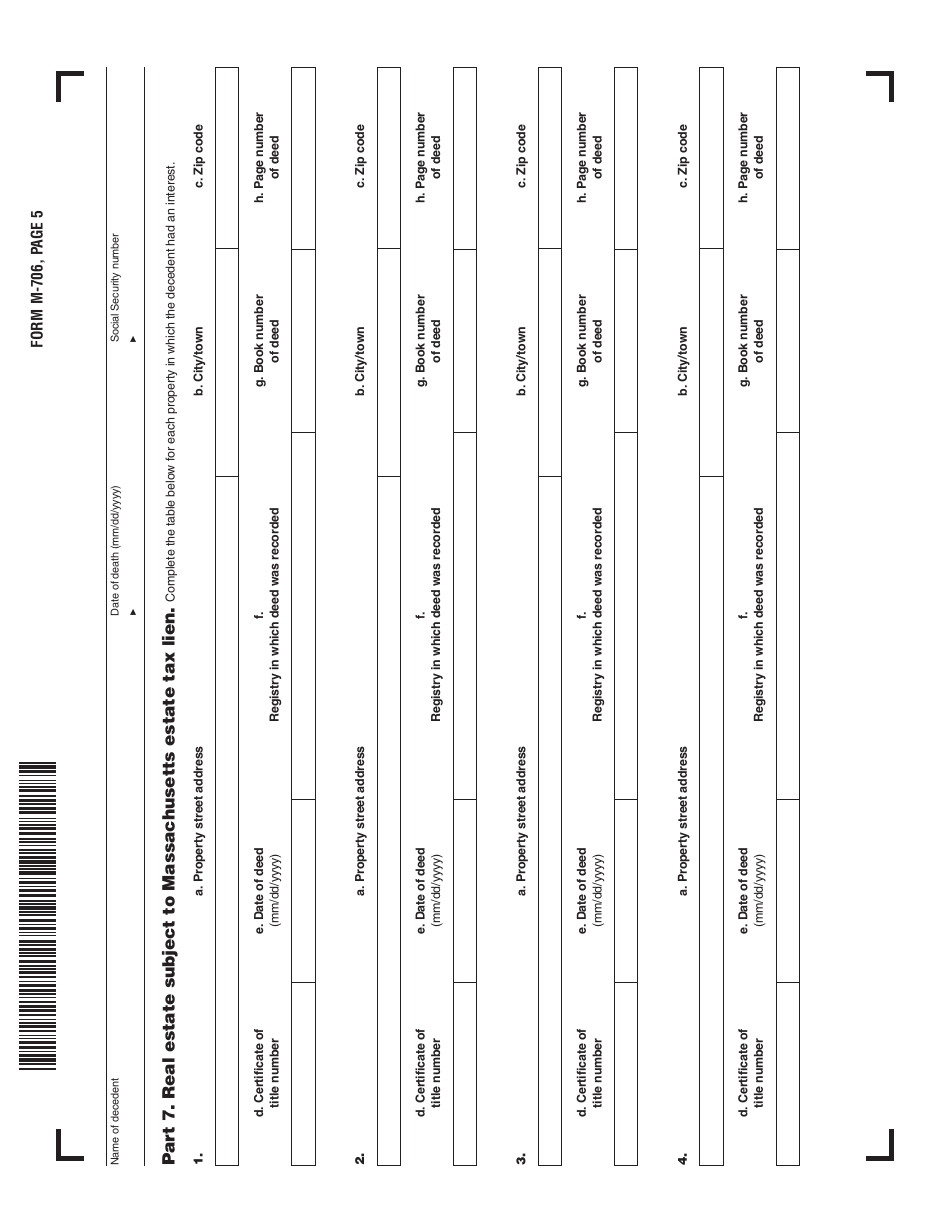

Q: What information do I need to complete Form M-706?

A: You will need to gather information about the decedent's estate, including assets, debts, and other relevant financial information.

Q: Is there a fee to file Form M-706?

A: No, there is no fee to file Form M-706.

Q: Do I need to file Form M-706 if the estate is not subject to federal estate tax?

A: Yes, even if the estate is not subject to federal estate tax, you may still need to file Form M-706 to calculate and report the Massachusetts estate tax.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-706 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.